Good morning! Another quiet morning for results.

Northamber (LON:NAR)

Share price: 33p

No. shares: 28.2m

Market Cap: £9.3m

This is an IT distributor. I'm beginning to wish that I hadn't started the day with this company, as trying to decipher the Chairman's report has already given me a headache. It's not quite gibberish, but every sentence has to be read two or three times to work out what it's trying to say.

Mind you, the Chairman owns 61.5% of the company, so is free to write whatever he likes!

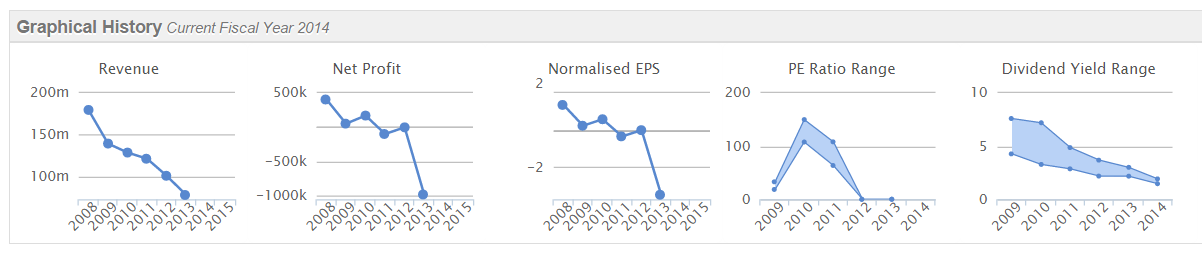

Preliminary results - for the year ended 30 Jun 2014 have not impressed me. Turnover is down 19% to £62.9m, and the company only eked out a tiny 6.8% gross profit margin of £4.3m. Overheads were considerably more, at £5.5m, thus generating a loss before tax of £1.2m, slightly worse than the similar loss for last year.

Balance Sheet - this looks fairly strong, with £21.5m net assets. No breakdown is given of the £8.3m in fixed assets, so I've checked back to the 2012 Annual Report on the company's website (the 2013 AR doesn't seem to be on there yet), and note that fixed assets is almost entirely land & buildings, most of which appears to be the company's freehold warehouse, bought for £6.4m in 2012.

My opinion - this is an interesting asset-backed situation where the company's market value is less than half its own tangible net assets. As the company is loss-making, the first key question to ask is, "why does this company exist?" The logical thing to do would be to shut it down, and liquidate the assets, thus generating a better return for shareholders than continuing to trade at a loss.

There is no point in anyone trying to force the company to do this, as the Chairman holds a controlling stake, so could block any attempts by activists to force a change of direction. I therefore feel that the company is essentially a play-thing for its Chairman, and cannot be taken seriously as a potential investment, if nothing is likely to change.

Dividends are being paid, but are not covered by earnings, so if the trends below continue, no reliance can be placed on the continuation of dividends, although today it is announced that a 0.3p final divi (same as last year) is to be paid, in addition to the 0.3p interim divi.

The outlook statement indicates that performance has improved towards the end of the year being reported, and subsequently.

In my view the company should give serious thought to whether or not they continue with their existing activities. Box shifting at a loss is a mug's game, and they should either work out how to make a profit, or use the warehouse and staff to do something else altogether more productive - maybe becoming an outsourced warehouse for small online retailers which cannot afford their own warehouse?

Mello 2014

Last call for attendees to Mello 2014, the new investor event being organised by my friend David Stredder - a renowned small caps investor who set out to design his own investor show from the ground up. The focus is on interesting companies, and many excellent speakers that you won't see at other investment shows. So this really is a unique event, and I wholeheartedly support it, and will be in residence there for the whole three days.

I've just seen the draft programme of speeches throughout the 3 days, and have to say it looks absolutely fantastic. Hopefully they will get the programme up on the Mello 2014 website asap. Ticket sales have been good recently I am told, so it's not far off capacity, so get booking if you want to join us there.

The dates clash with the World Money Show in London, but I think these events are very different, and appealing to different audiences.

Redde (LON:REDD)

Share price: 75p

No. shares: 291.5m

Market Cap: £218.6m

This company used to be called Helphire, but changed its name. After almost going bust a few years ago, it has undergone a very impressive turnaround, and is now a financially strong company. The original business was fairly low margin provision of replacement cars for people who had accidents, with the cost claimed back from insurance companies. Note that Aviva owns 16.9% of Redde's shares, which looks significant to me.

More recently Redde broadened its business model into other areas, such as personal injury claims, which completely put me off, so I sold out of the company when that news was announced some time ago. Ambulance-chasing is just not an area of activity that appeals to me at all as an investor - the ethics are dubious, cashflows are negative, and regulatory issues can cause bombshells, as many of these companies dance very close to the edge in terms of what is allowed.

Having said all of that, Redde's statement today reads positively;

AGM Statement - this is a trading update, covering the current financial year from 1 Jul 2014 to 30 Oct 2014.

Quite a bit of useful detail, so I'll reproduce most of it below;

Current Trading

As previously announced in my statement of 3 September 2014, the Group's new

financial year has begun well and this trend has continued. NewLaw, our legal

services business is trading in line with our expectations. Sales in the

accident management businesses show an increase over the corresponding period

last year reflecting stronger trading volumes. As a consequence trading profits

are ahead of our expectations and the corresponding period last year. Early

indications are that this trend has continued during October and the Board

remains confident about the Group's prospects for the financial year as a

whole. We are seeing an increasing level of new business opportunities across

the Group and because our new business model is more capital-efficient than in

the past we are able to take advantage of opportunities to grow revenue and

profits with no undue increase in working capital.

Cash generation has continued to be positive and, in line with seasonal trends,

debtor days at 30 September 2014 were unchanged from 30 June 2014 at 108 days.

Last year's debtor days at 30 September 2013 were 126 days which were unchanged

from 30 June 2013. Net cash was £48.6 million at 30 September 2014 and compares

to net cash of £41.6 million at 30 June 2014. Total cash balances were £66.2m

at 30 September 2014.

My opinion - the above excerpt all sounds good. I particularly like the mention of working capital being under control, as this has proved to be the unraveling of several other players in this sector. Although it would be interesting to see the next interim figures, to check whether there are other debtors in addition to trade debtors which are ballooning, as has happened with another company in this sector.

Also good to note that the net cash balance remains strong, and has increased since the year end. Cash is king in this sector, so if the bank balance is going up, then you know there isn't a problem with working capital.

Dividends - the company has been particularly generous with dividends, which was given a lot of emphasis at the time of the refinancing. A 3.5p final dividend is announced today, giving a total of 6.85p in dividends for the year ended 30 Jun 2014 - representing a yield of 9.1%, although brokers are forecasting a small reduction in divis in the next two years, but a still remarkable yield of c.7-8%. If that is sustainable, then the shares might be worth another look perhaps, if you can stomach investing in this sector?

It's been a fantastic ride for shareholders over the last two years here:

Alumasc (LON:ALU)

Share price: 126p

No. shares: 36.1m

Market Cap: £45.5m

This is a building products company, which I like the look of, but its pension deficit has put me off in the past.

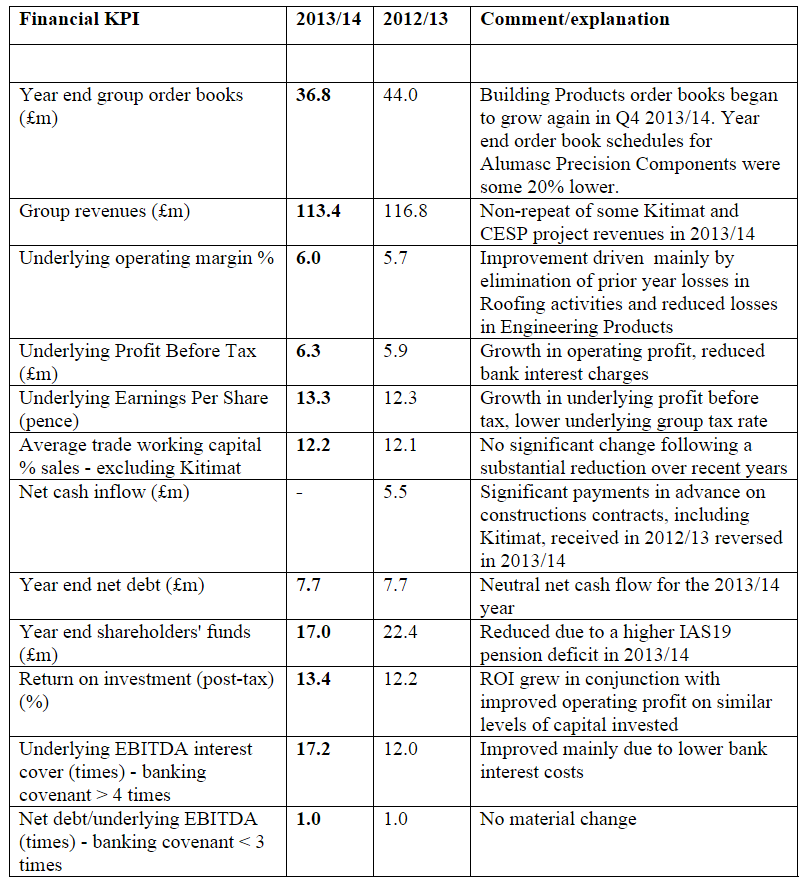

The most recent set of results, for the year to 30 Jun 2014, seem to have slipped through my net, as checking the archive here I didn't comment on them, on 2 Sep 2014 release date. It must have been a busy day with other stuff. So I'm having a quick whizz through those results now. One item particularly caught my eye, and I'm flagging it in the hope that other companies & advisers will take up this idea - the company published a really useful table of their KPIs, each with a comparison from last year, and a short comment. This is brilliant, and I'd very much like to see other companies include the same table in their future results, here it is;

Isn't that great?! More of this please.

Pension deficit - this is a very material issue, and is a deal-breaker for me. Ignore this at your peril!

The accounting pension deficit rose from £10.1m to £17.9m in the year to 30 Jun 2014, due to falling bond yields, but from the commentary below it sounds as if the full impact of that has softened by using an average? So the full impact could be worse still.

Most important are the cash outflows to replenish the pension fund. In this case, they have increased to £2.5m p.a., plus £0.5m admin costs. So £3.0m in pension fund related cash outflows, which is three-quarters of the company's reported profit after tax.

In my view this is a serious problem. How can you value a company, if over half of its future profits are going to be consumed by the pension deficit recovery payments?

Dividends - despite the big pension deficit, Alumasc is still paying a generous dividend yield, and that looks unsustainable to me. The company's Bal Sheet is already stretched, so trying to pay a big divi, and £3m p.a. in pension scheme costs, looks too much to me. They should cut the divi & build up the Bal Sheet in my view. Hence I won't be placing any reliance on the divi yield in valuing the company, as it doesn't look safe to me.

Balance Sheet - overall it is weak. Net debt of £7.7m is not excessive. However, if you write off intangibles, net assets fall from £17.0m to minus £2.2m. I don't usually invest in companies with a negative Balance Sheet, so this one fails my testing on that point.

Trading Update - I almost forgot to mention today's update! Looks like an in line statement;

Overall, trading to date has been in line with the Board's expectations. Group revenues from continuing operations1 are ahead of prior year to date levels by some 5%, with Building Products divisional revenues up by 9% and Engineering Products divisional revenues lower by 10%. Cash generation remains strong and the group's overall cash flow performance is in line with our expectation......Therefore, whilst still relatively early in the financial year, the Board remains positive on prospects for the year as a whole in view of the encouraging start from the majority of our businesses.

My opinion - to a certain extent this company's shares look a value trap to me. It's a nice enough business, but the pension fund will swallow up a very large part of future profits, as things stand at the moment. Maybe the pension deficit will reduce when interest rates normalise, but when is that going to happen? What if interest rates remain ultra low for years to come, as they have done in Japan? It's too big an uncertainty for my liking.

Kind Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.