Good morning!

It's quiet again for company results today - I must make a note to take this week as holiday next year.

Today's report will be a little later than usual, as I'm heading into the City for the analyst presentation for Boohoo.Com (LON:BOO) which is one of my favourite stocks at the moment. I'd better get my skates on, as it starts at 9am.

Boohoo.Com (LON:BOO)

Share price: 27.38p (down 2% today)

No. shares: 1,123.1m

Market Cap: £307.5m

(at the time of writing, I hold shares in this company)

Preliminary results - for the year ended 28 Feb 2015 are out this morning. I've just got back from the analyst presentation, which was well attended - about 40-50 analysts there at a guess, so the company is certainly getting noticed. I asked an adviser whether the overhang from disappointed IPO buyers (who overpaid, at the 50p IPO price) has now cleared, and was told that they believe so - i.e. people who want to sell are now gone.

I'll spend a bit more time on this company, as it's one of my favourite growth companies at the moment, and is the only online etailer I can find which is strongly profitable, growing at a decent pace organically, has global reach, yet is still reasonably priced (house broker Zeus have it on a cash adjusted PER of 20.7 times their current year forecasts).

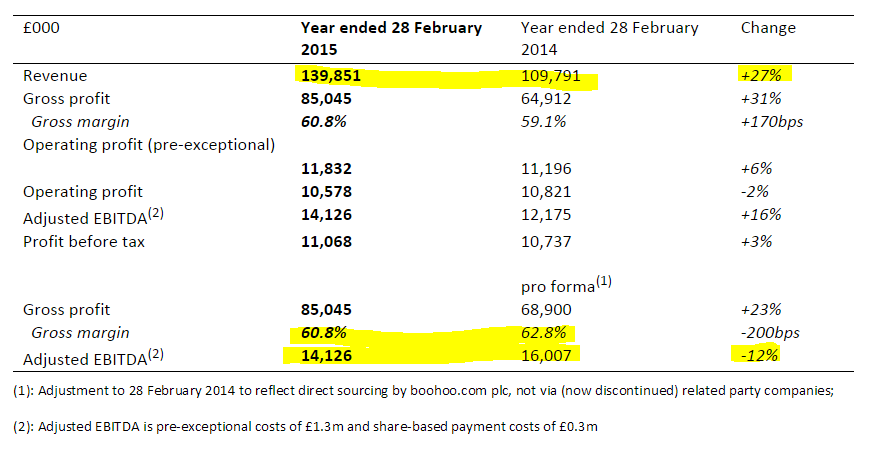

Here is the highlights table from today's results. I've highlighted the items that are most important, in my opinion;

First thing to note is the strong top line growth, up 27% as reported in sterling, but up 31% in constant currency. BOO sales are strongest in the UK, at 67% of total turnover. Its other most important markets are Australia, France, and USA. The company sells into most countries in the world, but has decided to focus its efforts on the countries where it sees most potential. As the CFO jokingly commented,

"Mahmud's (the founder, who is known for his colourful language!) new F-word is 'focus'".

Mahmud only spoke once, and spent the whole meeting fiddling with his phone & looking preoccupied/bored, whilst Neil Catto (CFO) and Carol Kane (joint CEO) gave presentations & fielded questions.

Expectations at the time of the IPO last year were far too high, and the business had a slowdown in H2 of last year. The CFO was questioned about this, and blamed an "exceptional series of events" - the marketing campaign & launch of A/W range was delayed in Aug 2014, due to implementation of new warehouse management IT system. This was a mistake, as he admitted, "we've learned that we can't afford to have a slow start to a new season". Then of course the mild A/W weather (which was a genuine factor), This led to competitors discounting on price much earlier, and Black Friday caused them problems as it concentrated competitor sales in an unusual way. BOO responded by reducing its marketing spend to protect profits, which had a further knock-on impact on sales.

The CFO said that this series of factors are "not likely to recur again", and "we've learned the lessons from last year's under-performance".

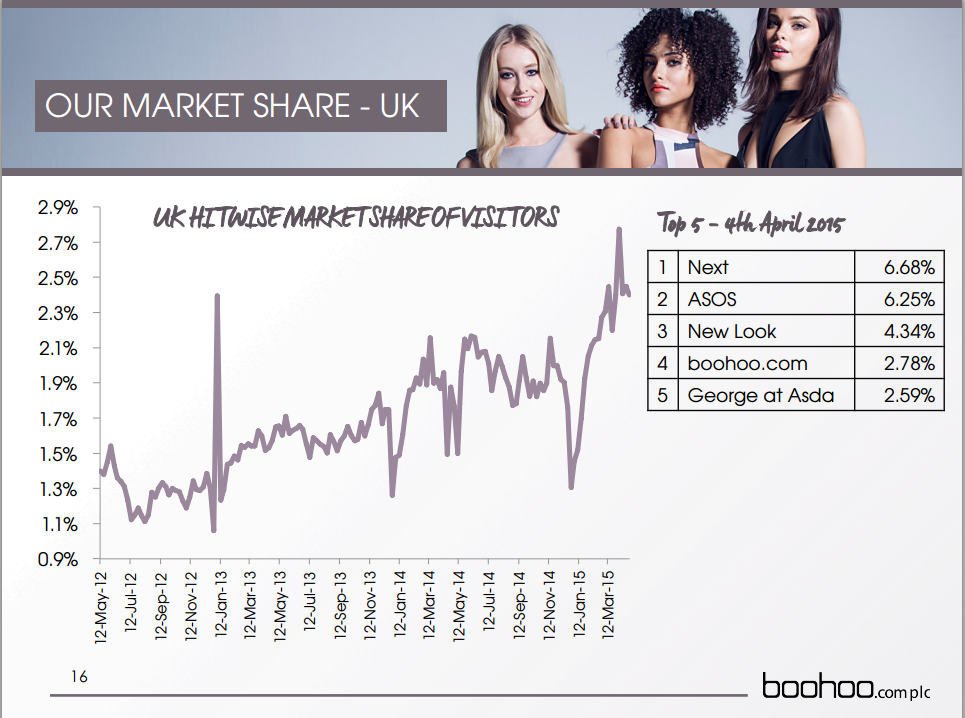

The presentation slide relating to market share shows encouraging recent trends;

Gross profit margin - is impressive, at 60.8%, especially as the company doesn't have all the costs of a chain of shops. Note that, whilst good, this was down from 62.8% in the pro forma figures for last year (which adjust profit to the same basis as this year, by eliminating related party sourcing companies).

Personally I'm relaxed about the margin - it's very high, and BOO has responded to a downturn in sales in Australia for example, by cutting prices. This has worked, and there was a strong recovery in sales in H2 of last year in that market. So a little off the margin is worth it, to drive higher sales. Demand is very elastic at this end of the market (low priced fashion).

The CFO indicated that the gross margin is likely to drop by about 70bps this year, as further price reductions are made to support growth, but that they will stay above the 60% level - more than satisfactory, in my view.

Profits - a number of options are given, but to my mind the most meaningful is pro forma EBITDA of £14.1m vs £16.0m last year. This is in line with revised expectations after the profit warning in Jan 2015.

Why has profit gone down, despite sales being up? This is due to considerable expansion in the distribution & admin overheads. The company is "investing ahead of the curve", in particular with a major warehouse expansion, which should mean they have capacity to expand considerably further.

Although one point that slightly concerns me is the dis-economies of scale as they expand - primarily that the warehouse is now so large, with so many product lines, that the manual picking process - people walking around the warehouse - is now getting slower, as the pickers have to walk longer distances. This might be automated in future, and the floors have been reinforced to be capable of holding the weight of such machinery.

The CFO said that he sees the benefit from this expansion in overheads flowing through this year & next year.

Other key points - in no particular order;

- Working capital - has a favourable profile, due to efficient stock management, so the business actually generates more cash as it expands.

- Really strong balance sheet - "great platform for future growth".

- Customers engage mainly by handheld devices.

- Heavy capex this year, £13m, for warehouse expansion (£8m last year).

- Current trading - all comments were favourable - "it's been a good 8 weeks", in line with mgt expectations. They sounded confident.

- Range extension - Carol Kane told us how well the new plus size range, and the petite ranges were performing. Also a gym wear range has been launched.

- Website is being re-designed to group products together into "shops within a shop", e.g. holiday ranges, festivals, basics, evening wear, blue (denim), etc. Should make it easier for customers to navigate a huge range of options.

- BooHoo is now no. 4 on hitwise - have overtaken key rivals Top Shop & River Island.

- Social engagement - getting good results from working with prominent Vloggers (video bloggers, e.g. Zoella)

- "Really good response to new ranges" currently.

Lack of an App - this strikes me as an absolutely bizarre omission for a fashion etailer - BooHoo doesn't have an App! Mahmud perked up and grumbled;

"I can't even tell you we have a shit App! We don't have an App at all!! It's been signed off though, our App should go live in about 60 days".

Whilst an astonishing omission, I think this could be a catalyst for an acceleration of growth. As one analyst commented, some competitors are getting 30% of their business through their App. If BooHoo's soon to be launched App is any good, then that could provide a nice uplift for sales later this year - customers seem to browse on mobile devices, but order on a PC at the moment, which seems a crazy way to arrange things, and must be holding back sales to some extent.

Valuation - the company has surplus cash of £54m at end Feb 2015, so that's 4.8p per share. It's obvious that the company doesn't need this cash, and there was talk of a share buyback recently. Therefore I think it's valid to deduct this cash off the share price of 27.38p, taking us down to about 22.6p which one is paying for the actual business.

Using the figures from Zeus Capital, adjusted EPS for the year just reported was 0.89p, so the ex-cash PER is 25.4. For the current year, Zeus are forecasting a modest rise in adj EPS to 1.12p, so the ex-cash PER drops to 20.2 times. In my view that's not an aggressive rating at all, for a company that is growing organically at an impressive rate.

Note also that BooHoo generates a much more impressive net margin than any other UK listed etailer - ASOS (LON:ASC) makes lower gross and net profit margin, and its profits have been steadily falling, as a percentage of turnover in recent years, so its sky-high rating looks to be highly questionable, in my view (disclosure: I am currently short of Asos shares).

I believe that, following the Jan 2015 profit warning, analysts are possibly now being too conservative with their estimates for BooHoo. There is a chance that BooHoo could get an Asos-style re-rating if sales take off in the USA - the signs sounds positive there - they are setting up a USA HQ, and have been pleased with the performance of their marketing trial in the New York area, including a pop-up physical shop, combined with "meet the bloggers" type events. All in all, BooHoo seems very tuned in to the whole social networking generation, which is good as that is its target customer base.

Balance Sheet - is bulletproof. The current ratio is terrific, at 3.66, and includes £54.1m in net cash. So you get a very strong cash buffer included with these shares. It makes me wonder why they raised so much cash at the IPO, which they clearly don't need. So hopefully a decent divi should arise at some point.

Note that the company capitalised £2.4m of intangible costs in the year, which needs to be taken into account when looking at EBITDA. It's not an excessive amount though. There is no pension fund issue, as it's a young company, so no legacy issues to worry about, thankfully.

Q&A - the analyst meeting went on to Q&A, here is a selection of things I jotted down;

Q1. Is the 10% EBITDA margin sustainable, and should we see that as a minimum achievable target?

A1. It's the right ballpark. Don't see it as a minimum though. We want to exploit growth opportunities when we see them.

Q2. What further investment is needed?

A2. Mostly done, or in progress (e.g. warehouse). We want more people in IT, and increase headcount in USA.

Q3. Capex guidance?

A3. £13m this year, c.£10m next year.

Q4. Will the warehouse be fully mechanised in due course?

A4. Something we're considering. Would only be done to accelerate growth and/or if achieved cost savings.

Q5. Currency hedging?

A5. We're fully hedged for the next year.

Q6. Picking costs?

A6. About 60p per unit (not sure if this was per garment, or per order?)

Q7. (from me!) Product quality appears to be patchy, judging from online reviews & market research I've done myself. Are you aware of this issue, and what are you doing to sort it?

A7. Carol Kane replied that quality issues only relate to a small number of items, and that negative reviews are rare. They have increased their quality control headcount from 3 to 20, and monitor the whole supply chain.

(I was disappointed with this answer, as if you ask the target customer base, they all say the same thing - product quality is variable, but it's cheap - so you get what you pay for. So I would have preferred management to have properly acknowledged this issue).

Q8 (also from me) They lost business last year at Xmas, as customers returned to the High Street over busy period, concerned about delivery delays. What are they doing this year to reassure customers that there won't be late delivery problems?

A8. Again, a defensive answer from Carol Kane, who missed the point unfortunately. Instead she said that BooHoo hadn't had delivery problems last year. I wanted to know how they would reassure customers in advance this year, and hence avoid a dip in Xmas sales again, but never mind.

Q9. Plans for wholesaling?

A9. Being trialled with Asos, and also in India & somewhere else. A new area of the business, we're setting this up now, from scratch.

Q10. Marketing spend?

A10. High at start of each season, then declines. Will be about 15% of turnover globally. Concentrated into key markets.

Q11. Next day delivery?

A11. Doing more offers for this, as good response rate in UK.

My opinion - I really like this company. It's delivering good organic growth, and has international expansion underway, as well as a leading position in UK, younger, cheaper, fashion.

The rating may not look cheap at first sight, but once you adjust for the surplus cash pile, and compare the stratospheric ratings of competitors, a case can be made for this share actually being good value, which I think it is.

Moreover, it seems that the profit warning a few months ago was mainly due to expectations being too high at the IPO. If you ignore expectations, then the business is actually performing well - growing the top line strongly, all organic remember, and maintaining a decent level of profitability despite absorbing increased costs related to future growth.

The company's website has the presentation slides, and a recording of this morning's webcast, which are well worth looking at/listening to, the webcast in particular, as it is basically the same as the analyst meeting, with commentary and slides. Here is the link for that.

I think there is scope for the share price to continue recovering, as market confidence gradually rebuilds. It takes time for the market to trust a company again after a disappointment, but in my view that has created a buying opportunity to get into a company that is going places, at a reasonable valuation.

As always, never a recommendation, this is just my personal opinion. Sometimes I'll be right, and sometimes wrong. So please DYOR in the usual way. Views from readers are welcomed in the comments section below.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.