Good morning and happy Friday!

Fairpoint (LON:FRP) (suspended)

This should be the last time we mention this legal services / debt management firm.

Last time I covered it, I said it was hard to imagine the equity was worth anything. £20 million in bank debt had been sold off to a sector specialist, who was continuing to finance the subsidiaries.

Those selected subsidiaries continue to trade, but the holding company (i.e. the company which some of us bought shares in) is entering administration:

...ongoing support for the Group's subsidiaries outside of the Legal Businesses is made more difficult due to the existence of the onerous lease on the Group's head office which has an annual commitment of c£1m per annum for a further 4 years. As a result, and following detailed discussions and the evaluation of a number of options, the Board has concluded that the holding company of the Group, Fairpoint Group plc, is no longer able to continue trading as a going concern and has filed notice of intention to appoint administrators.

People should have mentally written this down to zero some time ago, in my opinion.

I haven't sold anything short in a good while but this is an example of where, if the shares had been still trading up to this point, it might have been a good idea. You only need a limited number of people to think that the shares are not worthless for the share price to remain at a level greater than zero, and for a 100% negative return to be achieved!

Additional comment from Paul: I agree with Graham that Fairpoint has been a terrible mess. I've certainly learned a lot from this one, which we've discussed here before.

I'd just like to come back to Graham on the point of possibly shorting this type of thing (Fairpoint). DON'T! It's way too risky. There are a number of issues. Firstly, when the shares are suspended, the Spread Bet or CFD provider will usually increase it to 100% margin, on your original transaction price. This can suddenly swallow up a load of funds on your account, which are now effectively frozen. It can take months, and sometimes even years, for the stock to be valued at nil, and hence to get your funds unfrozen. So what seemed like a win, soon turns into something of a nightmare.

Secondly, the short squeezes on micro caps in their death throes, can be puzzling, huge, and very dangerous. Only today, we saw apparently worthless ENTU rise over 200%. I've no idea why. But anyone short on that, would have been badly hurt.

The same thing happened with Afren, in its dying days. I was stopped out at 14p on a short there, only to see it collapse days later. The share price of dying micro caps are not logical, or predictable. You can be correct in your idea, but lose your shirt in the process. So why get involved at all? It's not worth the risk.

The worst case I saw, was when something called CPP (I think, not sure, it was a long time ago) seemed dead, at about 1p. The business looked moribund, a certain zero. Then it spiked up to 31p! Apparently several short sellers were almost wiped out by that. So why entertain such a potentially vast risk?? Don't do it, it's madness.

I only ever short large caps, where the downside risk is relatively modest. Even then, you could be stretchered out, if say Amazon did an all paper bid for the company.

Some idiot was bragging about shorting Revolution Bars (LON:RBG) here, not long ago. Presumably he's learned a painful lesson about the dangers of shorting small caps. Just don't do it, it's far too risky.

Right, back to Graham!....

OnTheMarket plc

At the other end of the stock market life cycle, we have an announcement of intention to float from OnTheMarket.

OnTheMarket is the agent-owned property portal chasing Rightmove and Zoopla for market share.

The objective is to raise £50 million of growth capital in exchange for a minority stake in the business at a prospective valuation of £200 - £250 million.

It is intended that the funds raised, along with the existing fee revenue of the Company, will be used to support a heavy-weight national TV, digital and print media campaign. High profile local radio and out-of-home advertising is also planned. Funds will be committed to expanding OnTheMarket's sales and account management organisation and its technology development capacity. This will support the strategy to retain and attract more estate agents and other property advertisers to list on the portal and to grow the levels of traffic and engagement with the most motivated property-seekers.

Given the highly attractive (in my opinion) features of Rightmove as a company and a potential investment, I reckon that investors will be supportive of this IPO.

As for the merits of the valuation, I'll wait until I see some more numbers. While I don't think the other portals (Rightmove (LON:RMV) and ZPG (LON:ZPG) ) are at particularly expensive valuations, it will be interesting to find out whether OnTheMarket can convince investors to pay higher multiples compared to them.

Meanwhile, shares in Agents' Mutual, the alliance of estate agents, will be transformed into shares in OnTheMarket, so most of the portal will continue to be owned by agents:

Agents' Mutual's current members ("Members") number some 2,700 estate and lettings agency firms. In total, circa 5,700 agent branches list their properties with the OnTheMarket.com portal. Currently the Members have one membership interest per firm but, following the reorganisation into OnTheMarket plc, these firms will receive ordinary shares reflecting, amongst other factors, the aggregate amount of fees they have paid in order to list on the OnTheMarket.com portal since its launch in January 2015.

That will offer a nice bit of flexibility for these firms - some spare cash if they want to dispose of their shares, or a stake in a growing property portal controlled by their industry if they decide to hold on.

I'm instinctively a contrarian and I want to say that this IPO is another sign of an overheated property market. I also have some doubt about whether the property portal space can carry three large competitors long-term. But I'll wait and see the valuation versus OnTheMarket's latest figures. If it's reasonable, then perhaps this particular space in the property market isn't too frothy yet.

Additional comment from Paul: Many thanks for flagging this, Graham. I shorted Rightmove (LON:RMV) when OnTheMarket.com was first set up, but it didn't work, as the new portal failed to gain traction.

The IPO looks a bit of a "try on" to me - i.e. attribute a huge valuation to something that has effectively failed so far.

However, there's another way of looking at it. Rightmove (LON:RMV) clearly makes super-normal profits, by over-charging estate agents, and effectively abusing its near-monopoly position. That makes it potentially vulnerable.

OnTheMarket failed originally because it didn't have a big enough marketing budget, and the marketing they did was pathetic. Even their logo is just a meaningless symbol on estate agents windows, without a link to their website.

However, if the IPO is successful, then armed with a much larger £50m marketing budget, and hopefully some better ideas about how to differentiate themselves, I think this could have a much better chance of success.

I wouldn't invest in OnTheMarket, but I think the better trade is a short on Rightmove. So that's what I've done. Rightmove is largely ex-growth now anyway, so its premium rating is not justified, regardless of the renewed threat from OnTheMarket.

YouGov (LON:YOU)

- Share price: 277.5p (+7%)

- No. of shares: 105.1 million

- Market cap: £292 million

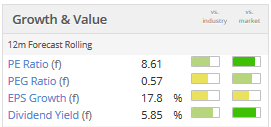

When I covered this market research firm in March, I asked "how can it be worth nearly £300 million"? The profit figures, once you ignored the various adjustments (and I think it's right to ignore them), didn't seem to come close to justifying the market cap.

It does have decent growth rates - constant currency revenue growth of 8%, last seen, plus a currency exchange rate tailwind.

And this latest fiscal year (the year ending July) has gone well and should be ahead of expectations.

YouGov has achieved another year of revenue growth well ahead of the global market research sector and maintained the performance trends reported in the first half of the current financial year. In line with our strategy, revenue from Data Products and Services has continued to grow strongly across a number of regions and our Custom Research business has significantly improved its profitability.

It's certainly a very well-known name both inside and outside its industry.

I can't get too excited by it as an investment proposition, however. Firstly, there is the unusual accounting presentation which Paul has covered extensively and which I've also discussed previously.

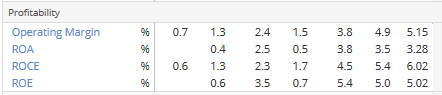

Furthermore, margins have never taken off here, despite it being a fairly mature business. Poor operating margins have resulted in weak return metrics:

Maybe that's finally about to change. I'm just a bit sceptical after so many years of lacklustre profitability, that's all.

And I'm guessing that staff costs have accounted for most of the increased expenses over this time period. It's a great place to work by all accounts but external shareholders shouldn't expect too much, in my opinion.

Additional comment from Paul: I agree with Graham. The valuation of YouGov has been wrong for years now. It generates very little free cashflow, and the tiny dividends reflect that. It's a good example of how aggressive accounting treatment of capitalising costs into intangibles, can fool institutional investors very easily. I think that's because not many Instis actually bother to scrutinise the accounts properly. There are some honourable exceptions to that rule, but most do very little proper due diligence. The accounts here are not at all credible, in my view.

S&U (LON:SUS)

- Share price: 1928p (+2.3%)

- No. of shares: 12 million

- Market cap: £231 million

This motor finance business and specialist lender issues an update for the H1 period (having last updated at the AGM in May).

S&U's share price has been drifting lower for the past two years despite the business continuing to grow strongly, and this trend continues.

It arranges hire purchase car loans for subprime borrowers:

Trading at Advantage, our motor finance subsidiary, continues at record levels. New loan transactions are up by 20% and monthly collections are 27% higher than a year ago. Monthly collections hit a record £10m from nearly 49,000 customers in July and debt quality continues to be good.

Some noteworthy figures have been speculating receently about the possibility of a crash in the car loan market, in particular with respect to personal contract plans ("PCPs") (see this article).

PCPs have cheaper monthly payments than hire purchase, because you are only really paying for the car's depreciation, nothing else. Instead of making flat payments with hire purchase, you have to make a balloon payment at the end of a PCP contract if you want to buy the car, which is worth nearly 100% of the car's estimated value at that time.

So PCP is akin to renting, with the option to buy at the end, whereas hire purchase is akin to taking out a mortgage.

PCP involves more exposure for the lender but S&U has nothing to do with these types of contracts:

Advantage is not involved in the PCP market which has recently come under public scrutiny. Advantage's average loan size is just £6,200 so should changes in the PCP market have a knock-on effect upon car residual values generally, this would have only a marginal effect upon S&U's business.

Indeed, maybe it would be a good thing for S&U if PCPs ran into difficulty, as it would increase the demand for hire purchase agreements?

I wrote positively about this company last time I covered it and it still looks very interesting to me at current levels.

That's all for today. Have a great weekend!

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.