SYS1 (new ticker)

Share price: 787.5p (+1.3%)

No. shares: 12.2m

Market cap: £96m

As previously flagged, Brainjuicer has changed its name to the more professional-sounding "System1". The new ticker SYS1 is now effective and the new website, (system1group.com/) will be launched later today.

Its old website (which can still be viewed online) is very quirky and interesting, so the new one should also be worth a look.

The share rating is fairly high but it remains one of the better-quality companies on AIM, and the new name will serve to unite the company's marketing and researching brands (System1 Agency and System1 Research).

Christie (LON:CTG)

Share price: 77p (unch.)

No. shares: 26.5m

Market cap: £20m

A weak result set of results considering the scale of revenues:

- Revenue growth of 1.2% to £64.5m (2015: £63.7m)

- Operating profit before exceptional items of £1.0m (2015: £3.8m)

- Operating profit after exceptional items of £2.3m (2015: £3.8m)

The total dividend for the year is unchanged at 2.5p and is still more than twice covered by earnings.

H2 improvement: The hoped-for improvement in the second half did materialise, despite the referendum result which the company had feared, as it registered an H2 operating profit before exceptional items of £1.9m, about the same as the prior year. This was almost entirely generated by the Professional Business Services (PBS) division.

Exceptional items: The exceptional item is a £1.3 million gain from inflation-capping the company's final salary pension schemes.

It's always refreshing to see exceptional items which improve the results, as it feels like in 99% of cases they are costs which the company wishes it hadn't incurred!

Outlook statement is positive:

The year for both our divisions has started more strongly than in 2016. We have some inflationary costs to absorb which our budgets allow for. Your management and staff alike strive to always deliver a service that is second to none, and on your behalf I thank them. We plan for continued growth in 2017.

Total Comprehensive Income

It's essential to look through the financial statements for the details which get left out of the headline numbers.

In this case, I immediately see that the company suffered an £8 million actuarial loss on its pension scheme (despite the inflation-capping measure, mentioned above).

Losses such as this aren't included in the income statement, instead they're in the Statement of Comprehensive Income.

Balance Sheet

Actuarial losses do feed through to the balance sheet, of course, and I must say that Christie's balance sheet doesn't fill me with a huge amount of confidence: it is in negative equity of £9.3 million, which is after including £3 million of intangible assets.

My opinion

Professional services are tricky for external investors, since they are so dependent on staff. And in the case of Christie, besides the expensive staff members carrying out the professional work, it also has staff in the Stock and Inventory Systems business whose wages are being artificially increased by the government's Living Wage measures, forcing Christie to raise its prices to clients.

So this is not the type of business I would instinctively be drawn toward. And reflecting high historic staff costs, retirement benefit obligations of £18 million now dominate the balance sheet.

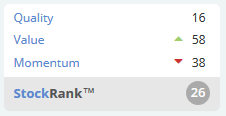

There is certainly a price at which the risk:reward ratio would start to look favourable but I'm not convinced we are there yet, and neither is Stockopedia:

Luceco (LON:LUCE)

Share price: 207.5p (+6.4%)

No. shares: 160.8m

Market cap: £334m

Fantastic growth numbers:

This company makes and distributes LED lighting, wiring accessories, power equipment and AV/home entertainment products, and manufactures both in the UK and China.

It's a recent IPO (October 2016) and the shares are already up by more than 50% from the flotation price.

Free on Board?

I'm a little curious about the statement's reference to "Freight on Board":

The Group's sophisticated Chinese presence and expertise with the Freight on Board ("FOB") business model enables the Group to service large international customer store networks without local logistical or stock keeping requirements. As more retailers reduce their supply chain costs by moving to this centralised direct import model, the Group increases its advantage over its competitors.

My understanding was that FOB meant "Free on Board", as described on the Wikipedia page at this link.

Free on Board means that the seller is no longer responsible for goods after they have been loaded at their port of origin. I guess the company is saying that it is doing well by sending product to be shipped internationally from its place of manufacture in China. 46% of total sales are FOB, with the rest distributed directly by Luceco.

The products themselves must have some differentiating competitive advantage, though, as LED sales grew 42% and wiring accessories sales grew 30%, and this is hardly all down to distribution expertise! There were "many successful product launches" during the year.

Later in the statement, we get the following broad explanation of the company's success:

Luceco's growth has resulted from investment in its Chinese facility and the creation of a wholly-owned supply chain, enabling the Group to reduce the cost and improve the quality of its products, as well as establishing a product development team for further diversification and growth through innovative product design and manufacturing excellence.

Outlook

The outlook statement could hardly be any better:

Trading in the new financial year has started stronger than expected as the Group continues to grow market share of its key brands in the UK and other, newer markets, at margins in line with expectations. A strong order book, new business wins and a full pipeline of new product launches means that our growth forecasts for this year are well underpinned and we look forward to the remainder of the year with confidence.

Net debt stands at £29 million, or 1.4x adjusted EBITDA following IPO proceeds, and the BoD considers the "deleveraged capital structure" to position the company for continued growth both organically and via acquisitions.

My opinion

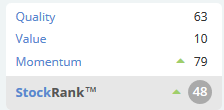

Overall, it's quite an exciting story of organic growth, international expansion and innovative new LEDs and other products.

It's not cheap by any means though if you strip out the IPO costs from this year's results and then pencil in another few years of growth, it could very conceivably grow into this valuation.

Worth a second look.

Innovaderma (LON:IDP)

Share price: 152.5p (+14%)

No. shares: 11.8m

Market cap: £18m

This owner of four cosmetics brands informs us that H1 revenue growth has "significantly accelerated" into H2, and the company has just recorded its highest-ever quarterly revenues.

Skinny Tan is leading the charge:

The strong performance has been driven by the Company's Direct to Consumer ('DTC') digital channel which is performing exceptionally well compared to the same period in the previous year. Skinny Tan's performance in Superdrug has been outstanding and the Board is very pleased to announce the brand has become the No.1 selling brand in Superdrug by revenue in its category for 2017, despite only being granted increased shelf space from mid-February onwards.

This is another recent IPO (September 2016) and so it needs to be treated with that bit of extra caution compared to seasoned shares.

That said, I don't consider it to be one of those "blue sky" shares which so often find a home on the stock market. It generated a healthy 58% gross margin on £3.2 million of sales in H1.

While that failed to pay for the company's administrative costs and a small loss of £150k was generated, the sales growth trajectory suggests to me that this is definitely worth looking at in closer detail.

Imagination Technologies (LON:IMG)

Share price: 103.9p (-61%)

No. shares: 283.5m

Market cap: £295m

Discussions with Apple regarding license agreement

The huge share price fall means that this is now below the £300 million market cap cut-off which Paul has often used for inclusion in this report!

Very serious news:

Imagination Technologies Group plc (LSE: IMG, "Imagination", "the Group") a leading multimedia, processor and communications technology company, has been notified by Apple Inc. ("Apple"), its largest customer, that Apple is of a view that it will no longer use the Group's intellectual property in its new products in 15 months to two years time, and as such will not be eligible for royalty payments under the current license and royalty agreement.

It sounds like a huge legal battle might be on the cards, as Imagination does not accept Apple's "assertions" that it can cut ties without violating Imagination's IP. Though the two companies are said to be discussing "potential alternative commercial arrangements".

I don't feel qualified to judge the investment implications of this for Imagination shareholders.

The simple facts are that revenue stream from Apple was worth c. £65 million this year, roughly half the company's total revenues and apparently having few direct costs associated with it. So if the prior share price reflected a belief that this threat was extremely unlikely to materialise, then it does make sense for the shares to currently be down by over 50%.

It's too difficult for me to figure out what the remaining business might be worth, or what the outcome of a legal battle with Apple might be - good luck to those who try!

That's all I've got for now. Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.