Good morning,

Paul is going to be busy for most of today, so I'll man the fort here.

At the moment I provisionally intend to cover:

- Harvey Nash (LON:HVN)

- Trakm8 Holdings (LON:TRAK)

- £G4M

Regards

Graham

Harvey Nash (LON:HVN)

Share price: 61.4p (-1%)

No. shares: 73.5m

Market cap: £45m

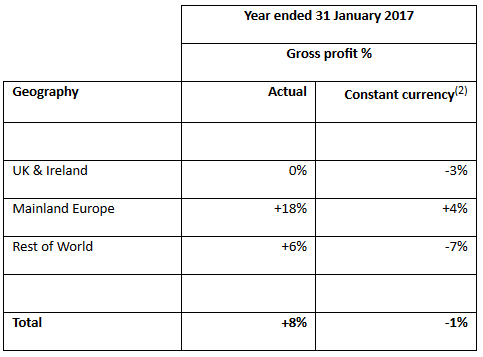

This lowly-rated recruiter seems to be doing ok, mostly because of currency movements:

However, today's statement from the company doesn't take any responsibility for the weakness seen, blaming the UK result on Brexit uncertainty and blaming the Rest of World result on "challenging market conditions" in Hong Kong.

Perhaps it's unrealistic to expect better explanations than this, but I much prefer when companies tell us that they made some mistakes or that they were beaten by superior competition, and that's why the results aren't very good.

Anyway, even with this lacklustre trading update, Harvey Nash shares are screaming value at the current level. I'm not surprised to see that the StockRank Value Rank is 99. The trailing PE ratio is 6.8x and that ignores the value of the healthy cash balance.

So if it can sail through the next year or two in a reasonable way, it's priced for a fantastic shareholder return, even if we assume the business is less than high-grade.

Trakm8 Holdings (LON:TRAK)

Share price: 75p (-4.5%)

No. shares: 32.5m

Market cap: £45m

The stream of bad news here has finally taken its toll on shareholders with a discounted placing. £2.1 million is raised through the issuance of 3.2 million at the discounted price of 65p per share.

The bookbuild was made available only to institutional investors, investing alongside management and directors who have put in £800k.

The statement acknowledges that the issuance price is at a 17% discount to yesterday's closing price. Needless to say, this is another instance of the disparity in opportunity faced by difference classes of investors.

For what it's worth, my general approach would be to seek to sell shares in any companies I owned which had heavily discounted placings, and wait until I had the chance to buy in again at or below the placing price. I'd almost be inclined to do that out of principle, regardless of valuation!

So I can understand why some investors might have sold Trakm8 shares today, to close the discount to the placing.

Rationale

A recent trading update (21 January) revealed that orders had been delayed and that a shift in the business model had led to lower short-term revenues (but hopefully greater long-term revenues), "with a consequent impact on cash flow and indebtedness".

Today's placing takes a bite out of £6.2 million in net debt (unaudited) which the company says it had on January 31st.

My opinion

The bank is said to remain supportive, and it appears that institutional investors remain quite supportive too, oversubscribing for today's deal so that the company has raised more than it intended to.

It's also a decent show of support from the Board and management team to collectively take part in the placing.

So it looks way too soon to me to say that there is any financial distress here. I'd only start to get extremely worried if there was a second fundraising in the near future.

£G4M

Share price: 655p (-3%)

No. shares: 20.2m

Market cap: £132m

I won't pretend to be expert in this company compared to Paul - and perhaps he will have his own thoughts on it in due course.

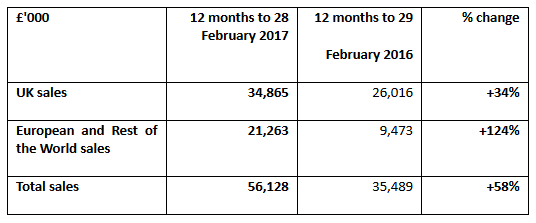

This is an update for the year ending Feb 28th:

I note that the Feb 2016 results were themselves a 47% revenue increase on 2015, so the top line has certainly ramped up.

Ex-UK is now 38% of total sales. A properly international business at this point, then.

Active customer numbers up by 49% is a slower rate than the sales growth - a good sign of increased spend per customer, perhaps?

Outlook

Funny that the share price is soft today when this is an ahead-of-expectations update!

"Whilst continuing to invest in the future growth of the business, we have closely managed our costs and the Board is now confident of delivering profits for the year marginally ahead of our increased expectations signalled in January."

My opinion

Unless I'm mistaken, those expectations which have possibly been beaten were for EPS of 9.2p this year.

Then for the year to February 2018, guidance is for EPS of 11.5p, followed by 14.5p after that.

So the forecast PE ratio is 45x on a year-after-next basis.

Only for the firm believers, might I suggest.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.