Good afternoon! It's Paul here.

It's very quiet for small cap news, so I had a lie in. Today I'll be covering;

Focusrite (LON:TUNE) - Final results

Audioboom (LON:BOOM) - Interims to 28 Feb 2017

Webinar 1pm tomorrow

Ed is launching some terrific new features, with a webinar tomorrow (4 May 2017) at 1pm.

Here is the webinar sign-up page. I've had a preview, and I really like the new features - a new "stock classifications" system, to sit alongside the StockRanks.

As you would expect from the boffins at Stockopedia HQ, it's well thought through, and has been number-crunched to oblivion!

This is another great feature for our toolbox in trying to find great stocks, and avoid all the junk out there.

Focusrite (LON:TUNE)

Share price: 241.5p (up 8.5% today)

No. shares: 58.1m

Market cap: £140.3m

(at the time of writing, I hold a long position in this share)

Interim results - for the 6 months to 28 Feb 2017.

This company describes itself as a;

global music and audio products company supplying hardware and software products used by professional and amateur musicians

I've written positively about this company here 4 times in the last year - click here to see those previous reports, which have useful background. I usually re-read my previous notes, to refresh my memory about the company.

These interim figures look excellent to me.

Revenue up 23.7% to £32.0m

Adjusted operating profit is probably the best comparison number, and is up 23.8% to £4.6m

Note that the numbers below this line are flattered by a big reduction in the finance charge line - which was £725k in H1 last year, but only £24k this year. Therefore, don't get over-excited about the 89.1% increase in profit before tax, as that's benefited from the reduction in finance charge.

Note also that some of this year's headline numbers are also flattered by there being no "non-underlying" costs in H1 this year, whereas last year contained £537k in non-underlying costs.

Adjusted EPS is up 52.2% to 7.0p

Broker forecasts look too conservative now, so I am expecting to see forecasts raised. Maybe the company could be heading for 14-15p adj EPS for the full year? Consensus is currently 12.3p, so the company seems to be running ahead of that.

Research Tree has got 2 broker updates on it today. Panmure have upped their forecast by 4%, but still look much too cautious in my view. They do say that their forecast of 12.6p adj EPS for this year is conservative. This provides us with an opportunity I think. I love situations where a company is trading its socks off, but for some bizarre reason the brokers decide to keep their forecasts well below what the company seems on track to achieve.

If I'm right about EPS heading for 14-15p this year, then at 241.5p this share is hardly expensive, on a PER between 16.1 and 17.3. That doesn't seem expensive at all for a high margin, cash rich, growth company.

Edison has also increased its forecasts today, and is looking for 12.8p for the current year. It strikes me that the company is probably guiding brokers low, so that it can under-promise, and over-deliver. That's fine with me, as it skews risk:reward in my favour. Unduly pessimistic broker forecasts are the investor's friend at companies which are performing well - it gives us a favourable entry price, and almost guaranteed upside when results are published that smash forecasts.

Outlook comments seem upbeat;

Since the half year end, revenue and cash have both continued to grow strongly. The new products introduced in the period and the second generation of our market-leading Scarlett range continue to sell well, and we look forward with confidence to the second half of the current financial year and beyond.

The company's good performance seems to have been driven by innovative new products.

USA is a particularly strong market, where sales have risen 25% on a constant currency basis (up 46% as reported in sterling - note the big forex benefit) . Note that this is now the largest region, having overtaken Europe.

Forex gains & losses on hedging contracts now by-pass the P&L, and instead go through reserves. This is a change in accounting policy from last year.

Balance sheet - is fantastic. This is a very conservatively financed company, stuffed with surplus working capital. Some people find that inefficient. I find it wonderful! The current ratio is a very strong 4.05 (anything above 1.5 I regard as strong). There's no debt too, just terrific. This is hidden value, so a very good thing for investors.

The company has scope to make acquisitions, which would increase earnings. Plus it can grow rapidly without any working capital constraints. Plus it won't have any problems surviving the next recession. Strong balance sheets are so good - it amazes me that so few investors pay much attention to the balance sheet, when it can provide smashing upside, often in for free.

Cashflow - looks fine to me. Note that the company capitalises a fair chunk of development spend. In this half year, it capitalised £1.6m in development costs, versus an amortisation charge of £1.2m. So the profits are flattered by £0.4m via this (perfectly valid) accounting treatment. I'm only pointing it out, not criticising it.

In my view, providing the amount being capitalised looks reasonable, and the company is clearly driven by product innnovation, then this accounting treatment is acceptable. It only becomes a problem when companies capitalise anything that moves (e.g. Telit Communications (LON:TCM) ) and where the benefit from capitalising costs creates artificial profits. Remember that was one of the many criticisms I had of Globo, which turned out to be a complete fraud. So excessive capitalising of development spend is a big red flag. Things look fine at TUNE however, so this is not a problem here.

My opinion - as you will have already gathered, I really like this share! It's exactly what I look for - a reasonably-priced, innovative growth company, that's profitable & cash generative, performing well & generating good organic growth.

It's imperative to always think about downside risks too. In this case, some people may not like the concentrated ownership structure. Personally I quite like that - the lack of liquidity can cause the share price to move up strongly. This is effectively a private company with a listing, so you have to be 100% confident about management. Given the track record, I am very comfortable with management having lots of skin in the game. That's much better than having hired hands who are only really interested in milking the company for their own remuneration.

Dividends look mean. Given the company's very strong balance sheet, I hope the company becomes more generous with divis in future. The 0.75p interim divi is up 15%, but it's still such a small amount, it's hardly worth the admin. So I'd like to see the company have a think about rebasing the dividends at a much higher level. There's plenty of cash in the kitty, so unless they have a better use for it, surplus cash really should be given to shareholders.

Another risk to consider, is that the company is reliant on continuous product development. Existing products tend to wane, and need to be replaced with new products. Therefore, if product development is not sufficiently good, then future profits could decline. There's no sign of any problems on that front at the moment, quite the opposite - new products are clearly doing well, and ranges are broadening, driving good growth.

Overall then, I think there's lots to like here. If things continue going well, I could foresee this share reaching 300p+ next year, at a guess. There are always risks with every share, but I think risk:reward looks attractive with FocusRite shares. It seems an excellent, and reasonably-priced growth company, in my opinion.

As always, it is imperative that readers do your own research, as I only have time to briefly review companies here, and might have missed something important. Also, due to the sheer number of companies I cover (500+ at the last count), it's not possible to go into great depth on everything. So these are just brief reviews here, to flag up interesting companies you might wish to research more thoroughly - and hopefully add a comment below, with your findings.

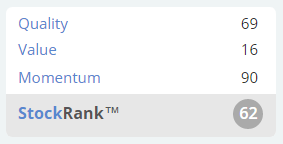

I'm surprised the StockRank isn't higher (see below). Perhaps the stingy divis might count against it on the value score?

Audioboom (LON:BOOM)

Share price: 2.17p (down 7.7% today)

No. shares: 919.0m

Market cap: £19.9m

Final results - for year ended 30 Nov 2016 - yes, that's November last year. It's taken this tiny company 5 months to produce its figures. That's ridiculously slow.

Audioboom is a website & smartphone app, delivering spoken-word audio content.

Revenue is up strongly in percentage terms, but from a very low base. So it's up 583% to £1.2m

Gross profit however, was only £266k, note the very low gross margin of only 20.3%

Administrative expenses were hugely out of kilter with gross profit, at £5.1m

To put that into perspective, if gross margins remain at 20.3%, then the company would need to grow revenues 19-fold, just to reach breakeven. That's ridiculous - this is clearly not a viable business, as things stand.

Balance sheet is very weak, with only £687k cash on 30 Nov 2016. However, the company has since raised another £4.5m before costs.

Cash burn was about £4.6m in 2016, down a bit from £5.7m in the prior year. Hence it's likely to be running low on cash again towards the end of 2017. More fundraisings will clearly be needed. Who knows what terms those will be on? It looks to me as if time is running out for this project. Luckily they have wealthy backers who have (so far) been prepared to continue pouring cash into the company. It all hinges on whether those punters have got the stomach for more fundraisings? The big risk is that they might lose faith in it, and pull the plug.

My opinion - another year goes by, and AudioBoom is still nowhere near being a viable business. The relentlessly optimistic narrative talks everything up, but the figures are as grim as ever.

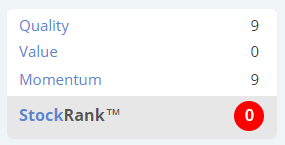

This share is ultra high risk, and this is reflected in its StockRank of zero.

I cannot see why anybody in their right mind would invest in this company.

I suppose people might think that it's a 10:1 punt - that's probably heading for failure. However, if it did succeed, then the upside could be big. That's the only reason I can think of as to why anyone would put money into this.

Trakm8 Holdings (LON:TRAK)

Share price: 88.5p (up 7.3% today)

No. shares: 35.7m

Market cap: £31.6m

(at the time of writing, I hold a long position in this share)

Contract extention - Direct Line has renewed its expired 3 year contract with a fresh 3 year contract. This sounds like a significant contract renewal;

Trakm8 have over 110,000 devices reporting in insurance applications built from a zero base three years ago and Direct Line are a significant part of this.

Directorspeak - this contract renewal helps improve revenue/profit visibility;

We are delighted to continue this relationship as the demand increases. This contract provides additional visibility for our expectations for the financial year and beyond."

Insurance telematics - I chatted to a senior telematics industry source recently. He explained to me that insurance deals for telematics are not much cop. The reason being that telematics-based insurance is mainly used for new drivers. The main insurance risk from new drivers is apparently in their first year of driving. Once they have satisfactorily completed their first year, without crashing, or having insurance cover removed for dangerous driving (detected by the telematics unit), then they tend to move onto standard car insurance policies (i.e. without telematics).

Therefore he suggested to me that the recurring revenues from insurance-based telematics don't actually recur for very long! Hence this line of business is possibly not very profitable for TrakM8.

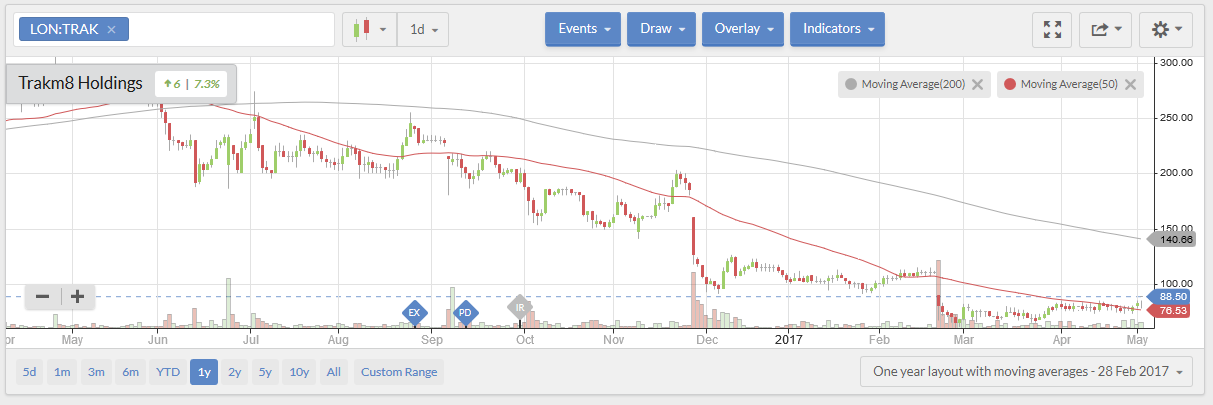

My opinion - I sold my TrakM8 shares when things started to go wrong last year. Good thing too, as the shares have absolutely tanked.

However, I went back in via the recent 65p placing, and the shares are now showing a healthy rise of 36% since the placing.

Management have really made a hash of things here, but maybe it's over the worst now? Forecasts show a significant recovery in profits this year. Although I think credibility is currently shot to bits, so it will take time for the market to recover in confidence towards this share.

That said, I think there is potential here, if new products take off. Time will tell. It's also encouraging that management put up a substantial part of the recent placing monies themselves - it's good to see them putting more skin in the game. That reinforces my hunch that we could possibly be over the worst here? Maybe!

OK, that's me done for today. See you tomorrow!

Regards, Paul.

(usual disclaimers apply - these are my personal opinions, not advice. DYOR please)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.