Good morning!

TT electronics (LON:TTG)

Share price: 111p (down 32% on the day)

No. shares: 159.0m

Market Cap: £176.5m

A very sharp drop in share price here today, so there must have been a profit warning.

Interim Management Statement - today's statement covers H2 trading to date, so from 1 Jul 2014 to end Oct 2014, and of course the year to date - so ten months in, they should have a very good idea of how the full year will look. There are a number of issues;

1. Relocation - as mentioned in my report of 10 Jan 2014, the company's plans to relocate some production from Germany to Romania looked somewhat questionable, since the high exceptional costs of £30m were expected to deliver £8m "efficiency benefits" (i.e. paying staff less) from H2 of 2015. After consultation with the unions in Germany, this plan has been torn to pieces, and instead now only some jobs will move to Romania, but the figures now look unworkable - indeed one wonders why the company hasn't abandoned the relocation plan altogether?

Today the company says that the relocation will cost £24m, but will only deliver projected cost reductions of £3.5m. Who knows what disruption & hidden costs will be incurred from things going wrong, in such a major relocation? If I were a shareholder here, I would be questioning management hard, to explain why they are pressing ahead with a major reorganisation that no longer appears to make sense.

Also, what will it do for staff morale, to know that you're working for a company that will throw you on the scrap heap if they can save a few Euros by employing someone in Romania instead? This seems to be the wrong way round - many companies are now re-shoring production back to their home country, because off-shoring production has so many hidden costs, and often quality goes downhill - as you would expect if a completely new workforce overseas is chosen simply because they are cheap.

So maybe this is a case of the bean counters making short-sighted decisions which are back-firing?

The implementation of the programme is underway and is anticipated to be fully completed during the first half of 2017. There have been a number of costs in the current year relating to disruption linked to the planned movement of manufacturing from Werne to Romania. Whilst we are now making progress implementing this programme these inefficiencies are expected to continue in 2015. We expect to see the first benefits from the programme in the 2016 financial year.

So as I suspected, it looks like they've made a right pig's ear of this. This puts a big question mark over the competence of the Directors in my view.

2. Strategic review - this sounds like the company will be making more closures & write-offs, etc next year, so expect a a whacking great restructuring charge as the new CEO kitchen-sinks the figures;

As previously announced Richard Tyson, who joined as Group Chief Executive in July, is conducting a comprehensive review of the business to ensure we have a sustainable, long term growth strategy. The review, which is looking at all areas of the business, is progressing to schedule and we remain on track to present the findings in March 2015 with our 2014 results.

3. R&D spending - has increased by £2.3m p.a., and note the impending write-off too. Providing the money is spent wisely, then R&D spending is good, in my opinion.

The business is continuing to invest in R&D to support future growth and gross R&D expense in S&C for 2014 has increased by around £2.3m year on year. As part of the ongoing strategic review we are undertaking a full review of our product portfolio and investment levels, including an in-depth review of historical R&D spend and amounts being carried on the balance sheet.

4. Profit warning for 2015 - oh dear, this is the worst bit;

We have also seen slower progress implementing identified performance improvement plans within the Sensors business and a move in volume mix towards lower margin product groups. These movements, together with the other factors identified above, are now being offset in 2014 by the significant non-recurring new order from an existing customer received by our US sensing business.

As a consequence of the above, and taking into account the Group's underlying performance for 2014, we anticipate that the performance of the business will be materially lower in 2015.

5. Financial position - updated as follows. With a lot of restructuring costs in the pipeline, I am concerned that net debt could rise significantly;

The Group retains a strong balance sheet, with net debt of £30.7 million at the end of October 2014 and continues to anticipate an improvement in working capital during the second half as outlined at the interim stage.

6. Current trading - mildly disappointing;

...the Group's performance for 2014 is anticipated to be at the lower end of current market expectations.

Overall then it's section 4 above which is the most material item - i.e. performance "materially lower" in 2015.

Valuation - where to start? Revised broker notes will probably give a lot more accurate analysis, but my back of the envelope view would be to take the 13.8p EPS consensus forecast for this year, and assume they might undershoot a little, so perhaps 13p this year?

Next year, who knows, but I would imagine sub-10p EPS is on the cards, plus a ton of restructuring costs. However, that may then lay the foundations for improved performance, perhaps back up to 15-20p EPS in the following couple of years?

The company was running at about 25p EPS in 2010 and 2011, so if it can get back to that level, and assume a PER of say 12, then that points towards upside to 300p per share, taking a medium to long term view. Not bad, considering the shares are now a little over a third of that level.

So it could be quite an interesting turnaround, although it looks as if there could be more bad news before the positives start to come through.

Pension deficit - looking at the last set of interim results, the section on the pension deficit says that it was £19.1m, and requires payments of £4.1m, £4.3m, and £4.5m over the next three years. So not great, but presumably at the end of that 3 year period then lower overpayments could be negotiated perhaps? It looks a contained problem, given the size of the company.

Mind you, having said that, it's a big scheme. Total pension scheme assets are £397.1m, and total liabilities are £412.9m (both at 30 Jun 2014), so a scheme this size can produce big variations when assumptions in the valuation model are changed.

Big pension schemes have another undesirable effect, in that they make it very unlikely the company will be a bid target, hence reducing the potential upside for investors.

Balance Sheet - overall it looks OK, although inventories look rather high to me - suggesting that perhaps the company is not operating efficiently?

My opinion - I think this could potentially be quite an interesting turnaround situation at some point, but for the time being I shall watch from the sidelines, and await the kitchen sinking of the accounts in Mar 2015. The relocation looks a hornet's nest, and no doubt there will be more bad news to come from that.

So staring into my crystal ball, I'm imagining looking at this share again after the next profit warning in 4 months' time perhaps, hopefully at 70-80p per share? That feels the sort of level where it might become more interesting on a risk:reward basis.

Plastics Capital (LON:PLA)

Share price: 109.5p (up 7.3% today)

No. shares: 30.2m (before Placing), 35.3m (after Placing)

Market Cap: £33.1m (before Placing), £38.7m (after Placing)

Acquisition & Placing - a reader asked me to comment on the news yesterday of an acquisition, part-funded by an over-subscribed Placing of 5.1m new shares at 98p.

In my view both Plastics Capital, and its advisers (Cenkos & Allenby) have done a really good job here. The new shares are being issued at a minimal discount to yesterday's share price, thus existing shareholders are not unduly diluted.

Moreover, I very much like the structure of the deal, in that the acquisition of Flexipol Packaging is being financed partly by new equity, but also by leveraging up that fresh equity through an increased bank facility. That makes complete sense, and is the right way to do things in my opinion.

£9.82m cash is payable on completion, with a small additional earn-out of £0.8m which might become payable subject to EBITDA targets.

So I like the way it's been financed, but is the company being acquired any good? I've looked up its accounts at Companies House, and the company has been around since 1994, so long-established which gives comfort. The most recent accounts to 1 Nov 2013 show turnover of £15.0m, and profit before tax of £1.07m. Profit after tax of £832k means that Plastics Capital has paid a PER of 11.8 times, which looks a fairly full price for a smallish private company. Not a striking bargain anyway. However, it depends on what PLA can do with the company to improve its profitability? It says;

Faisal Rahmatallah, Chairman and CEO of Plastics Capital, commented:

"We are very pleased to announce the acquisition of Flexipol Packaging Limited. Flexipol is very clearly a business that meets our acquisition criteria - specialty products, high recurring revenues with loyal customers, limited competition and healthy financial performance. This acquisition meets our criteria. It is complementary to Palagan and this should enable us to extract significant synergies in due course through cross selling, operational efficiencies and raw material cost savings.

We are also very pleased to announce an oversubscribed £5 million placing with both new and existing institutional shareholders, at a 4.4% discount, in order to part finance the Flexipol acquisition."

So the part I have bolded above explains why the deal has happened, and makes sense.

My opinion - I rate management at PLA, they've shown themselves to be careful in making acquisitions at the right time & price, and it's good to see the group grow, which might begin to justify the top-heavy central overheads of the group.

It's encouraging that they had strong demand from Instis for the Placing, so hopefully that might lead to some follow-on buying in the market from those Instis.

Broker earnings forecasts will obviously be raised considerably (about 25-30% by my reckoning) after this acquisition, so it's a material sized deal that makes the group a good bit bigger. Overall, it ticks all the right boxes for me.

Impellam (LON:IPEL)

Share price: 470p

No. shares: 43.9m (before Placing), 48.8m (after Placing)

Market Cap: £206.3m (before Placing), £229.4m (after Placing)

Placing - as with Plastics Capital above, this is what I would call a "good Placing" - the key points being that the money is being raised for a worthwhile purpose (a sensible acquisition), the dilution is relatively small for existing holders, but above all, the price of the Placing is not discounted, but is the same as the market price for the shares yesterday, at 460p.

Interesting to note that it's Cenkos again who did this fundraising, who seem to be doing a very good job in lining up new investors for smaller growth companies, instead of taking the lazy option of offering a deep discount for new shares (which of course tramples all over existing shareholders' interests).

£15m has been raised (before expenses) by issuing 3.26m new shares, priced at 460p.

I like the fact that Directors have participated in the Placing, buying 28,240 shares (worth £130k - a worthwhile indication of confidence).

Acquisition - Impellam is acquiring Lorien Limited, a UK specialist IT recruitment business. It looks to be a material sized acquisition, and will increase the size of the group P&L by about a quarter to a third roughly I think.

The consideration is £22.3m in cash now, plus 1.63m new shares with a 1-year lock-in being priced at 460p also, the same price as the Placing shares, so value £7.5m. There are also some quite hefty earn-outs, of up to £6m in Jan 2015, and a further £13.9m in Jan 2016, dependent on the performance of Lorien during those years. That's great, I really like earn-outs, as it should mean that everyone is incentivised to really drive growth & profitability at the acquired company.

So totting up that lot, the consideration will range between £29.8m (assuming nil earn-outs), and £49.7m (maximum earn-outs). Note also that Impellam is taking on £14m in Lorien's existing debt.

This price looks sensible for a business which is expected to generate £8.7m in EBITDA this year (ending 31 Jan 2015). I'm not usually keen on EBITDA, so a quick check of Companies House is in order, to ensure that Lorien is making real profits!

Lorien Limited is reported as making an operating profit of £4,071k for the year ended 31 Jan 2014. This compares with a figure quoted in today's RNS of adjusted EBITDA of £6.4m for the same year. Although I note that turnover rose by 37% on the prior year, which suggests to me that Lorien might itself have made some acquisitions last year. Hence there could be a goodwill amortisation charge which explains the difference between EBITDA and operating profit?

Overall I think that's probably fine. It looks a good deal. IT recruitment is a good area at the moment, I am told. The price paid for this acquisition looks sensible, and with a good part of the price being deferred earn-outs, it could even be self-funding?

Bank facilities have been increased to help finance this deal;

In addition, the acquisition will be financed by a new five-year loan of £15m with Barclays Bank plc. The Company has also extended its current invoice discounting facility with Barclays from £80m to £120m.

My opinion - I probably didn't need to go into so much detail here about this, but it's a material acquisition, and interestingly management comment today;

The acquisition of Lorien is a significant step for Impellam and makes us the second largest staffing company in the UK. It has long been our ambition to develop a substantial presence in IT staffing and I am delighted that Lorien, as a market leader in UK technology staffing, is now part of the Group. There are strong synergies between our businesses and an excellent cultural fit...

It will be interesting to see how the revised broker forecasts look, but it's worth noting that this share already looked very good value, on a forward PER of only 7.2. There's a reasonable divi yield too, of about 3.4% (forecast). So with a sensible acquisition under their belt, I am feeling positive about it.

The shares are very illiquid though, considering the size of the company, because Lombard Trust owns 58.6% of the company. So hopefully they haven't taken part in the Placing, so that overweight holding might at least be diluted a bit. The company needs to restructure its shareholder base, and get that big block of shares broken up, in my view. That would make the shares more liquid, and help them re-rate to a more sensible valuation.

Essenden (LON:ESS)

Share price: 69p

No. shares: 50.1m

Market Cap: £34.6m

This company restructured recently, and operates ten-pin bowling centres.

Update - a few interesting snippets in today's statement, which sound moderately positive.

A new site acquisition looks to have been done at a favourable price;

Essenden has acquired an existing bowling site in Doncaster on a leasehold basis from the administrators of Keith Brown Properties (Hull) Limited for consideration of £0.65m (including fees). The site is well-located on a leisure retail park, close to a cinema, restaurants and supermarkets. It has traded strongly over the past two years. The board expects that the acquisition will be earnings enhancing in the first year, even before the benefit from applying Tenpin's operating model.

Secondly, a fruit machine contract has been improved;

The new contract to provide Essenden's amusement machines estate, recently entered into with Bandai Namco Amusement Europe Ltd, has resulted in this key category being materially improved. The migration has now been completed on schedule. The new machine estate is operating satisfactorily.

Sounds positive.

Finally, a trading update is buried in today's announcement;

"The acquisition of an earnings enhancing site along with the successful machine transition further strengthens my view for 2015 despite some macro-economic uncertainty."

My opinion - this looks a potentially interesting company, in my opinion. Although the ludicrous bid/offer spread and illiquidity in the share is a pain. So it's not worth buying unless your broker can get some for a penny or two above the Bid price, in my view.

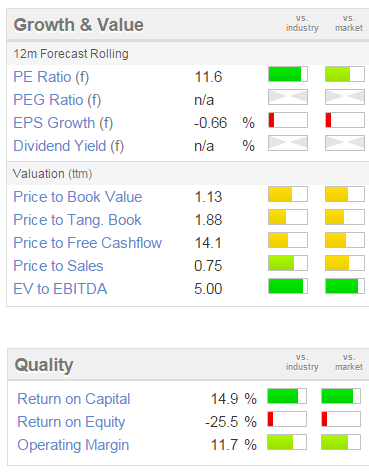

I'd like to properly work through the next set of accounts to be sure that it's valuation is sensible, as so far I've been estimating my own figures. I note that broker forecasts have now appeared, and its valuation looks fairly reasonable;

All done for today, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in IPEL and ESS, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.