Good morning! Developing events in the Ukraine seem to be increasingly the focus. Personally I think the risk of war involving the West is virtually zero - politicians and the public lack the will to take on Russia in it's back yard. Indeed, we're so dependent on Russia for gas, that it's difficult to see how much leverage can be put on Russia before Putin just flips the switch to turn off the gas, to make a point.

Still, markets hate uncertainty, and risk, so expect volatile times ahead. Personally I won't be making any portfolio adjustments based on this, as I never do. International crises like this are little more than blips on the chart historically, as things always get sorted out one way or another. Although I will be looking for bargain purchases via panic, or forced sellers in stocks that I like.

The question is whether after such a huge bull run in small & mid caps, the market might now use the Ukraine crisis as an excuse to sell off? I think that's a strong possibility, but we'll have to see. At the moment Russia itself is bearing the brunt of the markets' nerves - with the Rouble hitting a record low this morning, and Russian shares down about 10%. Also it has been forced to raise interest rates from 5.5% to 7.0%, I see from scanning my Twitter feed this morning.

Seeing Machines (LON:SEE)

A reader complained that I didn't comment on results from Seeing Machines last week. There's always the option of reading the results yourself! Joking aside though, I didn't report on them as it was a busy day, and there was nothing remarkable in the figures or narrative - everything looked as expected to me.

Seeing Machines is the Australian software company which has developed and is already selling equipment which monitors face and eye movements in vehicle drivers, to identify and alert driver tiredness, thus preventing crashes. It works well, and is being rolled out in the large & expensive vehicles used in the mining sector, via Caterpillar dealers.

So whilst the market cap of about £65m (at 7.6p per share) might raise some eyebrows (since it is a small, and still loss-making company), it is the market leader in a huge, and exciting market. Having proven the product in the rigorous mining sector, SEE should be in pole position to dominate the coaches, trucks, trains, planes, and eventually car markets too. Their product also has exciting potential in consumer electronics, and could become ubiquitous, as e.g. advertisers gain benefit from tracking eye movements, or mobile phones are controlled simply by looking at particular items on the screen.

Anyway, it is now cashed up in the surprisingly large recent fundraising, where a £15m Placing was done, plus a token £1m Open Offer that was considerably over-subscribed. So hopefully that should accelerate progress and keep the news flowing, which is essential for shares that rely on growth to support a high price. This morning brings news of another CAT dealer, WesTrac having signed up to sell Seeing Machine's product.

This is a good quote from the CAT dealer;

WesTrac's Executive GM Jamie Sanders said:

WesTrac is pleased to work, through our alliance with Seeing Machines, to support our customers to improve safety in their operations. Driver fatigue and the associated safety risks are high on our safety agenda and we are happy to be able to provide high ROI solutions which work.

So many blue sky companies have a supposedly great product, but then have a mountain to climb in terms of selling it. What I like about SEE is that the product is proven, already selling, and the hard work (and costs) of selling are done via CAT dealers.

Their shares are not cheap, but if the positive newsflow keeps coming, then investors will keep focussed on the future upside. I remain a holder.

Thorntons (LON:THT)

Bulls have very much been vindicated at Thorntons, both with a strongly rising share price, and good interim results published this morning. The half year reported today is an unusually long 28 weeks (seems odd!) to 11 Jan 2014. This period includes the very busy Christmas period, so constitutes most of the full year profit.

Revenues rose 4.5% to £139.7m, and pre-exceptional profit before tax rose an impressive 47.3% to £7.2m. The strategy behind this improved performance has been to pull out of loss-making shop leases, and concentrate on developing commercial sales. This seems to have worked well, pulling the company out of a highly precarious situation a few years ago.

Although glancing at their Balance Sheet, it's still far from healthy, and shareholders very much have an understanding Bank Manager to thank for this turnaround having been given the time to work. So it's been a very high risk investment that has turned out alright.

EPS is 7.8p for the busy H1 period, so fulll year might be heading for around 10p perhaps? So that looks ahead of broker consensus of around 7.9p for this year (ending 29 Jun 2014). The share price at 153p already factors that in though, at about 15 times forecast-beating 10p EPS for this year.

It's difficult to see how that price is attractive, unless you think further substantial progress in earnings is likely? There's a big pension deficit here too, which has grown to £28.3m on the most recent accounting basis. Looking at note 22 to the 2013 Annual Report, this section concerned the overpayments needed;

In August 2012 and as part of the schedule of contributions agreed with the Trustees to Thorntons’ Pension Scheme, it was agreed that the Company’s annual deficit contribution would increase from 1 June 2012 from £2.2 million to £2.75 million.

It was also agreed that the Company would make an additional contribution over each of the next three financial years, equivalent to the higher of either:• a third of any reduction in the net debt excluding VAT creditors for the financial years ending June 2013, 2014 and 2015; or

• the amount of dividends paid to shareholders above the level of £1.5 million.

...The pension contributions to be paid by the Group during the financial period ending 28 June 2014 are expected to be in the region of £3,188,000.

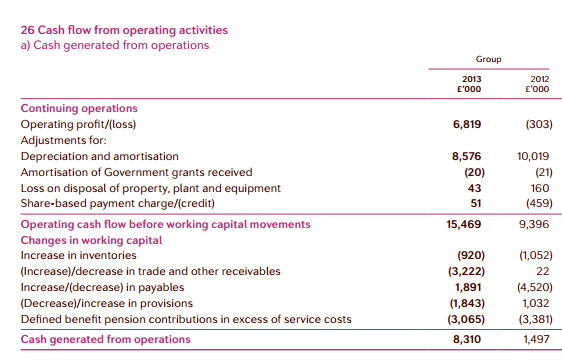

As you can see from the excerpt below from Thorntons 2013 Annual Report, note 26a, almost 20% of the group's cashflow is being used annually to plug the shortfall in the pension fund (see £3,065k paid into the pension fund, versus £15,469k operating cashflow);

So in my view you would be justified in seeking a 20% discount in share price to take account of the pension fund deficit recovery payments. Hence that takes the underlying PER up from 15 to 18, which strikes me as very warm.

If I were the FD here, I would take advantage of the buoyant share price & recovery story to do a fundraising, and get that Balance Sheet properly sorted out. In my view they need about £20-50m in fresh cash to properly straighten out the weak Balance Sheet.

On a positive note, see how large the depreciation charge is - therefore in a crisis the business could just be run for cash. Although it also raises the question as to what level of capex is needed just to stand still? It looks a fairly capital-intensive business, presumably all the machinery needed to make the chocolates, plus the fittings in the remaining shops.

Very small dividends are forecast for 2014 and 2015, which as noted above is restricted by the pension fund, since payments over £1.5m p.a. trigger additional payments into the pension fund.

It's remarkable how the market is just ignoring these negative factors, and pricing the company as if it were well financed and didn't have a pension deficit. On the other hand, perhaps bulls are offsetting the freehold property assets against the debt and pension deficit? Note 13 to the 2013 Annual Report shows £25.2m in long leasehold and freehold property, which I think relates to their Head Office site? I've tried googling to find information on the value of that property, but am misdirected to residential property in Thornton Heath, near Croydon!

EDIT: Some interesting exchanges on Twitter this morning concerning Thorntons.

@RebelHQ has been a long time bull on the stock, and has been very much proven correct. He points out this morning that there are 80 more store closures in the pipeline, all of which are currently loss-making, so sees 15p EPS being possible for next year. That would put the stock on a PER of 10, which looks a more reasonable valuation.

@equity_research (the Twitter account of commissioned research company, Equity Development), say: "Just back from packed $THT analysts meeting. Co confident re prospects for EASTER. Excellent momentum at FMCG division"

Johnson Service (LON:JSG)

This group is also a successful turnaround, which is starting to look interesting in my view.

Results for the year ended 31 Dec 2013 are out this morning, and look to be slightly ahead of broker consensus of around 3.7p, with 3.8p having been achieved. That 3.8p EPS figure is diluted (good, as that takes into account outstanding share options), but adjusted (potentially bad, if management have stretched the definition of adjusted).

Checking out the small print, the only items adjusted for in 2013 were £0.6m of intangibles amortisation, and £0.6m of exceptional items. That's small enough in the context of £17.0m adjusted operating profit, to be of no concern to me. So having established that I'm happy with the adjusted EPS calculation, how does the valuation stack up?

At 52p current share price, the historic PER for 2013 is 13.7, which looks about right to me.

Debt has been a big problem here before, but was sorted out in 2013 with a disposal, and ended the year with net debt at £24.5m, which looks OK to me. That's about 9.3p per share, or just under 18% of the share price, which seems a reasonable ratio. More importantly, the business generates a lot of cash (£32.3m net operating cashflow in 2013), so the Bank are probably pretty relaxed about things at this level.

Remember to factor in the pension deficit here too, which required £2m over-payments, costs that normally do not go through the P&L.

A quick review of the latest Balance Sheet shows a net current liabilities position (not good) - with current assets of £35.8m being 83% of current liabilities of £42.9m. With a further £46.1m long term liabilities, net tangible assets are too small, at only £15.1m. Personally I like to see a fair bit more Balance Sheet strength, although I'm probably being too conservative on that front.

Also announced today is a Placing at 51p, to raise £12.8m net of expenses. That's an impressive discount of virtually nothing to the current market price, and is about 10% dilution. The company being acquired looks a good fit, being a hotel linen provider. Proforma net debt will rise to £34m at 31 Dec 2013 following the acquisition and Placing, which is not excessive, but certainly at the top end of what looks comfortable, in my opinion.

Given that the company got into problems with excessive debt before, I'm surprised they have not adopted a more conservative approach this time around.

Overall, this company is starting to look interesting to me, so is going on the watch list.

Smiths News (LON:NWS)

This is a distributor of newspapers, magazines, and other products. Their shares are down nearly 13% today to 180p, on publication of a trading update today. The key part says;

As a result underlying Group profit before tax for the first half is expected to be in line with the prior year.

There has been no change in the underlying financial condition of the Group since the year ended 31 August 2013 and the Group continues to operate well within its new bank facilities.

So no change on prior year performance suggests about 21p EPS this year also. Broker consensus seems to have only been for marginally above that anyway, so the sell-off today seems a bit harsh at a first glance.

This share might look attractive for the 5% dividend yield, but in my opinion it shouldn't be paying any dividends at all - because the Balance Sheet is very weak. Reported net assets are negative, to the tune of £56.9m, and once you write off intangibles that worsens to a deficit of £125.1m. That's bad, and makes it uninvestable as far as I'm concerned.

Remarkably, a banking syndicate renewed their facilities, and even increased them, to £200m, maturing in Nov 2018. I can't understand why the banks are so comfortable extending such a large facility to a group this financially weak, although it seems to hinge on EBITDA rather than assets. So that's fine as long as the EBITDA keeps flowing.

Hence my view remains that this looks a potential value trap - shareholders are taking on a lot of risk in return for the 5% yield. There must surely be attrition in its core markets over time, as newspapers & magazines will presumably decline over time as the use of tablets increases? They seem to be offsetting that impact by acquiring companies in other areas.

I've not managed to cover everything today, so apologies for that.

Also, a reminder for Mello Central investor evening, this Weds at FinnCap's offices in London. Click this link for more details & how to book a place via the organiser, David Stredder.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SEE, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.