Good morning!

I've been busy over the weekend, setting up a new website called Placing Watch, which is designed to track fundraisings by listed companies, and campaign for private investor interests. All too often companies & advisers take the easy option, by raising money in a discounted Placing. This has the effect of excluding existing investors, causing them to suffer dilution often at an unfavourable price.

On the other hand, Institutional placings are quick and easy to arrange, and fees are relatively low. So in emergency situations, or where speed is of the essence, or if the amount being raised is too small to justify doing an Open Offer to all shareholders, then a Placing can make sense.

So I thought a good starting point would be to scrutinise Placings, and rank them on the key criteria of price discount, dilution, Director participation, and expenses. Then give each Placing an overall rating. Once that is established and well publicised, pressure can be put on brokers and companies to structure deals in a way which protects private investor interests. So if you think it's a good idea, and want to help, then please publicise the site. The more people who follow it, then the more influential it will become. I set up the site, but a group of private investors will be writing the content with me.

Trakm8 Holdings (LON:TRAK)

This is a small telematics company, making vehicle tracking devices for fleets. I recall speaking to management some time ago and being impressed with them, trying to buy stock at 19p, but finding the market was so thin & the bid/offer spread so wide, that after a few days I gave up trying to buy. What a pity, as the shares have 4-bagged since then, and are now 80p! So clearly I should have just paid up and not worried about the spread - something to bear in mind when you find something really cheap.

Results for the year ended 31 Mar 2014 have been published this morning, and look very good from the headline figures. Turnover is up 94% to £9.2m, although most of that increase seems to have come from an acquisition of BOX Telematics, part way through the year. The increase would have been even more marked for a full year;

From the date of acquisition to 31 March 2014 Box Telematics Limited contributed revenue of £3,815,129 and profit of £571,639. If the acquisition had occurred on 1 April 2013 Box Telematics Limited would have contributed a further £4,763,958 to revenue and £332,771 to profit before exceptional costs for the period to 24 October 2013.

Pre-exceptional operating profit rose from £40k last year to £863k this year, a dramatic improvement. Add on the £333k additional profit mentioned in the quote box above, and the annualised profit is £1,196k, very impressive.

The exceptional costs of £433k relate to the acquisition of BOX, so that's OK.

The Balance Sheet looks OK to me. There is net cash of £619k. Tangible net assets are perhaps a little on the light side at £1.9m.

Current trading is in line with expectations. There is no dividend, so this is a growth company at this stage.

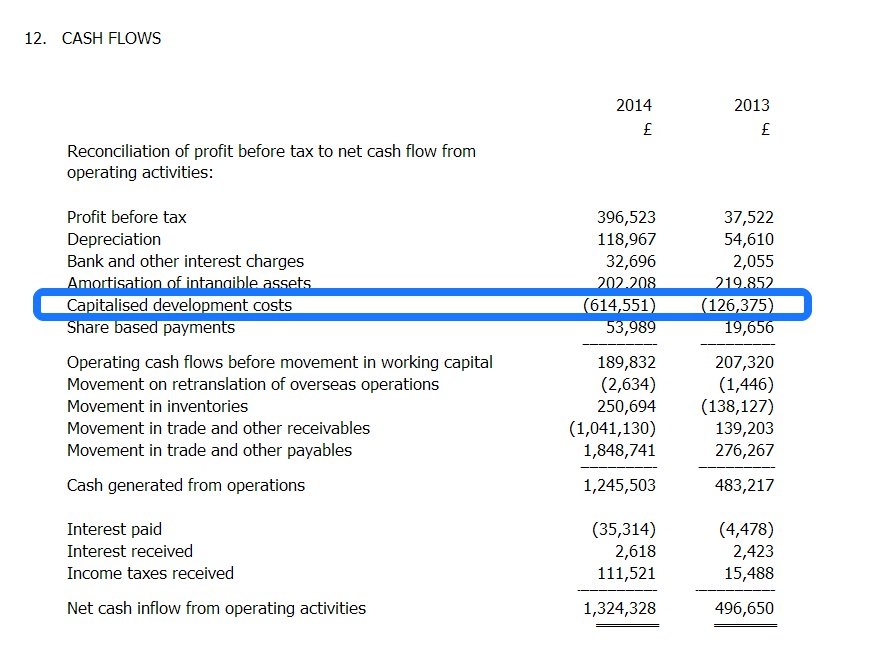

The fly in the ointment for me is that a lot of the profit has come from capitalising development spend. Note the big increase from this year to last year, shown on the excerpt from the accounts below. In my view development spending for this type of business is an ongoing cost of running the business. You cannot stand still, so whatever the accounting standards say, a more prudent view is to write-off all development spending immediately it is incurred. On that basis profit is much more modest here.

So the pre-exceptional EBITDA of £1.2m would translate into operating profit of just under £0.6m if you take the prudent approach of writing off development spending. That makes the market cap of £23m at 80p per share look too high in my opinion. Although the key question is what profit growth is likely to be achieved this year? Broker forecasts are for a further big increase in profit this year, to £1.6m, although bear in mind that will also benefit from capitalised development spend presumably?

It looks to be a decent company that is doing well, but perhaps the price has run ahead of events in the short term? That could be justified though if investors expect organic growth to be strong in future. There is mention of a major contract with Direct Line, which sounds interesting.

EDIT: An announcement has just been released saying that Trakm8 Holdings (LON:TRAK) is considering making an offer for Belgravium Technologies (LON:BVM). Interesting!

Mirada (LON:MIRA)

I've reviewed today's Placing announced by Mirada over on Placing Watch here.

The conclusion is that the deal looks a good one for shareholders - clearly it's negative that the company has effectively run out of money, due to delays on a big contract outside of their control by the looks of it. However, to raise a decent slug of new money at virtually no discount to yesterday's share price, is not a bad result at all.

Any shareholders who are miffed about the dilution can just buy today in the open market, which should be possible at a price only 4-5% above the Placing price, which is fine for a micro cap.

Just to emphasise the key point here - Placings are not bad per se. They are only bad if existing holders are diluted at a discount. In this case the discount is minimal, so anyone who doesn't like the dilution can just buy some shares in the open market. My key message is that if discounted shares are being offered, then they should be offered to everyone, not just Institutions in a Placing. Although that consideration can be overridden if a fundraising is very small, and/or where funds are needed in an emergency - when a Placing is the best method.

EDIT: I've just bought some more Mirada shares for just 12.8p in the open market (when bid price 12.75p, Offer price 13.5p). So having paid only 2.4% above the Placing price to top up my own holding, then I'm completely happy with the way this deal has been handled.

Solid State (LON:SSP)

Results for the year ended 31 Mar 2014 from Solid State look, well, solid!

EPS is up 16% to 25.3p. The dividend is up 6% to 8.5p.

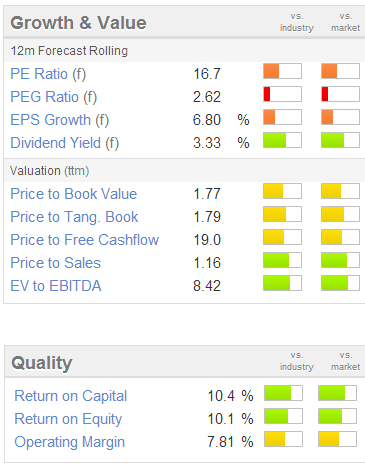

The shares are 400p, so the PER doesn't look a bargain at 15.8, that's a rich valuation for a small cap. The dividend yield is an unremarkable 2.1%.

The order book is up strongly, at £14.7m, compared with £10.4m last year.

It looks a nice enough little business, but I can't get excited about it at this price. The valuation looks fully up with events in my opinion. Maybe the price is justified if they carry on making successful small acquisitions? I'd be interested if the shares come back to sub-300p, but at 400p I don't see risk/reward as being attractive.

Churchill China (LON:CHH)

There's an encouraging trading update today;

Business performance for the period to 30 June 2014 has continued to be very encouraging against strong comparatives, with increased sales to Hospitality customers reflecting both the investment we have made in our business and our position in growing markets in the UK and Europe.

The Board continues to believe that it will meet its performance expectations for the full year.

They've phrased that in an awkward way. I would have much preferred if the statement had made direct reference to performance against market expectations.

I like this company, but at 464p the shares are too pricey for me. The fwd PER seems a tad on the warm side, especially as the strength of sterling might be hurting them a little in export markets?

I'll leave it there for today, and will see you again in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in MIRA, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.