Good morning!

McBride (LON:MCB)

Share price: 80.25p

No. shares: 182.2m

Market Cap: £146.2m

Trading update - covering the six months to 31 Dec 2014 (note that the company's year end is 30 Jun 2015). McBride is a low margin manufacturer of personal & household goods, supplied to supermarkets.

It looks as if poor performance has now stabilised;

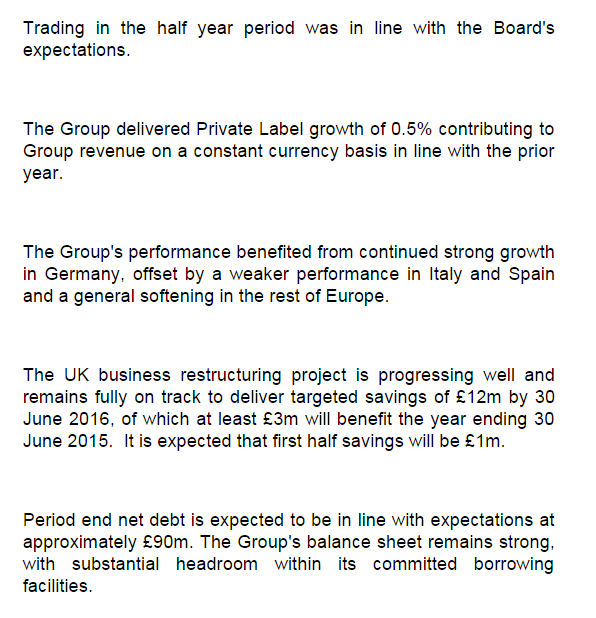

The key sentence is obviously the first one, saying that trading has been in line with expectations for H1.

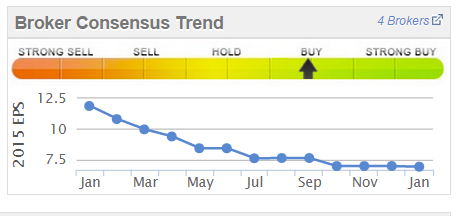

Although checking the handy Stockopedia graphic on broker forecasts, the bar has been lowered almost continuously over the last year;

Net debt - has been a concern for me here, and I think the £90m figure reported today is still far too high. To put that into context, £90m net debt is almost 62% of the market cap, so it's a very material figure. That's fine as long as the bank remains co-operative, but if something goes wrong there are no guarantees that will remain so. Maybe I'm too risk averse on debt, but having seen first hand how banks behave when they get the jitters, investing in highly geared companies strikes me as an unnecessary risk to take. Especially when the shares are not particularly cheap anyway, as in this case.

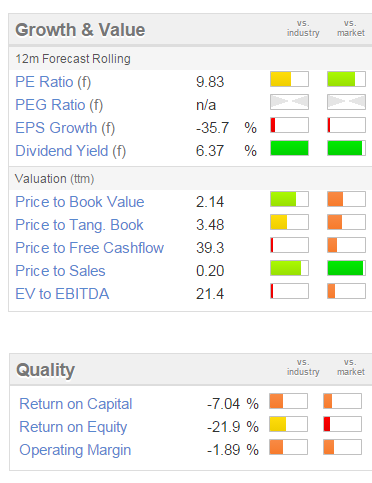

Valuation - as you can see from the usual Stockopedia graphics below, the PER and divi yield look superficially attractive. However, once you take into account the considerable debt, and the reality that the divi looks stretched, then it doesn't look so cheap after all.

The quality scores are poor because the figures from last year are loss-making, but even in good years the operating margin is low - c.2% from 2011-2013.

My opinion - Given the unprecedented battle underway between supermarket chains in the UK, they must be squeezing their supply chains like never before. Therefore I'm trying hard to avoid any companies which supply them, since I reckon any profit will be ruthlessly hacked away by the supermarkets.

On the other hand, the UK turnaround plan sounds intriguing. Today's announcement indicates "targeted savings of £16m by 30 Jun 2015" - it's not entirely clear if those savings will drop straight through to improved profits, or only partially? Broker forecasts already predict a significant improvement in profits next year - up from £11.4 to £16.7m, so quite a bit of upside is already baked into the current share price.

On balance, it looks like a business that will be permanently battling to maintain even a wafer thin profit margin, and is capital intensive too. There's a pension deficit too, and with ongoing very low interest rates, pension deficits are generally rising again. It's difficult to see much upside here at the current valuation, but plenty of risk. Therefore it doesn't look attractive to me.

Also announced today is that a new CEO, Rik De Vos, is starting on 2 Feb 2015. I wonder if he will slash the dividend to a more prudent level? Companies with heavy net debt should not be paying divis at all, in my view. So this is a good example of where chasing an apparently generous yield can be a mistake.

Looking at the two year chart, it's been a steady decline, but it does look as if investors are beginning to support the shares around 80p, so maybe it's finding a floor?

Midatech Pharma (LON:MTPH)

Share price: 304p (up 14.5% today)

No. shares: 27.8m

Market Cap: £84.5m

Midas tip - an article in the "Midas" column in the Mail on Sunday (click on link to the left) caught my eye this weekend, about this recently floated drug delivery company.

It sounds highly speculative, but has a lot of the ingredients which could potentially excite investors - something innovative, it's well funded (fresh money raised at IPO), and maybe most interestingly, it has been heavily supported by star fund manager Neil Woodford.

Also, it's a great story, that I suspect investors will warm to - the company is developing novel ways of using gold particles to get drugs into specific areas, and to therefore concentrate drugs within the body to better target certain cancers. Would be amazing if it works.

Therefore I think this could be a nice little speculation in 2015, so I bought a small position first thing this morning. It's impossible to value, so very much a speculative punt, rather than an investment, but it looks potentially interesting to me.

Redhall (LON:RHL)

Share price: 13.75p

No. shares: 49.1m

Market Cap: £6.8m

This company has been in a tight spot for a while - poor trading, and dangerously high levels of bank debt. A very interesting solution has been found though;

Bank facility update - Henderson, which owns 27.7% of the shares in Redhall, has bought £10m of Redhall's borrowings from HSBC Bank. One assumes that Henderson will have bought the debt at a discount, i.e. HSBC are likely to have taken a haircut, in order to extricate themselves from a problem lending situation.

This looks to me like an elegant solution, which gets the bank largely off the hook, and avoids Administration. Owning the debt and 27.7% of the equity means that Redhall is now firmly under the control of Henderson, so what happens to the shares depends entirely on how they decide to play it.

They could decide to dilute existing holders to oblivion, if they play hardball and impose a punitive debt for equity swap on drastic terms. On the other hand, they might want to protect the existing equity as much as they can, in order to provide an eventual exit route themselves. Or they might decide to do a pre-pack administration to clear the decks? Who knows. Maybe Henderson will bid for the whole company now?

We can only speculate too under what circumstances this deal was done - I wonder if the bank threatened to pull the plug?

Anyway, all will become clear in due course. It remains on my bargepole list as far too risky to contemplate an investment.

Leeds (LON:LDSG)

Share price: 42p

No. shares: 27.5m

Market Cap: £11.6m

I don't seem to have reported on this company before. It's a fabric distributor. I'm really surprised to see it has the maximum StockRank score of 100 here on Stockopedia.

Interim results to 30 Nov 2014 announced today look alright. Profit is up slightly against last year's H1, at £1.06m.

I like the Balance Sheet, which seems very solid.

Outlook - sounds promising

Valuation - these are based on trailing twelve month (ttm) figures, as there are no broker forecasts. The valuation looks OK, but not strikingly cheap;

My opinion - this is based only on the most cursory look at the figures. However, I am scratching my head as to why this stock gets the maximum 100 StockRank. To me, it looks an OK business, but nothing exciting, either in terms of valuation or organic growth.

Although the company does say that currency headwinds meant European results scaled back in sterling terms, masking growth. Also, there has been an acquisition of some fabric shops.

It's quite surprising that a business in this sector is viable at all, as I thought practically all the rag trade had long since left Western Europe for low cost manufacturing countries.

The lack of divis rules it out for me - if I'm going to invest in a boring, mature business, then I want thumping great divis. None seem to have been paid here since 2001, which seems odd given that the Balance Sheet looks strong enough to finance decent divis. If I were a shareholder, I'd be pushing hard for the resumption of divis. Note that value investor Peter Gyllenhammar holds 21.3% of the shares here. So it's possible there might be some freehold property in the Balance Sheet too, as value players usually like to have asset backing.

That's all for today, see you back here tomorrow morning. This first five-day week of the year is going to be a struggle I think!!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.