Good morning!

The US market is shut today, so that usually means a slower day in the UK.

It's worth noting again the considerable disconnect between the FTSE 100 and small to mid caps. Its high dollar earnings means that the FTSE 100 has been remarkably strong recently - because once translated into sterling, those dollar earnings have of course gone up significantly, due to the recent weakness of sterling, caused by Brexit.

At the time of writing, FTSE 100 is down 0.15% today, whilst the mid caps index is down 1.5%. If you're a small cap investor, and you benchmark (or hedge) yourself against FTSE 100, then you're using the wrong index!

Corporation Tax

There has been a very important announcement from George Osborne, saying that he intends to keep reducing Corporation Tax to below 15% in due course. This is on top of existing reductions of 1% p.a.

This is clearly a positive development, and necessary, since companies need to be persuaded to remain in the UK, and continue inward investment. Having a super-competitive tax regime is likely to achieve that aim.

Obviously it will go down like a lead balloon on the continent, as a beggar-thy-neighbour policy, but there we go.

The annual reduction in corporation tax will of course give us, as investors, a gentle tailwind. Since earnings are after-tax profits, then the lower tax rate will be a gentle boost to earnings each year, for companies with UK earnings. That's helpful in the current circumstances.

Trakm8 Holdings (LON:TRAK)

Share price: 255p (up 8.5% today)

No. shares: 32.3m

Market cap: £82.4m

Results y/e 31 Mar 2016 & contract win - for the avoidance of doubt, I don't currently hold this share, but am mulling whether to buy back in or not. The headline figures today look really good, and have benefited from 2 acquisitions in the year - both of which have been profitable so far.

Adjusted EPS comes out at 13.44p, up an impressive 115% on last year. Although note that this is flattered by a negative tax charge. The rest of the results are self-explanatory, so I won't regurgitate that here.

It probably adds more value if I outline the Q&A session that I had with the Chairman & FD this morning, to answer my particular queries on the results statement. Call me old fashioned, but personally if I have queries about a company's accounts, then I pick up the phone and ask the company for an explanation. I then assess whether or not the explanation makes sense.

1) Debtors of £7.6m looks high relative to turnover of £25.6m. Normally I would expect debtor days to be about 60 days. So (including some VAT in debtors), that suggests to me debtors should be around £6m. Therefore it looks as if there's a an excess of about £1.6m in debtors, above a normal level, which could indicate problems.

The explanation from management is that RM was acquired near the year end, and therefore it contributed little to the P&L, but the full year end debtors are consolidated into the group accounts. Furthermore, RM is a project-based business, so tends to accumulate large debtors, which are then periodically paid in large lumps.

I was one of several commentators who looked up the pre-acquisition accounts of RM, and found them utterly bizarre! TRAK confirmed today that they have revised RM's accounting treatment, to make their revenue recognition much more conservative.

Putting a figure on it, the impact of RM debtors on the group accounts is about £1m, of the £1.6m which is my estimate of the unusually high element of TRAK's debtors.

There was also a £250k impact on debtors from one particular client contract which is payable over an extended time period, as agreed with the customer. I think some of this should probably be moved from current assets into non-current assets - the element which is receivable after 12 months from the year end.

Overall then, these factors are a satisfactory explanation as to why year end debtors is somewhat higher than normal.

2) Development spending - the group capitalised £1.9m of development spending during the year. The amortisation charge for previously capitalised development spending was c.£800k. Therefore you could argue that reported profit is flattered by £1.1m.

Personally I prefer a conservative view of development spending, writing it all off to the P&L as incurred. Therefore I would adjust the profit down by £1.1m when valuing the company.

3) Why is the tax charge negative? The group was able to bring in over £2m in previously unrecognised tax losses, to offset against its tax liability. Also, they benefit from the UK's generous tax regime regarding R&D tax credits.

I asked what a normalised tax charge would be, once the tax losses are used up? FinnCap has worked out the figures, and believes a 5-10% corporation tax rate would be normal in future.

Therefore, in valuing this share, I think investors should adjust EPS to a normalised tax charge. I imagine FinnCap probably do this in their forecasts, but I'll check that.

4) Are they happy with the Route Monkey acquisition? The RM acquisition raised some eyebrows at the time. However, management say it has gone well. RM contributed £596k towards group profit in its first 3 months. I queried this figure, as it seems unexpectedly high.

The explanation is that it does project-based work, so profits and cashflow are lumpy. This was an unusually good quarter. In a full year, RM is expected to contribute c. £3m revenue, and c.£1m profit.

As an aside, the Chairman mentioned that prospective customers always react favourably, when shown RM's products. So if customers like the product, it's probably going to do well.

The first new products incorporating RM's software are due for launch soon.

5) Are there any acquisitions in the pipeline? They didn't want to answer this question directly. They did however point out that there is plenty of headroom on the banking facility, and that it's a very fragmented market. So more acquisitions are possible.

6) Impact of Brexit & forex changes - this is referred to in the results statement. Weaker sterling will cause some cost increases for imported components. However this is partially offset by gains from sales contracts priced in Euros. Management didn't wound worried about this overall - it's likely to only modestly impact on their margins.

Brexit - could cause some customers to delay contracts, but none have so far. The return on investment from TRAK's products is so compelling, that management feel the sales team should be able to overcome any reluctance of customers to sign contracts. Also they pointed out that rising fuel costs further improves the case for telematics products.

7) Any other comments? I always end calls by asking management to mention any key points that we've not covered. In this case, TRAK management flagged up the maiden 2p dividend. Also they flagged the group's good cash generation.

EDIT: Broker note - I've just received the latest FinnCap note, which emphasises the free cashflow of £1.9m, "refuting the recent cash flow criticism" (from Winnifrith).

Finncap's forecast for FY2017 is as follows;

- Revenues £34m

- Adj. PBT £6.4m

- Adj. EPS (fully diluted) 17.0p (based on a 10% tax rate)

- This equates to a new year PER of 15 - hardly excessive.

So if TRAK achieves forecasts for the current year, then the shares will probably be higher this time next year. There's no guarantee they will hit forecasts of course, as with any company.

Balance sheet - there are a lot of intangibles, due to the series of acquisitions made, and also capitalised development spend. However even if you write off all intangibles, the balance sheet still looks OK in my view - in the context of a good stream of recurring revenues.

So no concerns here.

My opinion - I like it. This is a strong growth company, operating in an exciting area, with compelling commercial reasons for customers to buy their products & services. The client list is impressive, and growing. I also like that the company is continuously developing new products - this is a fast-moving space. I also like that customers typically pay on monthly contracts - so there is strong visibility of revenues, and hence earnings.

In terms of valuation, once you adjust for a normalised tax charge, and take a conservative view on expensing development spend, then the price is probably high enough for now, in my opinion.

It's good to see the flimsy bear case against this share collapse in ruins. I don't like it when decent companies are attacked on the most spurious of grounds. Bear raids should be reserved for basket case companies, which this one is very far from being. It's generating genuine cashflow, and organic growth. Basically the bear arguments are just sour grapes, from people who have got it completely wrong. Ignore them! This is a good quality growth company, with capable management. I think the shares are probably priced about right for now.

Plastics Capital (LON:PLA)

Share price: 93p (up 2.2% today)

No. shares: 35.3m

Market cap: £32.8m

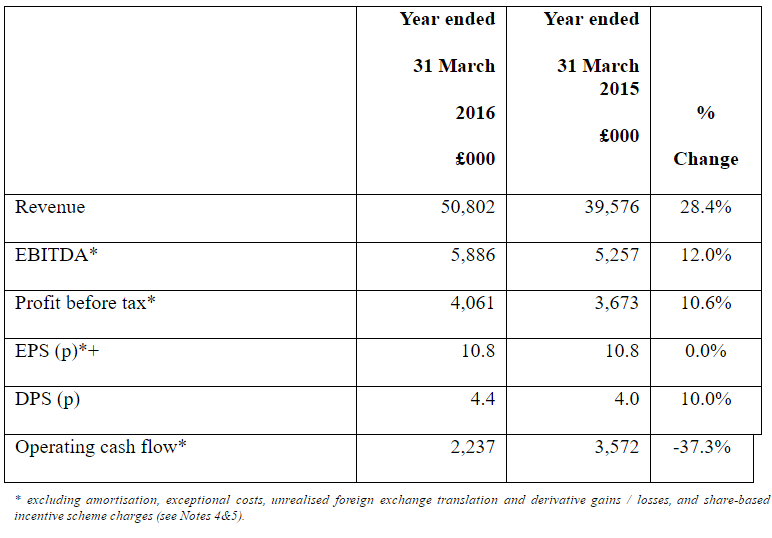

Results y/e 31 Mar 2016 - the headline figures look pretty good. Although note that adjusted EPS has remained static at 10.8p, since there has been an increase in the number of shares in issue;

I'm also concerned at a few other issues;

- Negative tax charge on P&L, thus flattering EPS.

- Complicated presentation of results, with lots of adjustments, concerns me (as mentioned before). Adj. EPS is 10.8p. but basic EPS is only 3.5p, a very large difference.

- Finance charges are high, and overall I'm not terribly comfortable with the overall level of gross debt.

- EBITDA is highlighted, but this ignores hefty capex of £2.3m, plus £349k of development spending was capitalised.

Dividends - the yield has risen well, and with 4.4p total divis for the year, that represents a healthy yield of 4.7%. Although I'm not keen on highly indebted companies being generous with the divis. The danger is that they have to do a placing to shore up the balance sheet in future, thus diluting existing holders. Wouldn't it make more sense to retain cash for reinvestment in the business, rather than paying out divis?

Outlook comments sound reassuring;

Trading for FY2017 is currently in line with management's expectations. Trading continues to follow the slowly improving trend we have seen as FY2016 progressed. We remain very focussed on implementing the key initiatives outlined above as this is what will drive the long term growth of the Group, as well as maintaining day-to-day operational excellence to ensure customer retention and cost efficiency. Integration of our recent investment in CCM is also a priority.

However, I can't find any comments specifically about forex movements post the Brexit vote. I feel that all companies need to spell out exactly what overall impact is likely on their future results from the material movements in exchange rates recently. Without this information, it's very difficult to value a share.

My opinion - with apparently quite aggressive accounting, and no guidance on exchange rates, I don't feel able to assess this share properly. So in uncertain markets, I'm not interested in taking the risk.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.