Good morning!

It really feels as if we're dodging bullets left, right, and centre at the moment. Not only are many/most small caps expensive, but there seem to be lots of profit warnings happening too. This certainly makes me nervous, and more prone to cut positions where I don't have strong conviction, and a positive recent trading update - or solid reasons to expect positive trading.

Certainly the market is being brutal with anything where there is any hint of trouble, so it's not a time to be holding things that are based on hope over substance in my view.

Although in most cases, profit warnings don't actually come out of the blue. Usually common sense can allow you to steer clear of problem companies, and problem sectors. The previous trading update can often contain clues to a forthcoming profit warning (e.g. we expect an H2 weighted year, or we expect to close large contracts by the year end, etc), and often broker forecasts have been trimmed in advance of the profit warning, as the company gave a steer to analysts as it becomes increasingly clear they are likely to miss forecasts. So it pays to look for these signs, and act on them, before the proverbial hits the fan.

Escher Group (LON:ESCH)

Share price: 155p (down 29.5% today)

No. shares: 18.7m

Market cap: £29.0m

Profit warning - the key sections say;

Escher Group Holdings plc (AIM: ESCH, "Escher" or "the Group"), a world leading provider of outsourced, point of service software for use in the worldwide postal, retail and financial industries, announces that the Group will not now close additional license sales that it had expected in H2.

As a result, Group revenues are now expected to be approximately $22m for the year to 31 December 2015 compared to $21m in 2014 on a reported basis. On a constant currency basis, revenues are expected to be approximately $23m (2014: $21m). License revenue, which is high margin, will be materially lower than expectations.

As a result the shortfall in license revenues will feed through to the adjusted EBITDA*. However, Escher still expects to report adjusted EBITDA growth in excess of 80% from $2.1m in 2014.

Following on from my introductory comments above, you can usually see problems coming. Indeed, I warned readers here on 14 Sep 2015 that there were numerous issues with the interim accounts - a flawed business model, which is overly reliant on unpredictable licence revenues, excessive debtors, too much debt, a complete absence of any dividends in recent years, the list goes on & on. So really, anyone holding this stock was just choosing to ignore many problems, and hence got caught out with a not entirely unexpected profit warning.

EBITDA - a totally meaningless figure for software companies. As an example, in this case the company refers above to $2.1m EBITDA in 2014, but it capitalised $2.2m into intangible assets (thus by-passing EBITDA). So in real world terms, which is how these companies tend to measure performance internally, i.e. cash profits, it actually made a slight loss in 2014.

The last sentence in the quote above has left me flummoxed. How come they are saying that EBITDA for 2015 will be 80% UP on last year? Looking back at the last interims, adjusted EBITDA was up 66%, so it looks as if H2 will be up about 100%, in order to arrive at +80% for the year as a whole.

My opinion - this looks like a disappointment, rather than a disaster. So if you like the company, then there's an opportunity to buy the shares at a 30% discount today. That's not an offer which particularly appeals to me, as I've always had reservations about this company's business model.

Additional detail given in today's update suggests that the company is feeling the pain from trying to move to a SaaS model, where licence fees have to be foregone in the short term, in order to secure longer term recurring revenues.

On the upside, I feel that this company must have strategic value to an acquirer, due to its customer relationships, with many of the world's largest postal operations. Maybe a larger software group might pounce for it, with a takeover bid, given that the shares are currently weak? Although are postal services a growth area, given email substitution?

I wouldn't completely rule out a smallish, speculative punt on this share, but it's not a sleep at night investment. The danger from jumping in after a profit warning, is that an Institution (or several) might have already decided to wash their hands with it, and hence could be drip-feeding stock into the market for months to come. So it usually pays to hang back, and wait for the share price to stop falling, and build a base over several weeks or months.

IMImobile (LON:IMO)

Share price: 150.75p (down 3.4% today)

No. shares: 59.4m

Market cap: £89.5m

Share options - many thanks to the reader(s) who added comments after yesterday's articles, pointing out the apparently very high level of potential dilution from share options at this company. It's been worrying me, so thought it good to return to this issue and investigate.

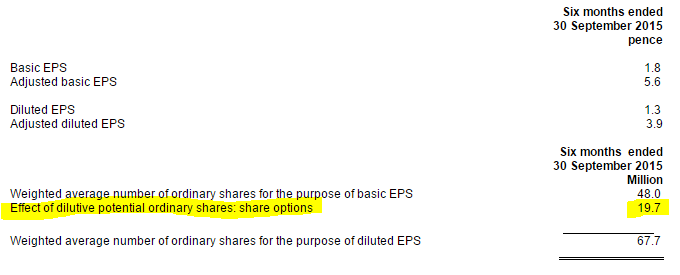

As our eagle-eyed readers spotted, the disclosure in note 5 to yesterday's interim results, showed a huge potential dilution from share options. Share options are commonplace, but a conservative level of potential dilution is under 5%, and certainly 10% is seen by most investors as the absolute limit of what can be tolerated.

As you can see from the figures below, the share options at this company appear to have the potential to dilute existing holders by an astonishing 41%:

My next port of call, is to get more detail on the potential dilution, from the last Annual Report, which is on the company's website.

Note 23 of the Annual Report concerns me. It details a second class of share, B shares, of which there are only two shares issued, but it seems to be saying that holders have the right to convert them into 11.3m ordinary shares. Checking the RNS of 23 Sep 2015 about share options, it seems that the 59.4m figure which Stockopedia has for number of shares in issue already includes the potential dilution from this 11.3m of new shares. I think this is related to Indian subsidiaries, and the peculiar rules which restrict foreign ownership, so this might be a work around related to that, possibly?

Turning to note 24 in the accounts, there are a number of share option schemes mentioned;

Plan A - nil outstanding

Plan B - nil outstanding

Flowering - 3m shares (exercise price £0.03)

2014 Unapproved - 6.37m shares (exercise price £0.33)

CSOP - 994k shares (exercise price £1.24)

Rollover scheme - 820k shares (exercise price £0.30)

Total - 11.18m share options

Adding together the 11.18m options, and the 11.3m B share figure, gets to about 22.5m potential dilution shares, which is in the same sort of ballpark as the 19.7m share dilution figure mentioned in the extract from the interim results above.

My opinion - I don't know what to make of this, other than it very much puts me off buying any shares in the company. Or at least I would want to work out my valuation using the fully diluted number of shares, and only consider a purchase if the valuation looked reasonable on that larger diluted shares figure.

I have asked the company's advisers to comment on this issue, as it would be interesting to understand the rationale for the B share dilution, and the seemingly excessive level of share options for employees/Directors. I'll publish any response from the company or its advisers here in future.

Brady (LON:BRY)

Share price: 45p (up 1.1% today)

No. shares: 83.0m

Market cap: £37.4m

Forthcoming interview - regular readers might recall that I was pretty scathing here about the profit warning which halved the value of this software company's shares on Monday this week.

The company's advisers have been in touch, and requested that the company be given the right to reply, and that they would like to do an audio interview with me, so that they can answer the questions raised in my report on Monday, and answer any further questions that readers & investors may wish to put to them, and put their side of the story.

I sometimes charge for my interviews, but as this is likely to be a tricky one, I feel it's essential that I am seen to be completely independent, so on this occasion I will not be charging the company any fees. So it should be a very interesting interview.

To submit questions, please don't reply to this thread, but please use this form, as it will collate all the questions in one place for me, so I don't have to rummage around on various bulletin boards to pick up all the questions.

Should be interesting!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.