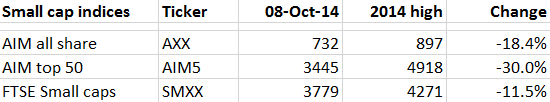

Good morning! It's ugly out there in small caps right now - many investors feeling a lot of pain, one friend described the market as "pretty dire" right now. The three small cap indices which I follow are hitting new lows for the year today, here is a table of the falls we have seen since this year's high points in Feb-Mar - some severe falls here, so this is very much a bear market in small caps now. Which of course is when you find the bargains, so as value investors we should be getting excited rather than fearful!

Here are the same indices over a one year period, which as you can see is grim. So if you invest entirely in small caps as I do, then you're almost certainly having a bad year so far;

Unpleasant though it may be, this market is creating opportunities - it's in bear markets when we can buy stocks at irrationally low prices, as the market throws out the baby with the bathwater. Plenty of stocks needed to come down, as they were over-priced. However, I'm increasingly seeing good value appear, and often sellers snuffing out price rises on good news - e.g. with Norcros (LON:NXR) yesterday (and Synety (LON:SNTY) ), where in both cases a selling overhang prevented the share price rise getting very far after positive announcements. That's a buying opportunity in my opinion, as sellers only last so long - once they are gone, then the price is free to move up.

There's not much news today, so I will recap on a couple of results that I didn't have time for yesterday too.

easyHotel (LON:EZH)

Share price: 92.4p

No. shares: 62.5m

Market Cap: £57.8m

This was a recent IPO, at the end of Jun 2014. I looked at the listing particulars at the time, and was unimpressed. It's too small to have floated, and it's not clear that they have a particularly viable business model. Taking over cheap hotels & splashing a bit of orange paint around pretty much sums it up!

Trading update - for the year ended 30 Sep 2014 gives various details, but the key part says;

Trading for the year ended 30 September 2014 was in line with management's expectations in both its owned and franchised hotels.

My opinion - I'll be interested to read the next set of accounts, due for release on 9 Dec 2014, but I remain sceptical about the valuation for now, which looks toppy. Forecasts are only for £0.8m profit for the year just ended, on just £3.7m turnover. That's a long way from being a serious business.

The shares are likely to be overvalued, because small investors might have a tendency to over-value the Easy brand name, and not do their research properly, assuming that it's a much bigger business than it actually is, perhaps? The IPO almost didn't happen - I can't remember the details, but seem to recall that the terms had to be amended to get it away, due to lack of demand.

T Clarke (LON:CTO)

Share price: 45p

No. shares: 41.4m

Market Cap: £18.6m

There is an Interim Management Statement (IMS) today, covering the period 1 Jul 2014 to 7 Oct 2014. Updates are given on several problems, including an insurance claim (now settled), resulting in a £0.2m exceptional charge. Also, the bank has agreed a formal waiver of the breach in the company's banking facilities, and is maintaining borrowing facilities of £13m. A "sizeable loss" has been incurred on a major account, in order to settle a dispute without litigation.

This whole thing just looks a complete can of worms! So today's RNS reinforces why I avoid building contracting firms. They are low margin, and very susceptible to significant problems emerging with disputed or badly costed contracts.

On the positive side, the order book is at a record high, with further "high value projects" in the pipeline.

On trading the company says;

... we expect a significant reduction in profits in the current year. We now expect to report underlying profits before tax of between £0.5m and £1.0m.

My opinion - it doesn't attract me at all. Note also there is a pension deficit with sizeable recovery payments. With a weak balance sheet, and an unsustainably high dividend yield, I think it's only a matter of time before divis are cut. It's a high risk share, with a much higher than usual risk of insolvency, in my opinion. So personally I wouldn't touch this share. However, it's not bad enough to go on my bargepole list.

For more detail on the figures, please see my report on the last set of interim accounts.

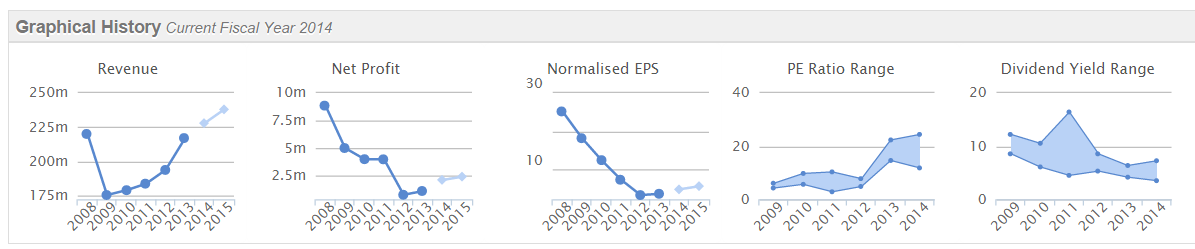

Mind you, looking at the historic graphs below, if this company manages to get back to previous levels of profitability, then it could be in for a big re-rating? So it looks a risky, cyclical share, but with potential upside, if you're prepared to take on the risk of a 100% loss if something goes badly wrong.

ST Ives (LON:SIV)

Share price: 195p

No. shares: 124.9m

Market Cap: £243.6m

This is a printing & marketing group, which issued results yesterday.

Preliminary results for the 52 weeks ended 1 Aug 2014 look impressive at first glance - revenue up 3% to £327.6m, and underlying profit before tax up 17% to £29.4m. That's a reasonable profit margin of 9% of sales, indicating that the company has a product/service that its customers want.

Underlying EPS is up 15% to 18.3p, although I note that there's a big difference between this figure and basic (i.e. unadjusted EPS) of 8.6p, so I would need to carefully check the adjustments to ensure they are sensible, and not getting into the creative accounting space that so many companies seem to seek out.

This 18.3p EPS result is a little ahead of broker consensus forecast of 17.5p, so this might lead to upgrades for the current year (ending 2 Aug 2015) possibly?

Net debt has risen considerably, from £15.2m to £42.7m, due to acquisitions, so it's important to also check how much of the profit growth is organic (thus justifying a higher rating) or from acquisitions (deserving a lower rating).

Balance Sheet - this fails my testing, since net assets of £144.3m reduces to -£22.9m after the substantial goodwill & other intangible assets are written off. I just don't like investing in companies with negative net tangible assets, as they don't have enough financial strength to fall back on when times get hard.

Outlook - this sounds reasonably positive;

The current year has started well and in line with our expectations, with our Marketing Services segment benefiting from the UK economic recovery, from increasing marketing spend by our UK and international clients, and from our own organic growth initiatives.

Overall we are confident that St Ives will make further strategic and financial progress this year.

Valuation - I reckon it might do about 20p adjusted EPS this year, so the shares are on a PER of 9.75, which looks undemanding. Once you factor in the net debt, which is another 34p per share, then the Enterprise Value is 229p per share, so being lazy and not adjusting earnings for interest cost, that increases the PER to 11.5 for the current year, which looks fairly reasonable. That's probably about the right price, given that it's not a terribly exciting business, and may be facing long-term structural decline on the print side of things.

Dividends - these were deeply slashed in 2009, but have been building up again nicely since. The yield is now a reasonably attractive 3.8% forecast for the current year.

My opinion - it looks reasonably priced, probably about right. Bear in mind though that this is a cyclical business, which could lurch back into losses once the next recession happens, as some customers turn off marketing spend when times are hard.

I'm also a bit concerned that management describe their Balance Sheet as strong, when it obviously is not strong! That is either PR flannel, or more worryingly it might show naivety about the appropriate levels of debt to take on when times are good - which could lead to a car crash in future when things go wrong. All just things to consider. Overall I don't have a strong view either way. I can see the attractions, but it's probably not one for me.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions

a fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.