Paul is taking a well earned break in the sun this week. Fortunately, with Paul’s help, we’ve managed to enlist Graham Neary, who is temporarily stepping in to take the reins. With Graham’s awesome analysis and the usual excellent community spirit here, it should be more or less business as usual! Thanks, Ben (at Stockopedia)

Plastics Capital (LON:PLA)

Share price: 117.5p (+0.43%)

No. shares: 35.6m

Market cap: £41.7m

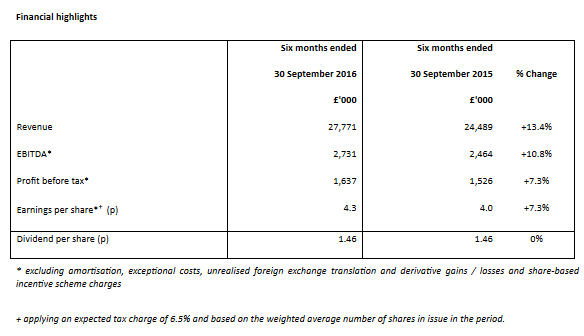

Interim Results for six months ended 30 September 2016.

Plastics Capital is a collection of six subsidiaries, giving investors a challenge in terms of understanding each of the moving parts. But they are all related to plastic and/or packaging, so you might feel that if you understood one of them, you understood them all!

The company reports organic revenue growth of 6.7% at constant currency, and this would be my preferred measure of sales growth.

Within that, Industrial Division revenue is up 19.2%, "led by key accounts growth in bearings business". It's always worth checking for customer concentration risk when you read statements such as this! At first glance, Plastics looks to be reasonably well diversified: they sell to 80 countries and don't have any >10% customer at a group level, according to the 2016 accounts.

Those 2016 accounts remarked that the company's costs were denominated in a range of currencies, but the devaluation of Sterling still looks set to provide a healthy tailwind.

Net Debt: Increases to £15.1 million from £10.1 million during the six month period, driven by an acquisition, an internal investment program, and dividends.

Dividend: Interim dividend maintained at 1.46p. The company remarks as follows:

Because of the excellent organic growth opportunities we see, the Board now believes that our internally generated free cash flow should be allocated increasingly towards reinvestment in the business.

Outlook: Quite positive! A "healthy improvement" in the order books has been seen, and improved financial performance is anticipated for the second half. A five year plan is being executed.

My opinion: The accounts are very dirty since we have to contend with a lot of distractions from underlying performance: i) FX derivatives, ii) exceptional costs, iii) H1/H2 seasonality, iv) huge intangible assets and their associated amortisation costs, v) interest payments on the debt pile.

For the year ended March 2016, £3.8 million of net cash from operations was generated. In the latest 6-month period, £1.8 million was generated.

Compared to those figures, the enterprise value of £57 million looks quite affordable.

But is this a quality business? The balance sheet is almost as large as the enterprise value (£56 million, much of it intangible). The company's five-year plan targets EBITDA growth, and this does tend to lead to balance sheet expansion, rather than sweating profits out of a company's existing assets. In 2014, the balance sheet was just £41 million.

So based on the strategy at play here and also on the company's track record, I would suggest it's unlikely that this company will generate above-average returns on its assets for shareholders.

Purplebricks (LON:PURP)

Share price: 124p (+18%)

No. shares: 246.8m

Market cap: £306m

Interim Results for the six months ended 31 October 2016

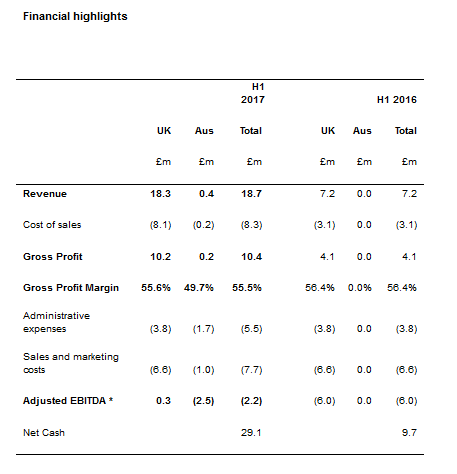

Explosive growth by this online estate agent (founded in 2014).

By taking a fresh approach to managing online sales and property advertising, they seem to be able to massively undercut traditional estate agents. Key to the customer proposition is a fixed fee.

Having listed on the market less than a year ago, the figures show that the business has more than doubled in size: revenue up 159%, instructions up 108%, and hired experts up 119%.

They claim to be "the most positively reviewed estate agent in the UK." It always helps if your customers like you!

Australia launch: an ambitious growth strategy has been launched down under, which is still in its infancy:

The launch into the £3.3bn Australian market on 28

August went smoothly. Similar to the UK, we followed a regional launch

strategy, commencing with Queensland and Victoria with a view to

extending the rollout across the country thereafter. Early indications

are very encouraging and we are growing more quickly than the UK

business at the same point in its evolution.

One thing I'd note is that revenue per customer has increased substantially over the period. This is because, on top of the flat basic fee:

There are additional charges if the customer wants

Purplebricks to undertake the viewings on their behalf, if they require

an energy performance certificate or a Rightmove premium display. The

Company's additional sources of revenue currently comprise fees from

conveyancing, mortgage referrals and insurance.

Perhaps this is a little bit like the airline strategy of getting customers on board and then asking them if they'd like to buy anything else! But it still sounds more transparent than a typical estate agent.

Loss from Operations: £2.8 million, much improved from the £6.4 million loss recorded a year ago.

Net Cash: £29.1 million, down from £30.5 million at the start of the year.

My opinion: This looks more than fully funded for growth, which is the most basic test of investability for a growth stock. I'm not surprised that the shares are sharply higher today, given the outlook statement and the prospects.

The company's market share in the non-traditional sector is now 63%. The big questions I'd be exploring here would be: assuming that Purplebricks remains the clear market leader, how much bigger and how quickly can this sector grow?

And then: how many international markets do we think the company could translate its business model to?

I like this business; whether it turns out to be a great long-term investment will hinge on the answers to these questions.

For what it's worth, Woodford Investment Management owns 29%.

Rex Bionics (LON:RXB)

Share price: 20p (+0%)

No. shares: 25.5m

Market cap: £5m

Interim Results for the six months ending 30 September 2016

This company manufactures robotic mobility devices which enable users to walk instead of using a wheelchair.

Unfortunately, previous funding rounds have failed to bring it to commercialisation. Just three units were placed during the most recent six month period (two of them sold and one of them rented out). They are said to cost about £90,000 each.

The company remains positive on the existence of a market opportunity, but having raised cash in August, it summarises its funding outlook as follows:

Additional funding will continue to be required before the end of the current financial year, but the Board remains confident that this will be forthcoming if the progress achieved in the development of the business over the last period can be maintained.

With the company remaining very far from commercialisation, I doubt that existing investors will have any ability to protect their position here.

The basic test for investability is that a company is fully funded to execute its plans. If you don't have that, you have an obligation to turn it down - if making money is your objective!

Thanks for reading. I look forward to your feedback!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.