Good morning,

I'm planning to cover a few stocks from yesterday, since there is a lack of news today (ignoring the macroeconomic issues, of course!)

Regards

Graham

Epwin (LON:EPWN)

Share price: 106.4p (+2%)

No. shares: 142.5m

Market cap: £152m

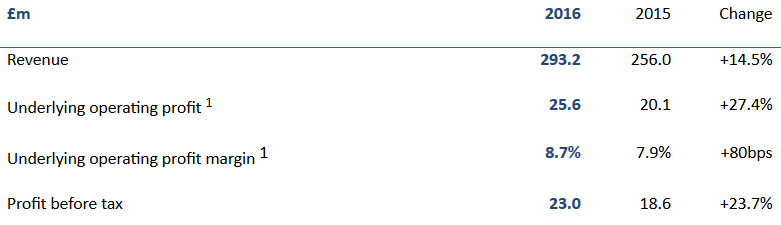

A strong set of results from this manufacturer of building products (windows, doors, decking, etc):

Final dividend is increased marginally to 4.4p.

Net debt also increases to £20.6 million.

Epwin has been pursuing growth by acquisition; all acquired companies are said to be performing well.

Outlook is a bit subdued:

"Whilst the long-term impact of the EU referendum result on consumer confidence remains unclear, trading in the current year has been in line with management's expectations. Input costs have increased sharply as a result of the weakening of sterling since June 2016. However, the Group is continuing its efforts to mitigate this and the Board remains confident in the long-term fundamentals of the Group and the markets it serves"

The overall vision seems to be continuously expanding/improving the product range and ending up with vastly more cross-selling opportunities and economies of scale as a result.

And the statement makes a few interesting arguments to the effect that people aren't repairing and maintaining their properties as much as they should, so that a backlog of necessary repair work is being built up. They would say that, wouldn't they!

Like-for-like revenues (excluding acquisitions) grew by just 2%.

My opinion

Seems difficult to get too excited about this. On the one hand, it would be much too harsh to describe this as a commodity business - there is substantial expertise required in the manufacture of many of these products.

On the other hand, the company's admitted vulnerability to exchange rate movements, and the lack of like-for-like growth which is also due to factors beyond its control, leave me with some doubts about its underlying quality.

Regular readers will be aware that acquisition-led growth is something I instinctively shy away from.

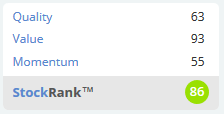

Apparently I'm not the only one suffering from a bit of scepticism toward this share, as the PE ratio is undoubtedly very cheap versus the market as a whole, at less than 8x.

Stockopedia agrees that it's in the bargain bucket:

Motorpoint (LON:MOTR)

Share price: 150.75p (+3%)

No. shares: 100m

Market cap: £151m

This gave the magic words "in line with expectations" in the sub-heading, so investors immediately knew not to panic (indeed, they pushed the shares markedly higher from the 140p prior close).

Turnover for the year of approximately £820m, an increase of 12.5% on FY16

The Board expects the Group's Profit Before Tax for FY17 to be at the upper end of the range of current market expectations, reflecting the improving trading performance in the second half (see note 1).

Scrolling down to Note 1, I see that this range for adjusted PBT is considered to be £14.6 million to £15.5 million.

When Paul covered Motorpoint's profit warning last October, he noted that their PBT broker forecasts were reduced from £21 million to £16.7 million at one particular broker, at that time. Things may have deteriorated a bit further after that, so that the final result will be around £15.5 million.

They key promise last October was that net margin would recover in H2, and that appears to have occurred in Q4:

The final quarter of the Group's financial year in particular has seen increased customer footfall and online traffic, driving improved volume performance both in like-for-like sales and sales at new sites.

Outlook

Safe to say that this is a bit cagey?

The Board is cautiously optimistic regarding the UK used vehicle market and remains confident that Motorpoint's independent and flexible model ensures the Group is well placed to continue to grow market share.

My opinion

I like the concept of focusing on the "nearly new" car segment, and I note that the service has an excellent (9/10) rating on trustpilot, where it has well over 300 reviews. Most reviews highly praise the staff, describing the service as a no-pressure sales environment, which must be a welcome relief from the typical second hand car dealership!

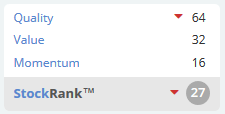

The Stockopedia rankings aren't too keen on it, particularly in terms of Value and Momentum, though for what it's worth the forecast PE rating is less than 10x and perhaps Momentum is set to improve now that the shares have bounced after this latest update?

I'd put this on the watchlist.

Findel (LON:FDL)

Share price: 200.4p (-0.3%)

No. shares: 86.4m

Market cap: £173m

and

Phil Maudsley Appointed Chief Executive

A double-barrelled update yesterday, including the announcement of an internal hire for the position of CEO, who replaces the Chairman in the executive role.

The new CEO was previously MD of Findel's "Express Gifts", its direct-to-consumer online retailing division, and appears an obvious choice for the role..

Separately, the long-serving Group Finance Director has "stood down" (no further details given), and the search for his successor is about to begin.

The position of FD is a sensitive one and I think investors like to know the circumstances surrounding the departure of an individual from this position. For Findel specifically, it very recently announced that it needed to increase provisioning for customer refunds in relation to flawed insurance products from £18 million to £29 million. Perhaps one could be forgiven for supposing that there might be a link between these events?

Getting back to the trading update, things are a bit mixed:

The Group has seen strong sales growth and anticipates total like-for-like* sales growth for the full year to be around 10%. As highlighted in January's trading statement the rate of sales growth accelerated in the second half of the year.

Pre-exceptional PBT is a slight miss:

Overall, the Group expects to report a profit before tax and exceptional items slightly below the bottom of the range of consensus **. Core net debt is expected to end the year at c. £80m, an improvement of around £5m on the prior year and slightly better than market expectations.

Again checking the footnotes, the lower bound of the range for PBT over the 53-week period is £25.5 million. So something a bit worse than that is in store.

Express Gifts is said to have done well in terms of revenues and customer recruitment, but sacrificed margin due to a sales drive in imported USD-priced product.

Things are less rosy in the Findel Education Division. LFL sales are down c. 4%.

Outlook

Sounds upbeat to me:

The significant increase in the Express Gifts customer base and the continued investment in customer recruitment activity form an encouraging base to take into the new financial year. We remain watchful of pricing conditions as a result of foreign exchange movements from the perspective of Express Gifts, but look forward to delivering growth in the coming year.

My opinion

There's quite a lot for an analyst to unpack at Findel, but it's the sort of business I might be interested to buy at the right price.

Something I don't really understand is why shareholders have reacted in such a calm way to the recent flurry of announcements.

Given the recent increase, there must remain an element of uncertainty around the provision needed for historic mis-sold insurance. Also, the loss of an FD would ordinarily result in some selling pressure. And the company is set to miss its earnings forecasts. But the share price is slightly higher now than it was before all of this was announced!

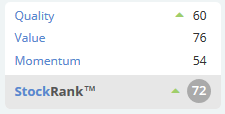

I guess it is not too highly rated at the current level. Expectation must already be fairly low.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.