Good morning!

It's election day today, so you can sprinkle some spread bets on the parliamentary outcome along with your share trades if you're that way inclined (I'm not!)

Instead, I'll carry on looking at individual company results. There tends to be a bit more volatility around political events, of course, and currency movements in particular can be dramatic. GBPUSD is currently a little over 1.29.

Now, onto a few results:

Boohoo.Com (LON:BOO)

- Share price: 241p (+9%)

- No. of shares: 1148 million (after Placing)

- Market Cap: £2,766 million

Successful £50 million Fundraise & 36.6m Share Placing

Not a small-cap, but much-loved on these pages, I have to mention the latest Boohoo news.

The rationale for raising £50 million is as follows:

As disclosed in the trading statement released yesterday, the growth rates of the Group's brands are accelerating the need for more warehouse capacity. Consequently, the Group announced yesterday plans to construct a new automated super-site of c.600,000 sq ft, which is intended to provide boohoo with over £2 billion of net sales capacity, in addition to the estimated £1 billion net sales being provided by the extended Burnley site. The land acquisition of the new site, together with the construction, is expected to cost c.£150 million over three years to FY20.

To enable the Group to be able to maintain a strong cash position that will enable it to take advantage of investment opportunities as they arise, approximately £50 million will be raised through the Placing of New Ordinary Shares and the Group's cash generation will fund the Group's capital expenditure requirements.

That's a fairly straightforward and reasonable explanation, and the dilution caused is minimal. The share count increases by only about 2%, which most people wouldn't consider to be material.

In addition, the Concert Party (family of the co-CEO) are selling £80 million of stock. But they still hold stock which is worth £975 million at the Placing Price, and have agreed to a 6-month lock-in.

So usually dilution and insiders selling out are big warning signs, but if the dilution is small and with a good reason, and if the insiders still retain a large stake, then we can look at it more favourably.

Now onto the trading update:

· Revenue £120.1 million, up 106% (2016: £58.2 million)

· Like-for-like(1) revenue growth of 78%

· Gross margin 54.2 % (2016: 56%)

· Strong balance sheet with net cash of £74 million (2016: £61 million)

The above results are for the group, drilling into the components, boohoo revenue is up 48% (44% at constant exchange rates), while prettylittlething revenue is up 305%!

Checking back to the equivalent update a year ago, before the acquisition of prettylittlething, revenue grew by 41% (42% at constant exchange rates).

So the growth in core boohoo revenue, looking at Q1 results only, has accelerated by a couple of percentage points.

Growth in active customers is a bit lower: it grew 30% last year, whereas it has grown by 24% this year. Revenue per active customer has obviously improved.

Outlook has improved:

As a result of very strong trading momentum in Q1, we now expect Group revenue growth for the full year to February 2018 to be around 60%, ahead of previous guidance of revenue growth approaching 50%. We expect Group EBITDA margins to be in line with previous guidance at around 10%."

Encouraging to see EBITDA margins in line with guidance too, despite the slight fall-off in gross margin reported this quarter.

My opinion

A fantastic business, of course. Valuation is now getting on for £2.8 billion (for context, prior guidance for 2018 net profit was £26.5 million - this will need to be increased).

The EBITDA figure should be circa £47 million for this year, rising to possibly £60 million in 2019.

Arguably, successful online plays are so few and far between, and result in such sparkling growth rates as boohoo's, that they are worth the prevailing multiples.

It's a bit too racy for my own investment style and I admit this is probably a defect of mine, but I have a psychological difficulty with paying 6x sales for a 10% EBITDA margin business.

Boohoo doesn't determine its own valuation, of course, the market does, and I guess my suspicion is that boohoo is a bit overvalued along with many other good-quality companies in current conditions. That's why my personal strategy at the moment is to accumulate more cash in my portfolio.

But if I already owned boohoo shares, I'd probably continue to hold a decent chunk of them. Painful drawbacks are part and parcel of holding big winners, so I'd be determined to hold it through the drawbacks as well as the strong share price rallies.

Since this is the Small Cap Value Report, I should gently point out that Boohoo's ValueRank is 6 and that the risk rating is Speculative!

Best Of The Best (LON:BOTB)

- Share price: 397.5p (+2.6%)

- No. of shares: 10.1 million

- Market Cap: £40 million

This share has been a firm favourite of Paul's, and is again up considerably versus the last time he covered it (18 January, with 315p share price). It has doubled over the past year.

It runs competitions for luxury cars, selling tickets online and at physical venues. Online is now 80% of revenues (using H2 numbers).

Revenue up 7.0% to £10.81 million (2016: £10.10 million)

Profit before tax increased by 42.7% to £1.51 million (2016: £1.06 million

Earnings per share increased by 41.6% to 13.74p (2016: 9.70p)

It has rewarded shareholders extremely well for their support, paying out a 10p special dividend in December 2016 and declaring another 6.5p special dividend today (in addition to 1.4p ordinary).

But I wonder why it doesn't improve the ordinary dividend at a faster pace - does it only consider a 1.4p dividend to be affordable from some sort of "normalised" perspective? Clearly the investor community disagrees, or it wouldn't have pushed the shares up to 400p.

Some excellent comments explaining the benefits of experience and economies of scale:

"[H]igher margin online sales contributed to improved margins overall, which were further aided by increasingly well-informed digital media purchasing and execution. Furthermore, the Company is now buying cars as prizes for winners almost every week and as a result the Company has been able to negotiate better volume discounts from suppliers. This improved purchasing power combined with selective offers and discounts for targeted brands and models has aided margins over the period, contributing to the strong performance.

Reading through the statement, I like the sound of the company's ambition to keep growing its marketing investment. It says all channels "are carefully assessed to analyse marketing returns versus player lifetime values" - so if it's getting better and better at this as it accumulates data and experience, then the prospects should keep getting better. It's looking to increase the marketing budget by another 70% this year, including with TV and radio ads.

Outlook statement is positive:

BOTB has increased both revenues and profits during the year, remains cash generative and is supported by a robust balance sheet. In the current financial year, the Board will focus on executing an increased multi-channel digital marketing plan, leveraging the new website and updated IT infrastructure, whilst ensuring that this strategy provides a solid return on investment for shareholders.

I believe the business is well positioned for the remainder of the financial year, and I look forward to updating shareholders on further progress in due course.

My opinion

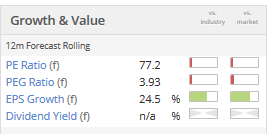

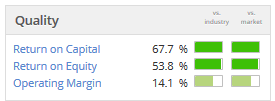

I think I'd actually choose this one, over Boohoo, for a growth story. Both companies have good margins and good quality metrics, though BOTB is actually a bit better:

Furthermore, I can more easily envisage BOTB growing into its valuation in a shorter time frame: £40 million market cap versus net income of £1.4 million this year, and with the potential for a big result coming next year and in subsequent years from the 70% increase in marketing spend.

Perhaps it was originally not so very hard to replicate what BOTB did, but as it grows and becomes more expert at finding and monetising customers online, then perhaps the competition becomes more limited in terms of the up-front costs required to accumulate that expertise and data.

Conclusion: I'm optimistic about prospects here.

CMC Markets (LON:CMCX)

- Share price: 136p (+7%)

- No. of shares: 288 million

- Market Cap: £392 million

Disclosure: I currently own shares in IG Group (LON:IGG).

It's important to keep an eye on the competition, if you have the chance to do so, so I'm glad to have the chance to keep an eye on CMC. Its larger rival in spread betting and CFDs, IG, is one of the very few shares where I am actively contemplating making a fresh purchase.

IG recently reported a "quiet" Q4 trading period for March-April-May, but revenue for the full-year was ahead by about 7%, and PBT "modestly ahead" of the prior year.

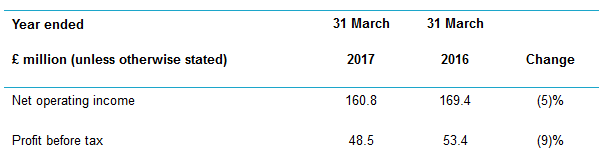

CMC hasn't managed to achieve the same comparatives for a fiscal year ending in March:

These percentage declines reflect the decline in number of trades (6%) and value of trades (3%).

The only bright spot is that the number of active clients increased by 5%.

What IG has demonstrated over the years, however, is that value per client can be a much better route to success then increasing the total number of clients.

Still, I could be tempted to invest in the stock of CMC, too. It has own funds of £183 million, or nearly half the market cap. The trailing PE ratio is only 10x. Dividend is unchanged, and the yield is 6.6%.

The great cloud hanging over it, of course, is the mooted leverage limits on retail traders by the FCA, which could have a disproportionate impact on CMC. Germany has also been making moves to limit retail traders' losses.

The Chairman's comment argues that strong legislation would help CMC in the long run as smaller players leave the industry, but since this argument applies most compellingly in the case of IG, that's where I'm most inclined to keep investing.

Having said that, I do have a strong suspicion that CMC is undervalued at current levels. Remember that it IPO'd at 240p only last year - it could easily be worth close to that again, should the final proposals be milder than expected.

Ramsdens Holdings (LON:RFX)

- Share price: 130.5p (-1%) (rose 5% yesterday)

- No. of shares: 30.8 million

- Market Cap: £40 million

Disclosure: I own shares in H & T (LON:HAT).

Responding to this by request for InvestedGeordie, though obviously it would be on my radar anyway due to my controversially large position in H & T (LON:HAT). Once again, as with the spread betting companies, I choose to own the largest player in the pawnbroking industry.

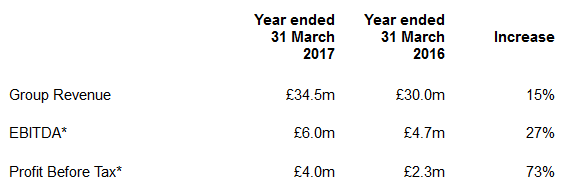

Ramsdens is doing well, and the shares are up about 30% from their February IPO price:

The company previously informed in a trading update that adjusted PBT was going to be comfortably ahead of prior expectations, hence the modest 5% share price increase when it announced these results yesterday.

I'm glad to see it doing well, because it means the sector as a whole is probably healthy. They do have a tendency to rise and fall together, to a large extent.

Looking into the segment results, the pawnbroking segment revenue is up 7%, which is the one I'm most interested in. Number of customers increased by 14% to 33,000.

The other segments are important too, of course, and they are all showing very positive growth. Retail jewellery sales grew the fastest, at 23% - these companies present jewellery as attractively as possible on the shop front, like any other retailer (but of course unlike any other retailer, they are both buying and selling from the public!)

Head-on competition between Ramsdens and H&T is somewhat limited. They do cover some of the same geographic areas, but Ramsdens tends to concentrate in Wales, Scotland and the North of England, whereas H&T dominates London and the South.

Growing demand for foreign exchange services is another secular trend which benefits both companies, and FX revenue for Ramsdens has grown by 18% according to these results.

Outlook

The FY18 financial year has started well for the Group. Customer demand for our products across our key business segments remains strong and the Group is well positioned to take advantage of its clear growth opportunities. We have a diversified business, a loyal and growing customer base, a committed team and a strong brand. These qualities give us confidence of successfully delivering the Board's clear growth strategy in the year ahead.

My opinion

As with my view on IG/CMC, I reckon that both H&T and Ramsdens are good investments at the current levels. I know which one I prefer, so I'm sticking with H&T, but I wouldn't have any problem buying into Ramsdens.

Its shirt deal with Middlesbrough expires next season, and I have no reason to believe that it will be extended, so that could be a negative in terms of brand exposure.

But 12 store openings are planned from the current 127 and so, assuming an acceptable level of profitability from them, I think Ramsdens easily justifies its current £40 million market cap. The balance sheet is fine and it's about as well-positioned as a company in the sector can be.

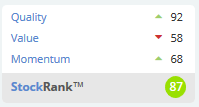

Stockopedia has rewarded it with an excellent rating:

That's all I've got today, see you tomorrow!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.