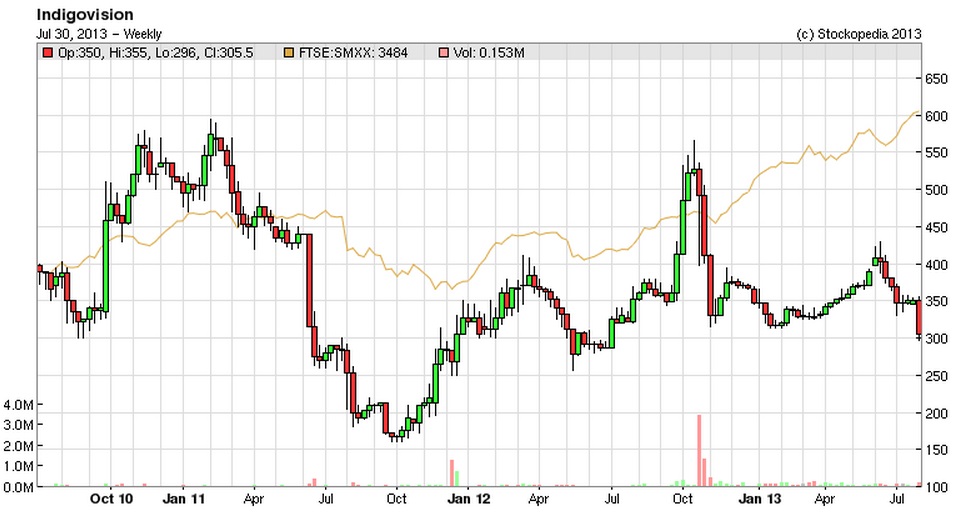

Good morning. My largest investment, Indigovision (LON:IND) delivered an unpleasant surprise yesterday just as I was nearing London Bridge station on the 12:21 from Hove, for an afternoon and evenings of meetings, so that threw things out of joint for the rest of the day. Their trading update yesterday was delivered two days earlier than the usual year-end date of 31 July, and constituted a mild profits warning.

This is disappointing, but there is no point in being emotional about these things, that just clouds one's judgment. It's always a question of carefully & disapassionately appraising the new information, and making an informed call on how that affects the valuation of the company. Then deciding whether to sell, hold, or buy more.

I'm mindful of the fact that a lot of friends & family have bought this stock, and been heavily influenced by my view on it, so before we get stuck into the numbers, I just want to apologise for it having disappointed. Although as I explain below, my view is that it's far from a disaster, but is just a disappointment.

So what are the key elements of IndigoVision's trading update?

Turnover - expected to be around £32m. Up 6% on last year (£30.3m), and in line with guidance.

Camera sales - showing strong (over 30%) growth against last year, and now account for half of group sales, more than offsetting a fall in traditional encoder sales.

Gross margins - improved in H2 versus H1, as planned. H1 gross margin was 54%, and the target range for margins is 50-60%, with the product mix being the key determinant. Gross margin last full year was 59%, so this year we are probably looking at a slightly lower margin of perhaps 55-58%? Still very good though, especially when you consider there is a further margin added on top of this for the system installer. So the products have considerable pricing power.

Overheads have continued to rise as planned. Strikingly, the sales & pre-sales headcount has been increased by a third.

Product development - increased spending on this. Product range broadened significantly.

Summary (my bolding):

During the current year we have again broadened the core product range significantly and increased the sales and pre-sales headcount by one third. The benefit of this investment in future growth has begun to show through in intelligent camera sales growth, but the transition has impacted the operating result for the year."

So, it is clear that if they had chased short term profitability, then they could have hit the profit target. My understanding is that they were hoping to deliver above target sales, and this would have recouped the investment in the increased sales teams. However, some significant deals have not been closed in time to get into the 2012/13 financial year.

Therefore the trade off is that results for 2012/13 are below forecast, because investment was made to drive growth with considerable product development & investment in the sales teams.

The company is upbeat about the outlook, with a strong sales pipeline, and feel their product strategy has been vindicated, in that they've driven growth from new products (mainly cameras), but the traditional encoders have slipped backwards due to competitive pressure & the fact that Indigo let the grass grow under their feet, and didn't update their product for five years! That has now been fixed, with a new and more competitive range of encoders being launched.

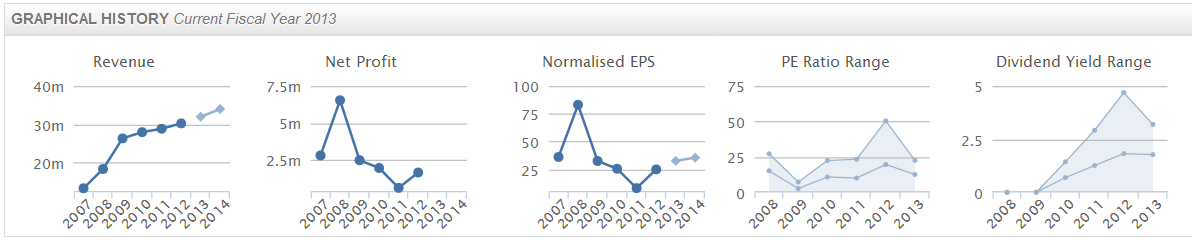

If you look at the Stockopedia graphical history, you can see there is a gently upward trend in revenues, and that the £2m profit for 2012/13 is in the same sort of ballpark as the last 4 years, broadly speaking (the second chart below). EPS looks to be coming in around 25p by my rough estimate, so again that's in the normal long term range, but below forecast of 32.7p.

I'm disappointed they didn't hit the profit target, but in the overall scheme of things, as a long term shareholder, I think it's more important that they've invested in the products, and have beefed up the sales teams for a big push for growth.

That was always the plan, remember this is a 3-year turnaround. Year 1 was to put in place the people & systems. Year two (the year just reported on, y/e 31 Jul 2013) was all about new product, and year three (the new year, ending 31 Jul 2014) is all about growth. Therefore it's now just a question of whether they can execute, and deliver the growth. If they can, the share price is likely to go up strongly, because of the operational gearing with gross margins expected to remain in the 50-60% range, depending on product mix.

If sales disappoint, then you've still got a profitable business paying a decent dividend.

So having gone through the figures, I think there's everything to play for, and the market cap of £23m is attractive, although there's no denying that in the short term the company has disappointed on profits, hence we saw a nasty markdown in price yesterday (on top of earlier falls).

I think the market has corrected the price to match short term performance (i.e. disappointing), but there is good upside from them hopefully executing the growth strategy this year, as planned.

The house broker has issued an update note on IndigoVision, which makes interesting reading, and confirms my thoughts about it. So the forward PER is 10.6, and the forward dividend yield is an attractive 4.2%. The figures for 2012/13 are less attractive, as they under-performed at the last minute unfortunately, so the PER there is 15.9, and the yield 3.6%. That's based on a share price of 307p.

Right, let's look at some other companies. This report is over-running, so I'll carry on writing until about lunchtime. So if you're reading this from the email list link, then you might like to refresh the page to read the rest of it a bit later.

Newriver Retail (LON:NRR) has issued a portfolio update which the market seems to like, with the shares up another 6p to 243p this morning, after a good run of price rises lately. There's masses of detail in this announcement about what they are doing with their various properties, and it confirms my bullish stance on the company.

The discount to NAV has now almost gone, which is entirely sensible. There is also development upside on the NAV to about 300p in due course. Plus long-term capital value appreciation, and a generous dividend yield. So for a long-term portfolio New River strikes me as a good holding to have, and I'm sticking with it. Although there's probably not that much more upside % on the share price in the short term, possibly?

Pure Wafer (LON:PUR) has issued a positive trading update. They are a silicon wafer reclaim service to semiconductor manufacturers. It's an interesting turnaround situation, which I've been looking at for a while, but didn't really understand the business well enough to invest.

Their financial turnaround has been pretty good though. They state today that production is running at record levels. Trading during H2 (they have a 30 Jun year end) is described as strong, but unless I missed it, there doesn't seem to be any reference to how results will be versus expectations. So I'm not quite sure how to value it. If anyone would like to elaborate on it, please feel welcome to do so in the comments section below.

Postal industry software group, Escher Group (LON:ESCH) is an interesting company. They presented at a ShareSoc event a little while ago, and I remember being mightily impressed that this small Irish group had come to dominate the niche of providing software to postal services. The reason I decided not to buy shares, was because it was so difficult to value - because a lot of its revenue was licensing, hence very difficult to predict. They have some recurring revenues too, but my worry was that I'd end up buying after a series of good contract wins, and then see earnings fall back down in subsequent years. That's usually the big risk with software companies, and why the holy grail is getting clients to sign up for annual licence payments on long term contracts, and long term support contacts.

Escher today reports interim (six months to 30 Jun 2013) turnover is up 47% to $12.8m, and that adjusted EBITDA is in line with expectations at $2.4m.

I don't accept EBITDA as being a valid performance measure for software companies, because it ignores their product development costs, which are capitalised and then amortised. So looking at EBITDA ignores those costs altogether, which is clearly nonsense.

Strip out the intangibles from the Balance Sheet, and Escher has net assets of nothing. I'm not keen on this one, as it doesn't actually look very profitable at all, once you include all the cash costs.

I see that Simon Thompson of Investors Chronicle has stuck the boot in with a pretty vicious and badly informed article on Indigovision (LON:IND) published today. He clearly doesn't understand their business model, as he wrongly suggests that they must have known that they were going to miss profit expectations some time ago.

In reality, the lumpy nature of sales at high margins, combined with fixed costs, means that large deals around the year end date will always have a material impact on the full year figures. It's the Achilles Heel of Indigo's business model unfortunately, and shareholders just have to live with the volatility that this causes.

I'm quite shocked that a generally well regarded journalist would publish such an ill-informed piece, that has obviously been written in the heat of the moment whilst emotionally charged. As a friend just quipped, "hell hath no fury like a tipster scorned!"

Pretty poor show - encouraging readers to buy high, and sell low, and not even bothering to find out the facts before publishing a sell note.

OK that's it for today. See you from 8 a.m. tomorrow.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in IND, NRR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.