Good morning! Very little news again today, as expected, so I treated myself to a lie-in, as the noise from the storms kept me awake all night here in windswept Hove. Luckily the roof stayed on, although this type of weather is arguably a good time to get rid of stuff you don't want, by lobbing it over the fence into next door's garden! (only joking, I saw that on Twitter, and it amused me).

Talking of weather, Debenhams (LON:DEB) issued a profit warning on 31 Dec 2013, again blaming the weather - something they did earlier last year too. The trouble is, that excuse has been blown out of the water by their competitors - House of Fraser (whose own staff used to call it "House of Failure" in the 1990s!) seems to have really got their act together and reported a very strong Christmas. As also has John Lewis Partnership (would we expect anything less from them?). So it's very clear now that Debenhams are not executing well, and I would imagine larger investors will be clamouring for either an overhaul of strategy, or a change of CEO. That said, as we discussed in yesterday's comments section, in my view DEB is fixable, and the price now looks attractive to me, hence why I'm long there, and heavily averaged down yesterday.

As I worked for 8 years until 2002 as an FD in ladieswear retailing, this sector particularly interests me, so this is the one time of year when I comment on large cap retailers.

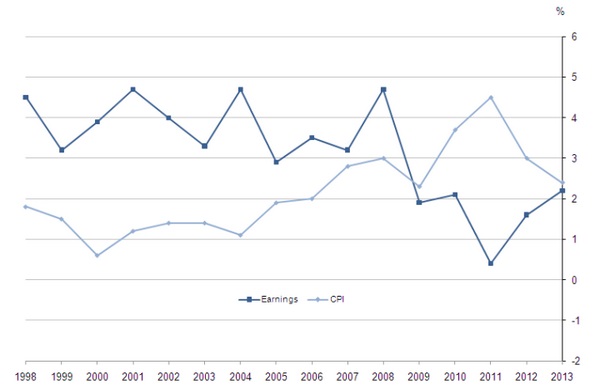

The other thing to consider is that the squeeze on household incomes is now arguably coming to an end.

Twitter is a mine of useful information on economics, and this article from political commentator Guido Fawkes contains an interesting chart showing that annual pay rises on average have now risen to just over 2%, whilst CPI inflation has fallen to just over 2%. Therefore, based on this data, the squeeze on household incomes should now be coming to an end.

As investors it's our job to anticipate trends, hence why I'm prepared to give Debenhams the benefit of the doubt for the time being. It's also been in & out of Private Equity ownership several times before, who know the business well, and I wonder if they might be circling it again? Remember that PE like retailers because of their strong cashflows, so they might try to do what they did before - i.e. strip it of assets, load it up with debt, starve it of capex, then sell it back to the City a couple of years later at a much higher price.

Debenhams is a bit riskier than I would normally look at, due to debt being uncomfortably high, but relative to EBITDA (a key Covenant) it looks manageable, although I think their share buyback programme was a mistake - the money should have been used to repay debt, so it's a good thing that the buyback has recently been ended, in my opinion.

Today's stand out retail performance is from class act, Next (LON:NXT). They've had a remarkably strong Q4, as detailed in today's trading statement, as always a model of clarity. I've always liked the way Next actually give figures for full year guidance, rather than the usual coded wordings used by other companies which are so often prone to misunderstanding.

Next is the sort of business that we should all be scratching our heads over, and wondering why it isn't a core long term holding in our portfolios? They do what they do so well, and it's always been obvious - from the success of the Next Directory, to the huge queues they always attract at Sale time. Sometimes we can all end up not seeing the wood for the trees. Certainly I'm kicking myself over Next, it's a share I should have held, as I knew it was a great business.

The other interesting thing is to look at how Next has used share buybacks to massively increase the share price over the years. As the number of shares in issue is constantly falling, that enhances EPS over and above the growth in the business. Over many years that has been a brilliant strategy. So hats off to them. They are set to deliver EPS growth of 21-24% this year (ending 25 Jan 2014), which is absolutely astonishing for a business this size, in a relatively weak economy.

There are a couple of non-retailer trading updates. Dry cleaner Johnson Service (LON:JSG) has issued an in line with expectations trading update. This has been a good turnaround, with net debt now reduced to below £25m at the end of Dec 2013.

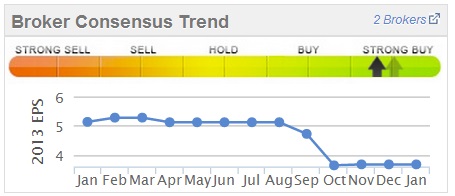

The Stockopedia graphic for broker earnings consensus shows quite a big reduction in estimates for this year, as you can see on the right.

The Stockopedia graphic for broker earnings consensus shows quite a big reduction in estimates for this year, as you can see on the right.

So I would want to know what has driven down those forecasts. The PER of 14.5 based on 2013 estimated earnings doesn't look particuarly cheap to me, so I cannot see anything here to get excited about.

The debt may have reduced a lot, but it's still pretty significant, and remember there is a pension deficit here too, which requires £2m p.a. cash overpayments. Overall then, I cannot see enough upside here to make it worth researching further.

That's it for today & this week. We should be busy again from next week, with lots of trading updates coming through, so I'm looking forward to that.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in DEB)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.