Good morning!

PuriCore (LON:PURI)

Share price: 35.5p

No. shares: 50.14m

Market Cap: £17.8m

Interim results to 30 Jun 2014 have been published this morning. The company makes disinfection products for a number of markets - supermarkets (fresh food, and cut flowers), and medical (wound care both human & animal). I've always thought the products sound promising, and the company has won impressive contracts with major customers, but it has not as yet succeeded in making a commercial success of these products.

The area that was commercially successful, its endoscopy disinfection business, was recently sold for what seemed a good price. Therefore the nature of the investment has changed, in that it's now heavily cash-backed, with a loss-making business attached. So it is now critical what they do with the cash.

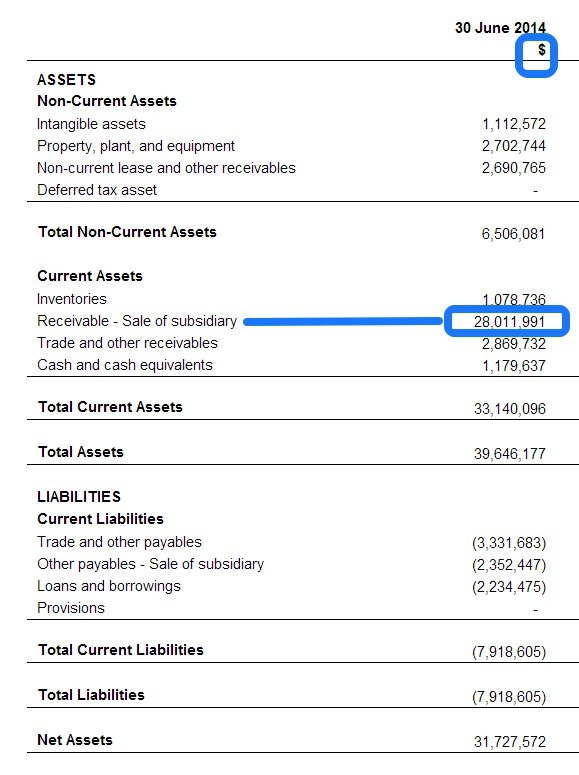

Balance Sheet - As you can see from the 30 Jun 2014 balance sheet, I've highlighted two items, firstly note that the accounts are published in US dollars, so everything needs to be divided by 1.68 to translate into sterling.

Secondly, the balance sheet is dominated by the $28.0m receivable from the sale of the endoscopy business. This sale completed on 1 Jul 2014, just one day after the period end. Therefore the $28.0m receivable can be considered as cash.

In my view the cleanest way of finding the current net cash position is to take the $28m receivable, add on cash of $1.18m, then deduct the $2.35m payable & the $2.2m borrowings figure, which gives a net cash figure of $24.6m = £14.6m.

Note that this adjusted net cash figure is 82% of the current market cap, which values the business at an enterprise value of just £3.2m.

Downside protection - Some might say that valuing the existing business at hardly anything is very sensible, given that it has not been established that they have a viable business there. I agree with that. However, it does mean that you have the downside protected to a considerable extent, whilst the upside potential (i.e. if they do deliver a good result from the ongoing business) is thrown in for very little.

Ongoing losses - The problem is that the ongoing business had a poor half year, and made an operating loss of $3.7m on turnover of only $8.6m. That was a significant deterioration from H1 last year, when turnover was $12.3m and the loss was smaller at $2.0m (in both cases the endoscopy business has been stripped out, as it is now a discontinued operation).

Valuation - I'm in a quandary about this share. On the one hand the performance of the business has been poor, which is clearly negative (although not a surprise, as poor trading had previously been announced). On the other hand, the sale of the endoscopy business has de-risked things considerably by providing a cash pile that makes up the bulk of the market cap now.

So if management do something wise with the cash pile, then hopefully they could create an interesting business - look at Tristel (LON:TSTL) for example, where a very nice growth business has been created in the infection control area. On the other hand if management squander the cash on more sales & marketing that doesn't deliver a return, then they could end up destroying shareholder value here - and let's face it, their track record is fairly mixed, if one is being charitable.

Outlook/Strategic Review - This is rather non-specific, as follows;

PuriCore continues to identify both significant market opportunities and prospects for sustainable growth within and around refocused Continuing Operations. The sale proceeds provide the resources to enable the Company to identify and execute strategic growth opportunities in a targeted and disciplined manner. The strategic planning process is underway, the results of which will be communicated to the market later this year.

It's not clear to me why a small business like this needs several months to conduct a strategic review - surely they already know their products & markets, and where the best opportunities lie? We're not talking about turning around Tescos here, this is just a £ 10m p.a. turnover minnow at the moment!

I hope management have included substantial pay cuts for themselves in the strategic review, as now the business is smaller & more heavily loss-making, the generous pay packets of the past cannot continue. If they can't come up with a convincing strategic plan, then it might be time for a clear-out of old management, and bring in some fresh blood, in my opinion. This seems to me a situation where shareholders need to start kicking some butt. However, let's firstly hear what they say in the strategic review due to be announced in Q4 of this year.

My opinion - It's not trading well, however the valuation is now on very solid foundations of a cash pile that makes up 82% of the market cap. That gives time for management to turn things around. If they cannot do that within 6-12 months, then they should probably be replaced, in my view.

The products clearly have potential, if sales can be driven up to the next level, without a prodigious sales & marketing spend to get us there. So with the cash backing, the shares are really buying mainly a cash pile, and secondly the upside potential on the business, which may or may not happen.

If some decent contract wins were to occur, and a move into sustainable profit became possible, then the upside potential could be exciting - my best investments have generally been from cash rich shares which investors had given up on, but which then went on to be multi-baggers when a commercial breakthrough occurred. Trouble is, you don't know in advance which ones will work, and which ones won't.

The company needs to do a root & branch review of costs, and strip out everything that is not vital, in my opinion, then focus all their effort on driving up sales. So a much leaner operation is necessary in my view - the "General and administrative expenses" line on the P&L now sticks out like a sore thumb as being much too high.

As you can see from the two year chart below, PuriCore has seriously lagged the small caps sector, due to its poor commercial performance. However, the Small Caps Index (SMXX) comparison line gives an idea of the upside potential if the newsflow were to become positive.

Redcentric (LON:RCN)

Share price: 111p

No. shares: 144.1m

Market Cap: 160.0m

This is a managed ICT* company that was Listed in Apr 2013, having been demerged from the Redstone Group.

(* ICT is apparently the new TLA^ that we should be using to describe IT that also involves communications)

(^ TLA = Three Letter Acronym)

It's a new one to me. The trouble is that Stockopedia doesn't show the historical figures, as it is a new listing, so one would need to do some digging on the company's website to find the listing particulars, which will probably have the historic proforma numbers in them.

I've just had a quick review of the Admission Document, and must admit I don't really get it. The historic figures look very lacklustre - a small business operating not much above breakeven. So there must be more to it than that. Looking through the historic RNSs, the company seems to have made a "transformational acquisition" in Nov 2013, financed by a Placing of 80m shares at 80p

Results for the year ended 31 Mar 2014 look a lot more sensible, with proforma revenue of £87.4m and the dreaded EBITDA of £16.2m, with synergies of £3m anticipated. A 1p dividend was also paid. I'm not keen on the Balance Sheet though, with negligible net tangible assets, and some debt. With it being recently floated, and with a big acquisition during the period, the figures are not easy to interpret.

Trading update - issued today sounds positive. The company has a 31 May year end, so it is reporting on just over 2 months of Q1 today. The bullet points say;

- Strong first quarter, delivering on all key performance indicators

- Organic growth at top end of management expectations

- Strong Q4 cash flow has continued into Q1, demonstrated by payment of maiden dividend

- Integration proceeding well

- Comfortable with full year market expectations

.

Valuation - Stockopedia shows the current year broker consensus EPS forecast as 7.55p. So at 111p per share that values the company on a PER of 14.7, which looks sensible. Although I'd want to check what basis the EPS forecast is made on, and that they haven't stripped out too many costs in arriving at an adjusted EPS.

My opinion - I've only just looked at it, so don't have enough info to form a meaningful opinion at this stage. Will report back here when the next set of results are published. The shares have been a reasonable perfomer so far since listing;

Seeing Machines (LON:SEE)

Share price: 4.25p

No. shares: 822.23m

Market Cap: £34.9m

This is a small Australian company, listed on AIM, which has developed, and is selling into the mining sector, devices which read the faces & eyeballs of vehicle drivers, and sound an alert when they are over-tired or not looking at the road.

There was considerable excitement around this company late last year, which coincided with a Placing at 5p. The size of the Placing grew rapidly as there was so much investor appetite for it, and the company ended up raising £16m, which was far more than it had initially hoped to raise.

As a result, the business plan has been completely changed. Instead of being a small, lean operation that was set to move into profit, and had its R&D funded by partners, it has now become a more heavily cash burning, more blue sky company. This seems to have (understandably) scared off some investors, and of course the stampeding herd of speculators who were so active over the winter of 2013/14 are nursing their bruises in a corner somewhere at the moment, after practically all speculative stocks have sold off considerably since Feb/Mar 2014.

A series of positive announcements about business partners, etc, have been issued in recent weeks, including one today about a JV with a S.American company. There has also been a very interesting announcement about the potential roll-out of the technology into trucks, being trialled by a S.African insurance company. To my mind that's probably the most exciting development, as if this trial is successful it could lead to insurance companies eventually requiring the fitting of the Seeing Machines product into cabs, since it prevents accidents.

In the current market, nobody is interested, the shares are just drifting down regardless of what announcements come out. However, in my view this type of sell-off is an ideal opportunity to pick up companies that have been putting out good news, and in this case is now less than half the price it was 8 months ago. Plus it's cash backed (for the time being anyway).

So at 4.25p per share it's looking attractive again, in my opinion. Sooner or later another speculative surge will occur, and people who like the story will rush to get back in again once it's moving up - have you noticed how people only seem to like buying shares that are going up?! Personally I like to buy before they start moving up, once the valuation is right, as you can buy as many as you like at the price you like.

This share is speculative obviously, so not for everyone. However the cash backing, and increasing sales, mean that it's a proper growth company, not completely blue sky. I have held these shares continuously for about a year in my long term portfolio, but have now started buying them for my shorter term portfolio too. DYOR as usual.

Looking at the chart, maybe I should wait until it hits 3p before buying more, but given the large fundraising at 5p in Nov/Dec 2013, I suspect that 4p might possibly be at or near the bottom for the share price. However, that depends on what other people in the market decide to do, so it's just a guess on my part really.

Hyder Consulting (LON:HYC)

There's even more good news for shareholders in this construction consultancy group.

An agreed cash takeover bid for the shares at 650p was announced on 31 July. However, that offer has now been trumped with a 680p cash offer from a Japanese competitor. So it remains to be seen whether the original Dutch bidder, Arcadis will raise its bid further?

a very nice position to be in for shareholders though, having two cash bidders in a bidding war.

We're all done for the day and the week now. Thank you for reading & commenting.

I shall be jetting off to Greece in the early hours of tomorrow morning, for a week in the sun. However, morning reports will continue to be submitted by laptop, from my poolside location on the island of Paxos! Although they might be a little shorter than usual if I have a session on the Ouzo!

Regards, Paul.

(of the companies mentioned today. Paul has long positions in PURI and SEE, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.