Good morning!

As it's a busy day for results, both Graham & I are working today, and both running late - our apologies! Graham's report is taking shape here.

Tracsis interview

It was a busy day yesterday. As well as writing a report here, I also recorded an interview with the CEO & CFO of Tracsis (LON:TRCS) . You can listen to that if you wish, here. I managed to ask all your questions, and thanks for submitting them.

Tracsis are presenting at tonight's ShareSoc seminar in Leeds. Click here for more details on that. Management at Tracsis are refreshingly open & straightforward. They've asked me to pass on the fact that they welcome contact from shareholders. So if there is anything you would like to clarify, or a question to ask, then please feel welcome to contact management yourself, directly.

Tasty (LON:TAST)

Share price: 74p (down 35% today)

No. shares: 59.8m

Market cap: £44.3m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the 53 weeks ended 1 Jan 2017 - note the extra week, which will give a boost to the profits.

The company is an expanding restaurant chain. So a roll out - my favourite hunting ground for investments. The company opened 13 new sites in 2016, mainly trading as "Wildwood". It currently has 63 restaurants, of which 56 trade as Wildwood, and the balance of 7 are a different format called "Dim T".

This page on the company's website shows a lot of the interiors of the sites, which seem to have quite pleasant, modern interiors. The menu looks rather boring & predictable - burgers, pizza & pasta basically. Very similar to numerous other chains. So it's not clear to me how this chain differentiates itself from the competition?

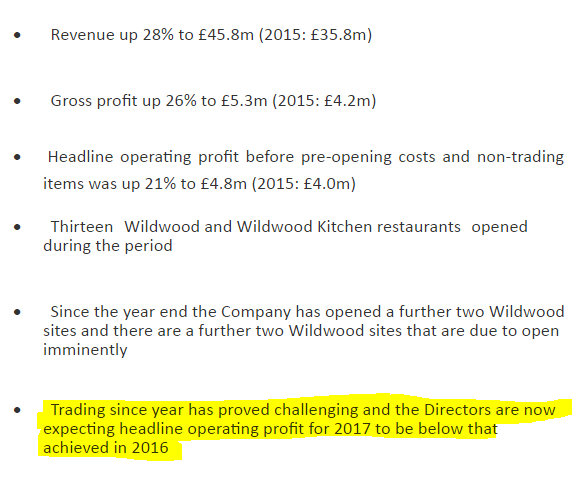

The first 5 bullet points in the highlights section look good, but then the final bullet point drops a bombshell - a profit warning for the current year:

Worse still, it's what I think of as an open-ended profit warning - i.e. it just says below, but with no indication of how much below. No wonder the share price has dropped 32% today.

Outlook - it doesn't really explain what has…

.png)