Good morning!

Very quiet for small cap results & trading updates today, but there's still plenty of news to digest re Greece, and the continuing market crash in China (down another 10% overnight, but bouncing back about half that at the time of writing). We have to think about these things - how do they affect our investments?

I really cannot see why an entirely speculative boom & bust in the Chinese stock market should have any impact at all on the price of UK small caps. It's not as if we export much to China is it? Also, I'm not aware of any UK small cap investors in my network who buy Chinese stocks. Indeed, experience of how dreadful Chinese AIM stocks have been, has very much put many of us off looking any further at Chinese investments! So overall the crashing Chinese market seems fairly irrelevant to me, other than perhaps making one or two people here a little more nervous than they would otherwise be.

Falling oil prices have historically been very positive for Western economies overall, so again I'm not worried about oil prices falling further. It's mainly oil/resources stocks which are pulling down the FTSE100, as it's so overweight in those sectors. If you don't invest in resources stocks (or their support companies), then I don't see how any of this really matters. Cheaper oil puts more money in the pockets of consumers, and lowers transportation & raw materials costs, so for the sort of companies I invest in, these macro factors are actually a good thing.

It's Budget day today of course here in the UK, so I'll be watching the coverage of that over lunchtime, and pondering how it might affect my investments, and perhaps any investment opportunities which might spring to mind.

Although I think we're already aware of the general bullish themes, of increased housebuilding, recovering household confidence & spending, and improved business optimism & capex. So in my view the macro backdrop for UK shares is quite positive at the moment - we've probably got several years of solid growth to come, so I'm generally keeping focused on companies which are enjoying a cyclical recovery. In particular, brokers often under-estimate operational gearing (both on the way up, and the way down), so you can find some companies reporting profits ahead of expectations at this stage of a recovery.

Xaar (LON:XAR)

Share price: 480p

No. shares: 77.0m

Market cap: £369.6m

Scheduled trading update - what a good idea, giving this announcement the title "Scheduled trading update", as then you immediately know that it's not an unscheduled profit warning. It might still be a profit warning of course, but I much prefer companies to have a logical, evenly spread schedule for issuing trading updates to shareholders.

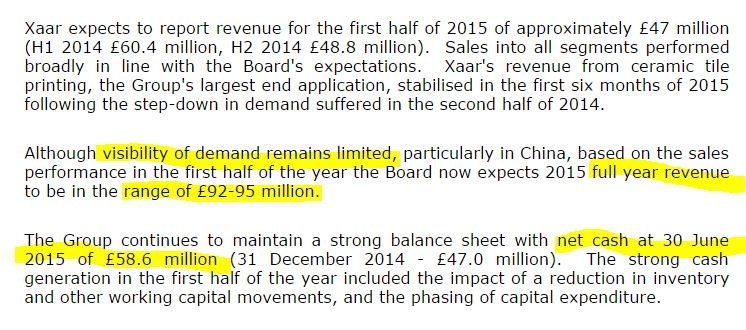

Another good point with Xaar's announcement today, is that it gives us concrete figures, as follows:

Although note that there's no mention about profitability, just sales, which seems a bit daft. Surely a trading update needs to inform shareholders and analysts about profits, first and foremost?

Net cash is holding up well, at £58.6m, but seems to have benefited from one-off factors, such as favourable working capital movements & timing of capex.

China - as indicated in the statement, Xaar is highly dependent, for sales, on one sector in one country - namely ceramic tile manufacturers in China. So going back to today's preamble, this is a share which is highly influenced by business conditions in China, so risks must have increased in the last month, with the Chinese stock market crashing?

My opinion - Xaar has some very exciting next generation products in the pipeline, but for the time being is highly dependent on ceramic tiles in China. That means the shares must be at high risk of another profit warning at some point in the future. As you can see from the chart below, there were three profit warnings in 2014, so for traders, it looks to me like an interesting potential short position, with a stop loss not far above 500p perhaps?

Fevertree Drinks (LON:FEVR)

Share price: 317.5p (up 9.5% today)

No. shares: 115.2m

Market cap: £365.8m

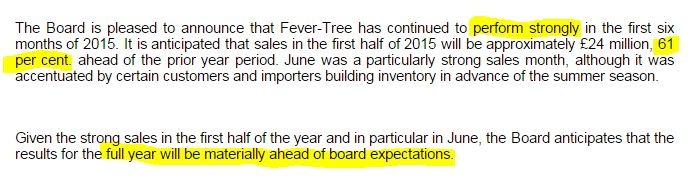

Trading update - a terrific update today from this maker of posh mixers to go with alcoholic drinks:

Valuation - broker consensus is presently for £43.2m turnover, and £8.9m profit for calendar 2015, which would deliver 7.65p EPS.

What does materially ahead mean? At a guess, I reckon they might be heading for say 10-12p EPS this year. That would put the shares on a PER between 26 and 32, so still a racy rating, that anticipates further growth.

My opinion - you have to pay up for growth, and 61% sales growth in H1 of this year does suggest that their products are in fashion, and are proving very popular with customers. The margins are high too.

My main concern is that the products could be a flash in the pan - fancy drinks come and go all the time, which could be why this share was floated in Nov 2014 - to capture a high valuation when the company is in a sweet spot for growth, which may not last?

How long before copycat products are filling the shelves in fancy wine bars? That could curb sales growth, and squeeze margins. We'll have to wait and see, but personally I'm not prepared to pay up so much for a growth business that seems to have very little in the way of a moat.

Monitise (LON:MONI)

Share price: 8.1p (down 18% today)

No. shares: 2,168.2m

Market cap: £175.6m

Update on VISA relationship - this reminds me of the "Brown Bottom" in the Gold market - where Gordon Brown proved that the worst thing you can possibly do, is to announce in advance that you're going to sell a large amount of something into a market.

That's exactly what VISA has done today - by informing Monitise that it intends to reduce its shareholding (currently 115.75m shares) in the company over time. They've knocked 18% off the value of their holding today alone, with this announcement.

Monitise also says it will continue to work with VISA "on a number of projects and services" until Mar 2016, and will assess future ways of working together.

It's still very difficult to value this company - because it's not clear if they have a viable business model or not. I'm steering clear.

Seaenergy (LON:SEA)

Shareholders are revolting at this poorly managed micro cap. It seems that the company's recent update, which included Director pay cuts, has not been enough.

A concerned shareholder has created a Sea Energy ShAG (shareholder action group) here. I agree with his proposals for reforming this micro cap to unlock shareholder value.

In my view the current Board have failed, are ineffective, and can therefore be seen as an unproductive overhead which needs to be jettisoned asap, and for the minimum cost. So this ShAG has my full support. Let's hope the group gets somewhere.

I'll leave it there for today, as I need to digest the details from the Budget.

Certainly the fall in Corp Tax to 18% in the next two years should boost shares, as it means earnings will rise.

I'm also delighted that the Living Wage policy has been adopted by the Tories (originally a Labour idea). It's absolutely right that we gradually increase the shocking low pay of the working poor, and better incentivise people to work instead of claiming benefits.

The measures to further increase the personal allowance are also welcome. I just hope that, at some point, they do something about the chronic lack of affordable housing in the South.

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only, and are NEVER financial advice or recommendations - our ethos is on readers doing your own research & taking responsibility for your own investment decisions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.