Good afternoon!

Not a great start to the day - I've come down with the lurgy, so have been shivering in bed with a fever and a sore throat. Also it's taken me half an hour to crank a rather temperamental PC into action, further delaying things. So I'll write this report throughout the afternoon, hence if you refresh this page later in the day, more stuff will appear.

Globo (LON:GBO)

Share price: 40.75p

No. shares: 373.7m

Market cap: £152.3m

I had a look at the latest interim accounts from Globo (LON:GBO) last night, and all my concerns remain, indeed have strengthened. It's one of the most bizarre & unreal-looking balance sheets that I've ever seen. Once again the company reports huge profits, but once again the bizarre debit balances on the balance sheet pile up into ever larger & more unbelievable mountains.

Cash & debt - most companies have cash, or debt. There might be a bit of overlap, with some cash in transit, or cash at one subsidiary, and debt at another. Usually though the net picture makes sense. Not here! The group reports cash of E104.4m at 30 Jun 2015.

On the same date, it reports borrowings of E56.9m. Given that interest rates on cash deposits are close to zero, this is a staggeringly inefficient, indeed totally illogical arrangement. The P&L shows E368k of interest income, and E1,981k of interest cost, in just a six month period remember. Therefore, the first job I would if I became CFO of this group would be to repay all the bank debt from the cash pile. That would still leave the group with net cash of E47.5m, which looks ample.

However, by repaying all the bank debt, I would at a stroke have reduced the P&L interest charge by E1,981k * 2 = E3.96m. So there is a cost saving of nearly E4m p.a. interest charges just sitting on a plate, which could be taken today (unless there are early payment penalties on the debt).

The fact that Globo continues to report this huge net cash balance, whilst simultaneously holding significant, and expensive debt, is beyond bizarre. It's highly suspicious, since no rational company would allow this situation to persist for a considerable amount of time, as has happened here.

So the biggest, shiniest red flag is this weird cash & debt situation.

Debtors - this is the second big shiny red flag. Globo reports E54.5m trade receivables at 30 Jun 2015, which seems very high given that revenues for H1 were E72.4m. It's true that receivables includes VAT usually, whereas revenues doesn't, so that can skew things somewhat. However, I would always expect trade receivables to be less than half of interim revenues, or less than a quarter of full year revenues.

On that basis, Globo's trade receivables look excessive by about E18.3m to me.

However, it gets worse. There is another item called "Other current assets" of E35.8m, so a big number. There is no explanatory note given. So I looked back to the 2014 Annual Report, and the equivalent number is accrued income. The double entry for accrued income is this:

Dr Balance Sheet - Other current assets E35.8m

Cr P&L - Revenues (which drops straight through to profit) E35.8m

So this Other current assets line is effectively just more trade debtors, which haven't been billed yet. Add it to the other trade debtors figure, and you really have total trade debtors of E90.3m. That is equivalent to ALL of H2 2014 turnover (of E59.9m), plus E30.4m of H1 2015's turnover, or 42% of it. Therefore, there is nearly 9 months of sales sitting on the balance sheet, unpaid! What does that tell you? Answers on a postcard please, but it tells me that the company is probably booking fictitious revenues through the P&L on a huge scale.

That's always been the case in the past, when I've come across very excessive debtors like this. I can't think of a single case where excessive debtors has turned out to be absolutely fine in the long run. It's practically always the precursor to the wheels coming off, in some shape or form, accounts being restated, a huge write-off of junk on the balance sheet, Directors being kicked out - in fact that's exactly what happened at Quindell (LON:QPP) when I raised exactly the same concerns for several years before it eventually all fell apart.

It's always the same. To create fictitious profit, the debit entries are left on the balance sheet, and become more & more obvious for anyone who takes the trouble to look.

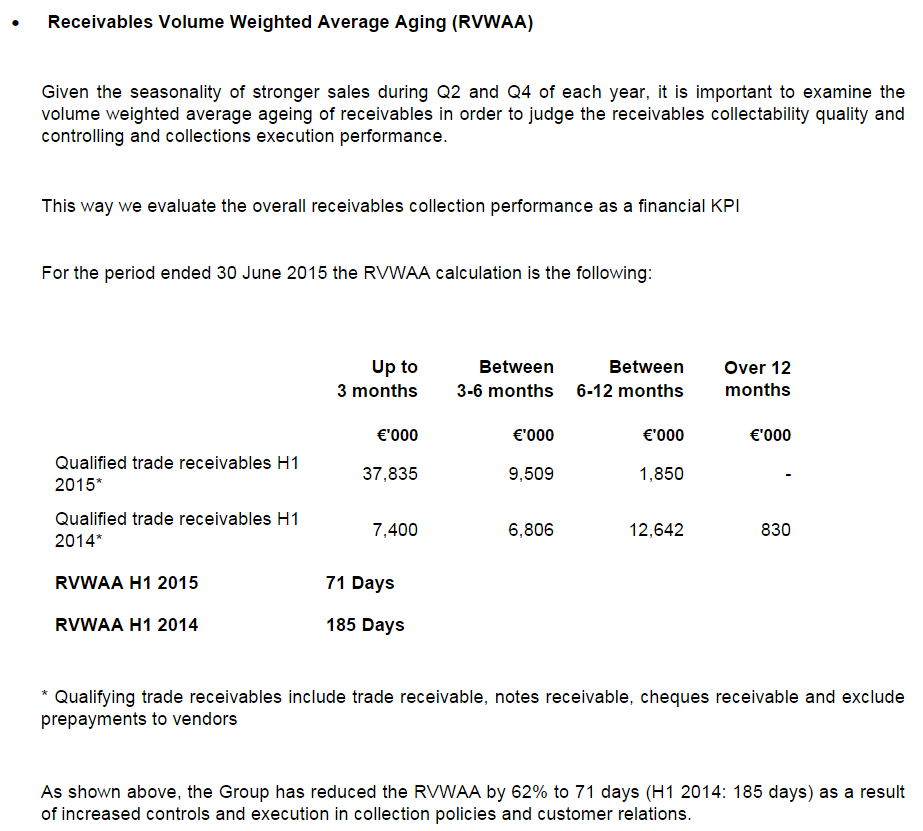

Another similarity between Quindell and Globo is that if you recall, once its debtors became insanely high. Quindell came up with its own definition of debtor days, which excluded a large chunk of total debtors. So it was nonsense. Globo has done exactly the same thing in these interim figures! There is a section where it tries to reassure on debtor days, see below;

Needless to say, it shows a dramatically improved picture! That's because it's actually ignoring about half of the total debtors! So this is just utter nonsense, designed to deceive in my opinion. Some people want reassurance, and so they will lap it up. More fool them!

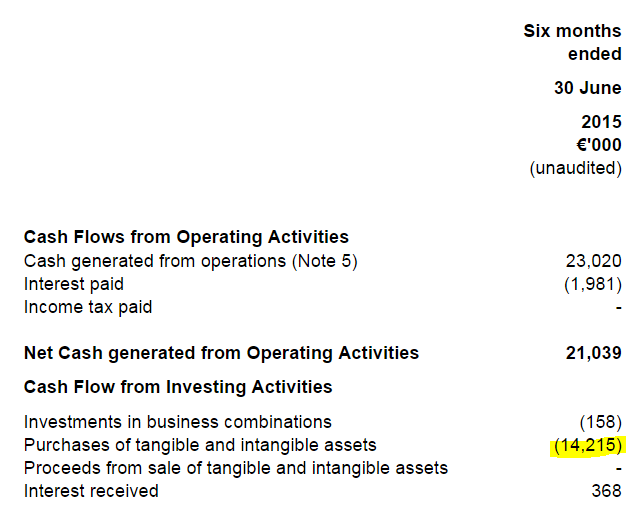

Cashflow - the top half of the cashflow statement is interesting (see below). This shows that the group does appear to be generating some genuine cashflow:

So the E23.0m cash generated from operations is largely consumed by purchasing intangible assets - i.e. costs that probably should have gone through the P&L, but instead have been capitalised. That takes cashflow down to E8.8m, or E7.2m after net interest costs.

So I concede that it's possible there might be a decent business somewhere in these numbers, but just not one generating anything like the profits that are shown on the P&L.

Acquisitions - the group says it is planning more acquisitions, and one (unnamed) target company was pre-announced recently. Today it says:

The Group has been targeting a series of acquisitions since the end of 2014 and we hope to progress certain of these over the coming months. We have recently announced the proposed acquisition of an innovative BYOD - Mobile Security Company in Europe for €14 million.

Our current cash position and cash flow covers all of our operating requirements and will enable us to pursue selective acquisition opportunities in the near term. In order to grow the business through more sizeable acquisitions, we continue our High Yield Bond discussions. The Company maintains a prudent view on the methods of financing its acquisition led growth.

Errr, hello! Earth calling Globo! A 10% p.a. interest junk bond is NOT a prudent way to finance acquisitions, at all. It's just another red flag actually - as the logical thing to do, would be to use your existing cash resources (supposedly substantial in this case) first, then only draw down any borrowings when actually needed. The way Globo is trying to do things looks plain fishy (like the rest of their accounts).

My opinion - as you can probably tell from the above, I think the figures for this company stink to high heaven. I would look very carefully at all the companies they acquire in future - are there any connected parties? Is the price reasonable (based on real profits, not adjusted EBITDA)? There is a risk that buying a lot of junk companies could just be a device to disappear the cash pile (if it hasn't already been disappeared).

Decent companies simply don't present their accounts in this way, nor run huge cash balances simultaneously with increasing borrowings. Remember the change of auditors, twice, some time ago, which was unconvincingly explained away but has since been forgotten by gullible shareholders, who just want the share price to go up, and don't care about reality.

There are so many issues with this company, that to my mind, and based on a lot of experience in the market, avoiding dodgy companies & warning people about them, it is inconceivable that everything will turn out fine here. I think it's a serious accident waiting to happen.

Even if I'm wrong (which is possible, albeit unlikely) why take the risk, when there are so many warning signs?

Koovs (LON:KOOV)

Share price: 44p (down 31% today)

No. shares: 24.1m

Market cap: £10.6m

Results y/e 31 Mar 2015 - these have been published just in the nick of time, as they're now 6 months old, and I think the shares would have been suspended if results had not come out today.

Anyone who thinks that it's easy to create & build a fashion website, should take a look at the mess that Lord Alli has made of things here. Remember too that he's experienced, having been involved with Asos for many years, so he should know how to do it.

The reality is that it's painfully slow, and very costly (especially marketing spending) to create a successful online retailer. Sure, there are few barriers to entry, but there are massive barriers to scaling up to a decent size. Creating a transactional website is easy, but getting large numbers of people to repeatedly buy from it, is very hard. Making a profit is harder still.

Koovs generated only £2.1m in revenue for the year, and incurred a staggering £10.8m operating loss! There was only £13.7m cash left in the bank, so only enough to take them into roughly mid-2016, at that rate of cash burn.

Bizarrely, the company confirmed on 2 Apr 2015 (which I reported on here) that it would need more funding. That's a terrible mistake, as it then means the existing shares can become virtually worthless, if providers of the next stage funding play hard ball. It's OK if there are financiers falling over themselves to invest, but on the back of the company's dismal performance to date, it's difficult to see why anyone rational would want to back this with more money.

Worse still, Koovs today says that it hopes to raise another £35m for continued losses, saying that the first tranche should be raised by the end of 2015. This means heavy dilution, as new investors are bound to demand a deep discount. The more dilution, probably at an even lower price, in 2016 and 2017.

My opinion - I think they should have adopted a far more modest business plan, instead of going for growth, and burning huge amounts of cash. It all hinges on whether new investors are prepared to throw substantial amounts of more money at it, or not? The existing shares have no attractions at all, in my view. I'd rather wait until it's properly funded, and is showing the first signs of being a viable business. It's a long way from that right now.

It's been a disaster for shareholders so far, as you can see from the chart below. Why invest in this, when you can invest in a successful, strongly growing, profitable, online retailer like Boohoo.Com (LON:BOO) (in which I hold a long position) at a reasonable price?

Apologies, I didn't get round to looking at any other companies today.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

Please DYOR. These reports are just Paul's personal opinions, which are fallible, and are never recommendations, nor advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.