Good morning! I had a second wind last night, and added sections on four more companies, so to recap on yesterday's complete report, this is the link.

I saw a snippet on Twitter this morning, saying that UK consumer confidence has hit a multi-year high. So I will be increasing my focus on consumer-driven shares. Generally I'm bottom up in approach to picking stocks, but I like to keep an eye on which way the macro winds are blowing (very topical!), as you increase your odds of investing success if there's a macro tailwind assisting the companies that you invest in.

Eckoh (LON:ECK)

Share price: 39.25p

No. shares: 223.1m

Market Cap: £87.6m

Update - this speech recognition software company updates for its March year end. The company performed "particularly strongly" in Q4, winning 6 new multi-year contracts, and 2 new contracts with existing customers. The growth area seems to be secure phone payment systems, and the company refers to its "growing dominance in this sector". A further 8 contract renewals which came up, were all successfully renewed - good news. So this company clearly has a product which appeals to its customers, always a good starting point!

The financial benefit of the new contracts will not benefit the year ending today by the looks of it, as the company refers to revenue in the new financial year "supporting current growth expectations".

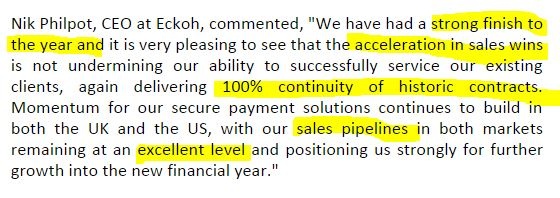

Outlook - all sounds positive (with my usual wonky highlighting of key phrases);

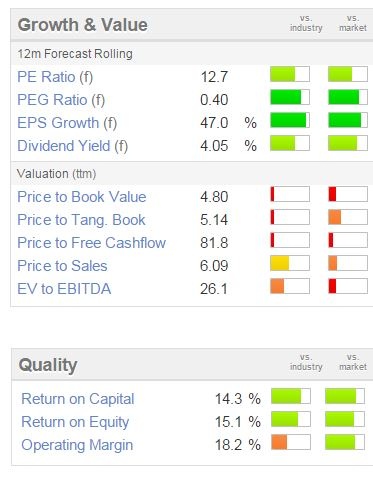

Valuation - hmmm, this is where it stops looking good. I like the company (have known it for years, I remember being in these when they were about 5p, and they never went anywhere, so I got bored & moved on), but everything has its price, and the price here just looks too high, given that growth is steady rather than stellar.

So a sea of red there, although it looks as if there might have been some one-off costs in the 2013/14 figures, which is suppressing the quality scores. Based on forecasts, net profit is seen rising to £2.88m for the year ending today, and £3.53m for next year, EPS of 1.25p and 1.35p respectively.

It would only make sense to buy this share if you think that the company can thrash forecasts for next year (y/e 31 Mar 2016). Given the positive contract wins announced today, maybe it will, who knows?

Dividends - very small, but at least it pays something - the forecast yield is 1.19%.

Balance sheet - looks fine to me, with £4.1m in net cash when last reported, 30 Sep 2014.

My opinion - a nice enough company, but unless growth steps up a gear, then the shares look over-priced. Based on performance to date, in my view this share should be priced on a fwd PER of about 16 perhaps - which implies a share price of about 21.6p, so just over half the current level.

On the other hand, if you think that growth can accelerate, and that broker forecasts are too cautious, then it might be worth more. Also the quality of revenues are attractive, being recurring in nature, and 100% customer renewals announced today is very impressive.

On the negative side, I've got a slight reservation about the longevity of people making payments over the phone. Personally I never do it, as it's so much quicker & easier to pay online, and with mobile payment apps appearing, that seems to me the direction of the future.

Voice recognition software frustrates the hell out of me, so I'm more inclined to hang up the moment a computer starts trying to interpret my voice, with the inevitable mistakes, having to start again, swearing at the computer, etc.

PuriCore (LON:PURI)

Share price: 31.5p

No. shares: 50.1m

Market Cap: £15.8m

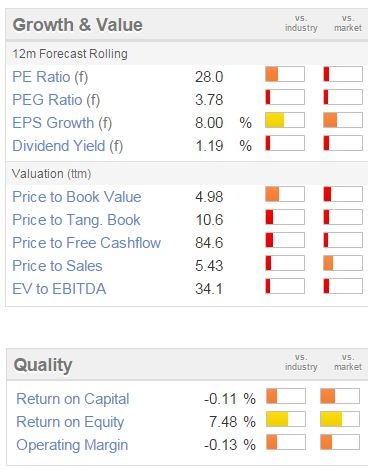

Final results - for calendar 2014. As expected, turnover is down, as the company has been trying to change its business model from selling capital equipment, to selling consumables, although it's not clear that this strategy is working.

Cash - As we know, the endoscopy business was sold during 2014, for net proceeds of $25.6m. So that has transformed the balance sheet, which is now cash rich. Although the company is already burning its way through that cash - net cash was down to $20.7m (£14.0m) at 31 Dec 2014, which is 27.9p per share - or nearly 89% of the entire market cap.

Continuing operations - are still heavily loss making, a loss of $7.0m, slightly better than the $8.6m loss in 2013.

EDIT: A reader has pointed out that the company is being economical with the truth by stating that the loss was reduced from last year. Last year's loss was greatly impacted by a one-off $5.8m loss on a convertible bond. When you strip out this factor, the loss last year was $2.8m, and it was a much worse loss this year of $7.0m. I should have spotted this, but in my haste I overlooked it, so my apologies for this oversight, and thank you to reader "actsofvolition" for pointing this out in the comments section below.

So the problem is that the cash pile is likely to be further depleted as time goes on, at this rate they've probably got enough cash to survive about 3 years', if there is no upturn in trading.

Outlook - is difficult to assess. The narrative talks in the usual upbeat fashion about future potential, and it's not blue sky stuff - they are selling the product, e.g. a new $17.8m agreement with a top 3 supermarket in the USA. The problem is just that, to date, sales have not been enough to make a profit.

Other products e.g. in healthcare, for wound care, seem to be struggling - turnover was down 17% to only $1.5m. That seems to include the new animal health wound products too. So all rather de minimis stuff.

My opinion - with the market cap only just above the company's own net cash balance, the downside is at least protected in the short term. However, the longer time goes on, the more cash will be burned, so your downside protection is slipping away slowly.

For that reason, my patience ran out with this share a few months ago, and I ditched them. To my mind, management should have returned at least half the cash from the endoscopy unit sale to shareholders, and I am amazed that the big shareholders allowed them to keep the lot, in the hope that they can generate increased future sales.

Care is needed with upbeat-sounding contract announcements from this company, which are released from time to time, as they don't mean the company has suddenly become profitable! Also, as the share is very illiquid, there are stale bulls holding it, so when any good news does come out & the price spikes up, sellers quickly engulf the price rise. So the upside is capped, unless & until the company can genuinely demonstrate serious commercial progress has been made.

I'll be keeping an eye on this share, for potentially going back in, but only if there is clear evidence that a viable business is being created. I'd rather sit on the sidelines and wait for proof of progress, rather than hold the shares on hope that something good happens, as the cash slips away.

MartinCo (LON:MCO)

Share price: 131p (up 4% today)

No. shares: 22.0m

Market Cap: £28.8m

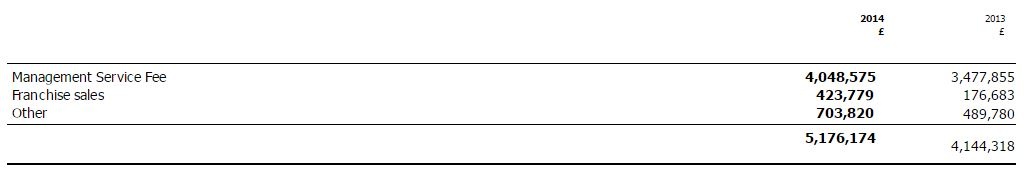

Final results - for calendar 2014. This is a franchise company for estate agents, which was floated at 100p on AIM, in Dec 2013. Figures out today look quite good. - revenue up 25% to £5.2m, and operating profit up 26% to £2.0m.

The growth has come from acquisitions, part way through the year, so a further step up in turnover and profit are forecast for 2015, as the full year figures for the acquired companies feed through. So it's important to bear this in mind, and not over-pay for growth which is of a stepped nature, rather than organic (which would be worth a lot more).

The company is a central services franchising business, which charges its estate agent franchisees a 7.5% to 9.0% of turnover fee, in return for providing management, training, IT, and various other support services. It looks a good business model to me. Easy to understand, capital light, and scaleable without the hassle & capex of having to open its own offices (the franchisees finance their own estate agency).

The focus is on lettings, rather than buying/selling, which again I like - it's a good growth area, and impervious to economic conditions.

Valuation - at 131p per share, that is a PER of 19.0 times 2014 earnings, falling to 13.5 times 2015 forecast earnings. That looks a sensible price to me. The PER of 12.7 shown on the graphic on the right will be based on last night's lower closing share price.

Divis - not bad. 4p in total divis (split 1.3p interim, 2.7p final) are being paid for 2014, and 5p is forecast for 2015. So the forecast yield is 3.8%

Balance sheet - looks OK to me. The current ratio is healthy at 2.43, but there is some long term debt too. Overall the cash of £3.4m at year end more than offset £2.5m in debt, so net cash of £0.9m. That looks fine to me, given the level of profits.

Net assets are thin, as the balance sheet is dominated by £6.3m intangible assets. So net assets of £6.3m nets down to nil for NTAV. That's fine in this case, as it has no fixed assets to speak of, so doesn't need any tangible assets overall really.

My opinion - overall, I quite like it! The valuation looks about right to me, but if the company delivers more growth from reasonably priced acquisitions, and recruits more franchisees, then the shares could do well. Not an obvious bargain, but priced about right, is my assessment.

I note from the accounting policies that franchise fees are recognised immediately on signing of the agreement. I've come across this issue before with franchising companies - it can lead to profits having a strong surge when lots of new franchisees are signed up, but profits can then slip backwards subsequently - i.e. you have to keep signing up more & more franchisees to maintain profitability. Although it depends on the split between up-front fees, and ongoing recurring fees. Note 7 gives this split actually;

I note that debtors contains £190k loans to franchisees, which is something to watch, as if that gets too big, it could be a precursor to a bad debt.

Your main risk with franchising is that the franchisees go bust, or decide to go it alone, plus if they are unscrupulous, they might not declare all their turnover, thus meaning the management fee payable to the franchiser is underpaid.

Christie (LON:CTG)

Share price: 144p (down 5.3% today)

No. shares: 26.5m

Market Cap: £38.2m

Preliminary results - for calendar 2014. This is one of Lord John Lee's favourite stocks, it provides a range of services to the retail & leisure industries, e.g. stock-taking, surveying, valuations, etc.

The headline figures look good, with revenues up 12.7% to £61.0m, and operating profit up 131% to £3.7m. EPS shot up from 0.82p in 2013, to 9.34p in 2014.

The PER works out at 15.4 times 2014 EPS of 9.34p.

However, it looks as if a big rise in profit was expected, indeed Stockopedia shows broker consensus of 10.6p EPS, so the company appears to have come in a bit below forecast. It's still a huge improvement on last year though. Although in the "outlook" section the company says today that its results for 2014 were "ahead of expectations", so I'm a little confused now!

"Strong pricing pressure" in retail stocktaking is noted. Also the company is continuing its European expansion - so that could be positive for earnings growth, if successful.

Outlook - there's not really any meat in this;

In the CEO's review, he mentions that the company deliberately retained its core capabilities (i.e. experienced staff), harming short term profitability, but that now leaves them well-placed to exploit the upturn. There's a lot to be said for taking such a long-term approach, in my view.

Ooh, I've just found another section about the future outlook;

Balance sheet - not good I'm afraid, it struggles with my simple tests.

Current ratio - this is not great, at 0.95, howewer as it's a services business, there is no inventory, so I usually accept down to about 1.0. This is a whisker below that, not ideal, but it doesn't actually cause me any concern in this case, so I can bend the rule to allow this point through.

Net assets - are negative, at -£6.7m. Taking off intangibles worsens that to NTAV of -£9.2m. I don't normally invest in companies with negative net tangible assets.

Pension deficit - this has shot up from £4.8m at end 2013 to £14.0m at end 2014, obviously for the usual reason of gilt & bond yields being so low at the moment. The main reason is the discount rate falling from 5.0% last year, to 4.0% this year, which means the present value of the scheme liabilities shoots up.

It's up to you how you view this. Some people are sanguine, and say that when bond rates go back up again, then the liabilities will reduce back down again. Although if you think we're in for a prolonged period of deflation (personally I don't), then the liabilities could persist for years to come. Who knows?!

Looking back at the last (2013) Annual Report, note 25 gives details on the pension fund. It had £49.1m of liabilities then, and £44.3m of assets. So the liabilities will have gone up a fair bit since then. It's not clear what deficit recovery payments are being made, but the total employer contribution in 2013 was £1.2m, so that's quite a material amount compared with profit, so I don't think this issue can be dismissed lightly. I would certainly trim my valuation of the company to factor in the pension scheme liabilities.

Dividends - the final divi is up 50% to 1.5p, after an interim divi of 0.75p, giving 2.25p for the full year. That's a yield of 1.6%.

My opinion - I should stress that I don't know this company well, so it's just a cursory review of their results. Overall, I'm really struggling to see what the appeal is here. The 2014 results are the first decent set of figures the company has delivered since 2007, so they've taken an awful long time to recover from recession.

The balance sheet is weak (although that's mainly due to the pension deficit, which could just as easily reduce back down again once interest rates rise somewhat), and the dividends are nothing to get excited about.

Having tripled in price over the last two years, on the basis of these results, I would say the shares are now fully up with events, or perhaps even a little over-priced? It just doesn't look a very interesting business to me (low margin, quite cyclical, limited growth), but maybe I'm missing something? It depends on whether there are further improvements in profits in the pipeline for 2015 or not? The narrative doesn't give much of a steer on that, so I'm not sure.

Ultrasis (LON:ULT)

Suspension - this doesn't look good. The company has been at death's door for some time, and has been propped up by its largest shareholder, Paul Bell.

The latest refinancing seems to be unravelling, perhaps Mr Bell has realised that he's throwing money down the drain?

I'll be surprised if it comes back from suspension, but it's possible I suppose (if unlikely);

Concha (LON:CHA)

Share price: 5.33p

No. shares: 1,477.7m (plus 257m in-the-money warrants & options)

Market Cap: £78.8m (£92.5m incl. options & warrants)

Interim results - there are some crazy things going on in micro caps at the moment, and this is one of them. It's just a cash shell, with £5.7m in the bank, and £0.5m of investments, yet the market cap is £78.8m!

Worse still, there are 307m warrants in issue, of which 207m have an exercise price of between 0.25p and 1.2p. Oh, and there are another 50m options in issue with a 0.2p exercise price. So the total shares in issue, plus in-the-money options/warrants comes to 1,734.7m, giving a theoretical market cap of £92.5m - for a company with little more than a £5.7m bank balance.

So why the massive over-valuation? It seems to be due to excitement about a deal which might happen;

Fundraising - note that £4m was raised at 4p per share, i.e. 100m shares, in Oct 2014, with warrants attached exercisable at 8p, when there was nothing of any significant value in the company. Indeed, a fundraising at only 0.6p per share had been done only a few months earlier, in Apr 2014.

So the only conclusion I can come to, is that the issue of new shares at 4p appears to have been a stage managed process to inflate the share price dramatically, and it has done (so far).

My opinion - this company appears to be trying to put the cart before the horse - i.e. creating a huge valuation on a company, based on nothing but hype about what it intends to do in the future. We've seen this sort of thing before in bull markets (remember in 2000 when a tiny leathergoods company called Knutsford soared in value from £2.5m to £700m within hours, after Archie Norman and Nigel Wray took control of it). So shorting shares that have detached from reality in this way can be potentially lethal. However, it always ends in tears, as sooner or later the cartel breaks ranks and shareholders begin selling, to lock in the massively inflated price.

It will be fascinating to see how this pans out. Anyone buying the shares is crazy, as it's nothing more than a wild & grotesquely over-priced speculation at the moment. Let's see if anything of substance does appear, to justify this absurd valuation. It's going on my bargepole list for now though.

There's nothing else of interest, so I'll sign off now. See you tomorrow!

Regards, Paul.

(Paul has no long or short positions in any of the companies written about today. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.