Good afternoon, it's Paul here.

I'm running late again, sorry about that - I appreciate it must be annoying to find only a placeholder post, when you're expecting a full post. I'm on the case now properly, so will update this article this afternoon.

Falling knives

I see that the car crash at Carillion (LON:CLLN) shows no sign of abating. There's been an incredible destruction of shareholder value there, with the share price now down to only 70p (it was 300p in Sep 2016). Therefore it's come into my universe of small caps now.

I really don't know where to start, in terms of assessing Carillion. A quick look at its balance sheet shows that it's dominated by goodwill. Strip that out, and the NTAV is massively negative. So that rules it out for me (before or after the recent profit warning).

Falling knives generally can be a tempting, but easy way to incur losses. I've done a lot of these over the years, so have worked out which ones work, and which ones don't. Basically it's all down to the balance sheet. If a company reports bad news, but has a strong, cash-rich balance sheet, then over time it tends to recover. That stands to reason, because management are not distracted by a fundraising or disposals in order to stay solvent. Instead, they can just get on with fixing whatever issues have caused the profit warning to happen.

So for me, when assessing whether to buy a falling knife, the no.1 consideration is that it must have a strong and stable (!!) balance sheet, with no requirement for any fundraising. Carillion clearly fails that test.

The other key factor for me, is whether the problems which caused a share price to collapse are fixable. If it's just something that's a one-off, ring-fenced problem, then I would consider buying the shares after bad news. If it's a bigger, more serious problem, then I'd steer clear. That's a judgement call, so not something that could be computer modelled.

It would be interesting to revisit Stockopedia's awesome profit warning study, and introduce a balance sheet test. Would that improve the results, I wonder?

Contract companies

Carillion is yet another example of a company dealing with complex, large contracts, has gone disastrously wrong. This happens over & over again with this type of company. It's only a matter of time before a large contract goes badly wrong, and that often threatens the survival of the company.

A few years ago there was a company called "Rok" which turned out to be anything but rock-solid, and went into administration after some contracts went wrong.

There was another similar one, but I can't remember its name. (EDIT1: many thanks to tic_tac_toe, who has reminded us in the comments section below, of "Silverdell" being another failed contract company. There's one more which went bust too, so a 50p prize to the first reader who can post a comment confirming the name of that one too. EDIT2: djmram wins the 50p prize, with "Connaught" being the other contract company which went bust).

Also, since writing the above, readers have added loads more listed companies where contracts have gone wrong, so this sector really is a total minefield.

Also, we've seen various lesser things go wrong at T Clarke (LON:CTO) and Lakehouse (LON:LAKE) of course. The list just goes on & on. Those companies survived things going wrong in the past, but I think it was probably a close shave, and dependent on bank support.

So why do people invest in low margin, accident-prone contract companies? Nobody really knows what horrors might emerge from large working capital balances. We don't know whether the profits are real - e.g. Carillion seems to have just announced losses which equate to over 5 years' previously reported net profits! So the accounting just cannot be relied on with this type of company, in my view - there are too many large numbers which need estimates, to arrive at the profit figure each year. That can cover up all sorts of nasties.

Carillion also shows that an apparently generous dividend is not a safety measure at all - in fact it can often be a trap. So high yield investing definitely needs a strict balance sheet test, to avoid you getting sucked into an unstable company, lured by high divis.

Overall then, recent events are just solidifying my aversion to any company that deals with large, low margin contracts - especially ones involved in construction, or building maintenance & repairs. It's far too risky an area, in my view. Why take that risk, when we have so many other companies to choose from?

OK, on to some company results & trading updates for today.

Fulham Shore (LON:FUL)

Share price: 19.5p (up 1.3% today)

No. shares: 571.4m

Market cap: £111.4m

(at the time of writing, I hold a long position in this share)

Final results - for the year ended 26 Mar 2017.

This company operates the "Franco Manca" pizza chain, and "The Real Greek" restaurants. It's mainly based in London, but has begun expanding across the UK. So the share is basically a roll-out, using internally generated cashflows, supplemented with some debt, to finance quite rapid growth in site numbers.

Roll outs can be some of the best investments, if you pick the rights ones early on. However, the hospitality sector is out of favour at the moment, because of cost pressures (especially wages), higher cost of imported ingredients, Brexit worries (European staff feeling less welcome in the UK, and their UK wages being less in Euro terms), business rates rises (especially harsh in London). On the upside, this is all putting downward pressure on rents. So companies which are expanding (or renewing leases) now, can secure some fantastic deals from landlords.

Given all that uncertainty, I was worried whether FUL might warn on profits. For that reason, I sold most of my original holding earlier this year, and only have a small residual holding.

The nice thing about retail/hospitality shares, is that you can visit the stores to check out the product & service. Although care is needed not to draw too wide conclusions just from one or two sites, which may not be representative. For example, I was concerned about Franco Manca Brighton being devoid of customers, but rammed full of staff. I felt like I'd gate-crashed an Italian house party! Imagine my surprise then to read in today's report that it's actually one of their top performing sites.

I've been particularly impressed with several Franco Manca sites, although product quality of the pizzas has been somewhat variable. They are delicious though, but with a far too limited menu (only about 7 pizza options). They're proper, wood-fired, sourdough pizzas, which I think are becoming very popular, in London & the South East anyway.

Incidentally, I think this trend could make Domino's Pizza (LON:DOM) a good short - as their product looks stodgy & over-priced in comparison with proper wood-fired pizzas. DOM must be losing market share to better, newer competition such as Franco Manca, which also does home delivery now.

On to the numbers. Key points;

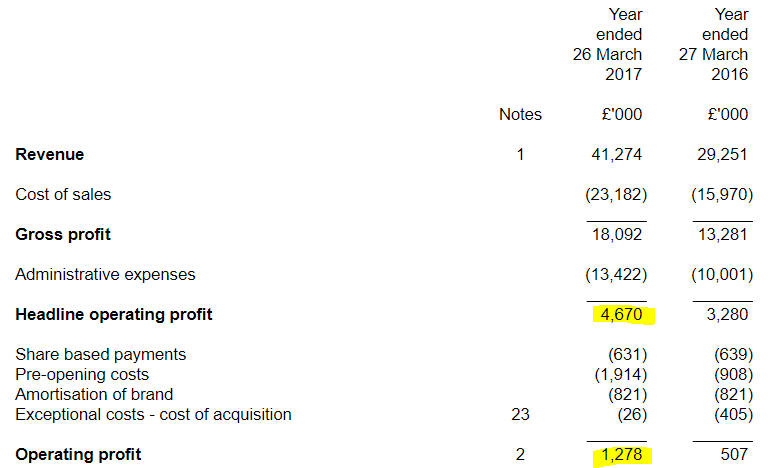

Revenues up 41.1% to £41.3m -a big increase, driven mainly by new site openings. I can't see any reference to LFL sales on the existing stores, so that figure is unknown.

Headline operating profit up 42.4% to £4.67m - a very similar percentage increase to the increase in revenues, which is always worth checking. So margins are stable overall.

However, if you check note 1 (segment information), the operating margin for Franco Manca actually fell from 14.9% last year, to 13.9% this year.

The equivalent percentages for The Real Greek are slightly better, with "headline operating profit" margin up from 11.7% last year, to 12.0% this year. What's interesting about this, is that everyone I've discussed this share with dismissed The Real Greek as being an unconvincing concept. Yet actually, its operating margin is pretty good, and improving. So perhaps investers ought to be taking The Real Greek a bit more seriously as a roll-out?

Is headline operating profit a reasonable measure? That's a very important question, because operating profit after all costs, is very much lower, at just £1.3m - not much for a business which is valued at £111.4m . Here are the adjusting items;

Share based payments - this is fairly static against last year, at £631k, which makes me feel this is not really a one-off, but looks like an ongoing thing. Therefore personally I'd be inclined to value the business after this cost - as it's just another form of employee/Director remuneration.

Pre-opening costs - has shot up to £1.9m, clearly a very material number. I've seen other retail/hospitality companies really abuse this number. In this case though, if you check the notes, the accounting policy is this;

PRE-OPENING COSTS

The restaurant pre-opening costs represent costs incurred up to the date of opening a new restaurant that are written off to the profit and loss account in the period in which they are incurred.

That looks fine to me. Also, the number is very large because so many new sites were opened - 16 new sites. So £1.9m divided by 16, works out at £120k per new site, which looks reasonable.

Amortisation of brand - this is just a silly accounting book entry, so it's fine to ignore this.

Exceptional costs - negligible this year. That gives me comfort that management are not using this as a dumping ground to inflate headline profit, so a tick in the box here.

Overall then, I'm fairly comfortable that the headline operating profit number is in the right ballpark.

Balance sheet - as you would expect for a rapidly expanding restaurant chain, the balance sheet is rapidly piling up fixed assets. The properties are leased, so there's not really much re-sale value from the fixtures & fittings, so no real asset backing to speak of. I don't think that particularly matters though, as this business will always be valued on a multiple of its profits and/or cashflows.

NAV is £38.6m, which reduces to NTAV of £11.3m once you strip out intangible assets. So not a very strong balance sheet, but not weak either.

I note that the current ratio looks very weak. That's partly due to the sector - since hospitality companies don't hold much stock, nor have much in debtors. They typically sell several batches of ingredients, before they have to pay suppliers for those ingredients.

Current assets are £3.9m, and current liabilities £14.0m, giving a very weak current ratio of 0.28. The trade creditors figure definitely looks stretched to me. This is confirmed in the narrative, when the company admits it was short of cash at the year-end;

At the year end, we took advantage of short term supplier trading credit facilities as we had several restaurants in build around year end. These are expected to reverse in the coming year.

That might sound alarming, but in this case I think it's fine. The reason being that increased bank facilities have been agreed since then, and the company is trading well overall. The time to get worried about bank debt, is if the economy goes into a proper recession, and trading deteriorated into losses.

Net debt was £5.9m at year end, which isn't a worry.

Cashflow statement - as mentioned above, the stand-out number is how much trade creditors has increased. Therefore, the impressive £10.3m operating cashflow is driven heavily by the £6.9m increase in trade creditors.

I find that EBITDA (of £7.1m here) can be a better proxy for cashflow, because it eliminates unusual working capital movements, such as happened here. Also, banks typically lend on a multiple of EBITDA, so it's wrong to just dismiss this measure. It's one of many variables that need to be taken into account.

Detailed narrative - I recommend people read the full narrative to today's results from FUL. The Chairman's statement in particular, is very interesting with a good sector overview, from an experienced expert in this field. A few snippets;

Over-capacity due to "unprecedented amounts of capital" having been invested in the restaurant sector in recent years.

Brexit - is making forecasting difficult.

This bit is terrific, and correctly identifies the risk factors facing restaurants;

Against this backdrop, some restaurant businesses will make the grade and others will not. We believe that operators with;

"me-too" offerings,

over-rented sites,

tails of unprofitable sites,

dated menus,

too much debt,

poor concepts and

unincentivised staff

(or all of the above) will struggle.

It's so good, I've reorganised it into a list. I suggest keeping that list bookmarked, and referring to it when an apparently cheap restaurant or retail share crops up. I immediately thought of Tasty (LON:TAST) and perhaps Restaurant (LON:RTN) (where I have a short position) when reading through that list.

Emphasis is put on using good quality, fresh, and organic ingredients. It really does show in the product too, in my opinion, which is very tasty. Compare that with Dominoes for example, where they've used revolting & obviously cheap ham & sausage for years. Customers notice things like this.

Incentivised staff - unusually, this company pays all staff the over-25 Living Wage, regardless of their age. Again, it really shows - every site visit I've done is noticeable by energetic, happy staff. That makes it a pleasant experience. So, very impressive. Staff are also given shares too, so many are small shareholders. Again, a very nice touch.

Cannibalising sales - by opening sites nearby. There has been a bit of this in London, but sites "gravitate back to original levels after a period of time".

Outside London - sales are building more slowly, expected to be over 3-4 years. This is probably my main worry with this share. I think the very high margins being achieved in London may not be replicated as the chain expands outside of London. So it's probably prudent to assume that the operating margin may gradually fall over time, due to this factor, and cost pressures. To emphasise, that just my opinion, and it could be right or wrong, time will tell.

Click & collect - this is good news, as it's additional LFL sales, on a largely fixed cost base;

We continue to see growth in the sales of take out, delivery and ordering on-line. Both The Real Greek and Franco Manca offer these services to our customers. 'Click and collect', where customers order on-line and then collect their order themselves from the restaurant, is proving particularly popular at the moment.

Expansion - continues to be mainly focussed on Franco Manca, but TRG looks to be an improved prospect, longer term;

We have seen excellent results from our new The Real Greek openings and we are looking to step up our opening programme from March 2019 onwards. We will, as we have at Franco Manca, bolster The Real Greek's central team over the next 18 months to support this increased pace of growth.

That means more up-front costs of course. So short term negative, long-term positive.

In total 15 new sites are planned for this year, with 9 already opened. This is a very rapid expansion so that does increase risk - of staff & systems not being able to cope perhaps?

Current trading & outlook - this excerpt sounds a little hesitant to me.

Also note that skilled European staff are proving harder to find;

Trading during the current financial year has so far remained in line with our expectations. However, there are many uncertainties out there: another General Election would be unhelpful, terrorist incidents have always reduced London public confidence (and therefore restaurant visits) and the long-term Brexit impact is unknown; it is, however, already affecting the availability of skilled European restaurant staff. In addition, food costs are currently on the increase and there is some evidence of reducing consumer expenditure.

Despite this, the UK dining out market continues to grow and as a nimble and agile operator with great restaurant brands we are confident of another year of good progress.

My opinion - I really like this company. However, the sector faces so many headwinds right now, that I can't bring myself to buy back in any size.

The trouble is that the company may continue to trade well. Or it may not. The narrative seems to be warming us up for potential disappointments in future. It would be strange if the company doesn't see profit margins reduce, as wages are likely to be forced up.

One broker has reduced its current year EBITDA forecast by 5% today.

Another broker says the results are impressive, and beat their expectations.

For what it's worth, I'm genuinely on the fence here. I really like the company, and think its roll-out, and experienced management, are likely to be a long-term winner. However, the current valuation does look rather ambitious, given the numerous headwinds facing the sector. So far FUL has done OK, but if the staffing bill goes up say 10%, then that would mean additional cost of £1.5m p.a. Remember that staff costs are likely to rise a fair bit every year now that Living Wage is in operation.

The company doesn't seem to publish its LFL sales increases, and so many new shop openings muddies the water. So I'm finding it unusually difficult to work out what the best course of action is here.

On balance, I'm probably going to play it safe, and retain my small existing holding, but not add to it. If there is a profit warning at some point in the future, and the price is slammed by the usual 30% knee-jerk fall, then I'd probably start buying at that point.

Please note that there's an excellent, detailed note about FUL, from Allenby Capital, available on Research Tree, dated today.

Cloudcall (LON:CALL)

Share price: 118.5p (up 15.6% today)

No. shares: 20.1m

Market cap: £23.8m

(at the time of writing, I hold a long position in this share)

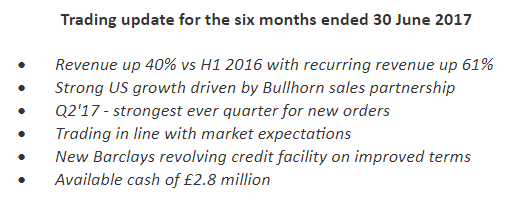

Trading update - patience is beginning to pay off, for long-standing (or should that be long-suffering?!) shareholders here. The company is a software/telephony business. Its product combines telephone calls & recordings with existing CRM systems. The company used to be called Synety.

The problem is that it was a start-up, which grew fast, but not fast enough. So there were several cash calls, which understandably dented investor confidence. However, things now seem to be improving, and the share price has more than doubled since last autumn - not bad for a share that many people thought was a busted flush.

These are the bullet points from today's announcement;

The company is still loss-making, but with decent growth, it looks as if the path to breakeven isn't too long;

"These new orders are now translating through to revenue, and our annualised run rate** broke through £6 million in February and £7 million in June.

This revenue growth, combined with the strengthening relationship with Bullhorn, means that we are well placed to deliver substantial operational and financial progress in the current financial year.

The pathway to EBITDA breakeven remains clearly within our sights."

I seem to recall that breakeven turnover was about £9m a while ago. So being past a £7m annualised run rate, means that it does indeed look close to breakeven. The monthly cashburn should be steadily reducing. There's only £0.9m cash left, but with an additional £1.8m bank facility, it looks as if the company should be able to reach breakeven without any more dilution for shareholders.

I suspect that it might want to raise more equity in future, but that should be possible from a much stronger position, and hence higher share price.

My opinion - the figures have always suggested to me that, if it can reach breakeven, then the market might take a much more positive approach to valuing the company. This is because it has a number of very attractive features to its business model, namely;

- High level of recurring revenues (hence why Barclays are happy to lend to it)

- Strong organic growth

- High gross margins

- Low customer churn

Put that together, and you've got an attractive business model, once it moves into profit. There's big operational gearing, so profits could move up dramatically.

The market seems to be anticipating this happening, hence the valuation rising quite nicely.

I believe the company is presenting to private investors at a ShareSoc event tonight, so I look forward to hearing feedback from that. The affable & enthusiastic Simon Cleaver tends to be a bit of scatter-brain at presentations, constantly flying off at tangents, and confusing listeners! Let's hope he's better prepared tonight than at previous presentations I've attended.

Note that the StockRank is dismal, at just 12, and the Styles section rates this as "Speculative", and a "Momentum Trap". So the Stockopedia computers are very definitely not convinced (yet)! Although I would expect that, as the historic figures are dismal. It will be interesting to see when the computers pick up on the fact that the future is now looking brighter?

eve Sleep (LON:EVE) - this is a recent float (May 2017) which sells memory foam mattresses online, claiming that they are the world's most comfortable mattress.

Today's update sounds positive;

Revenue for the period increased by 126% to £11.5m (H1 FY16: £5.1m) with strong e-commerce led performances across all territories. UK revenue grew 107% to £6.3m (H1 FY16: £3.0m) with combined revenue from all other countries in which eve operates increasing by 153% to £5.2m (H1 FY16: £2.1m).

The strong trading performance demonstrates eve's continuing momentum and reflects the brand's increasing penetration in existing territories, successful expansion into new markets, extension of the product range and development of retail partnerships.

There are lots more positive comments, culminating in this conclusion;

The Company remains on-course to meet the board's expectations for the current financial year.

That all sounds great. Unfortunately, what they omit to mention, is that the company is not trading strongly at all. It's forecast to remain massively loss-making this year & next.

Also, what's so special about memory foam mattresses? Granted, EVE mattresses look particularly thick, so no doubt are very comfortable. On checking their website, I can buy a memory foam mattress elsewhere, at a quarter of the price quoted by EVE, and the cheaper ones are perfectly satisfactory.

I see Neil Woodford's funds hold 18.6% of the company.

The Stockopedia computers rate this as a "Sucker Stock", with a StockRank of just 2. I agree. Quite why anybody would value this at £130m, is beyond me. The trouble with this type of company, is that building substantial revenues requires so much in marketing spend. It's not clear to me that they've done anything new. Memory foam mattresses have been around for years, and it's very easy to buy them online, and they've delivered in a bale, with all the air squished out. So EVE don't seem to have done anything more radical than squish it into a trendy-looking box, as opposed to an un-trendy, but much cheaper thick plastic bag.

Do any readers understand why EVE is supposed to be so exciting? Apparently you can return the mattress at no charge in the first 100 days, but how many people could be bothered?

I'll leave it there for today.

I still need to circle back and finish Tuesday's report, which is on the to-do list. Sorry for my erratic performance this week.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.