Good morning! My attention has been on ASOS this morning, as the online fashion retailer has issued a profit warning, and the shares have plummeted to 2855p at the time of writing. I've been saying for a long time that the valuation was nuts, and indeed I was short of the shares when they peaked at 7000p, but unfortunately banked my profits far too early at 5000p. This share is a great example of how investors become intoxicated with growth, and momentum, and end up paying multiples of what the company is really worth.

I think we might well see similar crashes in other online retailers that are priced to perfection. After all, they're only retailers, who happen to operate through a website. What people forget is that, whilst they don't have any of the costs of retail outlets, they do have all the costs & hassle of delivery to the customers' homes. Plus they have more complicated warehousing requirements, and above all the returns rate on online fashion is about 30%. Same as it was for mail order, as online retail is the same as mail order, but using a website instead of a catalogue. So the margins overall end up the same as any other retailer, mainly because of the cost of disposing of all those returned items that customers don't want because they don't fit properly, or have worn once & fancy a refund instead of wearing it again. Whereas the returns rate for a bricks & mortar retailer is far lower, at 5-10%, because most customers try the product on, and check the quality in the store.

Anyway, let's get back to doing what I'm supposed to do, and look at some small caps!

Harvey Nash (LON:HVN)

This recruitment group has issued an IMS for the first four months of its financial year (ending 31 Jan 2015). It looks reassuring, with the conclusion stating;

Overall, the previously reported momentum gained in the second half of last year, and particularly the final quarter, has continued with the result that performance in the first quarter has been in line with the management's expectations.

More detail is given on Q1 trading;

On a like-for-like basis, in the first quarter compared to the corresponding period in the previous year, revenue was 12% higher (15% on a constant currency basis*), gross profit was 2% higher (6% on a constant currency basis*) and operating profit was 12% higher (17% on a constant currency basis*).

The geographic comments are interesting for background on how particular economies might be doing overall;

Demand for permanent recruitment is strong in the US, UK and Hong Kong and there are continuing signs of improvement in Sweden and Finland, although Norway remains weak. Demand for permanent recruitment also remains weak in mainland Europe, however there it is offset by robust demand for contractor services. In the USA, demand for offshore services is picking up, offsetting lower demand for contracting as a result of the swing to permanent recruitment.

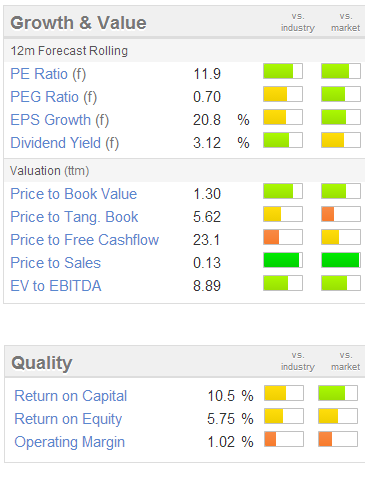

So how do the shares look in value terms? Not bad actually, it looks one of the better value recruiters out there with a reasonable forward PER of 11.9, and a sensible dividend yield of 3.1%, see the usual Stockopedia traffic light graphics below:

It's not compellingly cheap, for a fairly humdrum business, so overall I would say that it's probably a little underpriced, if you think good earnings growth is possible, but not a striking bargain.

I would say that the Balance Sheet is OK-ish, although I'm a little concerned by the sheer size of the Debtors & Creditors lines. I'm not suggesting anything is amiss, just that the swings in working capital could be quite large. So the business is heavily reliant on its £50m invoice discounting facilities. There is a risk that such facilities could be scaled back, or even cancelled, if (when?!) we have another banking crisis. I suppose you could say that about any company, but personally I like ultra-conservative Balance Sheets with no bank involvement at all, as it means you can sleep at night whatever is happening in the world.

Note that HVN has a very high StockRank of 98 (see below for more explanation).

Video of Stockopedia webinar - re stock rankings

For the avoidance of doubt, I have complete editorial freedom here - nobody tells me what to say, although occasionally I get a nudge from Ed saying "I think you went a bit far there!", which is fair enough. So I don't promote anything unless it is something I genuinely think is useful for investors.

As such, I strongly urge readers to take some time out to watch/listen to the recording of Ed's (Stockopedia's CEO) webinar yesterday, which in my opinion was the best one yet. He clearly explains how Stockopedia's stock ranking system works, and its first year results, which are remarkable.

I will certainly be making much more use of the StockRank system on Stockopedia, now I understand how it works, and how well constructed it is, and most importantly how it's been tested & proven to deliver a higher probability of market outperformance over a portfolio of shares.

They key nugget that I learned from the webinar was that the Momentum score is not just about share price movements, it also includes earnings momentum - i.e. forecast upgrades, outperformance against forecast earnings, etc. As such it's far more useful than I realised.

Great to see that lots of the stocks I hold personally score very highly on the StockRank system. So expect to see me refer to StockRanks much more in these reports from now on, since I now understand them, and am impressed with the thought that has gone into their construction, and their proven results.

A word of warning on the StockRanks though - there is still no substitute for properly doing your own research. StockRanks don't (as far as I'm aware) pick up things like pension deficits, excessive debt, dangerous ownership structures (e.g. where the co is controlled by one or a few people), weak balance sheets generally, the problem of excessive debtors (which can derail heavily promoted wonder stocks, when the profits turn out to have been inflated), and geographic risk (i.e. that some overseas companies listed in the UK have very poor corporate governance & dodgy accounts).

So personally I will use the StockRanks to come up with lists of stock ideas to do further research on, and to give me comfort that (hopefully!) I'm on the right lines with my existing stocks which score highly. And as a flag to review my existing stocks which have a low StockRank.

Therefore the mantra remains, do your own research! (DYOR).

Cambridge Cognition Holdings (LON:COG)

This share has been on my watch list after a successful investor friend told me that it's very interesting technology. The company has developed computerised testing which can detect early signs of dementia. It's a tiny market cap (£11m at 66p per share), and hence must be seen as high risk. Usual micro cap problems of illiquidity apply.

The company Listed on AIM in April 2013, raising £6.4m in a Placing. Hint - always check the "admission to trading" statement for a new listing, as often the money raised in the Placing can be partially to buy out existing shareholders, which is clearly not of any benefit to the company overall. Also you tend to find that new listings for companies that were owned by Private Equity are nearly always over-priced, and that the money raised is often being used to mainly pay off the excessive debt that PE usually loads onto companies to make their own dreadful business model work. Not to mention that PE usually structure deals so that Corporation Tax is eliminated, through devious debt structures. As a society we'd be better off if the whole PE sector & all their hangers-on just vanished overnight, in my view.

Anyway, in the case of COG, the company raised £5m before expenses in fresh cash at a Placing price of 70p per share. Looking at their results for the year ended 31 Dec 2013, the cash balance was down to £2.3m, so I would imagine the company will be looking to do a small Placing maybe towards the end of this year to top up the coffers.

The reason I mention this company today is because I am intrigued by their announcement that a £1.6m contract has been won for a phase III drugs trial, to test the cognitive safety of a new medicine under development. This seems to open up a potentially large new market for COG, which I hadn't realised was a possibility. It's quite a big contract win too, so a few more of them, and the figures should start to stack up nicely.

I've bought a tiny scrap of stock for my long-term portfolio, just to dip my toe in the water, and will start doing some more detailed research on it. So if any readers have looked at this company, I would be interested to hear your views, in the comments below.

It's not my usual type of value/GARP share at all, but sometimes I do like to dabble in more speculative stocks, especially if they are off the radar, low market cap, and have positive newsflow coming through. It's horribly illiquid though, and has to be seen as high risk. There was some issue with the management changing shortly after the IPO apparently, on some kind of disappointment, so that would need looking into. However, the past is the past, it's the future that matters, so I like the contract win announced today.

The company are presenting at a ShareSoc investor evening in London on 25 June, so I'll go along to that - should be interesting to find out more about the company, and meet the management.

Amino Technologies (LON:AMO)

Today's update from this set-top box maker sounds encouraging, so it's no surprise to see the shares up 6% to 95p (a market cap of £52m). The update concerns the six months to 31 May 2014, and the key bit says;

The Company expects to report profit before tax in line with expectations and a strong first half closing net cash balance of £19.7m (H1 2013: £18.2m).

Note that the cash pile here is highly material to the valuation - cash represents 38% of the market cap, or nearly 36p per share. It's genuine surplus cash too, since the current assets are £27.3m, versus total liabilities of £7.4m! That's 369%, where 120-150% would normally suffice! If I were a shareholder I'd be pushing management hard to pay that cash out to shareholders, unless they have a genuinely compelling alternative use for it.

The company has a policy of increasing its dividend by 15% p.a. so the yield is attractive here at forecast of about 4.5%.

I don't understand the sector they operate in, and it's subject to such rapid change from the convergence of internet & TV, that I'm uneasy about trying to assess this company's future prospects. However for people who have sector knowledge, this could be a good one to investigate. The ultra-strong Balance Sheet, and decent dividend yield are certainly a good starting point. I'm just flagging up the idea here, not expressing an opinion on it.

I shall leave it there for today. Time for lunch & a snooze on the sofa.

See you tomorrow as usual!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in COG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.