Good evening. My apologies for today's report being so late. As I mentioned on Twitter, this was due to breakfast having an adverse effect on me.

We don't want any gaps in the series, so I'll belatedly have a run through today's results & trading updates.

Tungsten (LON:TUNG)

Share price: 173.5p

No. shares: 103.5m

Market Cap: £179.6m

Market update - the battle between bulls and bears continues at this e-invoicing & invoice financing company. There was a very peculiar flurry of trading activity late Fri afternoon, which saw the shares spike a lot higher at the close, from 155p to about 170p. This struck me as suspicious, and it looks particularly suspicious now that a positive update was announced first thing Mon morning. So clearly those trades need to be investigated by the FCA as it very much looks like illegal insider dealing.

Today's update says that Tungsten Bank will now be taking deposits, to help fund its invoice discounting service;

My opinion - today's news seems to partially undermine the bear case against Tungsten, since the bears asserted that Tungsten had made a mistake buying a bank unnecessarily. If Tungsten Bank is successful in attracting deposits, then it will provide the company with very cheap funding for its invoice discounting product. This appears to be on top of the funding already in place from Insight, which is said to be several $billion.

I'm currently sitting on the fence with regard to this share, awaiting more firm evidence that there is a viable business here before considering whether to go back in.

On the chart (below) it looks like regaining & holding the 200p level for a couple of months would be necessary for bulls to claim success in seeing off the bears. I shall observe with curiosity. Sentiment is everything with this type of share, where you don't have any profits to value it on, nor any reliable forecasts.

Maintel Holdings (LON:MAI)

Share price: 675p

No. shares: 10.7m

Market Cap: £72.2m

Preliminary results - for calendar 2014 are out today. I don't seem to have ever reported on this company before, which is strange, as it's been around for years. That's possibly as I normally avoid small telecoms companies, as it's difficult to work out what they do, and if they have any competitive advantage. It's also a sector where things change so rapidly, that a company doing well one year, might be old hat a couple of years later.

The headlines look good at first sight, e.g. turnover up 35% to £41.9m, and adjusted profit before tax up 16% to £6.1m, however the growth seems to have come almost entirely from acquisitions.

Dividends - Stockopedia shows an excellent progression in divis from 5.6p in 2008 to 20.9p total divis announced today for 2014. So that's a compound annual growth rate of a very impressive 22.9% in divis over the last seven years.

Average no. shares in issue - it's always useful to look at this line on the StockReport, as it tells you whether a company has grown by issuing new shares (not good), or whether its growth has been generated from internal cashflow (good). In this case the average has remained almost static for 6 years at c.10.7m shares in issue. So it looks like a company generating real cashflows & using those to pay decent divis, and to grow the business.

Balance sheet - unfortunately, it fails my balance sheet testing, since NTAV is minus £15.4m, and the current ratio is very weak at 0.71. That said, a weak balance sheet is less of a concern at a decently cash generative business like this. Also I note that revenues are recurring in nature, which again reduces downside risk. So the less than perfect balance sheet is not necessarily a deal-breaker for me.

Valuation - the 46.7p EPS reported today for 2014 equates to a PER of 14.5, and that came in ahead of broker consensus of 44.6p. So maybe there is scope for the 56.0p EPS forecast for 2015 to be increased? Even if it remains at 56.0p, that puts these shares on a current year forecast PER of 12.1, which looks reasonably good value for a growth stock paying a nice dividend.

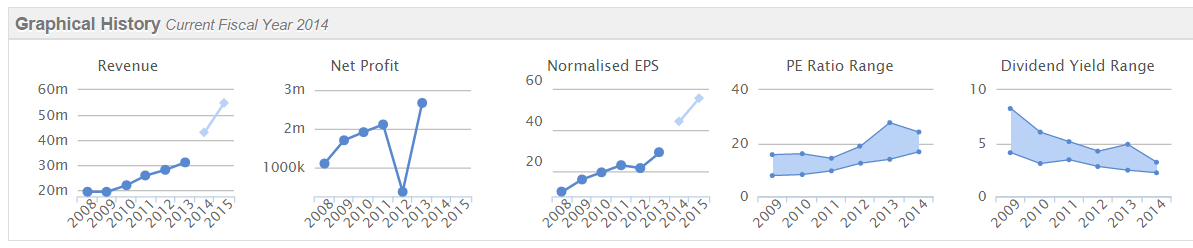

My opinion - overall, I would say this share is possibly worth a deeper investigation - note in particular the strong upward trajectory of EPS in the Stockopedia graphical history shown below:

Transense Technologies (LON:TRT)

Interim results - for the six months to 31 Dec 2014 are really awful - a loss of £1.7m on turnover of only £930k. Moreover, the company utters those dreaded words, "exploring all available avenues to raise further capital". So in other words, they're almost out of cash. With shareholders having already pumped over £26m into this project over many years, with very little to show for it, you have to think they must be very close to the end of the line. How many years do you keep soldiering on with a product that never really gains much commercial traction?

H1 last year looked as if the company was getting somewhere, with £2.2m revenue, and a £95k loss, but this year's H1 shows turnover more than halving, as cuts are imposed in the mining sector.

The company seems to be trying a different model, of offering the equipment on a monthly hire basis, rather than capital up-front, and there is a separate announcement today about a contract win on this basis.

My opinion - the story looks very stale to me, and I can't see any point in taking a punt on this, especially as they're almost out of cash. If one did develop some pressing urge to want to invest here, then the best course of action would surely be to contact the company and/or its broker, and ask to be included in the next Placing - which would normally be at a discount. That is only possible if you're classified as a professional investor, not a retail investor.

Escher Group (LON:ESCH)

Share price: 237.5p (up 10.5% today)

No. shares: 18.7m

Market Cap: £44.4m

Full year results - for calendar 2014 are published today. The results are poor, as expected. The company warned on profits, which I reported on here on 7 Jan 2015, so that article is worth a recap to set the background.

Why are the shares up today? Probably because of the more upbeat Directorspeak, and comments that the delayed contract in 2014 has been signed in Q1 of 2015, together with a reasonably upbeat outlook for 2015.

My opinion - I recall being tremendously impressed at a company presentation about a year ago - Escher seem to have global reach for their point of sale software, aimed at postal services, and their client list is remarkable.

The trouble is, they don't really make any money. The positive EBITDA figures quoted ($2.1m for 2014) are meaningless, because the company capitalises a lot of its costs into intangible assets. So with $2.2m capitalised in 2014, this actually takes the company to a loss of $0.1m, the way I look at things (expensing all development spend as it is incurred).

This gives a very similar result to the P&L, which shows a $1.0m loss for the year. The tax charge looks inefficient too, as it appears the group suffers unrecoverable tax on profits in overseas operations, which it can't offset against losses elsewhere.

The balance sheet isn't great either, with some net debt, and NTAV is weak, at $1.8m.

Overall then, it looks a poor investment on these figures. Having said that, I suspect this business could have some strategic value to an acquirer. Say if PayPal, or some other big group, wants to use Escher as a springboard for doing a deal with Post Offices around the world, then this could make an ideal way to spearhead such a move.

Personally I wouldn't buy into a share just on the off-chance that a takeover bid might occur, but that's probably going to be the likely end game here at some point.

Clarkson (LON:CKN)

With a market cap of c.£600m, it's well above my usual upper limit of around £300m-ish, but having a very quick look at results today, the shares look potentially interesting.

EPS for 2015 is forecast at 158p, and maybe there could be scope for forecasts to rise, given that 2014 results came in usefully ahead of forecast? If we lock onto 158p EPS, then that drops out at a PER of 12.8 times - sounds reasonable value.

Balance sheet - is smashing, with a very good current ratio of 2.07, which includes a very healthy net cash position of £152.9m, plus a further £25.3m in deposit accounts. This reduced somewhat after the period end, with £23.4m paid out relating to a major acquistion, and it looks as if £46.8m in vendor loan notes were also taken on.

Major acquisition - this link is for the RNS detailing the acquisition of a competitor called RS Platou, for £281.2m. It's such a major acquisition, that it's essential to research this, as it will dramatically change Clarkson's balance sheet - filling it up with goodwill, for example. Although the proforma enlarged group balance sheet looks OK, considering how much more profitable the larger group will be.

My opinion - shipping is not a sector I know at all well, so will defer to others on this. However, I just want to flag up the stock idea, which looks potentially interesting in my opinion. So worth doing a bit more digging on this one, I feel.

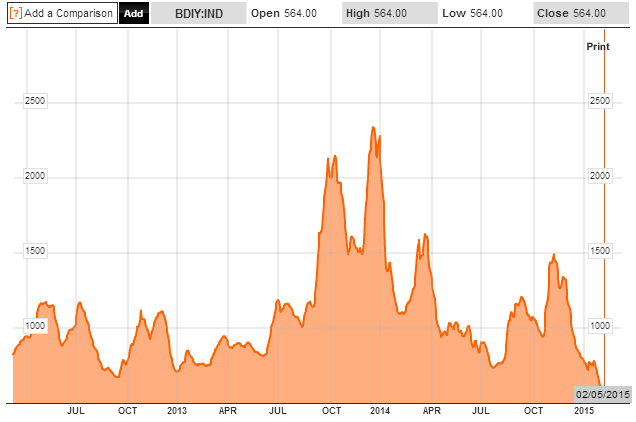

Shipping prices seem to be measured on the Baltic Dry Index, which I've found a chart for (see below) - note how incredibly volatile it is, this chart is a 3-year chart. Recently the index has dropped by two thirds, to about 500, so it would be necessary to find out what correlation there is between the BDI and Clarkson's profits? (Chart courtesy of Bloomberg):

All done. See you shortly for Tuesday's report, which will be on time.

Regards, Paul.

(of the companies mentioned above, Paul has no long or short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.