Good morning!

Next (LON:NXT)

Always of interest (for wider read-across on consumer spending generally) are the trading updates for High Street bellweather, Next (LON:NXT) . Its update today is perhaps surprisingly solid. Q2 sales showed an improving trend on Q1. Although not specifically stated, you can deduce from the figures today that LFL sales are still negative.

Its comments on Brexit are particularly interesting;

With only a few weeks since the EU referendum it would be unwise to draw any firm conclusions of the effect the decision to leave the EU will have on UK consumer demand, particularly as the week after the referendum was an unusually strong week the previous year. So far, we can see no clear evidence of any appreciable effect on consumer behaviour, apart from the first few days after the vote.

So this confirms my view that Brexit has had little to no impact on consumer behaviour. Obviously, more poorly performing companies are going to blame their poor results on Brexit, and/or the weather! Remember how Bonmarche Holdings (LON:BON) blamed the weather for its terrible performance in Q2? Funny that it hasn't affected Next, despite them having the same weather. So BON are looking rather a bit daft for those weather comments.

Next also makes some very interesting comments about the devaluation of sterling, as this is a key issue for clothing retailers. Most import the bulk of their product from the Far East, and it's usually invoiced in US dollars. Therefore the recent plunge in sterling will increase the cost of imported goods - meaning that selling prices in the UK are likely to rise in 2017.

On this issue, Next today says;

- Currency is hedged for all of this year (y/e 31 Jan 2017), so no impact.

- Imports expected to be 9% more expensive next year.

- Mitigating factors mean this can be squeezed down to c.5% higher cost prices next year.

Outlook - Q3 is expected to be tough, due to very strong comparatives from last year (+6%). However, Q4 could be stronger, due to exceptionally mild weather last autumn, which depressed sales of warmer winter clothing ranges.

Profit guidance (why can't all companies do this, it's so helpful?) has been narrowed from the previous range of £748-852m, to £775-845m. Note that the main movement in the range comes from a £27m increase in the minimum expected profit - clearly a positive thing.

My opinion - this is an amazingly high quality business. It executes so well, and makes a sector-leading operating profit margin of almost 21%. You can buy it now on a PER of about 12, which looks great value to me. Although there's not much growth potential, and online competition does seem to be slowly eroding their market share. So perhaps a PER of 12 is the right price for a mature business like this?

Importantly, if the economy does deteriorate, then a company like this will fare very much better than smaller, lower margin competitors. With a 21% profit margin, profits are very robust, even in a downturn. Whereas smaller retailers with profit margins of say 3-5% end up swinging into losses, and even going bust, in an economic downturn. So at this stage of the cycle, I would be avoiding apparently cheap smaller retailers, as they could be value traps. Instead, I think the ones to go for, are the big, highly profitable ones on reasonable valuations (like Next), or the fast-growing (but much more expensive) online players (e.g. Boohoo.Com (LON:BOO) & MySale (LON:MYSL) - in both of which I hold long positions).

There are not many results/updates from companies of interest to me today, so I'll go back to some of the ones I missed yesterday:

T Clarke (LON:CTO)

Share price: 68p

No. shares: 41.8m

Market cap: £28.4m

Interim results to 30 Jun 2016 - this was one of the shares that I culled from my personal portfolio before the Brexit vote, in order to de-risk. So I'm looking at it with a view to whether or not to buy back in.

Based on these interim figures, I'm inclined not to buy back in. Not because there's anything particularly bad about the numbers, it's just that my previous reason for holding was an expectation of rapidly rising profit margins, which doesn't seem to be happening after all.

Key points for the 6m to 30 Jun 2016;

Turnover rose 13.3% to £121.6m

Operating profit (underlying) rose 4.8% to £2.2m (H1 2015: £2.1m)

Note the wafer-thin margin of 1.8% - leaving no room for any mistakes on big contracts.

Net cash of £1.3m is a big improvement over net debt of £8.7m a year earlier.

Order book flat at £320m

Pension deficit has risen to £21.9m (H1 2015: £15.7m), which is the accounting basis. So actuarial deficit likely to be worse.

Outlook comments - probably more upbeat than I expected;

Whist there is some inevitable uncertainty, our order book has been fully replenished demonstrating our continued ability to secure landmark projects with blue chip clients. Our cash position continues to strengthen and with several contracts having just commenced we expect this to be sustained.

The Board's confidence in the future of the business is demonstrated by its decision to maintain the interim dividend. Our long term client relationships leave us well positioned and looking forward we can see a number of opportunities.

and CEO comments;

"We are pleased to be presenting a solid performance based upon our strategy of targeting quality projects and clients and are excited about current bidding opportunities that will give us good revenue opportunities into 2017 and beyond."

My opinion - everything sounds fairly upbeat (for now). However, it's important to remember that this contractor works on buildings that are nearing completion - it's mainly fitting-out (electrical, IT, etc). So it wouldn't see any downturn for some time (1-2 years) after a downturn in new building activity starts.

London looks like a giant building site right now - the crane count is astonishing, whenever you look across the city from the upper floors of any tall building.

Previous announcements from CTO indicated that margins would improve as availability of suitably trained staff tightened. The trouble is, yesterday's interim results show no sign of that actually happening, with the operating margin still stubbornly low, at only 1.8%.

The balance sheet is just about OK, but probably not strong enough to justify the fairly generous dividend yield. I would prefer to see cash being retained within the business, in order to strengthen the balance sheet ahead of the next downturn, whenever that happens.

Overall, I like management here, and it seems a well-run company. However, the margins are just too narrow to entice me back into the share. Especially now the cycle may be topping out, if Brexit does cause a slowdown in building activity.

Pendragon (LON:PDG)

Share price: 31.6p

No. shares: 1,452.3m

Market cap: £458.9m

Interim results to 30 Jun 2016 - I won't go through the numbers in detail. My interest here is mainly so see what they say about industry trend, Brexit impact, etc.

Surprisingly upbeat here too;

Whilst there is great speculation about the effect of the UK’s decision to exit the EU, to date we have not experienced any noticeable change in our customers’ behaviour and, based on discussions with our franchise partners, we do not anticipate any material effect on new vehicle pricing as a result of exchange rates.

The comment on forex is particularly interesting. This seems to suggest that European manufacturers are intending to absorb the impact of recent forex movements, rather than increase prices. That's very significant, and of course rather bullish for the sector.

My opinion - I really like this sector at the moment, on valuation grounds. The market has slammed share prices down, on expectations that demand would soften, prices would rise, and hence profits would fall substantially. However, it doesn't appear to be the case that any of that is actually happening.

Moreover, the market has changed radically. Many people are now getting new cars on very affordable personal contract hire arrangements. The monthly payment I'm paying on my car for example, is less than I was paying for an inferior, used car, 20 years ago. For that reason, new car sales seem to have stepped upwards, and I think are likely to remain at this new, higher level.

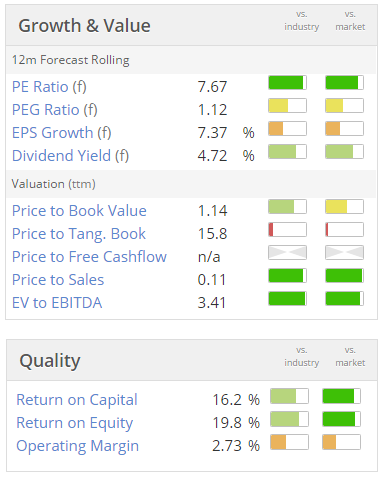

That creates opportunities for car dealers, who make a lot of their profit from aftersales. Balance sheets are generally good in this sector now too. So overall, I feel there's a good opportunity right now to pick up bargains in this sector. The results & commentary from Pendragon have reinforced my conviction, so I may do some more bargain hunting in this sector. There's plenty of green below, on Pendragon's Stockopedia graphics:

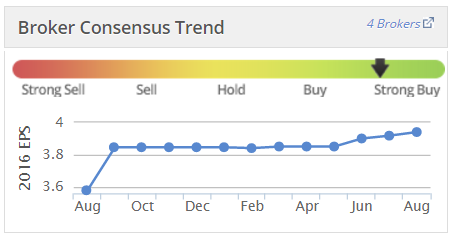

Also, I am surprised to note that in recent months, brokers have actually been increasing their earnings estimates for this company. This augurs well, and reinforces my view that there are bargains to be had right now in this sector, after share prices seem to have been wrongly smashed down on Brexit worries;

Filtronic (LON:FTC)

Share price: 14p

No. shares: 196.9m

Market cap: £27.6m

Results y/e 31 May 2016 - another set of absolutely terrible figures from this struggling "designer and manufacturer of microwave electronics products for the wireless telecoms infrastructure market".

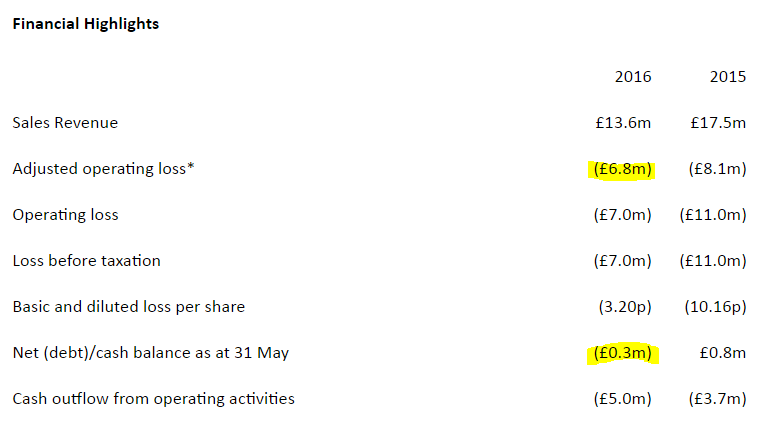

If these numbers are the highlights, I'd hate to see the lowlights;

Having a quick skim through the figures, trade debtors jumps out at me as looking far too high at £9.0m. That's way out of kilter with full year turnover of £13.6m. Even allowing for H2 being double H1, then H2 turnover was £9.5m, practically all of which was sitting in debtors - so it looks like customers didn't fancy actually paying for anything that they bought in H2. That needs investigating.

Net cash of £2.7m at the interim stage, 30 Nov 2015, has all gone. The company had net debt of £0.3m at 31 May 2016 - despite the stronger H2 turnover. So the £4.5m raised in fresh equity in Nov 2015 has all been burned.

The company is now relying on credit from its invoice discounting arrangements, so clearly cash is now very tight - expect another Placing fairly soon. The company would be mad not to do another Placing, given how buoyant its share price is right now.

Outlook - so why is this car crash of a company valued at £27.6m? The reason is that it has convinced investors that newly launched products will be winners, and take it into future profits.

Broker estimates - I see that Panmures have raised this year's (05/2017) earnings estimate to 0.53p, and 05/2018 to 1.19p. That would be a huge turnaround from the heavy losses of the last 2 years, so clearly relies on the sales of new products being buoyant.

My opinion - relying on hockey stick shaped predictions for future profits is a very high risk strategy. Things can & often do go wrong. Personally I wouldn't touch anything like this - a company that has historically performed dismally, doesn't become a fantastic company overnight. Being asked to pay up-front for possible future success, seems a ridiculous proposition to me. Also, this type of product only has a short lifetime, before it becomes redundant, and replaced by something better - often made by a competitor.

Risk:reward looks lousy to me at the current price, and having 3-bagged, I would be banking profits now. But each to their own. There again, if the new products do take off as hoped, then people who took a punt on that might end up doing well, who knows?

Greggs (LON:GRG) - just a quick mention about yesterday's interim results, for read-across purposes.

This High Street bakery/fast food chain delivered sound interim results to 2 Jul 2016.

Underlying profit up 6.7%.

LFL sales were good for the half year, being up 3.8%. Retailers need to achieve that kind of increase in sales, to cover all the cost increases (especially with Living Wage, pension costs, and the forthcoming 0.5% Apprenticeship Levy).

Outlook comments sound fine;

We have made an encouraging start to the second half of the year and are alert to any change in consumer demand that may result from the current economic uncertainty....Overall, we expect to deliver full-year growth in line with our previous expectations as well as further progress against our strategic plan.

My opinion - a nice business, probably priced about right for now - or possibly a bit too rich, at a PER of 17, and divi yield of c.3%? Given the fairly limited growth potential, I think the rating here could drift downwards possibly. Personally I wouldn't pay more than a PER of say 12-13 for it, so it doesn't interest me.

Interesting though that it's another High St chain which is saying that consumer confidence is fine.

Zotefoams (LON:ZTF) - somewhat underwhelming interim results, given the warm rating on which these shares trade. Key points;

- Turnover up 2% to £27.1m

- Adjusted profit before tax up 1% to £3.21m

- UK exporter mainly, so should benefit from forex movements (mainly in 2017)

- Positive comments about growth in H2, but broker forecasts for full year anticipating 20.8% increase in EPS. Very little delivered in H1, so looks susceptible to an H2 profit warning later this year.

For me, the rating looks too rich, given potential risk of H2 profit warning. Also note the broker forecasts have been steadily falling in the last 12 months. Seems a good quality company though, but I wouldn't pay the current price for it (266p = 17.9 times forward earnings).

Dialight (LON:DIA) - I've had a quick skim of its interim results to 30 Jun 2016. This LED lighting company has had lots of problems, but looks to be starting to get back on track, so it might be worth a closer look possibly?

A few snippets;

- Underlying profit jumped nicely, from £1.7m last time, to £4.2m this time (6 months to 30 June 2016).

- H2 order book up 10% on last year.

- Production is starting to move to outsourced partners - sounds sensible, as DIA proved themselves pretty hopeless at manufacturing in-house.

- Directorspeak is positive - market growth opportunity, new products, and expertise in its niche.

- Strong balance sheet.

My opinion - it looks expensive on a forward PER basis, but turnaround situations like this can sometimes out-perform against forecasts. So I might do a bit more research on this one.

WANdisco (LON:WAND) - another set of diabolical figures from this company. It amazes me that shareholders keep pouring money into it every time it burns through the last lot.

No revenue growth! Flat against H1 LY at only $5.6m

Sales bookings up 36% to $5.9m, but hardly transformational.

Loss from operations of $9.7m (reduced from $17.1m loss in H1 2015) - but still clearly diabolical - it's not a viable business at all, based on performance to date.

Out of cash at 30 Jun 2016, but raised $14.3m in a recent fundraising - I wonder how long that will last?

Cash overheads reduced by about a third (but still heavily cashflow negative).

My opinion - I see this as the worst type of jam tomorrow company - they created a huge central overhead, and have struggled to make much progress on sales. So investors have to keep pouring in large amounts of cash just to keep it afloat.

The trouble is, having been in that situation myself, you feel obliged to keep throwing in more money, to protect the value of your existing holding. So when it does eventually fail, you've lost far more money than putting in a small initial amount & writing it off if the original plan did not materialise.

AIM is littered with failing/failed jam tomorrow companies, of which this is one. Given its terrible track record, the £65m market here today (at 178p per share) looks completely bonkers to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.