Good morning!

It certainly feels a lot more calm today than it did this time yesterday, when we were seeing something of a mini panic sell-off. Encouragingly, a lot of the small caps I follow started to bounce mid to late morning yesterday, and recovered a lot of their losses by the end of the day. I'm seeing tentative buying this morning in some small caps too.

The general view seems to be that Greece is a nuisance, but widely expected, and something of a storm in a teacup as regards how we should value UK small caps. I think the EU will do whatever they have to do, to protect the Euro, and the banking system, and if that means cutting Greece adrift, then so be it.

On a human level, of course I feel sorry for ordinary Greek people. But this is what happens if you keep over-spending - eventually you run out of other peoples' money. There is no easy solution to what is going on there. I remain of the view that the most likely outcome is a compromise. It's inconceivable to my mind that the Greeks will voluntarily go for economic collapse, even if it would probably be in their best interests long term.

Plastics Capital (LON:PLA)

Share price: 97p (down 4%)

No. shares: 35.3m

Market Cap: £34.2m

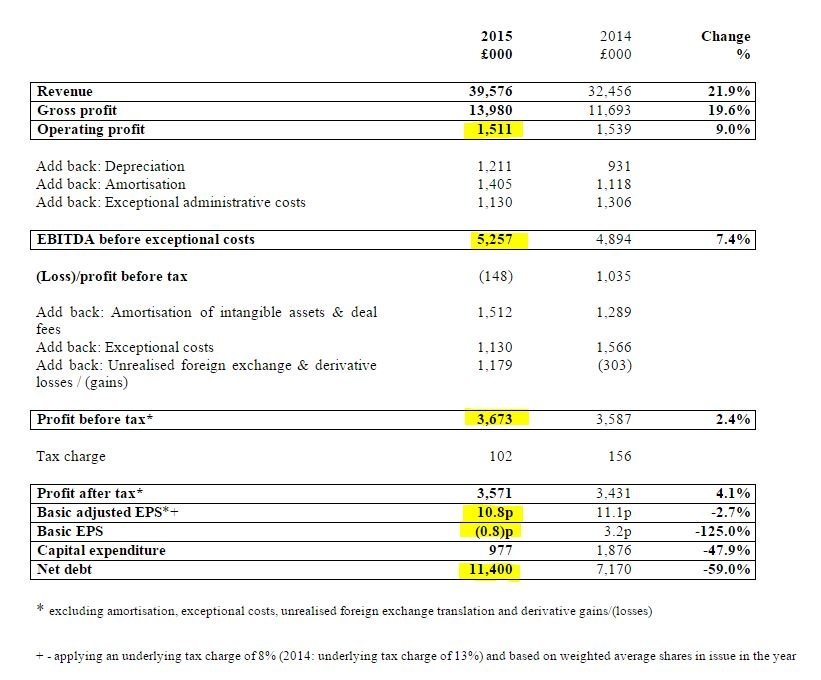

Final results y/e 31 Mar 2015 - adjusted profit before tax has come in at £3,673k, which is 2.4% up on last year, and looks to be in line with broker expectations. Although adjusted EPS of 10.8p looks below broker expectations of 11.7p, so at this point I'm not entirely sure if they have undershot, or not. Although the shares being 4% down suggests that the market is slightly underwhelmed by the numbers.

The trouble is, turnover is up 21.9%, driven by acquisitions, but profits are only really flat. So that implies the existing business has gone backwards in profitability.

PLA is also prone to making lots of adjustments to their figures, which leaves me feeling a tad uneasy - e.g. how exceptional are exceptionals, if they happen every year? This year £1.1m of costs are classified as exceptional. Last year it was £1.3m.

There is then a second layer of adjustments, for amortisation of intangibles, and deal fees, then a third layer of adjustments for forex & derivative gains/losses.

So investors can be forgiven for feeling somewhat confused as to how much genuine profit this group actually makes? Going from 10.8p adjusted EPS to an actual loss, of (0.8)p basic EPS, makes me feel uncomfortable about the extent, the nature, and the repetition of these accounting adjustments.

Note that there is only a very small tax charge, in both 2014 and 2015, so under HMRC rules the group doesn't make much taxable profit. Worth bearing in mind when valuing the company.

The company is transparent about it though, and provides this useful table:

Net debt - is getting a bit on the high side again, in my opinion. Although the narrative mentions that a property sale & leaseback was completed after the year-end, realising £1.4m.

It's all very well the company saying that net debt is only 1.6 times EBITDA, but that's in the good times. What happens in a downturn? EBITDA would drop sharply, and all of a sudden the net debt looks too much, just at the time that banks are getting jittery & looking to slim down their own balance sheets.

PLA sailed close to the wind on debt in 2008, so let's hope they don't over-gear in the good times again this time.

Dividends - these have been rising nicely, and the company is proposing a 2.67p final divi, taking the total to 4.0p this year. So a healthy yield of 4.1%, although I have my doubts about how solid the foundations are for these payouts.

Remember that the number of shares in issue has gone up, from historically around 27m, to 35.3m now, to part-fund acquisitions. So in a way, the dividends are giving with one hand, whilst taking away (issuing more shares) with the other. Therefore it could be seen as a bit of a mirage.

Generally I like to see companies growing without issuing new shares, and would rather forego divis in order for that to happen. Whereas here, you get a nice divi, but are seeing your earnings (and future divis) diluted from the issue of new shares to fund expansion, which has only managed to hold earnings flat, rather than increasing them.

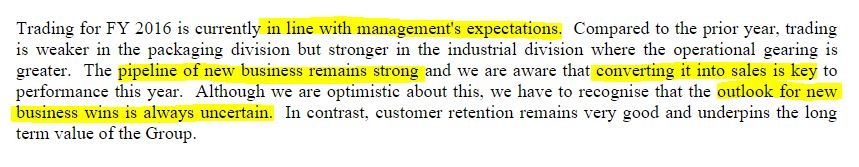

Outlook - sounds generally OK, but being cynical, they've given themselves wiggle room to warn on profits if sales leads don't convert into sales.

(please note my improved highlighting below - I cleaned the food debris off the bottom of my mouse & mouse mat, and it's easier to move sideways in a straight-ish line now!)

My opinion - sorry if the above all sounds a bit negative. It's not a bad company, but it's difficult to see any immediate upside on the share price, given that the results are lacklustre - showing no benefit from acquisitions, but now carrying more debt, and with more shares in issue.

I'm not convinced the dividend is sustainable at this level, and if it is, then there will probably have to be more dilution to finance any further acquisitions. I'm not convinced that the group structure adds any value, i.e. bolting heavy central overheads onto a small group of operating subsidiaries.

So for me, I'll pass on this one.

Torotrak (LON:TRK)

Share price: 7.2p (down 5.9% today)

No. shares: 276.3m now + 197.6m new shares = 473.9m + 71.4m re Flybrid = 545.4m

Market Cap: £19.9m now. £39.3m after fundraising completes.

Fundraising - as I predicted here, yet again Torotrak has come back with the begging bowl. The amazing thing is that anyone is prepared to keep funding this company, which has serially disappointed for over 15 years now. Although since the original gearbox technology wasn't really getting anywhere commercially, they've added on other similar automotive development projects into the company.

There's a Firm Placing with institutions for 128.6m shares, plus I am pleased to see that a 1 for 4 Open Offer for existing shareholders has also been included. Well done to the company and its advisers - this is very much best practice - after all, the principle of pre-emption rights is a core principle of company law. So an Open Offer of a meaningful size should always be combined with a Placing, unless there are exceptional circumstances.

Better still, it looks like the Open Offer shares will be taken by Institutions, if existing shareholders don't want them, so that's ideal. It gives existing shareholders first refusal, but there's a backup buyer, in case existing shareholders don't want them.

The amount being raised (before costs, which I expect will be hefty) is £13.8m. Ah I've just found it, the net amount is £12.4m, so the costs of £1.4m are just over 10% of the money being raised! Not exactly appealing - of the 7p subscription price, only 6.3p will actually end up with Torotrak, and the rest goes to advisers. Hmmm.

Earn out - an existing arrangement to pay up to £15m to the vendors of a previous acquisition, Flybrid, have been amended to be less onerous. Also, £2.8m in loan notes are restructured. Instead of £10m cash, the vendors will now get 71.4m new shares (£5.0m at the Placing price). That could become an overhang though, depressing the share price subsequently, possibly?

Note that today's announcement says if this deal doesn't get agreed by shareholders, then the company only has enough cash to continue operating until Sep 2015. Yikes! So the company and shareholders have sailed very close to the wind here - without a fundraising it would have shortly gone bust, or had to drastically down-size. I wonder how many shareholders were blissfully unaware of this risk? Probably quite a few - it amazes me how many people punt on shares without properly understanding a company's finances.

I'm sure this won't be the last fundraising for Torotrak. What price will the next one be at? 5p? 4p? 3p? 2p? Who knows?

On the plus side, operating costs are being reduced by 20%.

Final results y/e 31 Mar 2015 - as I suspected, the results are pretty awful. £3.8m turnover (similar to last year's £3.5m), and a thumping great operating loss of £8.4m (up from a loss of £4.8m prior year).

There is a tax credit though, of £626k, which I imagine is under the generous R&D tax credits scheme, whereby companies do actually get cash from the tax man.

Balance sheet - this has obviously been strengthened post period end, with today's announcement of the fundraising. So the company probably has enough cash for the next year and a bit, before it comes back for more.

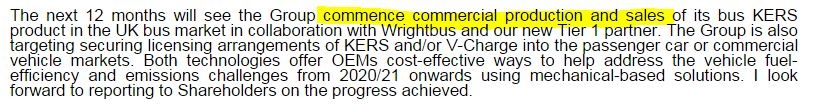

Outlook - as always, the company makes upbeat noises about new products, although at least shareholders can see a product coming into commercial production, so will be able to gauge success or failure accordingly, in a reasonable timescale:

I wonder whether a system for the UK bus market is a big enough market to be worth bothering with?

My opinion - given the many £billions spent every year on R&D by numerous car & vehicle companies, I've never really believed that Torotrak could deliver a commercial return for shareholders. So far it hasn't, it's just been a huge money pit for optimists. Let's hope they do eventually succeed with something.

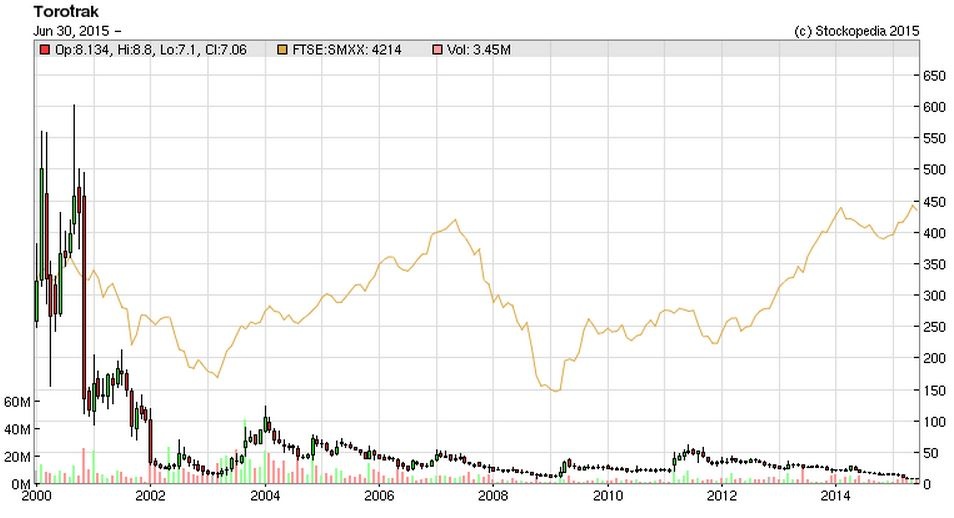

The long term chart for Torotrak is sobering. If you had invested in Torotrak shares in 2000, at 250-600p, you would now have 7.2p left. If you'd invested the same amount in the FTSE Small Caps Index, you would now have 440p.

Note that about every two years there is a flurry of excitement in Torotrak shares, before it goes back into a downtrend again. It would be interesting to plot the fundraisings on the chart too, but I don't have time. Maybe it will be different this time!

William Sinclair Holdings (LON:SNCL)

Share price: 10.95p (down 27% today)

No. shares: 17.4m

Market cap: £1.9m

Interim results to 30 Jun 2015 - I'm only covering this to keep the archive up-to-date, as this used to be a much larger market cap, but sadly this peat distributor has very nearly reached the end of the road I think.

The results are terrible - a loss before tax of £8.9m, which includes exceptionals of £4.5m.

Balance sheet - this is groaning under the weight of net debt at £23.7m, and a pension deficit of £18.5m. Although I note that net tangible assets are still just about positive, at £2.9m. So the key question is what the fixed assets are worth? If it's valuable land, worth more than book value, then the company could have a future.

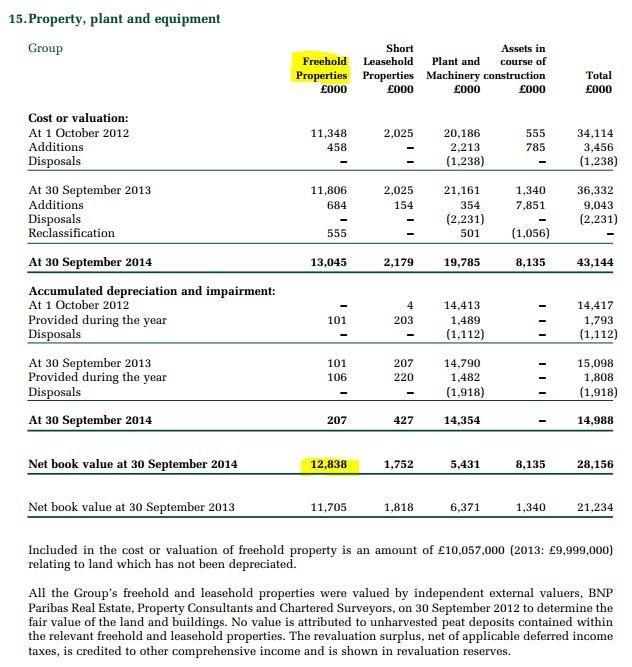

I've checked note 15 to their last Annual Report, and it seems that freehold land (at 2012 valuation) is in the books at £12.8m. That's only just over half the net debt, so sadly I don't think there is enough asset value on the balance sheet to save the day.

Fundraising - the new, turnaround management make it clear in today's statement that fresh funding is urgently required. So it's now a question of whether a fresh funding deal will attribute any value to the existing shares, or whether new financial backers will want to ditch liabilities (which would be sensible) through a pre-pack administration.

My opinion - in my view the existing equity is now worth nothing. Therefore I have (belatedly, since I've always been bearish) put the share on my Bargepole List - i.e. things that are too high risk, or too highly valued for me to consider investable.

Laura Ashley Holdings (LON:ALY)

Share price: 29.9p (down 10.2% today)

No. shares: 727.8m

Market cap: £217.6m

(at the time of writing, I hold a long position in this share)

Property purchase - an unusual announcement from Laura Ashley today. It has decided to spend £31.1m buying the freehold to an 8-storey, 98,254 sq.ft. office building in Singapore. This is to give the company a Far Eastern base, apparently. That's a lot of office space, for a company which does 90% of its turnover in the UK!

However, its overseas operations are via franchisees, and there are 303 such stores, which is greater in number than its 205 UK stores, and the segmental analysis shows that its overseas operations are decently profitable.

Today's announcement sounds like the company is gearing up to expand significantly in the Far East - "the Board has identified significant growth prospects for the Group in Asia".

Even so, to go all-in with a £31.1m office property purchase seems bordering on the bizarre, or worse. Given that Chinese companies on AIM have recently spirited away cash through buying apparently unnecessary land/factories, this unusual property purchase by ALY is bound to raise similar suspicions, especially as the company is controlled by Far Eastern shareholders. To be blunt, I think the market is wondering whether this is a device to defraud the company? Hence the 10% knee-jerk drop in share price today. After doing some digging myself, I believe this is not the case. The controlling Malaysian shareholders have a good track record - paying modest Director salaries (the entire Board only cost £648k in 2015, and £586k in 2014), and looking after all shareholders by paying generous dividends each year.

It has also been noted before that the major shareholder in ALY is going through a messy divorce, widely reported in the press. Although that does not seem relevant to today's announcement. I only mention it because someone else will do so in the comments, if I don't!

My opinion - Singapore is very different to mainland China, and ALY has today given full details of the property they are buying in Singapore, including its address, and the price paid, £31.1m, which is £316/sq.ft. outright purchase remember, not annual rent! So assuming say a 5% rental yield, that would become a rental value of £15.82/sq.ft. equivalent rental.

(Edit: note that a reader has helpfully put a link to Google Streetview in the comments below, so you can view the property concerned. Thanks for that).

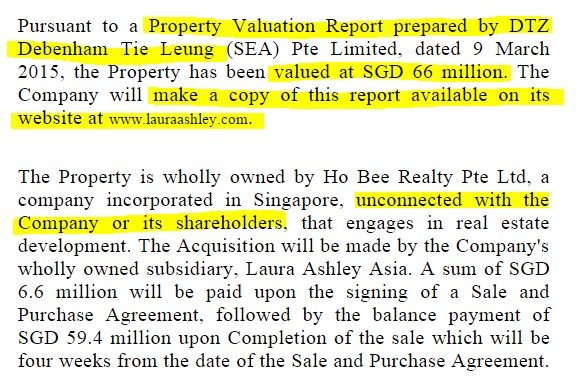

Therefore I am in the process of googling to find out if this is a reasonable price. However, ALY also mentioned today that big name international property firm DTZ have independently valued it at the purchase price, and the report will go on their website, which gives comfort;

Overall I reckon that cynics will say that this deal smells fishy, which to be honest, at first sight, it does. However, once investors have had time to inspect the valuation report, and conduct our own desktop due diligence on Singapore property, then attention should begin to turn to the expansion possibilities in the Far East. Who better than Far Eastern Directors and shareholders to manage that expansion? Therefore I expect today's 10% share price drop to rebound in due course.

Remember that ALY pays a fabulous dividend, and has done so for years. That's the crux when considering whether majority shareholders are feathering their own nest or not. If outside shareholders get a whacking great divi every year, and Directors remuneration is modest, as is the case here, then we haven't really got anything to complain about.

Overall this company is one of my favourites at the moment, and the Stockopedia computers love it too, with a StockRank of 99. It's just a pity that the ownership structure is so concentrated.

Advanced Medical Solutions (LON:AMS)

Share price: 143p (down 1% today)

No. shares: 208.2m

Market cap: £297.7m

Trading update - for the half year to 30 Jun 2015:

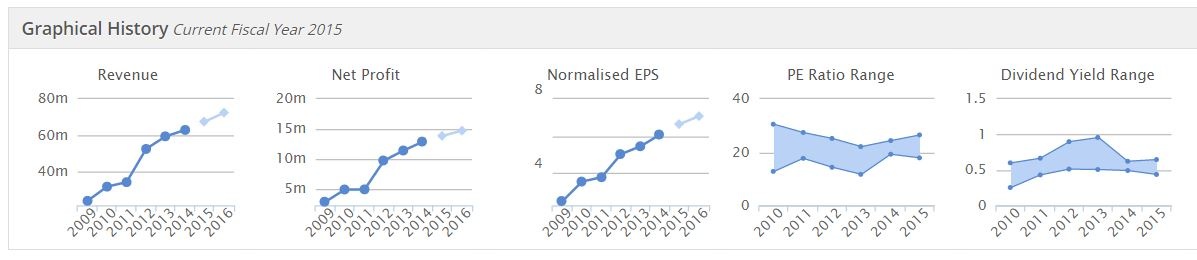

Looking at the Stockopedia graphs, the company has an excellent track record of growing profits and EPS, despite about a 30% increase in the number of shares in issue in 2012:

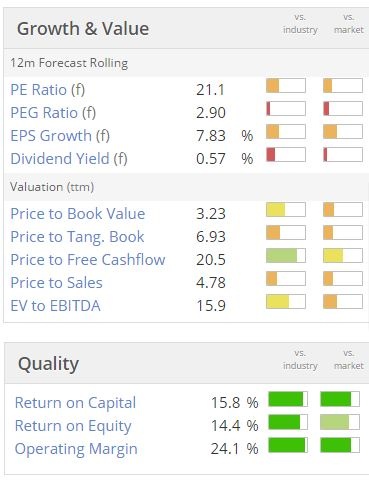

Trouble is, it looks fully priced for now:

My opinion - this looks to be a quality company, but the price reflects that. So the only way to assess it would be detailed research, and trying to ascertain what competitive advantages the company has, and how the future might pan out. You'd need to see continued good growth to justify the current price, let alone any increase in share price.

Sweett (LON:CSG)

Final results are out today, but since they have an ongoing SFO investigation against them, then I don't think this share can be considered investable until that is resolved, unless you're prepared to take a complete punt.

The level of debt at £9.7m is a worry here too. There are no divis this year.

I think it's just too risky at the moment. The Asian, and Indian businesses are being sold.

Phew, I'm melting in the heat now, that's got to be it for now!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ALY, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only. They are NOT financial advice, nor share recommendations. We very much encourage readers to do your own research, and make your own investing decisions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.