Portmeirion (LON:PMP)

- Share price: 925p (-3.4%)

- No. of shares: 10.8 million

- Market cap: £100 million

Good morning - Graham here, and I'm kicking things off today with this homeware manufacturer and distributor.

It has a heritage dating back to the 1960s and has been listed on the stock market since 1988, so in theory that should make it a relatively safe place to invest.

2016 was difficult for it, however, as sales suffered in South Korea, India and at home in the post-referendum UK. Pre-tax profit declined from £8.6 million to £7.8 million despite the impact of a home fragrances acquisition (£17.5 million deal size).

But management insisted that the outlook for 2017 was positive, and that the challenges would be overcome. Which brings us to today's first-half update (six months to June).

PBT forecasts for the full year remain in line with market expectations:

The Group is pleased to announce that total Group sales are up 16% for the six months ended 30 June 2017 relative to the same period last year, although 2016 only included two months of Wax Lyrical sales from its acquisition in May 2016. Excluding sales from Wax Lyrical, on a translated currency basis total Group sales are 3% ahead of last year and on a constant currency basis, excluding Wax Lyrical, total Group sales are 1.9% down on last year.

1.9% like-for-like, constant currency sales shrinkage is perhaps a little disappointing, and so the share price is down a few percentage points.

Edit: Martin in the comments has helpfully pointed out that these H1 numbers are noticeably worse than numbers given for the first four months of the year in the AGM statement. So trading looks like it has softened on a comparative basis over the past two months.

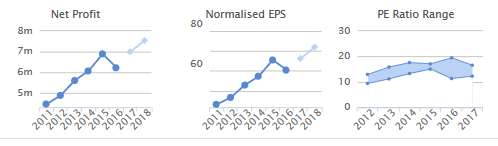

As you can see from the Stocko charts below, analysts have been forecasting net profit and EPS to increase this year, after the dip in 2016, with the help of the Wax Lyrical acquisition.

Note also the PE ratio range; so far this year, the share price has produced a PE ratio range of 12.3x to 16.6x. 2013 and 2014 had somewhat similar ranges.

The current PE ratio is just below 14x, close to the middle of the range, and with like-for-like sales growth being where it is, that seems about right.

It's not the most exciting company in the world by any means, but if the acquisition produces some decent synergies in the years ahead, I could see the share price doing well. Maybe a decent candidate for a long-term buy-and-hold.

Distil (LON:DIS)

- Share price: 2.9p (+16%)

- No. of shares 500 million

- Market cap: £14 million

This premium drinks business updates on trading in Q1 of the fiscal year (April to June).

It's a micro-cap where I've missed the boat so far this year - arguing that it "might be worth looking at" when the share price was below 1.5p!

It's arguably very early days for Distil, of course, so there are still huge gains to be had from the current levels if it succeeds.

Final results for the year ending March 2017 showed revenues and gross profits up 40%, stable margins, and the company achieved breakeven with a small operating profit. The major driver of this was domestic UK sales of RedLeg Spiced Rum. The cash balance ended at £910k, encouragingly only slightly reduced compared to the prior year.

Now that the company is in the black, at least for one year, it seems a much safer proposition, especially given the growth trajectory. Skimming the historical accounts, I see that the prior seven years were all losses! RedLeg Spiced Rum was first launched in 2012, back when Distil was known as Blavod Wines and Spirits and traded under the BES ticker.

Trading Update - that's enough history, now onto today's update. It is merely in line with expectations, but it's still very good.

Unaudited year-on-year first quarter revenues rose by 61%. Sales in this first quarter include Easter promotional sales appearing in April compared to prior year when they appeared in March. To remove this phasing imbalance, we also update the six-month performance figures to 30 June 2017; year on year revenues during this period rose 46% and volumes increased by 53%.

RedLeg has been picked up by a couple of major supermarket chains for distribution, and this is doubtless helping to drive the surge in revenues.

I can only see one commissioned analyst forecast, which suggests group sales can improve from £1.64 million to £2.1 million in the current financial year, a 28% growth rate.

As was with last year's forecasts, that appears too conservative.

It looks to me as if operating profit could be in the region of £250k this year, doing some back of the envelope calculations.

Still quite a long way to go then to reach critical mass, and to overcome its operating expenses in a meaningful way, but I remain of the view that this one is interesting!

Quarto Inc (LON:QRT)

- Share price: 170.5p (-1.2%)

- No. of shares: 20.4 million

- Market cap: £35 million

Sale of Books & Gifts Direct Limited (New Zealand)

A quick mention of this book publishing company which has recently suffered a severe share price fall and been widely discussed by investors here.

The forecast PE ratio appears minuscule but there is a lot hinging on a H2 recovery, and the PE ratio would be somewhat misleading anyway since there is over sixty million dollars of debt on the balance sheet (December 2016).

Non-core assets have been disposed of in recent times, improving the cash position and simplifying operations.

Today's disposal is small ($0.6 million, plus some debtor receipts and profit share for the next few years). The significance of it is that it moves Quarto fully away from bookselling to instead become purely focused on publishing. CEO comment:

"With the disposal of Books & Gifts Direct New Zealand - our last non-core business - Quarto starts a new chapter as a publishing-only business with a unique platform to become the dominant publisher of illustrated books worldwide. In the short-term, everyone across the Group remains focused on delivering our plans for 2017."

I am getting curious about this share, as I have the impression that it can do well having disposed of those parts of the group (the non-publishing elements) which dragged on results last year.

Net income for 2016, excluding Books and Gifts Direct (BGD), was $10.7 million, versus the current enterprise value (using $60 million net debt estimate) of $105 million.

Those odds look ok to me. Net debt has reduced from $81 million in 2012, and should reduce further now without any BGD distraction.

Proactis Holdings (LON:PHD)

- Share price: 184p (+5%)

- No. of shares: 50.2 million

- Market cap: £92 million

Proposed Acquisition, Placing and Notice of GM

A massive deal announcement, relative to its size, from this software company which helps businesses to improve their processes and manage their spending.

It is raising £70 million (gross proceeds) at 165p to make a £102.4 million ($132.5 million) acquisition of Perfect Commerce, LLC, a company operating in the same sector of spend management solutions. The rest of the funds will be coming from £45 million of new debt facilities with HSBC, and some convertible loan notes.

Perfect Commerce is said to have "complementary territorial reach" with Proactis- that's really important, because it means that the companies are not merging simply in order to stop duplicating each other's efforts in the same territories! Although there may be some element of that all the same.

The CEO of Perfect Commerce will become CEO of Proactis, and the deal qualifies as a reverse takeover.

"Significant efficiencies" are expected from the deal.

I tend to be a cynic when it comes to mergers and acquisitions. There is a lot of research out there suggesting that most of them destroy value. But I'd try to keep an open mind here. If it's true about the complementarity of their respective geographies, this could be one of the good ones.

£5 million in annualised cost savings in the enlarged group, to be achieved by July 2018, would make the £5 million one-off cost of the placing seem like a good deal.

But Perfect Commerce has been loss-making for each of the past three years according to the summary financial information provided in the RNS, though it achieved to an operating profit of $3 million last year on significantly improved revenues.

It operates an SaaS revenue model and with tech and growth-oriented valuations where they are at the moment, it is not hard to justify a $130 million market cap on $3 million of operating profit from such a business.

Even if the combined group performs well on its own terms, I think this sector as a whole is currently overvalued and therefore would stay away from this.

That's all from me for today. Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.