Good morning! For anyone interested, I interviewed renowned small caps investor David Stredder last night, and webcasted it. Click here to listen. If people like the format (chatting about results in the last week, and previewing results for the coming week) then we'll do more of them.

VP (LON:VP.)

Share price: 616p

No. shares: 40.2m

Market Cap: £ 247.6m

Trading update - there's a strong update from this equipment rental group today;

Vp has continued to experience positive trading conditions in the markets which the Group serves. The gradual but sustained recovery in the general construction and housebuilding markets, in particular, continues to be supportive to the Group's activities.

As such, the Board anticipate that the Group will deliver results for the year ended 31 March 2015 ahead of market expectations.

This might well have read across for other companies related to the construction sector, which seems to be firing on all cylinders at the moment.

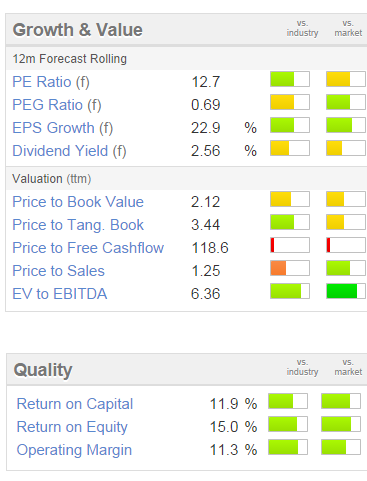

Valuation - as you can see from the usual graphics below, the valuation seems reasonable on a PER basis, especially considering that EPS growth is decent too. Bear in mind that this data will be based on the previous day's closing share price. However, the shares are up about 8% this morning, and the company has reported it is ahead of forecast, so those two factors are likely to roughly offset, making the graphic below still relevant & in the right ballpark.

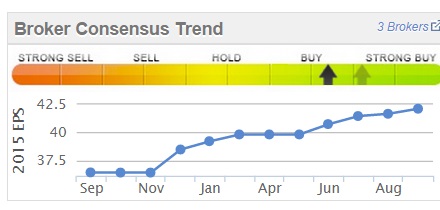

Earnings momentum - something I've been looking at more of late is companies which are continuously upgrading their forecast earnings. This is encapsulated in one of my favourite little charts on Stockopedia. Here you can see that VP has seen steadily improving forecast earnings over the last year - a very positive thing, especially when combined with a reasonable valuation;

My opinion - I wish I'd bought some of these when I saw management present at an EDIF event early last year. They impressed me at the time, but I decided (wrongly) that the shares were a little too pricey. The shares have doubled since then!

I'll have a think about this one - it still looks quite attractive, as a reasonably-priced growth company, in my view. It's not clear why the shares dropped suddenly in the last few weeks - there doesn't appear to have been any negative news, indeed today's news is positive.

CityFibre Infrastructure Holdings (LON:CFHL)

Share price: 67p

No. shares: 105.4m

Market Cap: £70.6m

This is a company which floated in Jan 2014 at 60p, and builds fibre-optic networks, then leases out the use of those networks to large organisations.

Interim results - are published this morning, and reinforce the fact that the company is much too early stage to be able to value it on historic figures. Turnover was only £1.3m, and an operating loss of £4.0m was incurred in the six months. Even allowing for one-offs, that means the company has to greatly increase sales to come anywhere near to covering its costs.

Outlook - sounds OK, if you're prepared to be patient;

The Board is pleased with the Company's development in the first half of the financial year and remains confident in the medium term prospects for the Group. Current trading is ahead of the Board's expectations at the beginning of the year. The Directors expect full year results to be in line with market expectations.

Valuation - how do you value a loss-making company? In this case broker consensus seems to be for a £5.3m loss in 2014, and a £4.9m loss in 2015. So it's cash hungry in the short term, as it costs a lot of money to build fibre networks in cities. Once built, there is then a long-term cashflow from customers. So you would need to do a discounted cashflow calculation, based on what income is expected, versus the financing costs & overheads. Presumably brokers have done this?

My opinion - it's a nice concept, but without seeing credible forecasts pointing towards profits & divis, it's impossible for me to value, so not something I could invest in at the moment. I tend to find that concept stocks like this get hyped up too much on the story, and often come down to earth with a bump when the figures disappoint.

On the upside, the Govt is keen to promote high speed internet, and the excitable American CEO here did indicate at an investor presentation that the company could have access to £500m of Govt-guaranteed loans to finance more city fibre networks. That could create some impressive operational gearing, if true.

So overall, I think it's potentially interesting, but more hard facts are needed to assess whether there is going to be a viable business here or not.

Inland Homes (LON:INL)

Results for the year ended 30 Jun 2014 from this land regeneration & housebuilder look good - profit before tax is up 66% to £8.6m.

You can't value housebuilders on a PER basis of course, because their activities are so wildly cyclical - they make bumper profits in the good times, then go bust (or come close to it anyway) in the bad times.

So personally I don't like to pay much above book value for housebuilders - although there is a case for paying more than book value if the land was purchased cheaply, and will therefore enable the company to build a house on it & sell that for a bumper profit.

Inland seems to be achieving the scale necessary to support its top-heavy overheads, so that is less of an issue now.

My opinion - in fairness, I'm not close to the detail on this one any more, having sold out for a good profit some time ago. NAV, adjusted for some off balance sheet assets (Drayton Garden Village) are reported today at 34.4p, so the share price of about 47p is already at a 37% premium, so it doesn't look attractive for me to revisit. I would welcome views in the comments below from readers who are better informed on this stock than me. I'm avoiding all housebuilders at the moment, as prices in the South are so far above historic income multiples that it's an accident waiting to happen in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.