Good morning ladies & gentlemen. It's Paul here.

They say that the early bird catches the worm, and that's very true in stock market terms. I wish I could discipline myself to start work properly at 7am each weekday, but I can't. It's usually more likely to be a quick run through a few RNSs on my iPad, then back to sleep.

As luck would have it, I started work today at 5:30am, wanting to get the monthly accounts done for a share club where I'm treasurer. So by 7am I was fully functioning. That was good, as I spotted 2 companies in particular, where some really good news came out, and I was able to buy, or top up, at the opening bell.

So let's start today's report with those 2 companies.

IQE (LON:IQE)

Share price: 97.75p (up 15.0% today)

No. shares: 676.5m

Market cap: £661.3m

(at the time of writing, I hold a long position in this share)

Trading statement - this is a Cardiff-based company which describes itself as;

the leading global supplier of advanced wafer products and wafer services to the semiconductor industry

I've covered this company here before, but have never really understood the sector, or the future potential - I just crunched the historic numbers. Several readers were well ahead of the curve, spotting the opportunity some time ago, and have been rewarded handsomely so far - the share price has risen a remarkable 5-fold in the last year.

Reading its trading update today, I was struck by the comments at the end, which look game-changing to me. In particular this bit;

...In light of recent progress and its increasingly confident outlook, the Board expects the Group will now exceed market expectations for the full year and whilst it remains early into the start of the mass-market adoption of our technology, it is possible that with the current contract momentum, a more significant upgrade to current market expectations could be delivered for 2018."

We're in a roaring bull market at the moment, so that's exactly the kind of announcement which is likely to put a rocket under a share price. To a certain extent, this is the type of growth situation where the share price can easily detach from conventional valuation metrics (PER, etc).

I'm not really comfortable with that approach, but it's where the big money is being made right now. So I think it makes sense to join the party, even though I'm very late compared with more switched-on readers, who researched the company properly.

Our Graham did spot the opportunity in his report here on 14 Dec 2016, and the share has 3-bagged since then.

H1 2017 performance - the company has a 31 Dec 2017 year end, so it updates on H1 today as follows;

The Group announces that it expects to deliver revenues of c. £70m for the first half, reflecting increased sales in each of its three primary markets. Notably, photonics continued to deliver strong double-digit growth, enjoying the early phase of a significant ramp in VCSEL wafer supply for mass market consumer applications. As a result, overall wafer sales are expected to grow by c.16% against H1 2016. This has also been supplemented by c. £1m of license income (H1 2016: £3.5m).

That's not particularly exciting, because most of the 16% gain comes from favourable forex movements.

Capacity expansion - existing facilities are not enough for expected demand, so a further increase in capacity is being implemented - so about £15m more capex, one broker suggests today.

Free cashflow - I've been concerned in the past that the company produced very little free cashflow. However, I'm coming round to the view, that in a bull market, this might be ignored. It's all about new products, and strong growth - in particular from "photonics", which apparently is a new computer chip which allows 3D sensing, for the next generation iPhones, and other products. I think one of our best reader/commentators, Jane, mentioned this in the comments section a few months ago.

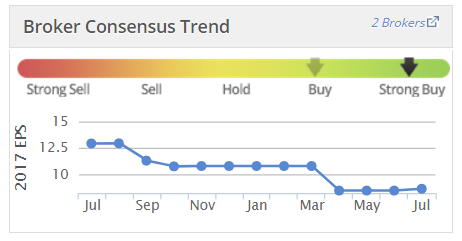

Broker notes - I've seen 4 broker notes this morning, 3 of which are bullish. One mentions that the upside case could be EPS shooting up to 12-15p EPS, if the new products really take off. That would clearly be very bullish indeed for the share price, even after big gains this year.

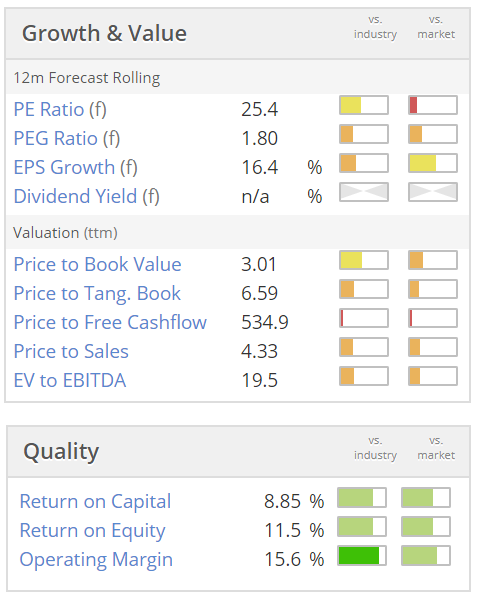

Although one broker concludes his report today by pointing out that the share is far from cheap, especially on a free cashflow basis. Although on a PER basis, it doesn't actually look particularly expensive, for a tech growth stock. Here are the Stockopedia valuation graphics from last night. Obviously the big share price rise today will subsequently move these numbers somewhat;

These figures are based on broker forecasts which look very conservative. The opportunity here is if the company absolutely smashes forecasts in future - which they clearly hint at in today's update.

There's an interesting post here on Stockopedia, from nickwild, who wondered if IQE is a Minervini stock in the making? I think he might be right, I can see similarities with Minervini's highly successful approach.

Our own Ben Hobson interviewed Minervini in Mar 2017, here.

My opinion - there's not a lot more to say really. Just that this could, potentially, be a very interesting company. The upside from making a new type of chip that is maybe about to take off in mobile devices, seems pretty exciting.

Also, on a PER basis (if you accept the basis on which the accounts are prepared), it's not crazily valued. The best stocks are rarely cheap, and if you stick to low PER things, you'll generally end up buying mostly junk, as I've learned the hard way. Sometimes it pays to push the boat out, if there are clear signs of something game-changing going on.

The risk with higher-rated, growth companies, is that if the market as a whole has a big correction, then often this type of stock gets hit hard. So it was a nervous buy for me today, being well outside my comfort zone! Reader comments on this one very much welcomed - as I'm learning from you on this one, rather than the other way around.

eg Solutions (LON:EGS)

Share price: 93.4p (up 11.2% today)

No. shares: 22.7m

Market cap: £21.2m

(at the time of writing, I hold a long position in this share)

Pre-close trading statement - this covers the 6 months to 31 Jul 2017, so H1 of FY 01/2018.

This is a software company, which describes itself as:

the back-office workforce optimisation company

It's a positive update:

The Group is pleased to report that trading in the first half of the financial year has been strong. The Board now expects results to be ahead of market expectations with Revenue for the full year ended 31 January 2018 to be not less than £10.5m (2017: £8.2m) and Adjusted EBITDA to be not less than £1.9m (2017: £1.2m).

It's interesting that the company is sufficiently confident at the half year stage, to forecast a beat on its full year numbers, and even give precise figures (always good). That suggests to me that the pipeline is solid, and there's possibly scope for a further increase in forecasts in H2 maybe?

I'm less keen on trumpeting EBITDA as if it were a proper profit number, which of course it isn't, especially for software companies which chuck a load of the payroll onto the balance sheet, instead of expensing it.

Looking back at the cashflow statement from the last full year accounts, this company has been capitalising about £1.5m p.a. of development spend. Therefore the EBITDA of at least £1.9m above, would really only mean about £0.4m in cash profits the way I look at things.

Therefore, even on improved performance, the business isn't worth the £21.2m market cap, in my view. However, it's all about the future. This company has a great client list, of big organisations, and seems to be on a roll, in winning new contracts. That could transform future profitability, if things continue in the same vein.

Order book - is also strengthening. As this grows, it should hopefully see a smoother progression of profits, instead of the erratic performance in the past.

Contracted orders of revenues to be recognised beyond the current financial year end have also increased by a further 14% to not less than £21.1m (31 January 2017: £18.5m) due to the increase in sales of the Group's Managed Cloud Services, contracts for which are longer term in nature.

So that's about 2 years' revenue, in the order book, a decent underpinning. Although I think it's spread over more than 2 years, so the company will have to keep winning new business on top of that.

My opinion - I'm still nervous about this company's past, but am slowly gaining confidence that it might be coming good.

United Carpets (LON:UCG)

Share price: 10.0p (down 2.3% today)

No. shares: 81.4m

Market cap: £8.1m

Final results - for the year ended 31 Mar 2017.

This company calls itself;

the third largest chain of specialist retail carpet and floor covering stores in the UK

These figures look OK. This is a tiny, illiquid share, so I'll only mention the key things briefly.

- LFL sales +1.3% - not too bad, in a tougher environment

- Revenue flat against last year, at £21.2m

- Profit before tax also flat, at £1.5m

- EPS of 1.58p, for a PER of only 6.3

- Sound balance sheet, with net cash of £2.6m

- Divis - note that the company has paid out bumper special divis, so there could be more to come perhaps?

- Current trading - "challenging", but LFLs have remained slightly positive. However, marketing activity has increased significantly, so that might mean profits start to slip?

My opinion - a nice little company, which is now vastly improved from when it went bust a few years ago (due to onerous leases, as is usually the case). Obviously it's cyclical, so dependent on consumer spending, although I think it serves the cheaper end of the market, so might be more resilient than others perhaps?

A while back, I made a nice little profit on this small company, and got some lovely divis too. If you strip out the cash, then the PER is really low. Although it probably should be low.

It's too difficult to get in & out of this share, due to illiquidity, so it's not one I would revisit personally.

Audioboom (LON:BOOM)

Share price: 2.2p (up 10.0% today)

No. shares: 930.6m

Market cap: £20.5m

Half year results - to 31 May 2017.

The company calls itself:

the leading spoken word audio on-demand platform

I'm afraid these results are just more of the same. Lots of gushing narrative, but unrelenting losses, and once again cash is running low.

Revenue is up 460% to £1.8m for H1, but so what, if it generated only £497k in gross profit. Yet the overheads were £3.4m in the 6 months. So an operating loss of £2.9m was incurred.

If the gross margin percentage remains the same, then revenue would have to increase 7-fold, from here, just to reach a breakeven run rate. How likely is that?

With only £3.2m left in the kitty, it looks like BOOM will need yet another fundraising in early 2018, in order to continue in existence. The delusional CEO thinks he has a strong balance sheet, with enough cash to see it through to breakeven.

Dilution - note that there were 638.0m shares in issue at 30 Nov 2016. Just 6 months later, there were 930.6m, an increase of over 45%. Management reckons that monthly cash burn is reducing, but I'd be amazed if the company can actually reach breakeven without having to raise more cash, thus diluting existing holders even further.

My opinion - it seems obvious to me that this is not a viable business. So why on earth would anyone keep pouring money into it? This is where it helps to have very wealthy shareholders - as propping it up is pocket change for them. Shoving in a few more millions is probably more about saving face, with a topping of wishful thinking.

Risk:reward here looks dire, so it's not something I would even consider investing in.

The Stockopedia computers agree with my assessment that this is one of the worst companies on the market - giving it a StockRank of zero!

There's a small chance that management might prove the doubters wrong, but why I want to gamble on that outcome, since it's so improbable?

Carr's (LON:CARR)

I last reported on this agricultural products & engineering group when it put out a mild profit warning in Mar 2017. Better news today, with an in line update:

Overall trading for the Group remains in line with the Board's expectations for the current year.

It's worth pointing out that expectations have come down quite a bit, this making it easier to achieve them:

The agricultural division is seeing improvements in performance.

The delayed contract in the engineering division has now been signed.

So it sounds like the group is getting back on track. Maybe there's some value here, but I can't really see it. It just looks like a boring, ex-growth, low margin business. That's really not what the market is generally looking for at the moment - in a bull market people want growth stocks mainly. So the risk is that this one could just drift down, or sideways, due to investor apathy.

Still, on the upside, the company's shares have recovered about half the fall caused by the profit warning in Mar 2017. I've no idea why the StockRank is so high, at 94 - maybe there's something here that I've missed? Do any readers like this one? There is a 3% divi, which is worth having.

Mothercare (LON:MTC)

Trading statement - obviously this is a UK & international retailer & franchiser of children-related products. I've been keeping an eye on it for several years now, waiting for a convincing turnaround to occur. I last reviewed the annual accounts here in May 2017, and came to the conclusion that it looks like a company which is running, just to be able to stand still.

That was 124p per share. We're now down to just 101p per share.

Q1 update today - UK seems OK, with LFL sales up 1.9%. Online sales growth is poor, at only +3.3%. That's not at all good, when online generally is growing at about 20% p.a. in the UK. So clearly Mothercare is losing out - probably to Amazon, like so many other conventional retailers.

International - this is a concern, as sales have fallen back badly - Q1 saw constant currency international sales down 8.3%. This is worse than any individual quarter in the prior year. Favourable forex movements mean that this does translate into a rise of 2.2% in sterling.

The Middle East is flagged as the problem area.

My opinion - this is looking increasingly like a struggling, old school retailer. I'm not convinced by the turnaround. More like managed decline, I'd say.

£JDG

Trading update - for the 6 months to 30 Jun 2017.

Performance at this acquisitive group of medical instruments companies, has been quite erratic in recent years. There won't be any complaints about today's update though, it looks very good.

Strong order intake augurs well for H2 results;

Order intake in the first quarter was very strong, reversing the trend seen since 2014. This was followed by a good second quarter. Consequently, for the first half as a whole, the Group experienced 28.1% Organic growth in order intake from the same period last year. The Organic order book finished the first half at 16.5 weeks of sales against 11.2 weeks at 30 June 2016 and 14.9 weeks at the beginning of the period.

H1 results sound like they should be respectable:

The Board expects the interim results to show solid progress in revenues, EBIT and earnings per share.

Outlook - I'm a bit surprised it's only an in line outlook for the full year. Maybe they're just being prudent, and holding a bit back? I'd say there's probably a fair chance that the company might now beat existing expectations:

The sustained strength in order intake in the last twelve months and the continued weakness of Sterling provide the Board with confidence that the Group can deliver a full year performance in line with market expectations.

My opinion - a nice group of companies, with strong management. It's good to see them getting back on track. Although this arguably has already been reflected in a share price up about 50% from the lows about a year ago.

Great, that's me done for the day!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.