Good morning! Just a reminder that tonight is the inaugural ShareSoc Brighton investor evening, hosted by myself and Simon Cooper. We have about 50 guests booked in, so it should hopefully be an interesting & fun evening. Our speaker has confirmed (the CEO of Tracsis, John McArthur), so all systems go!

Also, just to flag up another Webinar, this time for today's interim results from Matchtech (LON:MTEC). Details can be found here. The webinar starts at 1pm tomorrow*, and enables us to listen and view online a live results presentation by management, and to submit questions. A terrific format, and much more convenient than having to make a trip into London.

So let's move on to today's small cap results and trading statements.

* = My apologies, an earlier draft of this report mistakenly said that the Matchtech webinar was today. It's not, it's tomorrow, 9 April.

Matchtech (LON:MTEC)

I might as well report on their figures first, being interim results to 31 Jan 2014. This is a recruitment group, specialising in placement of engineering and professional services staff. The numbers look good. Net fee income is up 19% to £22.1m, underlying profit from operations was up 32% to £6.2m (this figure strips out the newly acquired Provanis business, and other things like amortisation & non-recurring costs).

Including the acquisition, profit was up 48% to £6.2m - it looks as if that is a coincidence that unadjusted profit is the same as underlying profit - it must just be the case that profit from their acquisition offset excluded costs.

Net debt is reported at £8.6m. The outlook/current trading comments sounds encouraging;

Demand for contractors remains high while the permanent marketplace continues its recovery, we are seeing increasing margins and an improving NFI conversion ratio across the business. The integration of Provanis is going well as we focus on cross selling its services to our wider client base.

Trading in the second half is progressing well and we continue to invest appropriately to support our ambitious growth plans. The Board currently anticipates that the results for the year to 31 July 2014 will be slightly ahead of its previous expectations.

Stockopedia shows broker consensus of 34.9p for this year (ending 31 Jul 2014) and 39.9p for next year. So if they are "slightly ahead" then perhaps that means 36p-ish for this year? So the shares are not exactly bargain basement at 623p - I make that a PER of 17.3. If you're prepared to pay up-front for increasing earnings, then it might be worth considering, but personally I'm not, and find this price too high.

Although it is worth looking at what operating profit margins companies made pre-financial crash, and applying that margin to future turnover, to see what scope there is to raise profits in future. Trouble is, that's getting harder to do, because pre-2008 figures are now dropping off the table of comparatives, due to the passage of time. Recruiters are quite operationally geared, so there is probably scope here for the operating margin to rise from its current level of about 3% to perhaps 5% (they reported 5.3% in 2007/8 for example).

So I can see why the market is pricing this stock on a relatively high PER, but even so it's not for me, at this valuation - looks from the chart like the smart money has already been made on this stock (and other recruitment cos), I think it's too late to join the party now;

Synety (LON:SNTY)

As I expected, the Open Offer at Synety was heavily over-subscribed. My estimate beforehand was 5-6 times over-subscribed, which was in the right ballpark as it was actually 437% subscribed. Not surprising really, when you offer a 300p+ stock for 250p! I won't go on about the structure of the deal, as that's been done to death, and I've had an opportunity to discuss it with the company.

Going forwards though, I think it is extremely important that brokers and other advisers realise that squeezing out private investors in fundraisings is just not acceptable, unless there is some sort of emergency reason for a Placing with no Open Offer attached. In this case the company told me that the Open Offer element only increased the fees marginally, although I have to say that the fees at £300k (presumably mostly from their broker, Singers) are absolutely extortionate for a £4.5m discounted Placing and £0.5m Open Offer. That's 6% of the funds raised being pocketed by advisers! Daylight robbery.

We're in a bull market, so exciting growth companies have no trouble raising fresh money, this deal should have been done from a position of strength, but never mind it's done now. Or at least it should be done in a couple of hours, when the EGM authorises the new issue of shares, which should be a formality.

InternetQ (LON:INTQ)

A reader asked me to take a look at the next set of results from this company, and I have to say the figures look awful to me. Greek companies do seem to like creative accounting. In Globo's case that means profits that never turn into cashflow, but instead just pile up on the Balance Sheet in Debtors.

In the case of InternetQ, they just capitalise everything that moves! As such the profit figure is effectively fantasy in my view. Consider this - for 2013 InternetQ reports EBITDA of E14.4m. However, it has capitalised E13.8m of costs into intangible assets. So reversing out the capitalised costs, in cash terms it was barely above breakeven, at only E0.6m!

Of that E13.8m of capitalised intangible costs, E6.6m was purchased software (which could be considered alright, depending on who it was purchased from - i.e. not a connected party), and the balance of E7.2m was internal costs. So this means that the way I view it (expensing all intangibles as a cash cost), the company is not generating anywhere near as much profit as it is reporting.

Debtors are large, at E36.4m (that is Debtors + Prepayments), but not outrageously large given turnover of E104.4m, which I make just over 4 months debtor days. A bit stretched, but not horrendously so.

The market cap at about £150m (at 395p per share) looks aggressive to me, matching the accounting presentation, so it's not something I would invest in.

Porvair (LON:PRV)

Porvair issues an IMS today, but it only refers to revenues, and not profits vs expectations. It's the latter which matters, so why issue a trading statement that doesn't mention profit? It also refers to the outlook as follows;

The outlook for the coming months is encouraging. Order books are healthy and the large engineering projects referred to above are progressing according to plan.

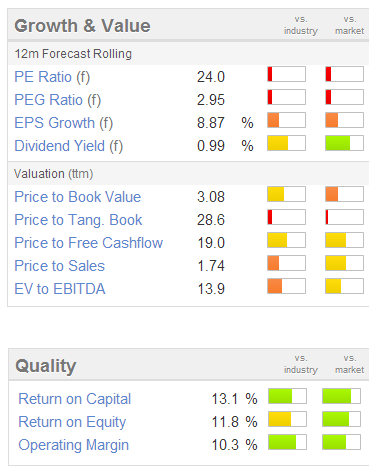

So that all sounds positive, but is it already in the price? I would say so. As you can see from the Stockopedia valuation figures & graphics, this share is not showing value on any measure. Bear in mind these are based on forecasts, so to justify this kind of valuation the company really needs to be reporting ahead of expectations profits, but that hasn't happened today.

Office2office (LON:OFF)

There's a rather bizarre situation going on at this struggling office stationery supplier. A shareholder called Nicholas Gerber has requisitioned an EGM in which he is trying to take control of the Board by firing the existing members, and appointing himself & some others in their place.

It now transpires that he apparently wants to reverse in a US fund management business, and a Bulgarian website development start-up into Office2office. This sounds an absolute crackpot plan, and in my view very foolish, since attacking a company which has a weak Balance Sheet in this way, could have been the trigger to destabilise the relationship with the bank and key suppliers.

I missed the latest results from this company last week, as it was a very busy day. However they have shown good progress in reducing net debt, which was last reported at £21.8m on 31 Dec 2013, down £7.2m compared with the start of 2013. That said, the Balance Sheet is still extremely weak, with negative net tangible assets of £43.1m. As such it's a bargepole share for me, ridiculously risky unless/until they raise a large slug of new equity to fix the Balance Sheet.

The EGM requisition looks like an unwelcome distraction, and I'd be amazed if it attracts any shareholder support.

Renold (LON:RNO)

This industrial chains group seems to be making good progress with its turnaround. A trading update today says that results for the year ended 31 Mar 2014 should be in line with market expectations.

Broker consensus is for 2.93p EPS for y/e 31 Mar 2014, and 4.16p the following year, which equates to a PER of 19.1 and 13.4 respectively. Whilst that might sound reasonable for the current year which began 8 days ago, it completely ignores the large pension fund deficit, and significant net debt. There's no dividend either. Taking all of that into account, I think the price is well ahead of itself here.

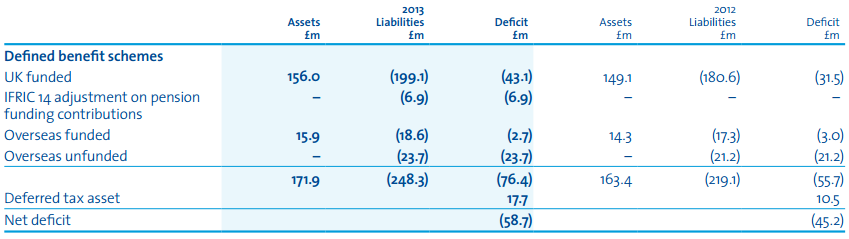

Pension deficits absorb a lot of cashflow to plug the gap, and that restricts dividend payments, so you can't just ignore them. Or if you do, then you end up overpaying for the company. As you can see from this extract from the 2013 Annual Report, there is a yawning deficit on the pension fund, which got a fair bit worse in 2013;

These are material figures in comparison with the current market cap of £125m (at 57.5p per share).

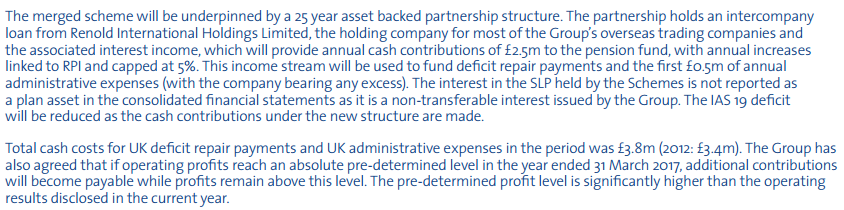

I've had a look through the 2013 Annual Report, and the section below talks about the deficit recovery payments, which are a large chunk of the company's profits & cashflow, therefore this is a serious issue that investors need to know about. So it looks to me as if there will be a £2.5m+RPI drain on cashflow for the next 25 years, and potentially more if profits rise significantly, as set out below;

So however you look at it, the pension fund deficit needs to have a material impact on valuation here. It seems to me that is not being done, hence the market is over-pricing these shares at the moment by apparently ignoring the pension deficit, in my view.

That's my lot for today, time to prepare for this evening's investor event in Brighton.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SNTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.