Good morning,

Quite a few updates today, so I'll try to prioritise those which are most significant (results vs. trading updates) and then see what's left.

Paul is away for a week but has rather dangerously brought his laptop with him!

Cheers,

Graham

Brainjuicer (LON:BJU)

Share price: 730p (unch.)

No. shares: 12.2m

Market cap: £89m

Unaudited results for the twelve months ended 31 December 2016

My third time covering this in as many months.

This share was sitting at 530p when I covered it in December - I've been watching it all the way up! But I think some of you have been participating in the rise, in which case congratulations are in order.

As was well-flagged by prior updates, PBT (profit before tax) comes in at £6.2 million, while net income almost reaches £4 million.

Remember that results are somewhat flattered by a GBP short exposure: gross profit is up by 27% at reported currency, or 15% in constant currency. It has heavy USD exposure, which also contributes to a higher tax charge than might otherwise be the case.

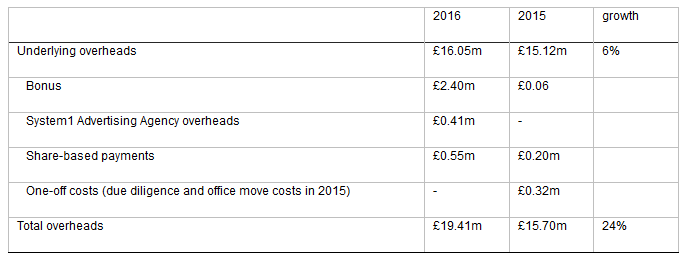

A helpful costs table is provided, so that we can see the non-underlying overheads (I tend to think of them as underlying, but at least the breakdown is fully transparent). Note the bonuses and share-based payments:

Guarded, as per usual:

We will continue to focus on our core products, particularly Ad Testing and Brand Tracking where we are beginning to get a foothold in large clients. These products are comparatively easy to grow and scale, and they also provide more revenue visibility than our other products. Nevertheless, our business still remains predominantly ad hoc, with limited revenue visibility, and as always we need to acknowledge that we cannot predict with very much certainty how revenue growth will unfold over the coming financial year. Having said that, we are pleased with the continued progress across the business and remain confident in its long-term potential.

Cash flow

Net cash generated from operations (pre-tax) was a very healthy £8.4 million, but the difference between that and the PBT figure is mostly accounted for by a working capital movement along with the use of share-based payments and FX gains (see footnote 7). So I personally would not read too much into the large cash flow figures given, from a company valuation point of view.

My opinion

The cash balance at almost £8 million leaves an enterprise value of £81 million, or about 20x net income.

When the market cap was £60 million (enterprise value £52 million), I said I was inclined to think that valuation provided sufficient compensation for the lack of earnings visibility. Most revenues are still ad hoc, after all, and it is very hard to predict contract wins.

Today's valuation, however, does not leave all that much margin for error.

Ashmore (LON:ASHM)

Share price: 337p (+6%)

No. shares: 713m

Market cap: £2,400m

I flagged this up last month after its quarterly Assets under Management announcement, which showed AuM falling against the prior quarter (but up 5% versus 12 months prior).

I still think this is worth a look, for all the reasons mentioned last time.

It's highly cyclical, as an emerging markets fund manager will inevitably be, but that means plenty of opportunities for the market to get the valuation wrong.

Today's results show that revenue generation remains considerable here:

- Net revenue up 24% to £144 million, comprising management fees of £115 million and performance fees of £22 million.

Even better, the managers continue to do very well against their benchmarks. The index fund is perhaps not yet the best solution for every investor!

- 91% of AuM outperforming benchmarks over one year, 81% over three years and 86% over five years (30 June 2016: 69%, 63% and 73%, respectively)

Besides generating fees on client funds, Ashmore invests its own capital to seed new funds: this seed capital generated gains of £26 million in the period.

Put all of the above together and you get PBT of £121.5 million.

Market Review: One of the reasons I follow Ashmore and other fund managers is that they are at the coalface of financial markets - so I tend to trust their perspective on macro-economics.

In terms of reasons why Ashmore might be worth further research, consider their view on emerging markets:

"Valuations remain

attractive both in absolute terms and relative to alternatives in the

developed world, and there remains a supportive technical position with

investors significantly underweight or not exposed to Emerging Markets."

That part in bold is key for me - asset allocators are notorious for trend-following, and they will come back to EM in response to strong returns.

Balance sheet: very strong. Cash generation is highly reliable. No concerns at all on this front.

Dividend: the interim divi is maintained at the same level since Q2 2015 - hopefully we will see a divi increase here before too long. The yield is excellent all the same, at 4.9%.

My opinion: This is on my watchlist, and I'd consider buying for my personal portfolio when I have spare capacity!

Innovaderma (LON:IDP)

Share price: 160p (+26%)

No. shares: 11.8m

Market cap: £19m

By request, I'll briefly mention this one (not something I've looked at before).

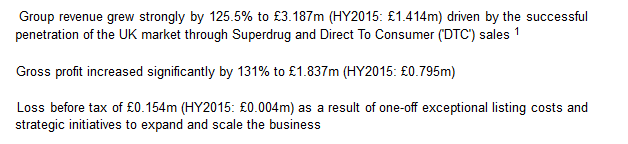

The financials look promising to me, with good gross margins of 57%, very strong revenue growth and operating close to breakeven:

It's a fast-moving story with Superdrug increasing the scale of their distribution, a US launch in November just past, new hair care products being developed, etc.

Outlook

There is a second half weighting here, presumably due to cyclical demand for tanning products?

Outlook for the rest of the year:

The Board is pleased with the current direction of the

business and confident of delivering further growth during the remainder

of the year.

My opinion

With cash at £0.7 million, at first glance this looks to me as if it is fully funded to break into profitability - the most important initial test.

Having passed that test, I would then need to do a bit more research into the popularity and potential of the brands. I'd also like to understand the company's history and the background to its listing in London last September - it appears to have delisted from France.

Worth a second look, I think.

Water Intelligence (LON:WATR)

Share price: 133p (+6%)

No. shares: 12m

Market cap: £16m

Q4 Trading Update and Year-End Corporate Items

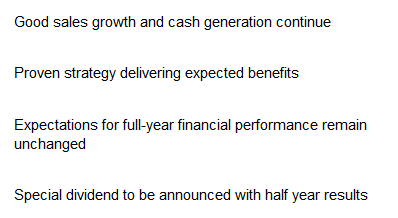

This primarily US-based leak detection and fixing business has been going from strength to strength over the past year, culminating in the following Q4 trading update:

The Company's strong financial performance referred to in the Q3 Trading Update on 21 December 2016, continued for the remainder of 2016. Revenue growth exceeded market expectations within all sales channels, including newly acquired UK-based NRW Utilities, with total revenues for the year of $12.2m (2015: $8.8m) with adjusted profit before tax in-line with market expectations.

Costs rose due to a UK acquisition and a few other activities which are not ongoing, so hopefully 2017 will be even better.

Profit margins are expected to grow during 2017 with a full year of trading from the 2016 acquisitions, together with continued organic growth.

There's another small bonus for investors as the company announces that it will release final results on or around 9 May. Last year, investors had to wait until June to get the figures, which is far from ideal.

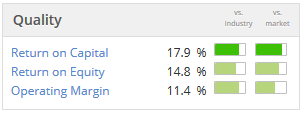

I discussed this company last year and noted the high returns achievable through its franchise business model - see the strong return on capital metric from the Stocko graphic:

DFS Furniture (LON:DFS)

Share price: 230p (+0.3%)No. shares: 211.5m

Market cap: £486m

This share doesn't get mentioned often on these pages but might be of interest for those who follow the home improvement sector.

Thing are going well at DFS:

According to my source, brokers are predicting PBT for this financial year (ending July) to be flat at £64 million.

In that context the net debt is manageable, last reported at £137 million or 1.45x EBITDA.

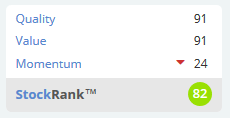

Quality and Value ranks are both excellent:

That's all I've got for today, thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.