Good morning! I am posting this early (the night before) because I want to give a quick last-minute update on;

Mello 2014 investor event in Derby, which is imminent, Thu-Sat (6-8 Nov). I'll be there for the whole three days, and I'll be doing my Small Cap Value Report live at 10:30 on Fri morning, in the lecture theatre at Mello 2014. So literally making it up as I go along, probably with a bit of a hangover, this could well be an embarrassing debacle, but what the hell, let's do it, it's only half an hour!!

Click here for the timetable of talks for the Derby event, which I am sure you will agree looks fantastic.

I understand that Thu & Fri are nearly full, but the Sat still has some places available. Therefore the organiser my good friend David Stredder has just emailed me to say that readers here can have a last minute special offer of Saturday only tickets for just a tenner. Use this discount code: MELLODAY-DISCOUNT on this link and select the 1-day ticket for Sat 8 Nov, which using this discount code will only be £10 instead of £49. Only for the Saturday mind.

The reason I am plugging this event is because it's going to be amazing - and as far as I know it's the first time a remarkably successful private investor has organised his own event of this scale, on a not-for-profit basis, designed from the ground up to bring together his most interesting contacts. The numbers are limited, so there will be great networking too, with numerous millionaire investors rubbing shoulders with fund managers & interesting small cap companies. So expect a somewhat smaller event than the London ones, but with great quality speakers & companies.

Of course, as with anything in life, there are always snipers, who want to throw mindless criticism and jealousy dressed up as cynicism, hiding safely behind false names on the internet. You just have to accept that, if you put your head up above the parapet and try to do something new & good, that the moaning minnies will snipe away. Well, who cares about that lot?! I certainly don't! You get a hide beyond rhinoceros thickness when you've been sniped at as much as I have, for various undeserved & irrational reasons, throughout life! Sod 'em!!! Let the good people prevail!

There is even superb quality evening music & entertainment organised at Derby by my brother! What more could one want?!

Derby is only 1hr 25m from London by train. I am so looking forward to this event, and hope to see many of you there. Would be good to see some midland & northerners there too, seeing as how they always complain investor events are usually in London!

I should have added that there is a date clash unfortunately, so Stockopedia won't be at Derby (although I will be flying the flag there!) as they were already booked to have a stand at the World Money Show in London this Fri & Sat. So for anyone who can't make Derby, then there's a good chance to meet the team in London.

Good morning! Ooh you can't beat a good rant! Talking of which, results from this company usually set me off, and today is no exception;

Wincanton (LON:WIN)

Share price: 140p

No. shares: 121.7m

Market Cap: £170.4m

I have no idea why anyone would hold this share. It has probably the worst Balance Sheet of any UK listed company, it's beyond bad, it's insolvent. Net assets are negative £268m, and once intangibles are written off that worsens to negative £369m! So it's clearly uninvestable with such a colossal deficit on the Balance Sheet.

Interim results - to 30 Sep 2014 are issued this morning. The headline figures look OK, with turnover up 1.6% to £550.9m for the six months, so a fairly substantial business. Underlying profit before tax is only £15.9m though, note that it's low margin, as you would expect for a logistics business. So if you ignore the Balance Sheet completely, then the shares look superficially cheap, on a forecast PER of 8.4.

Balance Sheet - this is where it unravels completely. Wincanton is clearly a zombie company - which is only able to continue trading because its creditors have given it extended credit.

Net debt has dropped from £87.2m to £66.9m, which doesn't look too bad, but I suspect that figure might be window-dressed for the year-end. Note 3 shows that interest expense was £13.9m last year, which if they are paying say 5%, means that average debt would have been £278m last year.

I've just spotted a note in today's accounts saying that average net debt for the six months ending 30 Sep 2014 was £141m. How is that debt going to be repaid? At some stage the bank will want that money back, yet Wincanton doesn't have the cashflow or assets to repay it. Freehold property is only £14.1m on the Balance Sheet, so there isn't really much asset backing here either.

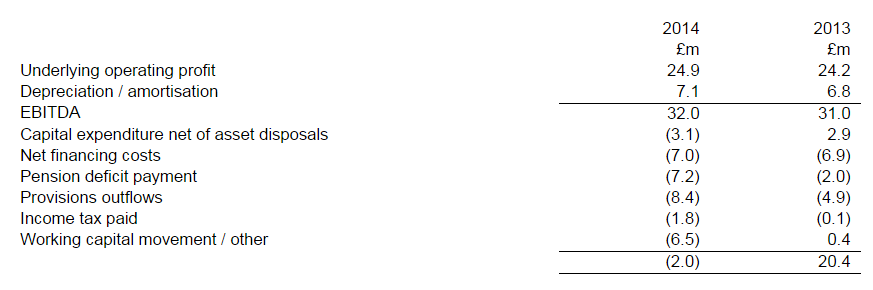

Cashflow is summarised by a table from today's results, which reinforces the fact that the cashflows generated by the company are consumed by capex, debt interest & pension deficit repayments. These are six-month figures remember;

There is no scope to pay shareholders anything in dividends, so arguably the shares are really worth nothing.

Working capital - this is in very poor shape. Current assets (i.e. stock, debtors, and cash) total £232.1m. However, current liabilities (which I would have expected to be about £150-200m) are actually £339.6m. Therefore that is a very poor current ratio of 0.68 (where personally I consider anything below 1.2 to be weak, and certainly below 1.0 is getting into risky territory).

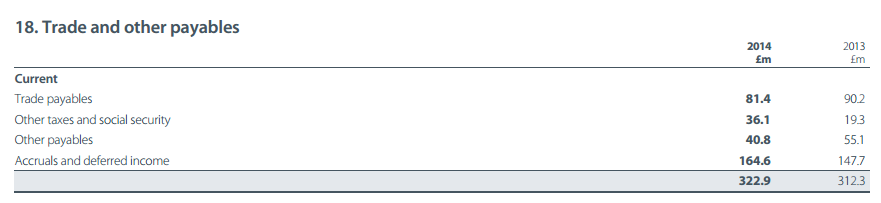

Trade & other payables - this is the figure which jumps out as being far too large, at £308.4m. Digging into the notes to the last Annual Report, it becomes clear in note 18, where the anomaly is £164.6m described as "Accruals and deferred income" (reproduced below).

The double entry for this deferred income is therefore Debit: Cash, Credit: Deferred Income. Both are Balance Sheet entries, so cash is boosted by £164.6m, and the other side of the entry sits in creditors.

So in other words, the £164.6m represents the amount that its customers have paid up-front for services not yet provided. Wincanton is therefore financing its insolvent Balance Sheet through cash advances from its customers, combined with bank debt. That's an extremely risky proposition. What happens if those particular contracts where customers pay huge amounts up-front are lost to a competitor? The deferred income would unwind, and Wincanton would go bust, that's what! Or, its banks would have to take up the strain & extend very much greater loans to the company. It does have substantial bank facilities, which frankly makes me think that the bank have taken leave of their senses too. Bank facilities can be withdrawn at the drop of a hat if a company breaches its banking covenants remember.

Pension deficit - this is another nail in the coffin for the Balance Sheet. The deficit has risen to £143.6m, and requires £14.1m in annual cash over-payments.

My opinion - the only reason this company still exists, is to service its bank debt, and its pension fund. There are no dividends (they stopped in 2011), and the company has no scope to resume dividends, and is not likely to for the foreseeable future. A very large cash call to shareholders is inevitable, the only question is the timing.

I cannot over-emphasise just how bad this company's financial position is, it's one of the worst I've ever seen. Anyone buying these shares needs to think very carefully about the risk involved. It may be fine at the moment, with customers happy to pay huge amounts up-front, and the banks happy to lend against cashflow, but what happens if something goes wrong? All that financing could disappear, and if creditors pull out, then an insolvent Balance Sheet will implode, rendering the shares worthless. Why take that risk when you don't have to?

It's going on my bargepole list, which has established a very good record so far for correctly identifying problem companies, so my 35-point red flag warning system that I've been developing seems to be working well. It's particularly interesting that on 29 Jul 2014 I spotted the warning signs on the Balance Sheet of Synectics (LON:SNX) at 335p per share (they are now 155p per share).

John Menzies (LON:MNZS)

Share price: 364p

No. shares: 61.3m

Market Cap: £223.1m

Checking the archive here, I've never reported on this company before - possibly because it was a little too large in market cap, although a profit warning this morning, following a gradual decline in share price has brought it into my remit with a thud!

The company has two divisions, newspaper distribution (declining sector, doesn't sound very interesting), and aviation - which seems to be a range of services such as baggage handling, etc.

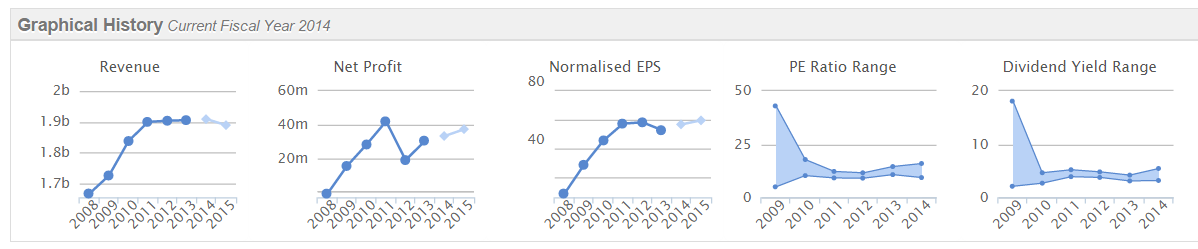

A quick review of the StockReport suggests that it's a mature, and low margin business. The generous divis are a stand-out feature, which has sparked my interest - if last year's divi is maintained, then the yield would be 7.3% - which is potentially good, but also worrying, as yields above about 6% often get cut, sooner or later.

Here are the Stockopedia historic graphs;

Balance Sheet - oh dear, this isn't good. Looking at the last reported Bal Sheet on 30 Jun 2014, net assets were £83.8m, but strip out intangible assets and that turns negative by £37.9m. So weak, but nothing like as bad as Wincanton. What is it with logistics companies? Why do they have such ropey finances?

The current ratio is 1.04, not great, but not a disaster either.

Net debt - by my calculations it was £116.3m at 30 Jun 2014, which was about double last year's "underlying operating profit" - a bit higher than I am comfortable with, especially as the company has warned on profit today.

Pension deficit - a liability of £50m is shown on the Bal Sheet. It's a big scheme too, with £292.8m in assets, and £343.0m in liabilities. I'm trying to find out what the recovery payments are. Ouch, it's not good. In note 11 to the interim results overpayments of £13.1m were made into the pension fund last year. That's a big chunk of profits/cashflow being consumed by the pension fund - it was about a third of operating profit last year, not good at all, as that is real cash going out of the business.

Dividends - very generous in the past, but now trading is tougher, can they maintain the divis at such a high level, considering the pension fund is cash hungry, and the business has a fair bit of debt, plus ongoing capex requirements too. I think they are stretching themselves too thinly here, and would expect the divis to be cut at some stage if trading doesn't improve.

Profit warning - issued today, says that problems have arisen in their aviation division;

As previously communicated, in the UK we are managing a number of challenges. The significant changes at London Heathrow have substantially reduced margins which will continue into next year and to address this situation the UK leadership team has been changed.

It's amazing how many companies with weak Balance Sheets (like this one) claim to have a strong Balance Sheet! This worries me, as it suggests management are either deluded, or are being economical with the truth;

The Group continues to maintain a strong balance sheet, with positive cash generation which leaves it well placed to support medium term growth ambitions. However, contract wins in North America will raise our short term debt levels. Reduced earnings in lower tax rate jurisdictions will result in the Group tax rate exceeding 30%.

Memo from me to John Menzies: Having negative net tangible assets, and tons of debt means you have a WEAK Balance Sheet.

It's difficult to judge how overall group performance might be affected by this, as it's not very clear;

Overall, as a result of the above issues, the full year outturn for Aviation will be materially below Board expectations and they will also impact the following year. It has been decided that Craig Smyth, Managing Director of Menzies Aviation will leave the Board with immediate effect.

My opinion - Checking back to 2013 results, the aviation division made £37.8m underlying operating profit, so is the more important of the two divisions, since the distribution division made a smaller £24.3m underlying operating profit.

Therefore today's warning of poor trading in the aviation division for this year, and next year, looks fairly serious. I also dislike the comments about debt increasing, and the tax charge being unfavourable at >30%.

Overall therefore it looks a can of worms to me, so I expect there will be more bad news in 2015, with restructuring costs probably, and a likely cut in the dividend. For those reasons I'm going to watch this one from the sidelines, and am resisting the urge to chase the 7%+ dividend yield. The company's finances are not strong enough to maintain that sort of payout safely, in my opinion.

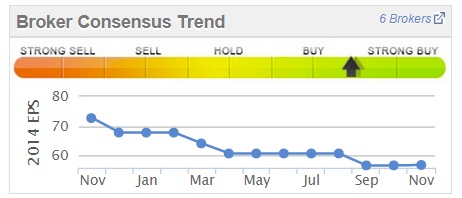

It's interesting to note that Stockopedia's great little broker consensus graph on the right, once again proved to be a good tell. After all, if the company is gradually guiding down analyst profit expectations, it means something is wrong! Hence the risk of a profit warning is greatly increased if you see this chart trending down - something to look out for.

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.