Good morning! I've not had a great start to the week, as I failed to save my work & have just lost this morning's report, so will have to start again. Drat!

For anyone who hasn't seen it already, I wrote part 1 of a 3 part series of articles, on the London Value Investor Conference which I attended a fortnight ago. Part 1 is Jon Moulton's speech, the renowned Private Equity investor behind Alchemy Partners, and Better Capital. I think his speech was full of great insights, so it's worth a read - click here for my article.

Parts 2 & 3 will follow when I can find some spare time, probably next weekend.

Fairpoint (LON:FRP)

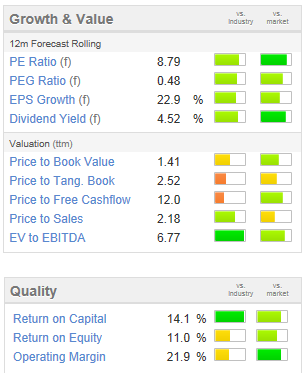

Shares in Fairpoint have looked cheap for a long time, and certainly on the forecast numbers look to be one of the best value shares in the market, as you can see from the many green bars on the usual Stockopedia graphics on the right.

Shares in Fairpoint have looked cheap for a long time, and certainly on the forecast numbers look to be one of the best value shares in the market, as you can see from the many green bars on the usual Stockopedia graphics on the right.

In particular, the low PER and high dividend yield look attractive.

Whenever you find a low PER stock though, the first key question to ask is whether earnings are sustainable? In fact that's the key question to ask about all stocks!

In this case, the company is up against several headwinds, with the core business seeing declining activity as the last vestiges of the credit crunch work their way through the system.

There again, business could pick up again in future perhaps, when zombie owner-occupied households come under pressure from interest rate rises, making mortgages unaffordable. In the worst case scenario, if there's a run on sterling and interest rates have to be hiked up enormously, then it would be absolute carnage, with half the country going into negative equity, and many households facing repossession. I find it astonishing that people so blithely take on huge mortgages that they could never possibly afford to repay from their income, but just assume that capital value will keep rising forever.

Another line of business that Fairpoint operate in, PPI claims against banks, clearly has a finite lifetime, and is presumably now also in decline.

I'm not keen on the business areas that Fairpoint chooses to operate in - making money from debt advice is morally questionable because there are free alternatives available through charities. Although it should be emphasised that Fairpoint seem to be operating properly, and a lot of cowboy operators were pushed out of the sector when it was overhauled a few years ago, with rules on fees agreed with the banks.

On current trading Fairpoint today says, in its AGM trading update;

Overall Group trading is modestly ahead of the same period last year during the historically quieter first four months of the year...

...although overall activity in the early part of the year has been relatively subdued, as claims activity relating to existing IVA clients reaches maturity.

So the business is looking for other ways to expand. Thankfully they rejected the idea of payday loans some time ago (why did they even consider it?!). Debtor books have been acquired from other companies, and most recently a £20m acquisition of a legal services company is being done. I'm not sure exactly what that involves, but presumably it's some kind of ambulance chasing activity - compensation after accidents perhaps? It all rather fits a mould of rather unsavoury activities, and that very much puts me off wanting to invest in these shares. It all feels a bit grubby to me.

There again, there can come a price where something is so cheap that you hold your nose and buy. I don't think this is quite cheap enough to tempt me in on that basis.

Also, I've found that very often ambulance-chasing companies make poor investments. Albermarle & Bond recently went bust. Accident Exchange was a disaster a few years ago. Prior to that, several debt management companies were on the stock market and were disastrous investments. Hence many investors are rightly wary of companies involved in any type of ambulance-chasing activities. I've been a long term bear of Quindell (LON:QPP) for much the same reason, as their core activity is basically ambulance-chasing, although they go to great lengths to obscure that fact.

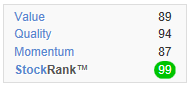

N ote that Fairpoint scores extremely high in Stockopedia's excellent StockRanking system, which I will be relying on a lot more, after watching Ed's excellent webinar last week explaining how it works.

ote that Fairpoint scores extremely high in Stockopedia's excellent StockRanking system, which I will be relying on a lot more, after watching Ed's excellent webinar last week explaining how it works.

I'm certainly impressed with the results from this system, and have developed my own stock screen using it, which I'll probably do an article about when time permits.

In particular note that the "Momentum" rating is not just about price momentum. It also covers earnings momentum, i.e. broker upgrades, out-performance against forecast at results time, etc. So it's far more useful that I previously realised.

Latchways (LON:LTC)

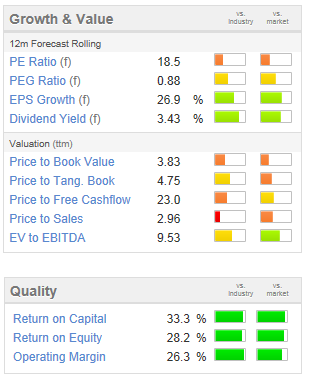

Latchways makes niche safety equipment, and is a high quality business that I would very much like to invest in. It has a strong operating profit margin, a ridiculously strong Balance Sheet, pays good dividends. However the share price is too high, so I haven't had an opportunity to buy any at the right price.

There was a profit warning some time ago, but even so the share price remained stubbornly high on a PER basis. The company has today issued prelims for the year ended 31 Mar 2014. They've come in slightly above expectations, with EPS down from 70.3p last year, to 50.7p this year - clearly not a good result. So the question is whether they can recover from this poor year, or whether there is something more structural going on - maybe competition eating away at their market share, etc?

Broker forecasts sugges that EPS will rise to about 61p this year, but even then the shares look pricey on a PER of 18.4 times. The strong Balance Sheet contributes to the valuation, so I would be prepared to knock off about 2 points from the PER to allow for that.

Prospects sound encouraging, although current trading doesn't sound as if there's much recovery underway;

Despite the challenging conditions in our core markets that we talked of earlier in the year, we are encouraged by the current level of prospects across the business. Underlying order intake in the first two months of the year has been in line with the same period last year and we will make further progress as our new sales resources and North American operation start to contribute

The "prospects" section of today's report also makes encouraging noises about future growth, but personally I'm not inclined to pay up-front for growth which is uncertain at this stage, so unfortunately it's not for me at the current price. If they warn on profit again, then that would probably be the time I'd pick up some stock, but it would need to be about 600-800p before I'd get interested.

Note how Latchways (LON:LTC) scores very highly in the Stockopedia "quality" measures, but looks expensive on the valuation measures, which reinforces my view of the company as good, but too expensive.

Coms (LON:COMS)

I've not looked into what this company does, but looking at their website it's something to do with telephony, and the cloud.

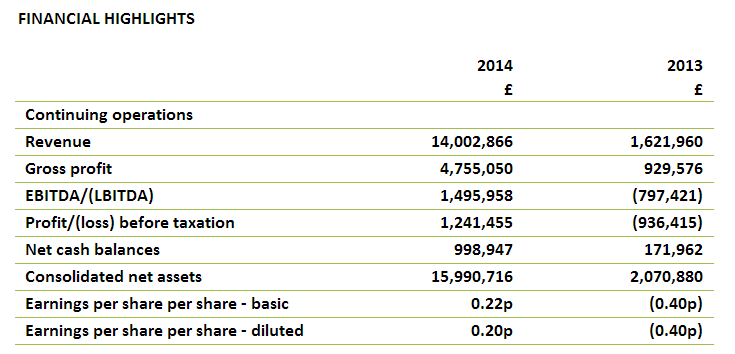

The financial highlights from today's results (for the year ended 31 Jan 2014 (shown on the right) look very impressive, but bear in mind several factors.

The financial highlights from today's results (for the year ended 31 Jan 2014 (shown on the right) look very impressive, but bear in mind several factors.

Firstly the growth has been achieved through acquisitions.

Secondly, EPS is inflated by a £415k negative "finance costs" line, which would need checking. Also there is a tax credit of £117k which boosts earnings.

Receivables of £8.7m looks extremely high, but that might be because of the timing of the acquisitions? (i.e. the P&L might only include part-year figures, whereas at the year end the Balance Sheet shows the full figures on that date).

It's always difficult to interpret the numbers when acquisitions or disposals skew them.

The Balance Sheet overall is on the weak side, with only just over £1m in net tangible assets.

The biggest issue is that at 6.2p the market cap is almost £60m, which is not very well supported by today's figures in my view. Although I would need to see a proper set of figures for a whole year (or at least half year) to fully understand the company's trading, and hence to value it.

Note that they quote the dreaded EBITDA prominently, which is always a good warning sign to check the cashflow & Balance Sheet for the costs that they are capitalising, or classifying as exceptional or adjusted! It's a real game of cat & mouse these days between investors and companies, trying to unpick all the things they have done to exaggerate the true trading performance.

The outlook statement contains possible seeds of a future profit warning;

Having reviewed current trading, commercial prospects and with regard to the cost of on-going integration initiatives I am pleased to report that the Board remains confident that the current 2014/15 market estimates for the full year revenue and profit before tax remain valid. However it is anticipated there will be a carry over of one-off re-organisation costs, which may impact performance in the first half of 2014/15 but which will be fully recovered in the second half of 2014/15 ensuring we perform in line with current market expectations

So the old H2-weighted year thing. I don't like that. It quite often leads to a subsequent profit warning.

It might be an interesting company, but the market cap is too high to make it worth my while doing any more work on researching it. I usually look for figures that I can hang my hat on, in valuation terms, not future expectations.

Sanderson (LON:SND)

Interim results from this software company look OK, although they rely on highlighting acquisition costs & other costs in order to produce an underlying profit increase.

It still looks pricey to me, as the growth seems to be coming from acquisitions rather than organically. There is also a pension fund deficit which is sucking out a fair bit of cashflow - £677k in the last full financial year, and £180k this H1.

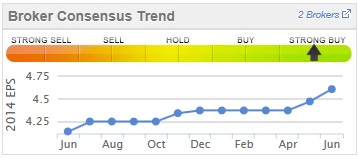

On the plus side, I see that broker EPS forecasts have been steadily increasing, and this has pulled down the forecast PER to a reasonable level.

The StockRank score of 89 is high.

On outlook the company says;

The Board remains focused on the continued development of Sanderson. The economic environment, whilst showing clear signs of improvement, is still characterised by historically low levels of investment in capital products and with sales cycles still being protracted, the Board intends to maintain a cautious approach. However, the Group's strong order book, improved market position and the two recent acquisitions provide the Board with an expectation that Sanderson will continue to make significant progress during the current financial year ending 30 September 2014.

Gotta dash now, but a few quickies;

Falkland Islands Holdings (LON:FKL) results look quite good, but the valuation is a bit too high for my liking, given the potential political/military risk.

Grafenia (LON:GRA) - This printing company has reported profits down against last year, and the dividend has at last been reduced, as it was no longer covered by earnings. They sound optimistic, with a caveat. If they can generate growth then the shares are cheap. If they can't, then they're probably priced about right, or maybe even too expensive? Tough call, but the company has seemed stagnant for a long time, so on balance I would need to see much stronger evidence of growth returning before wanting to buy any.

Distil (LON:DIS) - formerly Blavod Black Vodka. If a story gets stale, change the name! That's what both the last two companies have done. Figures look poor here, I don't think they have a viable business. Lifestyle company maybe?

Gotta dash, see you tomorrow morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

NB. For the avoidance of doubt, Paul is NOT currently short of QPP).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.