Good morning! The lack of communication over the suspension of Silverdell (LON:SID suspended) really has been shocking, and to a certain extent reinforces my belief that private shareholders are regarded as an after-thought, and are last in the queue to find out what's happening when something goes wrong, and to have our interests considered and defended. It's not good enough - the information vacuum here has been appalling, since the shares were suspended on 2 Jul 2013.

The company or its NOMAD still haven't properly informed private shareholders as to what actually happened, whereby part of the group fell into Administration and the shares were suspended on 2 Jul 2013. Here we are just over two months later, and there still has not been a clear explanation as to what happened, why, and what is being done about it. Suppliers and employees were thanked for their "patience & forbearance", leaving many shareholders wondering why, as the owners of the business, they have been largely ignored!

Anyway, this is clearly a unique situation - it's not a normal insolvency, because the existing Bank, HSBC, have been helpful in refinancing the Group, in order to enable it to buy back the business & assets of its subsidiary from the Administrator. So either there was some enormous liability which emerged, and had to be ring-fenced by putting Kitsons into Administration, or (as I've always believed seems more likely) the whole thing was some gigantic cock-up, over a Winding Up Petition for a relatively trivial amount of money, which was paid but apparently the Winding Up Petition not withdrawn for some reason or other.

I believe that shareholders will probably do alright in the end here, with the shares likely to come back from Suspension, with an equity fund-raising being needed fairly urgently one would imagine, to restore confidence and repay the Bank the bridging finance they have provided. Clearly though management credibility is shot to bits, and recognising that fact, the CFO (Chief Financial Officer - I see we are slowly adopting the Americanism [don't we always, eventually?!]) has today fallen on his sword, which strikes me as a good thing. It's his job to ensure things like this don't happen, so he had to go.

A new CFO has been found, being Mark Hazlewood, formerly Group FD at May Gurney before its acquisition by Kier Group in Jul 2013. So that looks a relevant, and reassuring appointment. In terms of general comments on the situation, this is all they say today to update shareholders, again disappointingly lacking in detail:

"Mark will bring a wealth of experience to the Board at a time of transition and his appointment is a further step in ensuring that we have the right leadership team in place for the future.

"We look forward to updating the market further on the next steps towards lifting the temporary suspension in trading in the Company's shares."

So clearly the shares are coming back from Suspension at some point, and my guess is that they will probably open around 4-6p, down from the 12.75p level where they were suspended, to reflect the chaotic situation here, and the fact that some shareholders will bolt for the exit at the first opportunity. This might provide a buying opportunity, although it would be very high risk indeed, as a potentially very dilutive equity fund-raising will be needed at some stage. The only question is whether they do that before lifting the Suspension, or whether they try to rebuild confidence first, and then do a fund-raising at a higher price a few weeks/months later?

I'll watch & wait, and react to events as they unfold, depending on the circumstances. I don't hold any Silverdell shares personally, as I always thought the Balance Sheet was stretched, and hence had only ever considered a very small position here (because I size positions based on a combination of underlying risk in the share [the riskier = the smaller size my position], balanced with my estimation of the upside case playing out, so risk/reward - everything in investing is fundamentally about assessing risk/reward, and buying into situations where the risk is relatively small, but the reward potentially large). I got cold feet and sold my very small position in SID a few weeks before the Suspension, as something just didn't feel right.

A company which I've mentioned many times before, Clean Air Power (LON:CAP 11.5p) and hold personally, has issued its interim results for the six months to 30 Jun 2013. As this is a growth company, the actual figures don't matter as much to the valuation as investor expectations of future growth. I'll need to read the full narrative to the figures to ascertain that, so will report back in more detail later once I've had time to read & digest the narrative.

However at the first glance, the figures look OK. Several points jump out at me. Firstly, CAP is a proper company with a viable commercial product, so this is not blue sky stuff. Turnover was £4.1m in H1(up 32% if you strip out a one-off from last year's H1, and up 7% if you don't). I also like the fact that CAP makes a decent gross margin for an early stage company - often the opposite is the case, i.e. product is actually made at a loss, before even thinking about all the administrative costs. I've been caught out on that type of thing before (e.g. the disaster that was Voller Energy), so having learned from that mistake, I always look for a decent gross margin at early stage companies - because that gives you the operational gearing, i.e. multiply turnover several fold at a company with a 48% gross margin, and suddenly it becomes a cash machine, and the shares go through the roof. 48% gross margin here isn't bad at all, although it's down from 54% last year, but that could be because of the one-off turnover last time perhaps?

The loss of £0.9m in H1 is not a disaster by any means, you expect companies like this to lose money as they are growing, and considering a £5m fund-raising was done recently, post period end, then cash looks fine for the next couple of years.

Note how volatile these shares are, particularly the intra-day spikes down (represented by the vertical lines below the candlesticks in the chart above) where it briefly spiked down to 5-6p in both Feb 2013 and Jun 2013. I was quick to react to these, and grabbed some more at 6p in late Feb - note also the volume spike on that day, as an Institutional holder dumped their stake at well below the market price, in a bizarrely clumsy sale - not something anyone rational would do if it was their own money!

The big excitement will be launch of the product in geographies where natural gas is plentiful & a network of filling stations exists, so USA and Russia in particular. Roman Abramovich & his best mate underwriting the recent Placing was a very intriguing twist to the tale, as although the amounts are pocket change to him, he must see some relevance for this technololgy. Well, it's relevance is pretty obvious - it enables diesel engined HGVs to run on a mixture of (much cheaper) nautral gas, and diesel, so it strikes me as only a matter of time before this is widely adopted. There are some good trials underway, e.g. 10 HGVs with UPS in the USA. Launch is in 2014 in USA, so I will certainly be holding to see what happens then, and will try to ignore all the price volatility between now & then, and all the silly background noise that you read on Bulletin Boards.

Next I've been reviewing the interim results for the six months to 30 Jun 2013 from Empresaria (LON:EMR). Surprisingly, it's a stock that hasn't been mentioned in this column before, which might be because it just slipped through the net, or more likely that its high levels of debt scared me off.

Having made a lot of mistakes in the past (and learning from them all), my investing approach these days rests on a starting point of preventing 100% investment losses altogether, by filtering out companies that could possibly go bust. This is done through a rigorous Balance Sheet review, that normally rules out companies with net debt, unless I am satisfied that the level of net debt is modest in relation to the company's ability to generate recurring cashflows, and that the terms of the debt are such that it is highly likely the facilities will remain available for the foreseeable future.

Empresaria is a difficult one, because I can see the upside case, and am really tempted to invest because there could be good potential upside on the current price as economies recover. However, on reflection the Balance Sheet is just not good enough to pass my scrutiny.

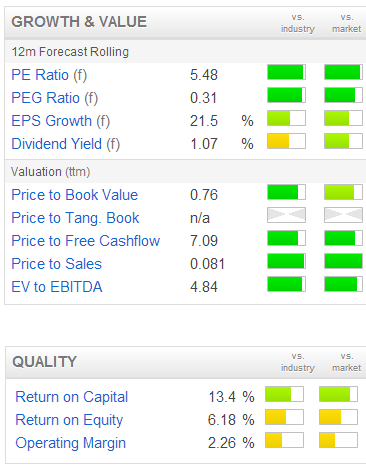

On the face of it, Empresaria shares look cheap - see the usual excellent Stockopedia "Growth & Value" graphic on the right. So this shows a very low PER of 5.48 (which is calculated using a weighted average of the 2013 and 2014 broker consensus forecasts - to make all companies comparable, regardless of year end date).

If you have Stockopedia Premium, then you can hover over the green bars in the StockReport, and a useful pop-up box gives you more detail - in this case that on a PER basis Empresaria ranks 6th best out of 98 companies in the "Professional & Commercial Services" sector. The sector mean PER is 12.9, so clearly this share appears to be remarkably cheap on this measure at just 5.48.

A PER below 6 usually means that there's something wrong, and/or that the company has a lot of debt. In this case, by my reckoning, the only issue is too much debt.

Empresaria is an "international specialist staffing group", so as usual with employment agencies, their turnover is high as it includes the worker's wages. So turnover for H1 fell 2% to £95.6m, net fee income fell 7% to £20.9m, and adjusted operating profit rose 11% to £2.0m. So that looks OK - good cost control offset the fall in turnover.

The outlook statement seems fine, with the key sentence being (my bolding):

Based on performance to date, we remain confident that earnings for the full year are expected to be in line with market expectations and look forward to delivering further growth with confidence.

Stockopedia shows the broker forecast consensus as being 5.95p for this year, and 6.6p for next year, so the 2013 PER is 5.6, dropping to 5.0 for 2014, based on this morning's slightly lower share price of 33.25p.

On the face of it, net debt reported at £8.9m at the period end looks high, but not disastrous, in the context of a business that should make about £5-6m operating profit this full year. However, that figure does not show the full picture, since it excludes invoice discounting. I'm not keen on the accounting treatment here, since if you read Note 8 to today's interims, it says they offset non-recourse invoice financing against trade debtors, and hence both debtors and net debt are both understated by £7.2m.

A fundamental accounting concept is the principle of no offsetting of assets & liabilities, so this accounting treatment just looks wrong to me. They would no doubt argue that because it's non-recourse debt, then there is no longer any potential risk to Empresaria. Well that's fine for as long as this invoice financing facility remains in place. But what if it were withdrawn by the finance provider? All of a sudden, Empresaria would face a major cash crisis.

So the true net debt figure is actually much higher, at £16.1m. Bear in mind also that all companies "window dress" their Balance Sheets for the year-end date, by having a push to collect in debtors, and delay paying suppliers a little, so you can safely bet that the average net debt figure throughout the year is probably nearer £20m. That's far too high for a company with a market cap of only £14.8m. So we can now see why the PER is so low. Adjust out all that debt, and it wouldn't be cheap any more.

A very low PER, combined with little or no dividend, is usually a warning sign of excessive debt, and so is the case here, with the yield being only 1%. If I held these shares, I would rather they cancelled the dividend for a few years, and built up their Balance Sheet, paying down debt - especially as invoice financing is expensive, so paying it down gradually would have a corresponding benefit to EPS. It would also greatly reduce risk.

As it is, I'm glad I dug into the debt figures, as this share is a lot more risky that it looks at first. You only have to hit a problem with trading, or some unexpected liabilities, and all of a sudden the Bank Manager is calling the shots, and has the power to make the company insolvent on a whim. Just because Banks have been lenient in the last 5 years, doesn't mean that will automatically remain the case forever. So why take the risk by buying these shares? It's not for me.

Finally, I've had a very quick look at interims from Fyffes (LON:FFY), the Irish-based fruit company that puts little stickers on bananas. It looks potentially interesting, trading a whisker ahead of last year, and they have raised full year guidance (I really wish all companies would issue guidance on the current year - it can be done, as Next do it for example. Would be much more transparent for shareholders if companies just said that we expect profits this year to be between £x and £y. Simple).

Anyway, Fyffes are on a forward PER of 8.3 according to Stockopedia, and a 1.5% dividend yield. The Balance Sheet looks OK overall to me, so for a fairly boring value share, this one might be worth a deeper look?

OK, I'm finished for today. Same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CAP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.