Good morning! I'll try a (hopefully) improved format today - let me know what you think in the comments - does the mkt cap info at the top, and the sub-headings make it easier to follow?

4imprint (LON:FOUR)

Share price: 695p

No. shares: 27.966m

Market Cap: £194.4m

Interim results for the six months to 28 Jun 2014 look impressive to me. This company makes promotional marketing products for its customers - so things they can give to staff & customers to promote their brand, examples in the photo on the right, taken from 4Imprint's 2013 Annual Report.

There is a small UK division, but the overwhelming bulk of turnover & profit comes from its N.American operations, so this should really be seen as an American company that has a UK Listing, in my view. Nothing wrong with that, it's a proper business which makes profit & pays divis.

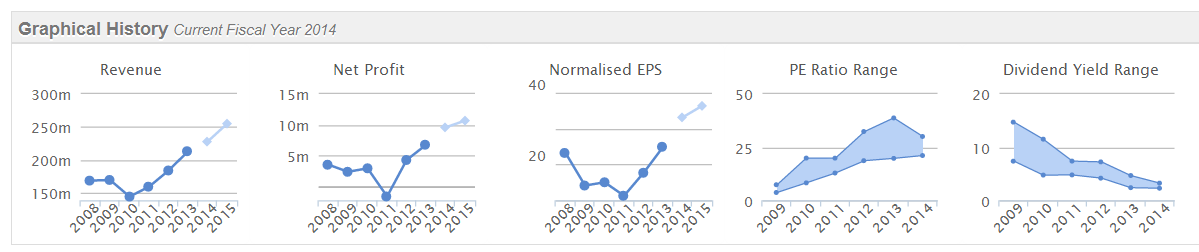

As you can see from the Stockopedia graphs below, the company's performance in the last four years has been excellent, with big increases in turnover & profits, although the valuation & divi yield have been getting more expensive, as the shares were steadily re-rated over this timeframe - so the ideal scenario of rising profits, and a re-rating to a higher PER happening at the same time.

So these two factors of higher profits and a higher PER rating are reflected in a stellar share price performance over the last five years, massively out-performing the FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX) (the beige comparison line):

Earnings - Is it worth buying now though? Today's interims show a superb 33% increase in "underlying" EPS to 16.0p (from 12.0p). There is a heavy H2 weighting to the financial year, with a 1:2 ratio for H1:H2 profits last year, which might be difficult to replicate this year. So broker consensus of 33.4p EPS this year (ending 28 Dec 2014), looks about right in my opinion.

Valuation - with the shares at 695p, the valuation therefore seems to be on a PER of 20.8, based on the broker consensus EPS figure of 33.4p. That's a fairly high PER, but it seems justified here, as the company is delivering excellent organic growth in profits - also bear in mind that they have been up against the headwind of the weaker dollar, so profit (before tax) growth at constant currency was even better, at 52%!

Growth - The growth all seems to have been organic too, which is a positive thing. It's always important to check this - since growth by acquisition isn't really growth, it's just bolting on another company, giving a one-off jump in profit. Whereas organic growth tends to indicate that a company is performing well, and hence usually continues.

Outlook - This sounds positive, with the chariman saying today;

"The Group delivered an exceptionally strong first half as a result of continued market share growth. Indications for the second half year are that good performance, consistent with our stated strategic growth objectives will continue."

.

Balance Sheet - 4Imprint passes my balance sheet testing easily. Current assets are a very healthy 197% of current liabilities, and that includes £17.5m of cash, with no debt. However, there is a...

Pension Deficit - Shown under accounting rules at £18.7m on the Balance Sheet. Looking at the last Annual Report, it is higher, at about £30m under the actuarial calculations. The key number in my view is the annual over-payment, which is a cash outflow, of £3.3m p.a., rising by 3% annually. This is agreed for 6 years, so £19.8m cash will flow out of the company, into the pension fund over the next 6 years. Probably the easiest way to value this, is just to ignore it - because the company has about that amount in cash on its Balance Sheet anyway. So I would just write off the cash, and net it off against the pension deficit, and value the company as if it were cash/debt neutral.

Dividends - The yield is c.2.8% this year, rising to nearly 3% next year. The track record is of divis being increased by 5-10% each year, so if you look at this as an inflation-proofed income stream, and capital gains on top as a bonus, then these shares could make considerable sense as a long term hold. Providing nothing goes wrong.

Broker upgrades - There have been a couple of broker upgrades this morning, so they are now forecasting 37-40p EPS for this year. That brings down the PER to under 20 again, even using this morning's now higher share price of 703p (at 10:07, 30-7-2014) which brings the PER down to 17.5 to 19, which looks a sensible valuation given the strong earnings momentum here.

My opinion - This seems a quality growth business, which is performing very well. Hence the high rating looks justified, providing good performance continues. One would imagine that growth is likely to continue, providing the N.American economic recovery continues.

Impellam (LON:IPEL)

Share price: 468p

No. shares: 43.9m

Market Cap: £205.5m

This is a recruitment company. Clicking on the picture on the right takes you to their website, for more info.

This is a recruitment company. Clicking on the picture on the right takes you to their website, for more info.

Checking my notes here, I've been dismissive about the company's performance, because it experienced some large losses from onerous contracts, suggesting a lack of financial control over its subsidiaries.

However, on reading today's interim results for the 26 weeks to 27 Jun 2014, I'm becoming more positive about the company.

It seems to be that the problems with onerous contracts at its Carlisle Support Services division have been dealt with, fully provided for (in fact £1.3m of excess provision has been written back), and new management put in place. So hopefully a line can be drawn under that.

Results - Operating profit for the six months has gone up 25.4% to £14.8m, and EPS has gone up 39.3% to 28.0p. That's just for six months remember, so doubling it to 56p for a full year, and add a bit to allow for an acquisition (of Career Teachers) made part-way through H1, and broker consensus of 61.1p EPS forecast for this year (ending 27 Dec 2014) looks about right.

Outlook - I've double-checked, but can't find any outlook statement with today's results, which is something of an oversight. However, H1 results look in line with expectations, and the narrative tone seems fairly upbeat, so one assumes things will make progress in H2 against a recovering economic backdrop.

Valuation - This is where it starts to look interesting, in my view. At 468p the shares are on a current year PER of just 7.7 times broker consensus of 61.1p EPS. That's a good bit cheaper than other recruiters, which seem to typically be priced on a PER of around 10-12 times.

Net Debt - This increased (mainly due to £20.3m spent on acquiring Career Teachers) to £33.0m at 27 Jun 2014. That doesn't look excessive to me, in relation to the £205.5m market cap, and I make it 1.9 times EBITDA (adjusted for corporate costs, this is £17.4m). Note that there is a huge debtor book, so net debt is likely to be a volatile figure. Finance expense on the P&L is £0.8m for H1, so doubling that to a full year of £1.6m, and assuming that is all interest payments at a (say) 4% rate, then that suggests average net debt throughout the year of c.£40m - not too far away from the half year end figure (which has probably been window-dressed down a bit, as everyone chases their customers hard to pay just before a financial period end).

It would be worth finding out the duration, size & cost of the bank borrowings, to see if it looks safe.

Dividends - These seem to have started in 2012, and a yield of about 3% is forecast for this year. Divis are in a rising trend, which is positive.

Balance Sheet - Not very good. Net tangible assets are only £8.1m, and I'm curious as to what the "other intangible assets" of £58.9m are, on top of £56.7m goodwill. There is net debt, as mentioned above, and the working capital position, whilst positive at 105% (current assets over current liabilities) is somewhat below the level where I feel comfortable (120%+). Although note that this does include all the bank debt - there is nothing much of any note in long term creditors, which is mainly deferred tax & provisions.

Risks - As regards downside risk, the bank debt situation needs looking into further. Also I'm worried about the potential bad debt risk, given (as with almost all recruiters) it has such a large debtor book. Today's results mention some problems collecting in cash from NHS Trusts, so what happens if one or more Trusts are made insolvent? (as occasionally happens). Does the company have adequate controls in place to avoid bad debts?

My opinion - This could be an interesting candidate for a possible re-rating, as the historic problems with Carlisle appear to have been dealt with. The current year PER of 7.7 seems unduly low, in my view. Note also that it achieves a very high StockReport score on Stockopedia of 98, which gives me increased confidence. Here is the two year chart (as usual with the FTSE Small Caps Index as the beige comparison line):

ITM Power (LON:ITM)

Share price: 27.1p

No. shares: 161.86m

Market Cap: £43.9m

This is a small company that seems to be trying to do very ambitious things, with hydrogen fuel production & energy storage.

I've only got a vague gist of what they do from their website - linked to by clicking on the picture to the right.

Results for the year ended 30 Apr 2014 look grim - it's burning through cash at an alarming rate. Revenue for the year was only £1.1m, but it generated an £8m loss.

There was £9.8m net cash at the year end, so presumably that's only going to keep them going for about another year - so presumably another fundraising is likely next year?

My opinion - Much too speculative. You have to really get under the bonnet of this type of speculative share, and understand everything in detail. Very few of them reach commercial success, so I can't see the point in looking at things like this. Especially as it generates a gross loss - customers are happy to buy things from companies which sell them for below cost, but that's not a sustainable business model.

Proxama (LON:PROX)

Share price: 3.3p

No. shares: 809.23m

Market Cap: £26.7m

This is a new company for me. The picture on the right links to their website. It's a small software & marketing company by the looks of it, doing proximity marketing (i.e. offers pop up on your mobile phone when you walk past a shop).

The trouble is, small companies like this which list on AIM hardly ever seem to work out. I got caught up in something similar a year or two ago, and it was a disaster - the problem being that companies invent a platform that sounds great, but completely underestimate the time & cost of marketing it. You then end up with a nice platform that hardly anyone uses.

In a trading udpate today, Proxama says that turnover in the six months to 30 Jun 2014 is only expected to be £350k (flat vs last year). An EBITDA loss in line with market expectations is likely for the full year, which looks to be about a £6m loss for this year, and close to breakeven next year.

So, with £5.3m cash reserves at end June, I imagine they will need to raise more money in the spring of 2015. If the growth rates are anything less than very strong, it will be a tall order to raise more cash.

H2 this year is expected to be "much stronger", at double H1, so that still means only £1m turnover for the whole year, and a £6m loss, which isn't anywhere close to being a viable business.

The CEO comments sound upbeat, but they always do with this type of company.

Neil Garner CEO stated "Our sales pipeline is increasing significantly and we expect this will continue due to the impact of the new additions to our business development team in Europe and the USA. We expect to make further announcements regarding strategic partnerships and live consumer service as we build towards scale beyond the tens of thousands of enabled locations and thousands of live users already engaging using our platform ecosystem."

My opinion - I can't see the point in taking the risk on these shares when it's this early stage. Even though it sounds a good idea, and there's no denying that this area of proximity mobile marketing will be commercially big at some point.

CML Microsystems (LON:CML)

Share price: 362p

No. shares: 15.96m

Market Cap: £57.8m

Shares in this semiconductor company took a bath in Jun 2014, and seem to have stabilised recently. So I wonder if it might be a value opportunity? Profitability seems to have slumped, with broker forecasts down from c.31p EPS, to just 12.8p EPS for this year (ending 31 Mar 2015). Although brokers are forecasting EPS to then almost double in 2015/16 to 24.1p.

Sometimes this type of situation can be a good entry point, if temporary factors are to blame for a profit setback. You get that kind of thing quite often with small caps - it's madness to assume a small company will deliver steadily rising profits, since in the real world small companies are subject to unforeseeable factors galore - as they are usually dependent on a few key products, clients, and staff. So many things can conspire to create material profit shortfalls. This is why smaller companies should be priced more cheaply than larger companies, but at the moment the market often forgets that and over-prices growth.

As the Stockopedia graphs below show, it's been a decently profitable company in the past, so it might be again? I'll try to find a time slot to do some more research on it, but am just for the moment throwing over the idea that readers may want to look into in more depth yourselves?

My opinion - none, not properly researched yet.

Time for lunch now, and a snooze on the sofa. See you tomorrow morning, and thank you for the feedback on the new format, which seems to have got a general thumbs up, so I shall stick with it.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in IPEL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.