Good morning/afternoon. I added two more companies to yesterday's report in the evening, reporting on the Open Offer result from Synety (LON:SNTY), and a trading update from Adept Telecom (LON:ADT). Please click here for yesterday's completed report.

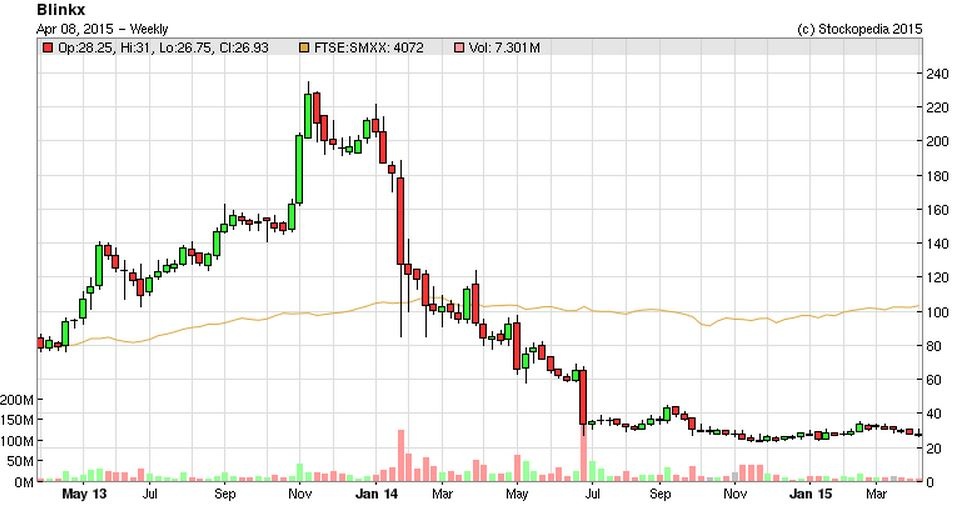

Blinkx (LON:BLNX)

Share price: 28.1p

No. shares: 402.3m

Market Cap: £113.0m

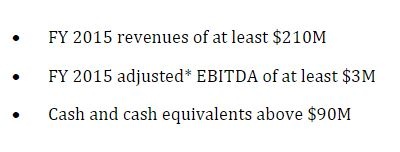

Trading update - the company reports on the year ended 31 Mar 2015. Three key points are made;

Looking back at the last interims, it did $106.0m turnover, and had an adjusted EBITDA of $1.0m in H1. Therefore H2 looks to be about $104.0m+, and adjusted EBITDA of $2.0m+, and note that H2 adj EBITDA is at least double that of H1, so some sign of improvement there.

Although I also note from the interims that the adj EBITDA of $1.0m turns into an adjusted loss before tax of $3.4m. So this seems another example of how EBITDA is such a misleading measure of (usually illusory) profitability, especially at technology companies. Share based payments appear significant here too. The full H1 loss before tax was $9.7m, a lousy performance.

Therefore it is clear H2 will also be loss-making, but maybe not quite as bad as H1.

Cash - the company reports "above $90m" cash at 31 Mar 2015. Note that it paid $15m for an acquisition (Adkarma) in Dec 2014. That explains some of the drop in cash from $114.6m at 30 Sep 2014, so that seems to leave a cash burn of about $9.6m in H2, unless there were other payments made for acquisitions? ($3.2m shows on the H1 cashflow statement for acquisitions, which I presume is for Lyfe Mobile?).

Therefore as things stand at the moment, the company appears to be burning cash, hence I'd be wary of placing too much reliance on the cash on the balance sheet when valuing the company, although clearly $90m is highly material to the valuatin, as it's about £60.2m at the current exchange rate, or 15.0p per share - just over half the entire market cap. So providing cash burn doesn't spiral out of control, then the shares do have some underpinning from 15p of net cash.

Valuation - other than the 15p per share cash, I have no idea how you value the rest of this group. Clearly there is something badly wrong with its business model, as profits have collapsed, and it's now loss-making. I wonder whether the strategfy is to use the cash pile to buy some decent businesses, thereby creating value that way? The other question is whether the previously profitable business can be rebuilt?

Change of auditor - tricky one this. One the one hand, it is good practice to change auditors every few years, as the relationship can otherwise become too cosy. On the other hand, you worry that maybe the old auditors have found where the bodies are buried, so need to be jettisoned!

Due to its cash pile, Blinkx won't have any trouble getting auditor sign off on the accounts over going concern anyway. PWC have taken over as the new auditors.

My opinion - the outlook statement with the H1 results anticipated that H2 would be "broadly similar" to H1, and that has indeed been the case - in fact H2 was slightly better.

My main problem with this company, is that it's not at all clear whether they have a sustainable business model or not. Therefore it is impossible for me to form a view on what the shares are worth, hence it's uninvestable for me.

Starcom (LON:STAR)

Share price: 7.75p (down 8% today)

No. shares: 84.4m

Market Cap: £6.5m

Profit warning - I'm only mentioning this one, to follow up on comments here on 29 Dec 2014 and 31 Dec 2014, when this share spiked up from 6p to a peak of 25p, and has since come almost all the way down again. As I commented on the time, this type of speculation is not worth getting involved in, unless you spot it before everyone else & can time your exit to perfection.

Anyway, there's an absolute disaster of a trading update today, I'm very surprised the shares are only down 8%, they should be down a lot more, in my view.

The company announces a change in accounting policy. They had been reporting turnover based on what they invoiced, however some customers were operating on a "bill and hold" basis - i.e. where Starcom retained the completed product, and the customer pulled off what they wanted. This seems to me just an incorrect accounting treatment. Goods should only be recognised in turnover when they are physically dispatched to the customer.

Anyway, Starcom is changing its policy to recognising turnover when goods are physically shipped to the customer, and that has blown a hole in the P&L for 2014, so reported turnover for 2014 which would have been $9.5m, is now going to only be $5.3m, which is "materially below market expectations".

Results for 2013 are also being restated, now showing a loss of $0.9m, instead of the $0.79m profit previously reported!

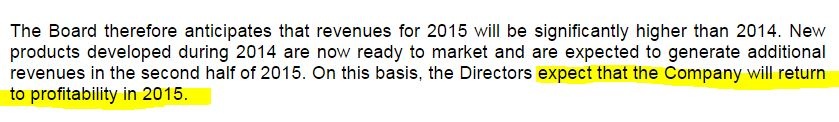

Outlook - this provides some comfort that things might not be a disaster after all, although given the sequence of events, I'm inclined to take this with a very large pinch of Dead Sea salt (it's an Israeli company!);

Cash - looks tight. They had $190k at end Dec 2014, and debt of $627k. The company says it can manage its working capital, but it looks high risk to me.

My opinion - in my view, given the above problems, this share can only now be regarded as uninvestable, so it's going on my bargepole list.

Gooch & Housego (LON:GHH)

Share price: 677p

No. shares: 23.8m

Market Cap: £161.1m

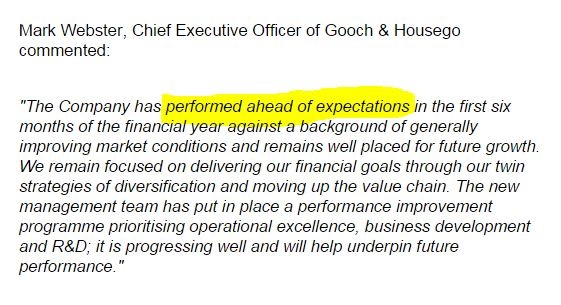

Trading update - for the half year to 31 Mar 2015. The company says it has traded "slightly ahead of management expectations". The reasons given are underlying strong demand, and a benefit from dollar strength. The current order book is up 5.8% in the last six months.

Directorspeak sounds fairly positive;

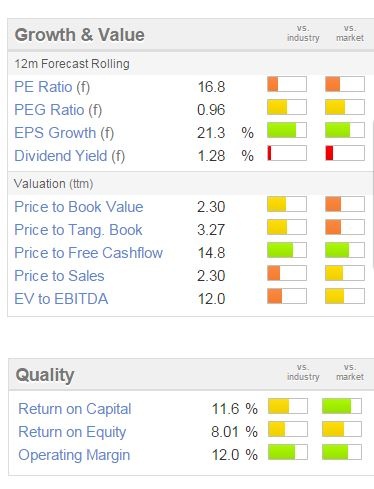

Valuation - this looks priced about right to me:

It has a Stockopedia StockRank of 76, which is good, but not exceptional, which ties in with my view of the company.

Hellenic Carriers (LON:HCL)

Share price: 16.2p

No. shares: 45.6m

Market Cap: £7.4m

Preliminary results - for calendar 2014 are out, and they're really bad. The problem is that operating dry bulk ships is not a great activity to be in right now, with over-supply, and the Baltic Dry Index having hit new multi-year lows in Feb 2015. It's recovered slightly since then (currently $583), but is still well below the range for 2014 of $750-1500.

So if these conditions continue, then presumably the 2015 results will be even worse.

Revenue was $20.6m in 2014, and the operating loss before asset impairment charges, was $9.0m. Then there was $3.8m in finance costs, since the company is highly geared. So the overall loss for the year of $17.0m is actually considerably more than the current market cap. That type of situation doesn't usually end well, in my experience.

Balance Sheet - is bad, but maybe not as bad as you might think. Net assets are $43.9m, which is £29.4m, and that is all tangible net assets too. So the shares are trading at only a quarter of tangible book value, which is the market telling us that it doesn't believe the figures, or the market anticipating further heavy losses which will deplete net assets.

With $93.3m debt, on $128.5m of assets (vessels), the company is at the mercy of its bank. So the key research element for this share is to find out the terms of the bank debt, what are the covenants? What is the attitude of the lender, and are they likely to continue supporting the company, or not?

My opinion - a lot of the losses are non-cash items, such as depreciation charges, asset write-offs, etc, so the company may be able to continue trading and get through this patch of very low Baltic Dry rates. OR the company could go bust, if the bank decides to pull the plug & dispose of the assets.

So this shares is an ultra-high risk, binary, punt. It could be a multi-bagger, if the Baltic Dry rises strongly at some point. Or it could go under, if the losses grow to a point where the bank has had enough.

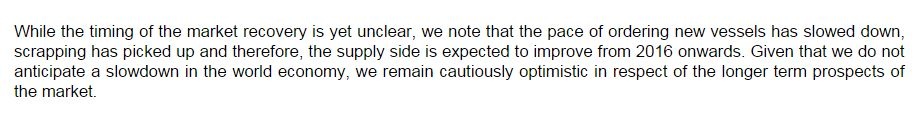

Management suggest that a recovery is possible in 2016, so if the bank remain supportive until then, who knows?

This has to be seen as ultra high-risk - so a significant risk of a 100% loss. But potential high reward too, if things start to move the company's way.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.