Good morning!

Absolutely loads of results & trading updates today, so I'll get through as many as I can, focusing on the ones that look the most interesting as potential investments. I tend to skim read nearly all announcements, but most can be ignored as there often seems little reason to get involved. It's smashing when you find something good, and overlooked though.

I shall be glued to CNBC later today, as Warren Buffett is appearing on the show at 15:30 UK time. The only drawback of watching CNBC is that you have to listen to their orchestral jingle about 285 times each day!

Interesting comments from Whitbread (LON:WTB) today, with healthy Q2 LFL sales increases at Premier Inns (up 4.3%) and Costa (up 4.0%). Those are very good businesses in my view, and even though this share is rated at 18 times forward earnings, arguably its consistently strong earnings growth justifies that.

The significant increases in Minimum Wage (now being called Living Wage) are very important for investors to consider. Businesses which currently make little to no profit, but have a large, low paid employee base, are clearly going to be worst affected (e.g. supermarkets, and other marginally profitable retailers, pubs groups, etc). Today Whitbread says;

We are developing plans to adopt the recently announced National Living Wage. We shall mitigate this substantial cost increase over time with a combination of productivity improvements, boosted by investment in systems and training, efficiency savings and some selective price increases. We shall announce more details of our plans with our Interim Results on 20 October 2015.

I think the big rise in wages for the lowest paid (which I very much welcome incidentally) will really sort the wheat from the chaff, and may well weed out some struggling businesses. That's life I'm afraid. If you can't afford to pay your staff enough to live on, then you shouldn't be in that business. Anyway, it's an important topic for investors to consider, as it's bound to be a drag on earnings for some companies.

Somero Enterprises Inc (LON:SOM)

Share price: 140p

No. shares: 56.1m

Market cap: £78.5m

(at the time of writing, I hold a long position in this company)

Interim results to 30 Jun 2015 - this is an American company, listed on AIM since 2006, which makes laser-guided concrete screeding machines, and seems to be the global leader in its niche. I don't normally touch foreign companies on AIM, but American ones are alright, if they've been around for a while, and are proper businesses (not blue sky). If they pay a divi too (which SOM does), then even better.

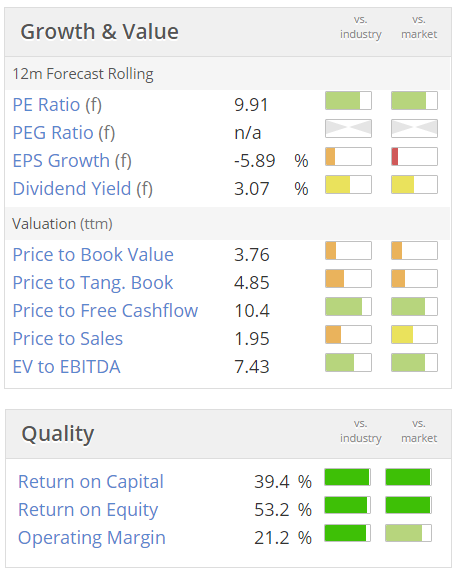

It's one of my favourite GARP shares, being apparently overlooked, and mispriced in my opinion. Stockopedia's computers agree, with a StockRank of 99. I should add that it's a highly cyclical business, which might explain some investor reticence to take the shares higher, perhaps?

The company reports in US dollars, and these figures look good. Key numbers;

- Revenue up 20% to $35.3m in H1

- Pre-tax profit up 29% to $8.2m (note strong net margin of 23.2%)

- Tax has normalised at 34.6%, compared with negative tax charge of -28.8% last year, which flattered last year's earnings.

- Adjusted diluted EPS has risen from 8c to 11c.

Narrative - key points;

Growth mainly came from the USA (their biggest market, 68% of total) and the M.East.

China - "market conditions have stabilised, but remain challenging for now"

Reiterates that China has potential to "...become a significantly larger contributor to our growth in the future...". "Concrete College" in Shanghai opening in Q4 2015 - driver for growth.

Net cash of $9.0m, c.10.5p per share

Balance Sheet - really solid. Current ratio of 2.93. Negligible long-term creditors (a $1.1m mortgage only). As it's a very cyclical business, they need a strong balance sheet, to be able to survive downturns, so this is essential.

Dividend - interim divi raised 27% to 1.9c (5.8 times covered by diluted adjusted EPS)

Cashflow - absolutely fine, no issues here.

Outlook - positive;

"Somero Enterprises, Inc. is pleased to announce the healthy trading momentum referred to in recent trading updates has continued. Revenues for H1 2015 increased 20% compared to H1 2014 driven by growth in our main regions and led by particularly strong activity levels in North America and the Middle East. We remain encouraged by trading early in H2 2015 and will continue to invest selectively in measures aimed at supporting growth into the medium and longer term. The Board is confident Somero will deliver another strong performance this year in line with latest market expectations."

Valuation - this share is far too cheap, in my opinion. However, a big caveat on that - my view is based on an opinion that Western economies are likely to see accelerating GDP growth, more than offsetting contraction in China. So I'm thinking in terms of Somero enjoying maybe 4-5 years of continued strong growth.

If I'm wrong about that, and the US goes into a recession, then these shares could drop heavily. Just look back at what happened in the 2007-8 financial crisis - orders dried up, and the company was in trouble. I think it's in better shape now than then, to weather any storm, but this is one of the last shares you would want to be holding when America is building up to the next recession.

Look at the quality scores below, and then consider that you can buy this for a forward PER of under 10, and with a bang up-to-date positive trading statement too. I think it's a tremendous bargain, but as always that's just one person's opinion, and of course like everyone else, I make plenty of mistakes.

Conviviality Retail (LON:CVR)

Share price: 188p (up 21% today)

No. shares: 66.9m before Placing +86.7m Placing shares +1.3m Warrants = 154.9m after Placing

Market cap: £291.2m after Placing

Acquisition & Placing - I reported here on 13 Jul 2015 about Conviviality's mooted takeover of drinks wholesaler Matthew Clark (Holdings) Ltd. Well, the deal seems to progressing, but since it is such a large acquisition, it's treated as a reverse takeover under AIM rules, and will therefore require shareholder approval at the meeting scheduled for 24 Sep 2015. I imagine that is just a formality, as it looks good deal, plus the company says today that it already has 63.6% support for the vote.

CVR is also taking on a substantial amount of debt, £80m, together with the Placing shares this will fund the £200m Enterprise Value being paid for Matthew Clark.

MC is a substantial business - turnover of £811.2m in the most recent year (to 28 Feb 2015), and EBITDA of £25.3m.

Note that one of the joint vendors is Punch Taverns (LON:PUB) and it's amusing to see how the deal is described by the buyer & seller. The buyer is keen to show what a great deal it is, so they quote EBITDA (the highest profit measure). Whereas PUB quote post-tax earnings (the lowest profit measure!) of £7.8m for its 50% share of the business (and using a different year end date too).

So doubling up Punch's earnings figure to get 100% of the business, it's earnings of £15.6m, so at £200m the buyer has paid about a PER of 12.8 times. That sounds reasonable to me.

(please note that at the time of writing, I hold a long position in Punch)

It certainly makes CVR a considerably bigger and more interesting business, so it will be interesting to see how the bigger group pans out. With more than half the shares having just been issued at 150p, there's no way I could bring myself to buy in the market at 188p today. Flipping of the shares by participants in the Placing, for a quick profit, could hold back the shares price in the short term perhaps?

Forecasts - a broker today says they estimate 18.3p EPS for the enlarged group, in the first full year of trading for the bigger group. So that puts the current PER at just over 10. That may seem low, but it's probably about right, given that there will also be a significant amount of debt to factor into the valuation too.

Cambria Automobiles (LON:CAMB)

Share price: 74.7p (up 8.3% today)

No. shares: 100.0m

Market cap: £74.7m

Trading update - another positive update from this growing car dealership chain;

The Board is pleased to report that the Group has continued to perform well in the second half of the financial year and that the results for the year to 31 August 2015 are expected to be ahead of revised market expectations.

Of course, there's a very favourable macro picture for car dealers now. Not only an improving economy, cheaper imports from Europe, but perhaps most importantly ultra-low interest rates.

I'm currently looking to update my 15 year-old Jag, as the repair bills are starting to mount, and whilst it hasn't yet broken down, I don't have full confidence in it on long journeys. So I was looking to buy something fairly modest, maybe 5 or 6 years old. Then an ad for personal leasing caught my eye, and the cost to lease a brand new car is now amazingly affordable - think £200-300 per month for a very nice, brand new car.

So I can very much see why new car sales are booming. Car dealers make very little profit on new car sales, but they benefit from owners nearly always getting the car serviced at the same dealer they bought it from, at least for the first few years. Used car sales are also correspondingly buoyant.

Valuations are still reasonable, and maybe the music will keep playing for some time to come? There's strong asset protection at CAMB and several other car dealerships too, so your downside is protected by the balance sheet strength, and paying a PER of 10 or 11 is hardly racy, even allowing for the fact that current market conditions may not remain this positive forever.

Unfortunately, my pick in the sector, Caffyns (LON:CFYN) has been the dog of the sector. I went for deep value, rather than growth & value, which so far hasn't worked. Whilst annoying, that does mean that its shares might play catch up, at some point, who knows?

Character (LON:CCT)

Share price: 517p (unchanged)

No. shares: 20.9m

Market cap: £108.1m

Trading update - it's so annoying when companies put out trading updates during market hours. It's totally thoughtless, and causes investors unnecessary stress, forcing us to rapidly assimilate and interpret price sensitive information whilst the market is open. It also gives traders with more sophisticated IT an unfair advantage against private investors who might be busy with their day job. So a big thumbs down for putting out this announcement at 11:49 today, instead of the proper time of 7:00, when everyone has an hour to read & interpret the announcement before markets open - i.e. a level playing field.

Anyway, the update reassures;

The Directors are pleased to report that trading for the financial year to 31 August 2015 has been satisfactory and that the Board fully expects to deliver a year end result in line with market expectations.

Valuation - broker consensus is for 38.8p EPS, so that puts them on a PER of 13.3, which looks quite good value still, providing earnings are sustainable at that level or higher.

My opinion - I don't have a strong view either way any more, as I've recently banked my gains here and moved on. The shares were strikingly cheap around the 200p where I was flagging them here as an opportunity about a year ago.

The price has risen over 150% in the last year, reflecting the company's strong performance. I don't know whether there will be further share price rises or not. The StockRank is very high, at 98, which points towards the probability (but not certainty!) that the price might possibly have further to rise.

The company today reiterates that it is continuing with its share buyback scheme, which has been helpful in soaking up sellers (of which the biggest was the retiring Chairman), who I think is now out, or nearly out of the shares.

So it's been a very successful share to hold in the last year. As I'm typing this, I see that the share price has slipped slightly, down to 505p, so maybe some holders were hoping for an out-performance statement instead of an in line one?

McBride (LON:MCB)

Results y/e 30 Jun 2015 - just a quick comment, as I'm running out of time. These figures look really good - a convincing turnaround is clearly underway at this previously struggling maker of private label household & personal care products.

Whilst turnover fell 5.4% to £704.2m, adjusted operating profit rose 29.5% to £28.5m.

Adjusted diluted EPS rose 56.6% to 8.3p, which is clearly excellent.

Dividends - have been reset to a lower level, which makes sense. I have warned readers here in previous reports that the divis at McBride looked unsustainably high, given its weak Balance Sheet, and I've been proven right. It's a mistake to chase high yields, without properly considering whether those high divis are sustainable - often they are not, especially when a company has a weak balance sheet.

Net debt - still looks too high to me, at £92.4m. Worryingly, the narrative says that the Directors consider this level of debt to be "conservative"! I think they're deluded, and it would really worry me investing in a company where management don't seem to be aware (or want to admit anyway) the inherent risks of running a fairly big company with a weak balance sheet that is too reliant on bank debt.

Pension deficit - rose slightly to £29.8m

Turnaround action - the narrative reads very well - they seem to have a coherent strategy to improve profitability, and it's clearly working. The plan is called "Repair, Prepare, Grow". The crux of this strategy seems to be simplifying the product range, and focusing more on the top 20% of customers. Cost cutting, pushing harder on purchasing, and reviewing under-performing parts of the business.

So in other words, they're starting to do the basics of running a business somewhat better! Which begs the question, why was the business allowed to become inefficient previously?

My opinion - this looks a convincing turnaround, so I can see the appeal. However, that has already been reflected in the share price recovery, and I don't like the weak balance sheet here. So it's not for me, but well done to the company & shareholders on a successful turnaround. I wouldn't be surprised to see these shares push higher, after pausing for breath.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.