Good morning!

It's a positive morning for airlines, with positive news as follows (briefly, as they're not small caps);

easyJet (LON:EZJ)

This share is up 6% this morning to 1774p on a trading update which outlines strong UK summer trading (for August especially) for European beach & city destinations - late demand being presumably driven by mostly poor weather in the UK during August.

Easyjet's profit guidance range for y/e 30 Sep 2015 has been raised from £620-660m to £675-700m.

Incidentally, why can't all UK listed companies (regardless of size) publish their profit guidance range to the market, and update/narrow it as the year progresses? This is surely the best way to manage investor expectations. Even if the range was very wide for small caps, it wouldn't matter. Surely it's better to say that we expect to deliver profit of £1-2m at the shart of the year, then narrow it to say £1.5-2.0m midway through the year, and then close in on a firm figure towards the end of the year? That makes far more sense than giving a single estimate via the house broker, which then constitutes a profit warning if it's moved down. Far better to give a range surely?

Easyjet's load factor is impressive, at 94.4%, so they're almost filling their planes. I'm not surprised - the prices are keen, service is generally good I've found, and the fleet of planes are new and in good condition. So I like flying Easyjet, apart from when the flight is disrupted by noisy Stag parties - something needs to be done about that - a zero tolerance approach in my view. Also their cabin baggage policy is ridiculous - people bringing on small suitcases & trying to ram them into the overhead lockers, really slows down the embarkation process, and causes friction & stress on board as there isn't enough space.

Dart (LON:DTG)

This airline/travel/haulage group has also put out a positive announcement today, propelling the shares up 10% to 486p this morning. The shares were starting to look expensive, but that now appears to be justified from positive trading.

In a way, the PER doesn't necessarily indicate whether a share is expensive or not. It is just telling us what the market's current growth expectations are. That's fine as long as a company achieves growth which justifies a premium rating, but of course problems emerge when growth companies on an expensive PER fail to deliver - then it's a long way down, usually vertically.

No chance of that sort of problem here for the time being I would imagine, after this statement today;

In view of the continued strong demand for our Leisure Travel package holiday and flight-only products, the Board is optimistic that Group performance for the financial year ending 31 March 2016 will materially exceed current market expectations.

That's really impressive, given that broker forecasts have already been considerably increased twice in the last year;

Material usually means at least 10%, so I would imagine we're possibly looking at high 30's in EPS, maybe up to 40p EPS for this year? Suddenly the shares don't look expensive any more, a PER of about 12 if EPS does come out as high as 40p. Well done to investors who anticipated this strong performance.

Dart also announces that it's ordered $2.6bn (£1.7bn - wow!) at list prices of new Boeing 737s, but confirms that it has negotiated a "significant discount" from list price. This is for replacements and additional capacity. Does any reader know how many planes they currently have, as that would then indicate the extent of additional capacity coming in?

All very impressive. On the basis of this material upgrade to forecasts, and more growth in the pipeline, you could argue a good case for gritting your teeth and making a fresh purchase now. After all, if forecasts shoot up, then what looked pricey suddenly looks good value again. At the very least, if I held the shares, I'd be inclined to hang on to them due to this strong performance reported today.

So my previous reservations about the valuation looking toppy, have been blown away by significant out-performance of the company. Trouble is, it's very difficult to know that in advance!

Flybe (LON:FLYB)

(at the time of writing, I hold a long position in FLYB)

I'm wondering if there is any read-across for Flybe (LON:FLYB) who might also have seen buoyant trading to the European destinations they serve? Although they have more of a domestic UK focus, they do some short haul European flights too.

Flybe has the forthcoming catalyst of disposing of its surplus Embraer jets, although we don't know when that will happen, nor the cost (which is capped at about £80m).

Other factors which are helping airlines, include cheap fuel. Furthermore, I think AirBnB is very positive for low cost airlines, as this popular website allows budget travelers to book amazingly cheap and often very good accommodation. Combine that with cheap flights, and you could see habits changing, with British people taking far more frequent, but shorter/cheaper holidays which they arrange themselves via budget airlines, and AirBnB for the accommodation, instead of the traditional big summer package holiday. So these trends are great for cheap airlines, but bad for hotels, who lose the business.

The lousy weather in August this year really shouldn't change the valuation of airlines though, as that's a one-off factor which could easily reverse next year if there's a heatwave in the UK. So I'm generally sceptical about reacting to weather-related announcements.

Fairpoint (LON:FRP)

Share price: 177p (up 3.6% today)

No. shares: 44.6m

Market cap: £78.9m

Interims to 30 Jun 2015 - I hope readers have benefited from the c.40% rise in this share price in the last month, as I've been flagging the value in this share for some time (e.g. here on 1 May 2015 at 124p, where I pointed out the potential for a re-rating).

Also here on 3 Aug 2015 at 136.5p when I had warmed further to the share, flagged the good quality acquisitions, and the likelihood of a re-rating to 200p. I'm not always right (by any means!) but there are plenty of good situations flagged up in these reports for you to take your pick from & DYOR. This share was one of the good ones.

The value stood out like a sore thumb for a while, before suddenly re-rating fairly swiftly - maybe a selling overhang has cleared? The catalyst has been a couple of recent acquisitions of legal firms, which has changed the main focus of the group from consumer debt management, to a more broad-based legal services business.

I'm talking to management at 11:30, so had better get acquainted with the figures now, beforehand.

Legal services is now 62% of group revenues on a pro forma basis (i.e. annualising the recent acquisitions, presumably).

There's not much point in analysing the H1 figures, as the group is growing through recent acquisitions, so I'm only really interested in what the outlook is like, and this sounds fine;

...As a result of the above factors, the Board is confident of delivering good progress in line with market expectations for the year as a whole, whilst further establishing the building blocks for continuing growth.

Valuation - broker consensus is for £55.1m turnover, £8.3m net profit (good margins note), and 18.4p normalised EPS this year. That should grow to 20.0p EPS next year (calendar 2016). I think you could justify a PER of 10-12, so that gives a price target of 200-240p, so a bit more upside from the current level of 177p.

It's difficult to know what PER is appropriate for this type of business, so I've gone for a level which is in the same sort of ballpark, or a little higher, than what they pay for acquisitions, which seems a sensible valuation approach.

Net debt - was £5.2m at 30 Jun 2015.

This has since increased, due to the acquisition of Colemans, which cost £8m cash and £1m in shares, so pro forma net debt is likely to be about £13.2m I think. That looks fine to me, as it's less than 2 times profit before tax. There are potential earn-outs, but these should be largely self-funding.

Balance sheet - looks fine overall to me. Investors need to keep an eye on Debtors and WIP in this type of business, as they can easily be exaggerated in order to boost profits, as happened at Quindell (LON:QPP) of course, to take the most extreme example.

Bear in mind that Fairpoint's cashflow should be very positive, as the IVA receivables of £13.5m gradually turn into cash, as that side of the business continues its decline.

Dividends - the interim divi has been raised 7% to 2.45p, which looks consistent the historic pattern of paying out a smaller interim, then larger (typically 78% larger) final divi. If that pattern repeats, then the final divi is likely to be about 4.4p, giving 6.85p for the full year - that is in line with broker consensus of 6.8p total divis for this year.

So the divi yield is currently 3.8%, still quite good (but it was a lot higher a month ago!)

My opinion - it's panning out exactly as I thought it would. It's not a share I currently hold, as I made a mistake and sold out around 160p when there was the big correction last week. This was because I held them in a geared account, and wanted to eradicate my gearing in case of a market crash. Although of course as it has turned out, that was a mistake, I should have held tight. Never mind. Nobody ever went bust banking a profit, so am not beating myself up too much about it, although not running a winner is a serious investing mistake.

There again, as I held it on a Spread Bet, geared up 4 times (on 25% margin), then grabbing a smaller percentage gain but multiplying it by 4, has actually made more profit in cash terms. Please note that I always disclose in the header if I hold a position.

I'm not minded to buy back in at the current price, but will keep it on my watch list and revisit it if there is a significant pullback at any point. It's quite illiquid, so with this type of share you can find that they drift in between announcements, as people get bored and decide to move on. There again, for existing holders, it could be a good one to hold long-term for the gradually rising divis.

I think management have done a good job in transforming what was a declining IVA business, into a bigger group. So they might well be worth backing long term, as they seem competent and from what I can see, trustworthy - very important in this sector, as dishonest and/or incompetent management can very easily blow up legal services companies, as we have seen!

EDIT - I've just come off a Conf Call with management, and have to say I'm very impressed with their strategy to grow the legal services business organically, and through more bolt-on acquisitions. So I think this could be a good long-term investment actually.

Empresaria (LON:EMR)

Share price: 78.7p (up 9.3% today)

No. shares: 44.6m shares

Market cap: £35.1m

Interims to 30 Jun 2015 - a quick review of this results announcement before I take a break for lunch. This is a small staffing group, with an unusually broad geographic spread for such a small cap, with largely autonomous subsidiaries operating in the UK, Europe & RoW.

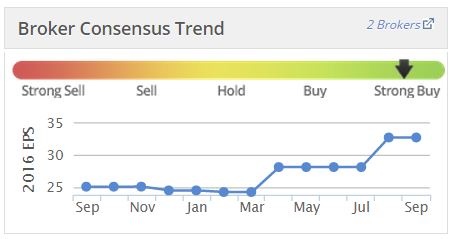

The last update was here on 20 May 2015, when the company said it was "on course to meet market expectations for the full year". As you can see below, market EPS expectations were upgraded slightly at the start of the year, but hiked more in Apr 2015 to just under 9p EPS;

What is most striking about today's interim results are that they have improved margins quite a bit. So turnover is actually down 2% (up 3% in constant currency), but Net Fee Income ("NFI") - which is what staffing actually make for themselves (i.e. excluding the wages paid to contractors) - is up 12% (16% CC) to £24.1m.

This has fed through to an impressive rise in adjusted profit before tax to £2.8m (up 33%). The driver for better margins seems to be that the sales mix has shifted towards more permanent recruitment (up 29%), and lower temporary (down 5%). This makes sense, because with permanent placements, the recruitment agency just earns a one-off fee that goes into turnover. Whereas for temps, the business is very low margin.

So actually, margins haven't really improved, it's just that the sales mix has moved favourably towards higher margin work, which results in a higher reported margin.

It looks as if there's an H2-weighting to profits, so I can't just double the interim numbers to forecast the full year. So let's look at the outlook statement instead for full year guidance.

Outlook - this sounds very good;

"Based on performance to date, we are confident that results for the full year will be ahead of current market expectations and look forward to delivering further growth. Despite increasing currency headwinds, market conditions are generally favourable and we see further opportunities to grow our business over the coming years."

Excellent stuff, so I imagine that 10-11p might be the right sort of EPS level for this year? With the shares currently 78.7p, that puts the PER at 7.2 to 7.9, which looks very reasonable. Although bear in mind this company has had rather heavy debt in the past, so I want to check out that next.

Net Debt - this is useful info given today, which reassures me that the reduction in net debt to £9.9m is not just something achieved to window-dress the 30 Jun 2015 balance sheet;

Interest costs reduced in the period, in line with the reduction in net debt. The net debt at the end of June 2015 was £9.9m, down 30% on the prior year of £14.2m. Average net debt levels across the first six months were down 39% on prior year. The ratio of net debt to trade receivables was 32% at the end of June, in line with the year end 2014 and down on the same time last year of 44%. Debtor days at the end of June were 52, in line with the prior year.

Updated information on the banking arrangements sound very positive to me;

During the period we finalised arrangements with HSBC to change the UK based revolving credit facility being used to fund German working capital financing, for locally based facilities provided directly to our German business. The new facilities comprise a three year term loan of €5m and an increased overdraft to €8m. All Group businesses with significant temporary sales now have local bank facilities in place. Centrally there is a £5m overdraft facility.

Following the repayment of the revolving credit facility, the bank is now simplifying the security and covenant requirements, much of which will be removed.

That last paragraph in particular makes me much more comfortable with things. I was particularly impressed with the FD, Spencer Wreford, when I met management a few months ago, and it certainly looks like he's doing a terrific job in restructuring the group finances. Mr Wreford is a capable CEO-in-waiting here, in my view.

Balance Sheet - overall it's OK these days, but not strong.

Net assets of £27.1m comes down to only £2.5m once intangibles (mainly goodwill) is written off, so that's only a sliver of tangible equity supporting the business, which still relies quite heavily on bank financing.

Current ratio - again is OK, but not great, at 1.15.

The main consequence of a weakish balance sheet is that you don't get much in the way of dividends - only about a 1% yield. Also, the business would be vulnerable in the event of another banking crisis, so it would be a share to drop like a hot potato if banks start shrinking their lending dramatically again in future. In the good times though, weak balance sheets don't really matter, so it's something to bear in mind when valuing the company, rather than getting too worried about, in my view.

My opinion - overall, the group is clearly on a roll, and the valuation looks reasonable. The PER could probably rise a bit, to maybe 9 or 10, given that the company is reporting positive trading updates. It shouldn't be rated any higher than that, due to the debt, and limited growth potential. Note also that the net debt has not reduced in the last six months, the drop in net debt actually happened last year, in H2. The shift in sales mix towards permanent placements should help keep debtors, and hence net debt, under control.

So I could see scope for this share to rise to say 90-110p as the year progresses. Maybe more, if they put out another out-perform trading update in future? So overall I quite like it, and think there is probably more fuel in the tank for moderate further increases in share price.

Note that it has a Stockopedia StockRank of 99 too, and this has proved to be a pretty good indicator so far.

Redde (LON:REDD)

Share price: 162.5p

No. shares: 296.8m

Market cap: £482.3m

Results y/e 30 Jun 2015 - as the mkt cap is now nearly £500m, it's getting too big for these reports really, so this might be the last time I report on this company. Checking the archive, I last reported on the company on 29 Jun 2015 when they put out a year end trading update, which said they would be "likely to exceed the upper end of market expectations".

In that report, I guessed that adjusted EPS might be about 8.0p. Today's results show adjusted EPS actually hit 8.4p, which is good, but it's only up 12.4% vs last year, which I'm a bit puzzled about, as adjusted EBIT is up 91%. So that implies there has been a large increase in the number of shares in issue, and/or issues with tax.

Note 1 shows that the diluted weighted average number of shares in issue has risen from 247.7m to 298.3m, so that explains some of the reason why EPS has not risen much despite profits almost doubling - because of the issuance of new shares.

Normalising tax - ah, I think there is also a complication with tax - there was a tax credit through the P&L of £4.2m last year, which boosted adjusted EPS by the looks of it. Note 8 also shows a tax credit this year too, but smaller at £957k. The trouble with this, is EPS is stated after tax, so the negative tax charges boost EPS, which would then drop back down again when the tax charge normalises in the future.

If you normalise earnings for a say 20% tax rate, then EPS in 2014/15 would have been £18.2m divided by 298.3m shares = 6.1p.

Normalising tax in 2013/14 again at 20% just for simplicity, gives earnings of £11.9m, divided by 247.7m shares = 4.8p.

It would be worth checking a broker note, to see if they also normalise the tax charges. You really should do, to arrive at a meaningful valuation.

Valuation - using my normalised tax EPS figure of 6.1p (and assuming that is correct, let me know if I've dropped a clanger here) then the PER drops out at 26.6 times - yikes that is really high for this type of business, even one that is performing very well.

It looks like the broker consensus that people are working from has not normalised tax, which potentially could mean people might be inadvertently over-valuing the shares? Even though this business has performed very well, a PER of over about 15 looks very aggressive for this sector.

Balance Sheet - looks fine. Debtors remain under tight control, which is the main worry for this type of company. It has net cash of £39.7m, which is a very good position to be in.

Dividends - generous! The forecast divi yield is still very good, at over 5%, so the cashflows are real. Divis are the ultimate litmus test of cashflows in my view.

Outlook - there's another out-performance comment for the new financial year already, which is excellent;

The new financial year has started well with performance in the first few weeks ahead of our expectations and the corresponding period last year. Additional contracts have been won and work has commenced in the period and this, together with the combination of our recent strategic acquisition, organic growth and further improvements in operational efficiency, gives the Board encouragement for the future.

Maybe they are picking up business from Quindell/Slater+Gordon, given their high profile problems?

My opinion - I like the company, but would like to get some clarity on what the underlying EPS figures are, once tax is normalised. So that would need investigating.

Also, I question the very high rating now, which maybe is getting a bit hot? However, as we've seen with other stocks on a roll, like Dart Group, shareholders who just run with the share, despite it looking expensive, have done very well, because the good news just keeps coming on earnings beats. So it's your call - it's your money after all - just do what you think is best!

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions, not recommendations or advice, so please DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.