Good morning.

I'm still in Warsaw, so am slightly detached from all the market goings-on. It seems as if the resources sector is in complete chaos - with an analyst questioning whether Glencore (LON:GLEN) is even viable at all now. I looked at Lonmin (LON:LMI) a little while ago, and came to a similar conclusion - the debt appears enough to engulf the company, if banks get cold feet. Cash is king in tough times.

Boohoo.Com (LON:BOO)

Share price: 34.38p

No. shares: 1,123.1m

Market cap: £386.1m

(at the time of writing, I hold a long position in this share)

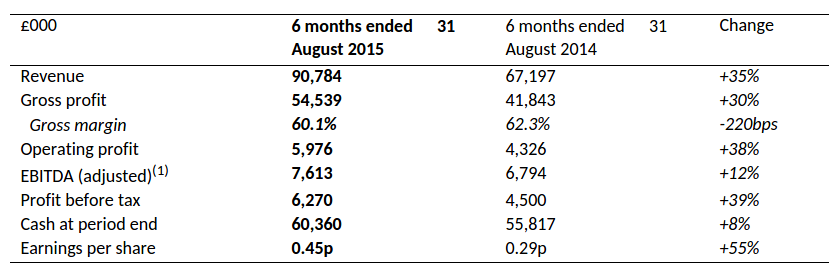

Interim results to 31 Aug 2015 - headline figures look excellent - remember that this growth is all organic, making it all the more impressive;

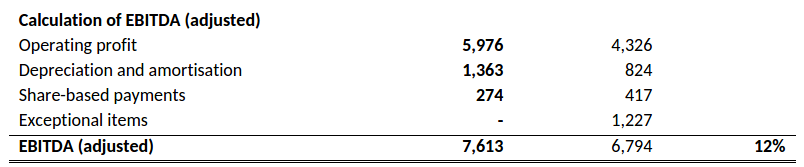

Note that the profit comparisons are flattered by inclusion of the IPO costs last year. A table itemises this, and shows that the +12% EBITDA performance is probably the best year-on-year performance comparison:

Growth strategy - as explained at the last analyst meeting, BooHoo management recognised that demand is elastic - i.e. very sensitive to price reductions, so they made a deliberate decision (which is absolutely correct in my view) to aggressively grow sales by offering keener pricing, and frequent customer deals on next day delivery.

I think this is a far better strategy than trying to maximise short term profit margins - after all, BOO doesn't actually need to make any profit particularly in the short term, as it's already swimming in cash, and doesn't yet pay divis. So why not go for growth, and become the dominant player in its niche, of fast fashion for pocket money, mainly for the 16-24 female market.

International growth - the core UK market is growing strongly still, which I'm encouraged at. The growth rate actually accelerated in the UK from 27% to 32% - really good news.

Rest of Europe was the softest region, slowing from +45% in Q1 to +26% in Q2 (at constant currency), which also faced a currency headwind, reducing +26% to a reported +13% in sterling. These are still very impressive numbers compared with most businesses though - how many other UK companies are reporting organic growth of this magnitude? Very few.

Rest of World is the stand-out growth area, with Q2 sales up a remarkable 81% at CER, which is still extremely good in sterling, at +64%, similar to the Q1 growth of +66%.

If you look back at Asos, the shares really went bananas during its high growth era, when it became clear that international sales were taking off. You're suddenly then looking at a whole different potential scale of the business. That seems to be starting to happen at BOO also.

Soft comparatives - BOO issued a profit warning in Jan 2015, due to softer performance last autumn/winter. Therefore last year's disappointment has become this year's easy-to-beat comparatives, so I suspect we should get more decent performance being reported early in 2016.

Outlook - all sounds fine to me. This is an excerpt;

During the first half of the year we have invested in acquiring new customers with revenue growth exceeding our initial expectations. We now anticipate revenue growth for the full of year of between 30% and 35%. During the second half we will continue to look at opportunities to invest in building customer lifetime value and market reach which may impact margins in the short term. We are trading in line with current market expectations for EBITDA.

We remain focussed on driving growth in our business and we are pleased with the start we have made to the AW15 season.

The company has been saying all this year that it wants to drive the top line aggressively, hoover up market share, and this means accepting a lower profit margin. It's important to understand that this is a deliberate and planned strategy - it's not something that is being forced on the company.

A rapidly growing company should not try to maximise profits, if that means stifling growth, so I'm 100% in agreement with this strategy.

Brokers - positive reactions this morning from three broker notes I've seen, with upgrades to the top line, and more modest upgrades at the EBITDA level too.

Cash - BOO had proven that it's a cash machine, by increasing its cash pile from last reported c.£54m, to over £60m now. The business actually generates cash as it expands, since it sells for cash, and buys on credit. So no concerns whatsoever are justified on cashflow - it's excellent. The only question is, what is the company going to do with all this cash it's sitting on? Pity it wasn't at least partially spent on share buybacks, when the share price was artificially low after the profit warning.

Bear in mind the cash pile is now 5.4p per share, so is material, at 15.6% of the share price.

Balance sheet - is bulletproof.

My opinion - this is my favourite GARP share at present, and I intend holding for several years. People who think the shares are expensive are not valuing it correctly, in my view. Historic PER is meaningless for growth companies. Even forward earnings estimates are affected adversely by the costs of driving the rapid growth. Even so, margins are still very good, and far superior to Asos for example (both gross, and net margins).

I believe the shares were over-hyped & over-priced for the IPO, which resulted in a profit warning once the growth rate reduced in late 2014. I think that then presented an outstanding buying opportunity at about 24p per share, which was when I loaded up, as I know this business well, and recognised that it has terrific potential - management have been in the trade for decades, and really know their stuff on design & sourcing.

The test & repeat business model is ideal for managing inventories tightly, and minimising markdown. There's no shrinkage from a network of stores, and margins are sustainable at or around current levels. Remember that pricing of clothing is anchored by physical stores, who have to achieve a gross margin of c.60% in order to cover their fixed costs. Online fashion retailers can sell cheaper, but then have massive marketing costs instead of the costs of a store network.

So whilst it's easy to start a fashion website (few barriers to entry), it's impossible to scale up to a serious size without huge marketing spending. BOO is now big enough to out-spend its competitors on marketing, which is why I think it will become increasingly dominant in its niche.

Today's results, positive outlook, and positive broker reaction, should be enough to silence the rather bizarre, and ill-informed bear raid on the shares recently. This is a company that is clearly firing on all cylinders again, and when you adjust out the cash pile, the rating isn't particularly expensive at all, for a company delivering such impressive organic growth.

Panmure Gordon & Co (LON:PMR)

Share price: 95p (down 23%)

No. shares: 15.5m

Market cap: £14.7m

Interim results to 30 Jun 2015 - clearly the market is unimpressed with these results, as the shares have taken a bath this morning.

The company seems to blame macro factors for a collapse in profits, from £2.0m in H1 last year, to a loss of £0.2m this time. That's not good enough to my mind. The reality seems to be that business is too lumpy to form a dependable base, hence there's no way of really knowing what future profitability will be, so how can you value the company?

NTAV is £19.5m, well above the market cap. It strikes me that the main beneficiaries of this company's existence are its management & employees. Shareholders just seem to be providing a cost-free pile of assets to the employees to utilise in order to generate their own hefty salaries & bonuses.

So on balance, if I had to make a choice, I'd rather be an employee than a shareholder in this. To my mind shareholders need to have a conversation with management, along the lines of, "what's in it for us then?".

Oh dear, I'm being hassled to vacate my hotel room now, so will sign off for now. Will try to do some more from the airport, if I can get a WiFi signal. Back in Blighty later tonight!

P.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.