Good morning!

Portmeirion (LON:PMP)

Share price: 815p

No. shares: 10.7m

Mkt Cap: £87.2m

Interim results for the six months to 30 Jun 2014 have been published today by this crockery maker.

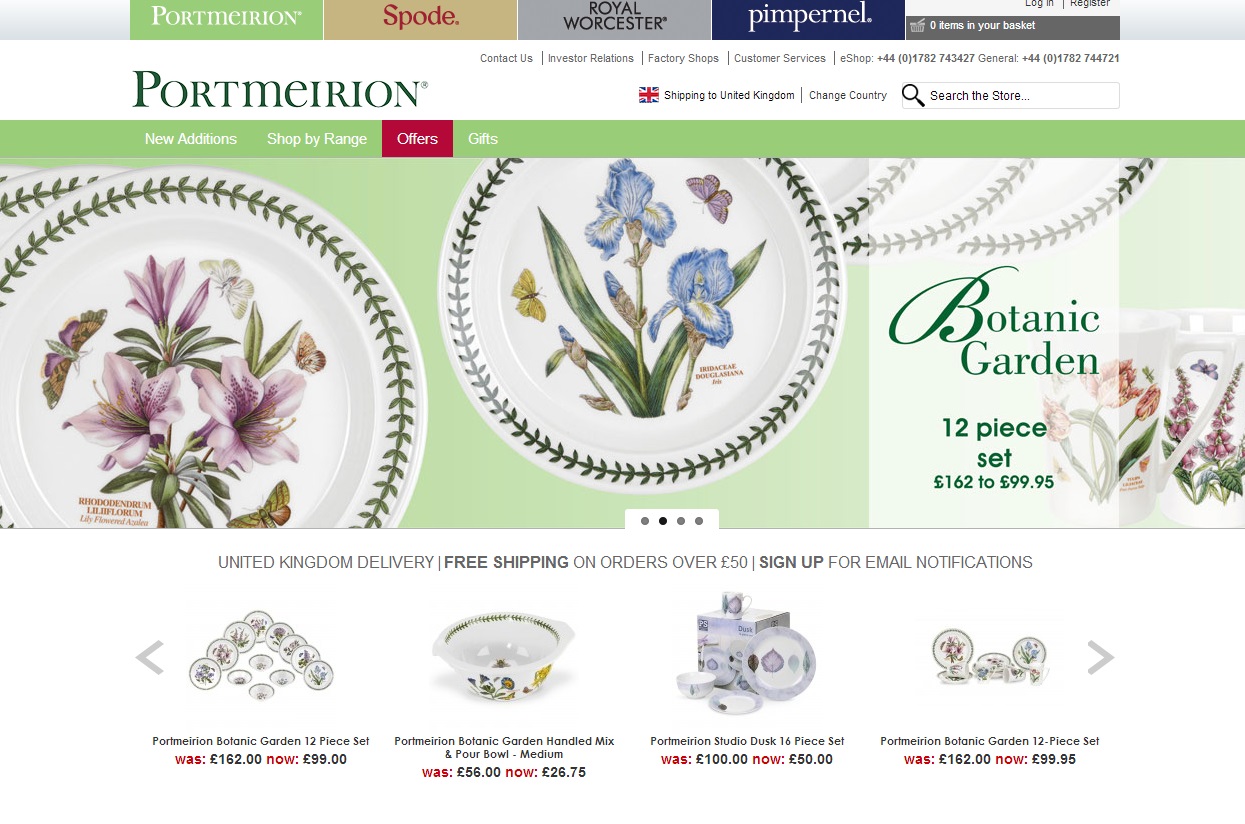

Portmeirion owns a number of well-known brands, and the screen grab on the right from their website shows the classic "Botanic Garden" range.

It's probably my favourite long term hold, as the company ticks all the boxes I like - modest valuation, good profit margins, a strong Balance Sheet with freehold property and net cash, steady growth even in weak economic conditions, good progression in dividends, competent management, and predictable revenue streams. Having a product which will be dropped & broken by owners from time to time gives a nice replacement cycle too!

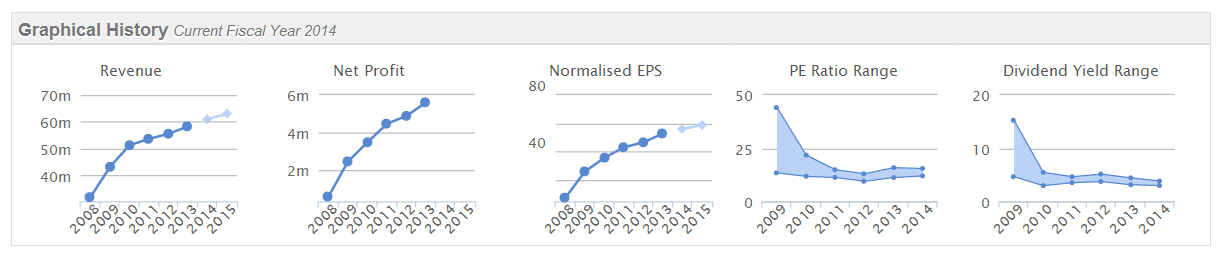

Look how well the company has done, during a 6-year period where its main markets (UK, USA & S.Korea) were economically soft;

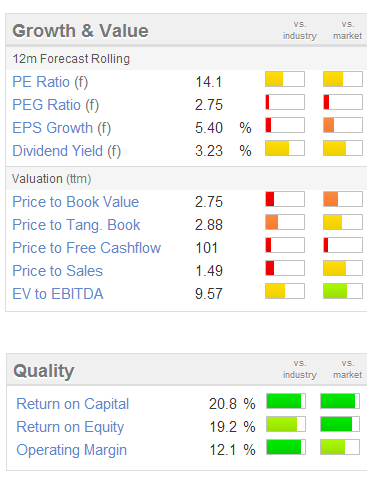

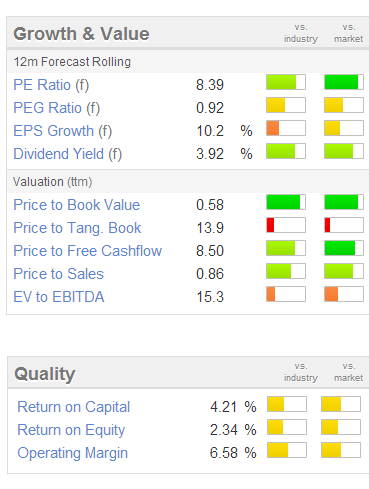

It's a quality business, on a modest valuation in my opinion, which is confirmed by the high quality scores on the Stockopedia graphics below, and its very high 95 score on the StockRank system;

Valuation - Note that the PER & dividend yield have only just turned yellow, having been green for a long time. That is probably because PMP shares have been strong in recent months, whilst many other smaller caps have been weak. So the undervaluation is arguably now not as pronounced as it was. Although to my mind this is a business that should command a PER of about 20, so the valuation of 14.1 seems to build in an attractive margin of safety for investors.

Interim results - The figures look good. Although as noted in the commentary, Portmeirion makes most of its profit in H2 each year, due to the dependence on the Xmas Tree line (which is a big seller in the USA), and the overall suitability of its products as seasonal gifts.

Nevertheless, the company has put in a creditable performance in H1, with EPS up 53% to 9.21p (2013: 6.03p).

Outlook - Since H2 represents the overwhelming bulk of full year profit, the outlook statement is more important than the H1 figures. So a "strong order book" for H2 is reported, and the Chairman comments;

"The performance of Portmeirion Group in the first six months of 2014 has been in line with our expectations and we remain confident of the outcome for the full year to 31 December 2014."

.

Broker forecasts - Stockopedia shows the consensus as 56.0p EPS for this calendar year, up 3.2p against last year. The interim numbers have already banked a 3.2p increase, so in my view we should be looking for a full year EPS out turn of 60p+. If I'm right, then at 815p the PER drops to only 13.6, which strikes me as very modest for such a good quality company.

Balance Sheet - As usual, this looks very healthy, with current assets of £25.6m being a whopping 426% of current liabilities. Note that inventories are higher than last year, at £14.5m (2013: £12.6m), which I hope could be indicative of preparations for a stronger H2 (i.e. to sell more, you have to make more!). Note that the company bought the long leasehold to its Stoke-on-Trent warehouse last year for £3.9m, so that adds further asset backing, and eliminated a rental cost, the benefit of which will build in value over time (since rental increases won't now happen). I love what some might call "Balance Sheet inefficiency" - the more assets, the merrier as far as I'm concerned.

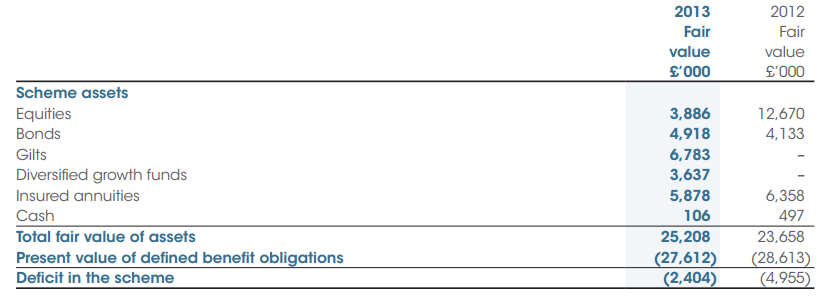

Pension deficit - This seems to be a manageable legacy issue. Although it is absorbing £0.8m p.a. in deficit recovery payments. I've had a quick look at note 28 to the 2013 Annual Report, and the last actuarial valuation was in 2011, so there must be another one due soon, as they're usually done every three years. On an accounting basis, the fund, and the deficit look modest, so are not something that I'm worried about;

.

Negatives - the EU anti-dumping tariffs are costing Portmeirion about £1m p.a., but they describe this as "manageable", and are exploring ways to reduce it. If I remember correctly, this relates to goods which are imported from the Far East.

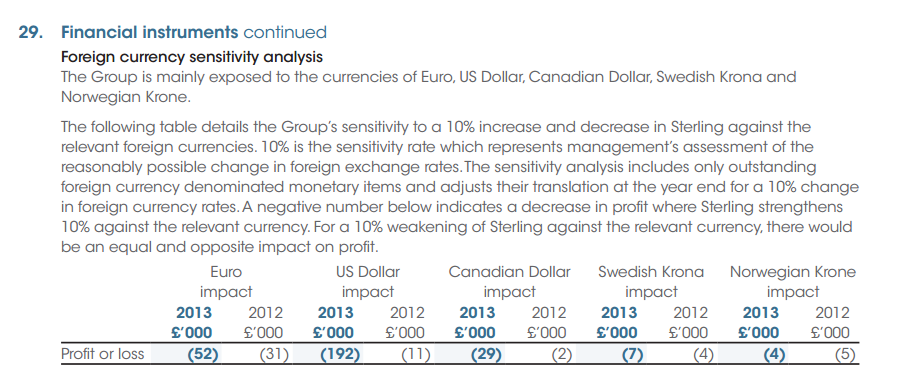

Exchange rates - Many UK companies are reporting problems from the appreciation of sterling, which reduces profits for UK exporters, and reduces profits from overseas operations when translated into sterling. I was a bit worried that Portmeirion might suffer, as a lot of their product is made in the UK. However, they seem to have everything under control, and the fall in US turnover was offset by stronger UK sales, especially online.

There is a very helpful note in the 2013 Annual Report which gives sensitivity analysis on exchange rates, so I urge readers to check for similar information in the Annual Reports of all companies you hold, as that could help warn you of potential trouble imminent - many other companies are reporting difficulties over exchange rates at the moment, so it's an essential area to check.

.

My opinion - This share isn't going to set the world on fire, but in my view it's a smashing company, at a modest valuation (given where we are in the economic cycle) - shares like this are difficult to find at the moment. So it will remain a core holding in my long-term portfolio for the foreseeable future. Obviously as usual, readers should DYOR. I'm particularly interested in hearing any bearish views on this company - so do please comment below if you think I'm wrong about this company.

Listening to & considering the bear case is absolutely vital in my view, and it amazes (and dismays) me that so many investors try to shout down bearish opinions on stocks they hold. Doing things that way is a sure-fire way to end up making expensive mistakes, and then refusing to admit you're wrong. We've all done it, but it's a key thing to unlearn if you want to be a successful long term investor.

Hyder Consulting (LON:HYC)

Share price: 642p

No. shares: 38.92m

Mkt Cap: £249.9m

Shareholders here are likely to be celebrating, not because of the IMS issued by the company today, which reports on Q1 performance as being in line with expectations.

Rather it's the recommended 650p cash bid for the company that has caused the 37% share price rise this morning. The bidder is a subsidiary of Arcadis NV, a larger European competitor, which had turnover of c.E2.5bn in 2013, and made an operating income of E151.1m. So Hyder looks a significant, but do-able acquisition for Arcadis.

This is "one that got away" for me, as I bought some after the profit warning earlier this year, at just over 400p, but banked a 10-15% gain fairly quickly. Pity, as if I'd held onto them, the gain would have been over 50% now. Never mind.

It looks a done deal, so it's just a question of whether shareholders bank the profit now, or hold out for the full amount, and the possibility of a higher competing offer? I've not read through all the blurb, as I don't hold shares in it.

Creston (LON:CRE)

Share price: 104.5p

No. shares: 60.1m

Mkt Cap: £62.8m

There's an in line with expectations trading update from Creston today.

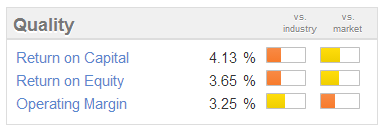

It looks good value on a forward PER basis, and has a good divi yield too. However, note the quality scores are low, and the accounts are difficult to interpret - too many adjusting & exceptional items, etc.

It has a 96 StockRank though, so Stockopedia's computers seem to like it!

Redhall (LON:RHL)

Share price: 22p

No. shares: 49.077m

Market Cap: £10.8m

I've warned readers here about the very high risk of insolvency, as this company is totally reliant on continued bank support. Whilst trading statements seem to always deliver more bad news.

Today's update seems to be another profit warning - the main factor being;

...the impact of lower volumes in our Nuclear Contracting businesses will lead to significant losses for these businesses in the current year.

We believe that we have now recognised the full extent of the issues in Nuclear Contracting and action is being taken to put the businesses on a sounder footing. In addition we have provided for further exceptional contract losses and restructuring costs across the Group bringing our exceptional charges for the year to £2.7m. Our bankers, HSBC Bank plc, remain fully supportive of the Group.

The Group continues to have a strong relationship with its key customers and whilst we have experienced delays in work from our major clients we expect to deliver our recovery plan albeit over an extended timeframe.

Although the market cap is now a lot lower, after the £7m Placing proceeds in Mar 2014 were absorbed by reducing bank debt, there was still £12.2m in net debt at 31 Mar 2014, which is way too much considering that it's not clear whether there is a viable business here at all.

The worst case scenario is that the bank tire of supporting it, and pull the plug. The more likely case is that it will soldier on, and have to do more equity fundraisings, if they can find anyone to put fresh money in? Either way risk/reward looks awful for shareholders. Hence it's going on my bargepole list as just too high risk. I've no idea what the outcome will be, but from an investor point of view, why get involved in something so messy & high risk?

Bonmarche Holdings (LON:BON)

Share price: 281p

No. shares: 50.018m

Market Cap: 140.6m

Trading update - My caution on this ladieswear value retailer might have been misplaced. The company's Q1 (13 weeks to 28 Jun 2014) is very impressive. Like-for-like ("LFL") sales grew by a tremendously impressive 13.5%, and with a 53.5% growth in (much smaller relatively) online sales, this took them to 15.8% LFL sales growth. You don't see figures in the teens very often, especially in a not particularly buoyant time for consumer spending.

So they must have had an appealing spring/summer range, which should also benefit gross margins (as there will be less stock to discount in the end of season sales). Sales & margins tend to move in tandem with fashion retailers for that reason.

The company mentions good weather this year as helping, which it will have done. They are not altering expectations for the full year, but surely the probability is now leaning towards upgrades rather than downgrades, after such a great start to the year?

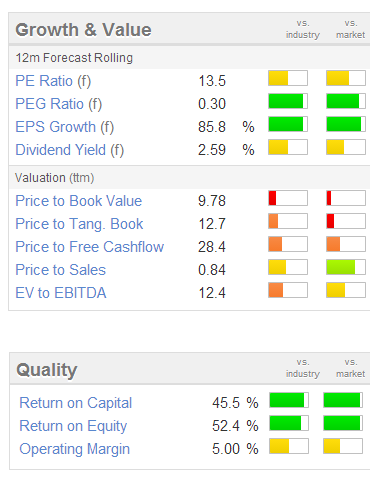

Valuation - Therefore these shares might be a decent one to have a look at, taking a long term view. If earnings forecasts go up, then the PER will come down, and it's not excessive by any means at 13.5. I can foresee this share moving usefully higher over the next year if good performance is maintained. So I might use any pullback as a chance to pick up a little stock at some point. It's going on the watch list anyway.

Communisis (LON:CMS)

Share price: 62.3p

No. shares: 198.9m

Market Cap: 123.9m

Interim results for the six months to 30 Jun 2014 for this marketing company look good at the P&L level.

However, it fails my Balance Sheet testing, specifically because the Balance Sheet is dominated by intangibles of £195.8m. Writing that off turns net assets of £140.3m into net tangible assets of minus £55.5m. The company is also too reliant on its bank facility in my view, and there is also a £31.4m pension fund deficit.

Therefore the apparently low PER is low for a reason.

That said, the divis have been growing steadily over the last few years, and it's now yielding around 3.0%.

If a geared Balance Sheet doesn't bother you, then it might be worth a look. However I like strong Balance Sheets with decent net tangible assets, and little to no bank debt.

It achieves low scores on the Stockopedia quality measures also;

Arden Partners (LON:ARDN)

Share price: 67p

No. shares: 22.45m

Market Cap: 15.0m

Stockbroker Arden has surprised the market with weak interims, with revenue down to £3.5m (2013: £5.7m) and a lurch into a £0.5m loss (2013: £1.0m profit) for the six months.

Specific reasons are given;

The first half saw specific issues with 2 corporate transactions, one where the client pulled back from the transaction at the point of delivery, after Arden had completed the work, costing c£0.5m and the other was hit by the change in IPO market sentiment which resulted in lost fees of a further £0.5m.

Certain long term investments also saw a decline in mark to market book accounting values during the first half and whilst these are non-cash items, they did impact the overall performance by c£0.3m.

.

This calls into question the business model, or racking up a lot of costs on a speculative basis, and then finding that a transaction doesn't go ahead. Perhaps some sort of non-repayable stage payments need to be included in larger projects?

The outlook for H2 is more positive;

The second half pipeline is strong, with delivery, as ever, dependent on market conditions, and the executive team is confident of a satisfactory outcome for the full year.

.

The share price has been clobbered to 67p (down 12%) today, bringing the market cap down to only £15m.

This business looks sub-scale to me, and would surely be better merging with another small broker?

Downside protection comes from a solid Balance Sheet though, with £10.7m net tangible assets.

All done for today! See you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PMP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.