Good morning/afternoon! Running a bit late today, due to the rip-roaring success of our Brighton ShareSoc investor evening last night. Thank you to everyone who came along, I'm sure everyone would agree that it was an interesting, friendly, and fun evening. My thanks also go to John McArthur of Tracsis (LON:TRCS), who gave a very interesting talk, not just about his company, but also about his impressions of AIM generally.

Some very useful tips in there about how to interpret trading statements, and the importance of reviewing the major shareholder list to look for shrewd Institutions - they've done the research for you, is his argument, something I agree with providing you follow the right ones! Not all Institutions are shrewd - some make remarkably bad decisions, and it can be their clumsy selling that hands us bargains on a plate!

This is particularly relevant, as Stockopedia are close to launching a new Ownership Module, which will be an add-on, giving analysis of major shareholders, and what particular fund managers are doing, etc. I've seen some previews of it, and it looks fantastic, I genuinely cannot wait to get my hands on it!

Volex (LON:VLX)

This is the electrical cables manufacturer. I dumped my shares in Volex in Nov 2013, because their interim results were far worse than I had expected - turnover was down 21.2% to $196.5m, and underlying profit was only $0.1m, so efffectively just at breakeven. Also, net debt had shot up to $41.4m, and it seemed obvious to me that the company would need to raise fresh share capital to reduce net debt. The company denied this, saying that their finances were fine. Then shortly afterwards in Dec 2013, they did raise some extra cash in a small Placing!

Based on their Edison forecasts, the company looked set to breach, or at lease come very close to breaching their net debt to EBITDA covenant. Hence I was very happy to exit from this share, which is now too high risk for me.

It seemed astonishing to me that the market brushed aside all these concerns, and the share price went back up to the 110-120p range, as if nothing had happened. People just ignored what were far worse interim results than expected. Apparently this was due to a highly polished series of presentations, where brokers and investors were convinced that the recovery plan would bear fruit.

So that sets the scene (as I see it anyway!), so let's take a look at today's trading update from Volex, pertaining to the year ended 31 Mar 2013.

It says that revenues were stronger in H2 than H1 (reversing the usual trend). However this has been achieved by lowering prices, which has hit gross margins and operating profit. Oh dear. So this sounds like another profit warning, although the next sentence appears to contradict that:

As previously announced, underlying operating profits in the year ended March 2014 will be materially lower than prior year, but within the range of market expectations.

I'm not sure what the range of market expectations are, so this isn't a terribly helpful announcement.

I'm not sure what the range of market expectations are, so this isn't a terribly helpful announcement.

EDIT: A reader has kindly pointed out that the trading update indicates the following in the notes (which I missed when I read the RNS the first time, my apologies).

Would have been a good idea for them to have put a (note 1) mark in the main body of the RNS.

(Memo to self: Make sure you read the whole RNS, including any footnotes!)

The Board believes current range market forecasts for Revenues and EBIT for the year ended 30 March, 2014 are: -

· Revenues: $390m to $400m with a consensus of $395m

· Underlying operating profit: $4.5m to $7.0m with a consensus of $5.9m.

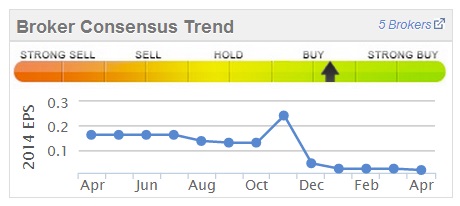

Although as you can see from the Stockopedia chart above right, broker consensus for EPS forecasts has been steadily reducing over the last year, and looks to be just above breakeven. So my guess would be that the company is bumping along at breakeven or a small loss.

It's rather difficult to reconcile these facts with the PR talk about the progress they claim to have made with the grandly named Volex Transformation Plan.

As far as I can see, they are operating at breakeven, in a highly competitive market, where they are having to cut their prices to remain competitive. Therefore the investing case that a return to previous operating margins would make the shares worth multiples of the current price is looking very shaky in my opinion. It's more likely perhaps that previous high margins could now be unattainable? There must be thousands of other companies in Asia that can churn out electrical cables, and are prepared to do so on a wafer thin profit margin.

Net debt of $33m is lower than last reported, but I note the fall of about $8m is less than the $11m they raised in the Dec 2013 Placing. So it looks to me as if the business is not generating positive cashflow at the moment. That could put pressure on the bank covenants again.

The shares are down 10p to 98p today, and in my view the market is still being generous with the valuation, which is currently about £63m market cap. That's a lot for a company that's scraping along at breakeven, and has a fair bit of debt. I think another fundraising is on the cards, and can't see enough upside to tempt me back into these shares. I might take another look if & when there is some real progress on the turnaround, reflected in improving profits, as opposed to just talk of a turnaround.

Bond International Software (LON:BDI)

Next I've been looking at the results from this Personnel & Payroll software group. It looks quite interesting, but on balance I've probably missed the boat. It's a share I held on & off a while back, when it was about 30p, but I got bored & moved on, which is a pity because they have since tripled in price!

It's fundamentally a good company in my view, and on a number of occasions other companies have mentioned they are upgrading their HR systems, and when asked which system they are installing, it's nearly always Bond. Interestingly, they in those conversations people usually tell me that they've held back on IT spending in the last five years, so now really need to take the brakes off and upgrade their creaking & groaning systems. So Bond are clearly in the right place, and this is the right time in the economic cycle too.

I've crunched the numbers in their calendar 2013 preliminary results, published today, and am happy with their definition of adjusted profit. The adjustment principally relates to stripping out amortisation of goodwill, which is fine by me.

I've crunched the numbers in their calendar 2013 preliminary results, published today, and am happy with their definition of adjusted profit. The adjustment principally relates to stripping out amortisation of goodwill, which is fine by me.

However, as I often mention here, you have to be terribly careful with software companies, as they also try to steer investors towards ignoring amortisation of internal development costs, which of course then leads you to over-value the shares!

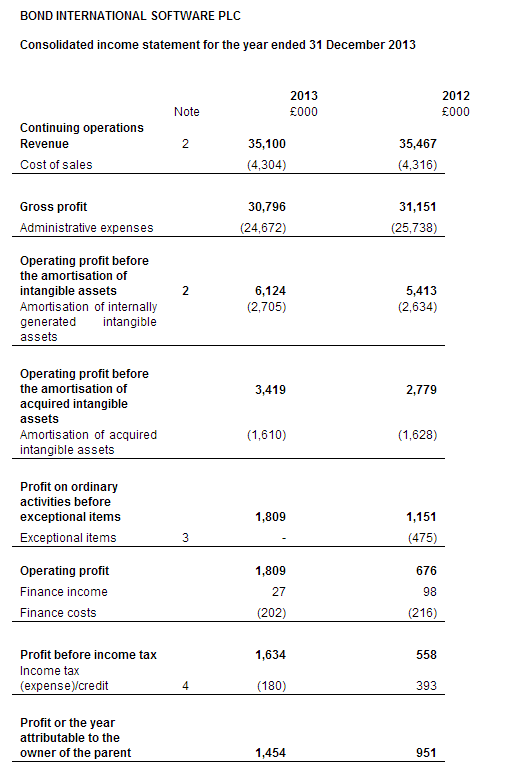

In this case the profit & loss account (copied on the right here) shows no fewer than six versions of profit! I might be tempted to scoff at that, but it's actually very helpful.

My preferred measure is the £3,419k operating profit before amortisation of goodwill. Take off say £200k finance cost, and notional tax of 20%, and I make that earnings of about £2.6m the way I look at things.

So at about £35m market cap, that's a PER (on my definition of normalised earnings) of about 13.4, which actually looks quite good value. That works out at about 7p EPS. The company reports adjusted EPS of 6.6p in the narrative, so it looks like I'm in the right ballpark with my figures.

The dividend has been increased 22% to 2.2p, for a yield of 2.3% at 95p per share.

The outlook statement sounds positive;

The board has been encouraged by the start to 2014. Trading conditions are good in the major markets in which we operate and we believe the group is well placed to benefit from the ongoing economic recovery. The acquisition we announced today will complement our payroll bureau operation by allowing us to offer international payroll solutions to customers and prospects alike.

The Balance Sheet is OK, but net tangible assets are rather light, at just £3.3m, although with strong recurring revenue streams, Balance Sheet strength is of less importance.

On balance, I can't bring myself to buy after such a big rise in price, although must admit to being tempted. It's certainly going on my watch list, and I'd be a buyer on any sharp pullback.

Seaenergy (LON:SEA)

Two things to report here - firstly that the shares have apparently been re-tipped by influential value shares writer Simon Thompson, of Investors Chronicle. He's written some excellent, really thoroughly researched stuff on Sea Energy before, so I look forward to reading his latest piece shortly.

Secondly, the company has issued news about paying the final earn-out to the vendors of its subsidiary R2S. In my opinion, R2S is very much the (obscured) jewel in the crown of this group. It is a niche software company which takes 3D photographs of assets such as oil rigs, then integrates the maintenance records of that site into the pictures. So users can utilise this software for all sorts of training & planning purposes, from a remote location.

This is the first time I can recall SEA setting out clearly just how well R2S is performing;

As confirmed in our preliminary results for 2013, R2S exceeded the earnings' target which triggered the maximum earn-out payment. In the year to 28 February 2014 the SeaEnergy subsidiary, R2S produced an EBITDA of £2.8 million, well in excess of the £2.5 million required for the vendors to earn the maximum final earn-out payment of £4.6 million.

SeaEnergy has elected to settle a portion of this payment through the issue of 905,440 new ordinary 10p shares in the Company, with the balance of £4,284,001 being settled in cash today.

I don't like EBITDA being used, and would much have preferred operating profit being quoted, but seem to recall that there's not a huge amount of intangibles being capitalised here, the question was asked at one of several meetings I've attended where the company did presentations.

Other important points to note, is that this will use up substantially all of SEA's cash reserves, so it should now be viewed as more-or-less cash neutral. Also, the amount of new shares issued is relatively small, so should not create an overhang.

With 56.36m shares in issue, and at 37.75p current share price, that's a market cap of £21.3m.

Unusually, SEA also owns about 20% of Lansdowne Oil & Gas (LON:LOGP), although that's been dropping like a stone, so is only worth about £4m now. Still, it's a useful bonus, and who knows that could deliver some value at some point. Although the only real value in the group at the moment is R2S in my view. In fact, I would like to see everything else got rid of, and SEA become simply R2S - the market would then get excited about the growth, and probably put it on a growth company rating.

However, providing they don't burn up too much cash on the other activities, I can live with management trying to develop them.

Well, I do apologise for the leisurely pace of today's report, but got there in the end!

See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SEA, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.