Good morning! It's Paul here.

I'm meant to be having a day off today, concentrating on moving house. However, I've done my usual morning scan of the RNS, so thought I'd put up some brief comments. Graham is planning on doing some more in depth reporting later today.

Founders cashing in

The list is growing of companies where founders are cashing in significant portions of their stakes. Coming after huge moves up in share prices, this is another sign that the market for growth companies is clearly getting toppy.

Actually, I think we're possibly now into the final, "euphoria" stage of a bull market. Whilst that may sound alarming, this is also a time when fortunes can be made. The trick is obviously to cash out before the market eventually corrects, or crashes.

Off the top of my head, I can think of £G4M and Purplebricks (LON:PURP) (both of which I hold personally) where Directors have taken a fair chunk off the table. Yesterday Directors of Keywords Studios (LON:KWS) did the same.

Today it is Fevertree Drinks (LON:FEVR) - a founder Director Charles Rolls intended to sell 2.5m shares, but "due to significant institutional demand" (lol!) he ended up kindly selling them 4.5m shares, but took a haircut on price - selling at 1625p per share. That's £73.1m he's banked - not bad going! Mr Rolls still holds 12.9m shares though, so still has acres of skin in the game.

Should we begrudge Directors taking advantage of an extremely buoyant market, and cashing in some chips? Possibly not - I'd probably do the same in their shoes. However, when you see Directors cashing in at many companies, then it clearly points to a market that is expensive. If there are willing buyers though, then maybe these share prices could go even higher? In some cases I suspect we might already seeing the "greater fool theory" in play.

As regards Fevertree Drinks (LON:FEVR) I briefly bought some for my Stockopedia portfolio, Beam Me Up Scotty, but got cold feet after the last trading update. For me, the bull case rested on the likelihood that broker forecasts look far too pessimistic (as has proven the case historically). However, the last update indicated the company is "comfortably ahead of current market expectations". Whilst clearly good news, I'm not convinced it's good enough to justify the share price rising further, for now? Hence I ditched my real life & fantasy portfolio position in the company. That may have been a mistake, but if in doubt, I sell out.

Revolution Bars (LON:RBG)

A correspondent tells me that my name is being taken in vain at the lower end of the bulletin board spectrum, due to my incorrectly positive stance on this share, which has since dropped by about 50%. A few points;

- Everyone gets plenty of stock picks wrong, including me, and I've never claimed otherwise.

- The performance of BMUS shows that I get a helluva lot more right than wrong. Nobody would read this blog if that were not the case. Are there any fund managers whose ungeared, long-only small caps portfolio is up 200% in the last 2 years? BMUS is. OK, it will be tough to impossible to repeat that performance in future, and pride comes before a fall, so I'd probably better shut up about this point for now!

- Profit warnings are not something to get uptight about, it's quite normal in the small caps space. If you can't cope with that, then get out of the pool!

- Bears on RBG are obviously enjoying their moment, and crowing about it, which is fine. However, I've not seen any evidence to suggest that anyone predicted the reason for the profit warning - significant cost over-runs. So bears were right by accident, and who cares anyway?! My focus is on the facts & figures, not on internet squabbling.

- I remain of the view (which may turn out to be right or wrong, we'll find out in due course) that RBG's problems are fixable, hence it could be a good recovery stock.

- Reflecting on things, I was definitely over-confident about this share. My mistake was to place too much reliance on broker forecasts, and management reassurances. Also, I didn't think enough about the potential downsides. In my defence though, it was reasonable to assume that experienced management like this would have been able to budget correctly for obvious & known cost increases. So it's mainly management that have screwed up here, not forecasters or commentators.

- With a net debt free balance sheet, and generating tons of cashflow, this is still a very nice business, now dirt cheap. So let's see what happens.

- The latest Numis note gives more detail on the specific cost over-runs. However, it also has a frightening statistic that each 1% drop in LFL sales knocks 10% off EPS. I didn't factor into my calculations this level of extreme operational gearing, which was a mistake. So if you think consumer spending on discretionary things like cocktails is likely to drop, then clearly this share is not for you.

- I'm more sanguine about the macro picture, and specific self-help measures RBG is already taking, which I believe could mean LFL sales hold up, or increase. Specifically, an App to order food & drinks is close to launch. Plus the food offering (previously seen as poor) is being revamped. If that works, then who knows, we could see a nice recovery in performance & investor sentiment later this year.

- The self-funded, debt-free roll-out continues. So even if existing sites struggle, the company is bolting on more profitable units (on highly attractive rents at c.6% of turnover for new sites), which should help shore up EBITDA at the current £15m level. For the avoidance of doubt, I only see EBITDA as a starting point for considering cashflows. We then have to subtract maintenance capex, tax, etc. The business is still a cash cow, which I like.

- Takeover potential - I see it as being a potential takeover target at the current bombed out valuation. A trade buyer in particular could strip out a load of costs. Drinks purchasing is based on volumes, so as part of a larger group, RBG's profitability could be increased a fair bit.

- Overall, an interesting situation. We never give recommendations here, as everyone knows. The focus of the site is on providing tools to help investors DYOR. Also, these reports are just mine & Graham's personal opinions. Sometimes we'll be right, sometimes wrong.

- In this case though, I was definitely over-confident about this share, which might have influenced some people. So an apology is in order, and I'll try to rein in my enthusiasm a bit in future. If it's any consolation, I've incurred a hefty paper loss on this one. Sorry if readers also took a hit, and were influenced by me.

- I don't see how any of us could have foreseen that management would fail to properly control costs, and fail to budget prudently. These seem basic mistakes, and it's no wonder that confidence in management has taken a big knock - reflected in the share price roughly halving in the last few weeks.

- Anyway, we live & learn. I always carefully ponder every mistake/loss, as it's so vital to learn from each one. That's the way we improve our performance in the long term. So brushing losses under the carpet is the worst thing to do.

- Above all, please DYOR. It's vital to think independently, and take responsibility for your own investing decisions & performance.

Elegant Hotels (LON:EHG)

I see that 12.5% shareholder Luke Johnson is the biggest shareholder in this group of freehold hotels in Barbados. Also of course, he's a remarkable entrepreneur, so is someone I follow.

He's been appointed as a NED. That's good news I think - adding such a high profile & experienced entrepreneur to the Board can only help.

I've been dithering about this share for a while. I like the company, but have 2 specific reservations;

- Forex movements - about 70% of the company's revenues comes from UK tourists. So the post-Brexit plunge in sterling likely to be very unhelpful.

- TripAdvisor reviews for most of the company's hotels indicate problems with maintenance capex - i.e. they're not up to scratch for the prices being charged, seems a recurring theme from genuine-sounding reviews.

On chatting to a couple of friends who visit Barbados every year, they all said that the forex movements wouldn't stop them visiting. It's already very expensive, so it costing a couple of thousand more, didn't seem to bother them.

On balance, I think the financials look quite attractive here, and I'm limbering up to buying an opening size long position in it. This breaks my usual rule of not touching any overseas AIM companies. In this case though, it looks a bona fide company.

The dividend yield looks too generous to me. I'd rather they cut back on divis, and spent more on improving the condition of their hotels.

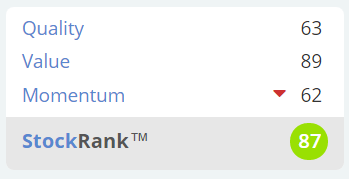

As a quick sense test, I note the StockRank of 87 is strong, and the new StockRank Styles rates it highly, as a "Super Stock". Jolly good - I always like it when the Stockopedia computers tell me that the probability is things are leaning in my favour.

Note the attractively low PER, high divi yield, and it's even trading at a discount to NTAV. So decent value characteristics, reflected in the Value score above of 89.

The momentum score has a down arrow next to it, which I assume means the momentum score has fallen - a useful pointer.

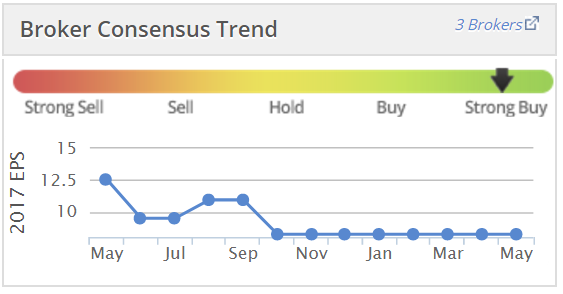

Sure enough, broker forecasts have come down a fair bit in the last 12 months;

Actually, I find that quite reassuring - because it shows that brokers have factored in reduced earnings from the issue with UK tourists & forex, which is bound to have some effect.

My opinion - Overall, I'm not 100% sure about this share, but am sufficiently comfortable now to open a modest opening long position. When I say modest, ballpark between 1-2% of my total portfolio. I like to get comfortable with shares over a period of time, and then scale up positions where my confidence level is increasing. Or ditch the ones where my interest fades - driven by newsflow, and deeper research. For me, researching a share is a continuous process, not a one-off event.

Belvoir Lettings (LON:BLV)

This small property lettings business says at its AGM trading update;

Trading during the first quarter of the current financial year has been in line with the Board's expectations. Group revenue was up 19% on the prior year, mainly reflecting the acquisition of Northwood in June 2016.

Various other details are given, but this bit caught my eye, as it is likely to have wider read-across for the sector;

...there is a healthy pipeline of further opportunities as some of the smaller independent lettings agents choose to withdraw from the sector in the face of a ban on tenant fees and increased legislation.

Overall, this looks quite an interesting little company, and there's an outstanding dividend yield of 6.9%. Mind you, when a divi yield is that high, it's possibly the market signalling that this level of payout might not be sustainable - so the figures would need checking.

Minds + Machines (LON:MMX)

Strategic Review - this company, which operates in the internet domain names sector, has put itself up for sale, and is considering other options too. This is because the sector is fragmented, and the company has had "a number of informal approaches from external parties".

It says that domain registrations are up 40% year to date. It sounds like that refers to quantity of, rather than value of domain registrations - which could be very different figures!

I've never really understood how to value this company.

It's only had a couple of blips of investor interest in 2010 and 2014, but apart from that the share price trend has been sideways.

I don't see any evidence that these top level domains such as .VIP are taking off. People just search for a company name on Google. The domain name seems largely irrelevant these days.

Henry Boot (LON:BOOT)

There's a positive trading update today from this property development company. The share price is up 5% today in response.

This all sounds positive;

Property trading and development activity levels since the beginning of 2017 have been very encouraging and the Group's three business segments; land promotion, property investment and development and construction are trading strongly.

Henry Boot is, fundamentally, a transactions driven business and there is always a degree of uncertainty with regard to the timing of these deals within a particular financial period. We are pleased to report that any uncertainty created by the current UK general election process is not having an impact on our business.

Given the strong start we have made in 2017, and anticipating no major changes to the underlying economic conditions in which we operate, we now anticipate the Group's performance for the current financial year ending 31 December 2017 will be comfortably ahead of the Board's existing expectations.

Good news for holders there. I don't normally analyse companies like this, as it's too time-consuming to properly research them.

Flowtech Fluidpower (LON:FLO)

This update today reads quite well in my view. So I'm a bit surprised to see the share price down 2% in response. The key part says;

"In summary, the Directors remain confident about the future; we fully expect our underlying performance to deliver another year of solid progress and, we remain on track to meet current market expectations for the year ending 31 December 2017.

This is a nice little niche business, at a reasonable price, in my view. So worth a closer look, possibly.

Redx Pharma (LON:REDX)

A total disaster here - amazingly the company has been put into Administration, by a creditor who is owed £2m plus interest. Yet the company raised £12m in fresh capital just 2 months ago, in Mar 2017.

Mind you, it's incurring huge losses, so that money seems to have largely gone. It made a loss of £9.8m in the half year to 31 Mar 2017.

This appears to be a story of amazing management incompetence (or worse?). They seem to have tried to string along a creditor, with a payment plan, and then been made insolvent.

This is a great reminder of why I NEVER invest in massively cash burning drug discovery companies. They nearly all fail, and the decent ones get bought out before shareholders see much upside.

Right, this was only meant to be a quick report, but ended up ballooning!

I'm off to dismantle my furniture now, and box up the last remaining items, before removal men come tomorrow morning. So I'll be out of action all day tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.