Good morning! It's Paul here.

Ed's charity bike ride

The boss here at Stockopedia, Ed, has signed up for a remarkable charity challenge, which is happening this Friday. Ed is attempting to cycle from London to Paris - in 24 hours - that's 300km. He's not even a keen cyclist, although has been putting in some serious training. It's a mind-blowing challenge, and would probably kill most of us just attempting it. Therefore this project clearly warrants our full support.

The charity concerned is raising money to find a cure for a disease called Duchenne. Friends of Ed's have a son with this condition. The explanation on Ed's charity fundraising page is very moving - one can only imagine what this child's parents (and others) have gone through, watching helplessly as their young child's health deteriorates.

As I haven't done a charity fundraiser myself for some time now, I'm feeling rather guilty. Hopefully SCVR readers will swing behind Ed, and donate generously. After all, Ed has paid me a fee for 4 years now to write these reports, which are free to read (not part of the subscription). So supporting this amazing charity challenge would be a nice way to give something back, to a very worthy cause. And most of us have done very well in this bull market!

So, good luck Ed! I hope he emerges in one piece from something so physically gruelling. I very much hope he doesn't injure himself, so fingers & toes crossed.

Here's the online donation page link again.

On to the markets. It's General Election day tomorrow, 8 June 2017, so I'm almost wondering whether it's worth reporting on individual companies today! - will anyone bother reading my article on a day like today?!

We're seeing quite a few erratic price movements, and profit-taking in small cap stocks which have done very well in this bull run. I'm wondering how many of the sellers are intending to buy back on Friday, if the election result looks positive for the markets? (i.e. a workable Tory majority, which the markets perceive as equating to stability & generally more business-friendly policies)

These violent price moves in some small caps are a timely reminder that you can incur a hefty percentage loss very quickly, when there's a rush for the exit. A lot of small caps are hideously illiquid. Combine that with market makers who like to run a neutral book, and it's a recipe for extreme volatility. When bearish conditions do kick in eventually, then I think a lot of people will get a nasty shock at how quickly big profits can dissipate - especially if you're using gearing.

A strange phenomenon I've noticed with myself is this - often when I sell something due to general market jitters, I find it difficult to buy it back. It's almost as if an emotional attachment to a stock has been broken by selling it. Then when you look at it later, with a completely fresh eye, with a view to buying it back, it doesn't actually look so attractive after all.

The lesson to be learned from that is clear - that we should assess our current portfolio holdings with the same critical eye which we would use to assess any new purchases. Easier said than done though - we humans like to think we're very rational, but a lot of the time, we're not.

As regards the election, I've come round to the view that a Tory win is by far the most likely scenario. Although I've got some hedges in place (mainly a Put Option on sterling:dollar) just in case there's an upset.

I'll recap on a couple of companies which reported yesterday, but I was too tired to write about at the time.

FreeAgent Holdings (LON:FREE)

Share price: 111.4p

No. shares: 40.7m

Market cap: £45.3m

Full year results - for the year ended 31 Mar 2017.

This is an accounting software company, which floated in Nov 2016. Its software is cloud-based, and is specifically designed for micro businesses - i.e. sole traders, and tiny companies with up to about 10 employees. FreeAgent is simpler & more user-friendly than Xero (I use both FreeAgent and Xero personally), and is a very good product for one-man bands, freelancers, etc. The closest competitor is probably QuikBooks, which looks very similar.

FREE is still loss-making, however that's deliberate, as the company is spending money on customer acquisition. The rationale being that once a customer starts using FreeAgent, then a stream of sticky, recurring revenues is secured.

The CEO of a SaaS business told me that the key metrics for a SaaS business are;

Churn rate - i.e. how many customers are lost each year. This looks extremely low (which is a very positive thing) for FreeAgent, at just 1.6% for direct customers, i.e. people like me, who sought out the product, and signed up directly from the company's website. As opposed to the other sales channel - which is customers who have been sold the product through their accountancy adviser - where the churn rate is slightly worse, but still outstandingly good, at just 1.9%.

What this ultra-low churn rate is telling us, is that once people start using FreeAgent, they like it, and stick with it. So the beauty is that FREE is adding new subscribers each year, and retaining nearly all their existing customers too. Each additional customer revenue stream is almost pure profit, which applied to a fixed cost base, is obviously an attractive business model, with massive operational gearing if sales really take off.

LTM/CAC - what on earth is this?! It's what FreeAgent call "LifeTime Margin" - i.e. the estimated gross profit from an average customer, over the expected lifetime. Or LifeTime Value (LTV) as some other companies describe it. That is then divided by the Customer Acquisition Cost - which I guess would mainly include marketing costs, social media advertising, sales teams, etc.

Given the low churn rate mentioned above, then LTM should be pretty high. There was a sharp deterioration in LTM/CAC from 3.8 to 2.9 for direct customers. That seems to imply that it's getting a lot more expensive to recruit direct new customers. However, it's still a reasonable figure.

The LTM/CAC for customers recruited via accountancy practices, is much better, at 6.1, which has shot up from 3.2 last year.

The only problem with these stats, is that the LTM is not knowable with any great certainty. If some new, killer product were launched (e.g. if Amazon or Google start giving away brilliant cloud-based accounting software for free, in order to harvest our personal data some more), then FREE's LTM/CAC figures would go out of the window, and the business would probably wither away to obscurity as customers drifted away.

The key P&L numbers are;

Revenues up 41% to £8.0m - very impressive, but remember this is being driven by heavy spending to recruit new customers. Of this, £0.4m was revenue from recharging development costs to RBS, so that has flattered the revenue growth figure somewhat.

Run rate of monthly recurring revenues is currently £8.6m p.a.

Admin expenses rose from £5.8m to £9.0m, which was a planned move to expand the business

Loss from operations rose from £1.0m last year, to £2.4m this time - again, as planned

Finance expense of £601k must relate to pre-IPO debt, which has since been cleared, so I think this should disappear in the 3/2018 figures.

Balance sheet - is OK, rather than great. The company has net cash of £4.3m, but its cash burn is fairly significant.

Cashflow - note that the company capitalises development spend. That was £969k last year. It fell sharply to £379k this year, but that was due to a chunk of costs relating to the RBS deal going through the P&L. So I suspect this line is likely to go back up again next year.

The trouble is, with this type of business, they have to keep spending on development, or the business would wither away. So it's up to you how you view that. Some people are happy with capitalising & amortising, whereas others prefer to adjust the accounts manually to write off all development spending as incurred (my preferred treatment, as it's ultra-prudent).

RBS deal - this could provide exciting upside - the idea is to give away FreeAgent to all of RBS's 665k micro-business customers. If the take up rate is decent, then this could potentially drive a big increase in recurring revenues. I've not seen any forecasts, but it would be interesting to model this, and see how the numbers drop out.

R&D tax credits - this is an interesting point, and has read-across for other companies claiming tax credits. How secure are they in the future?

The income tax credit for both the current and prior year relates to Research & Development tax credits. We continue to invest in Research & Development activity and, while this is an area of ongoing review by HM Revenue & Customs, we expect to be able to claim these tax credits for the foreseeable future, albeit at a reduced level.

My opinion - the Stockopedia computers chuck a bucket of water over us, reminding us that this is speculative, to a certain extent. It's classified as a "Sucker Stock", so really needs a lot of thought before taking the plunge.

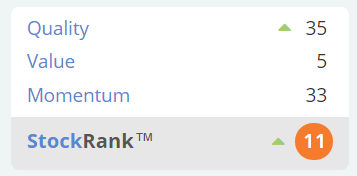

A lousy StockRank too, although that's to be expected for a loss-making company in the growth stage. I think this obviously overlooked the quality of recurring revenues, and the discretionary nature of marketing spend;

Therefore, in this particular case, I think there are good reasons to look through the current poor scores.

Overall, I do quite like it. It's a stock I've held before, but don't currently hold. I'm moderately tempted to buy back in at some point. The quality recurring revenues, and low churn are very attractive. Also the RBS, if it goes well, could be a nice catalyst for a re-rating. So, quite an interesting company overall, in my view.

Shoe Zone (LON:SHOE)

Share price: 177.5p (down 5.3% today)

No. shares: 50.0m

Market cap: £88.8m

Interim results - for the 6 months to 1 Apr 2017, from this discount shoe retailer (mainly in its own shops, but also a relatively small online presence).

These figures are only of passing interest, since the business is very seasonal, making nearly all its profits in H2.

Revenue fell 2.3%, due to "rationalising the store estate" - total store numbers fell from 518 a year earlier, to 504 stores at 1 Apr 2017. Note that the mix is leaning towards opening more larger stores, and closing some small to medium stores.

Underlying profit before tax in H1 fell from £1.7m last year, to £1.3m this year. Whilst clearly not positive that it's declined, this has to be seen in the context of last year's full year profit before tax being £10.3m. So a £0.4m deterioration in H1 this time isn't of much overall significance.

Dividends - the interim divi has been raised from 3.3p last time, to 3.4p this time. Divis are the main reason for holding this stock, as it's yielding about 5.7% - well worth having. Note that it also has a history of paying out special divis on top.

Outlook - "broadly in line" since the end of H1. Note that the company says it will benefit from the new business rates regime.

EDIT: Broker forecasts - I forgot to mention earlier, that FinnCap has reduced its EPS forecasts today, by 6% for the current year, and 4% for next year.

Balance sheet - is solid, with cash of £4.6m, and no interest-bearing debt. There is a pension deficit of £7.9m though.

Rents - a key advantage of this company, compared with other retailers, is that it generally takes quite short leases, and has very low shop fit-out costs. Therefore it is unusually flexible in its property arrangements. This avoids the risk of becoming lumbered with highly rented stores, and no means of exiting the lease - a problem which kills off many retailers.

Therefore ShoeZone can be opportunistic, and take advantage of cheap, empty shop units. Note that rents on lease renewal fell by 21.4%.

Total rents are 14% of turnover, which is actually quite high.

So the business model here is probably lots of fairly low turnover shops, but with high gross margins (due to directly sourcing product from Chinese factories), few staff & other store costs, and minimal capex needed to open shops, (and hence little depreciation), and short leases removing risk. Put that together, and it makes quite a nice, decently profitable business, which avoids a lot of the conventional risks in retailing. I like the business model, and also the entrepreneurial management.

As the High Street trading environment gets more & more difficult, it doesn't really affect these guys, as they can just relocate to cheaper & cheaper rented shops, hence remain profitable.

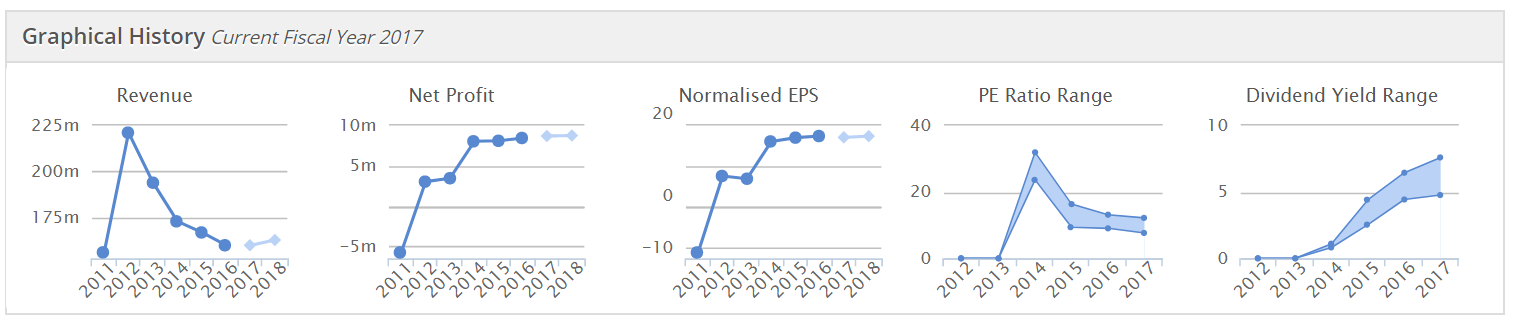

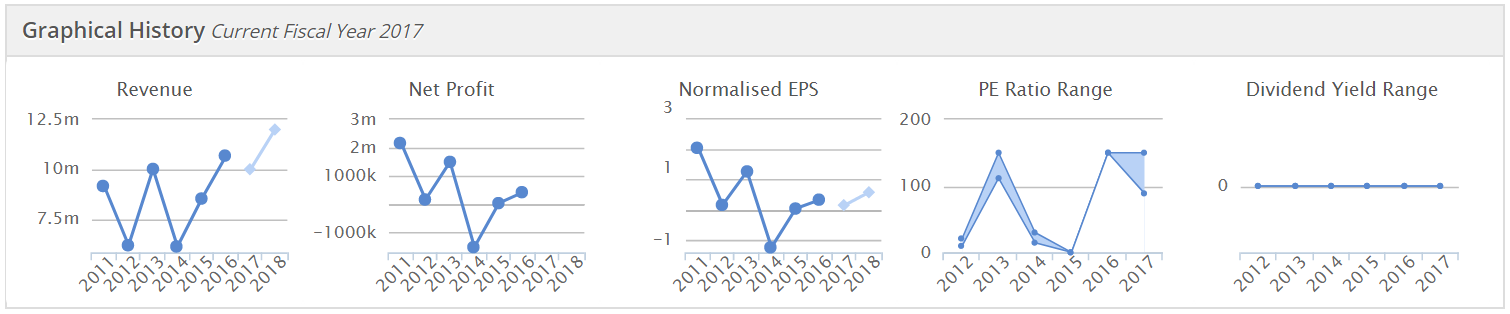

The Stockopedia historical graphs are interesting, and as usual give us lots of useful information at a glance;

Graphs 1 & 2 - note how resilient profitability has been, despite declining revenues (presumably as non-viable shops were closed & handed back to landlords).

Graph 3 - as this mirrors graph 2, that tells us that the company has not been diluting shareholders with share issues - something I like to see, and is often the case at family-controlled businesses like this.

Graph 4 - the PER has traded within a range of c.10-14 in recent years. This suggests to me that buying when the PER is about 10 is probably not a bad option.

Graph 5 - a lovely progression in divis, and I think this omits special divis, so it's better than this graph suggests.

My opinion - as a boring, old-fashioned value share, I quite like this.

Trouble is, we're in a bull market, where people are chasing sexy growth stocks up, and big profits are being made on those. So why buy something like this, which could get cheaper? One reason would be for the divis. Although my worry is that the share price could fall further, thus negating several years' worth of divis.

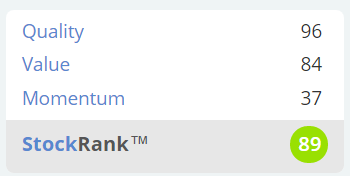

The StockRank is excellent at 89:

In terms of StockRank Styles, this company is rated by Stockopedia's computers as;

I'm enjoying the new StockRank Styles - it's an interesting sense check. The green texting of "Contrarian" means that it statistically fits with an investing approach which, on average, works well for a basket of shares.

I need to refresh my memory about the StockRank Styles, so here is the link to the explanatory notes on it. It's another neat tool for our stock-picking toolbox.

In conclusion then, I don't think SHOE is cheap enough to tempt me to buy any at the moment. This type of stock would probably need to be on a PER of something like 8, or below, to look attractive to me.

Also, remember that the broker forecasts are coming down again today, so the PER will go up. Therefore, I can't see that this is the right time or price to get involved in this share. Although if it dropped say another 20%, then I'd be tempted.

I'm finding it so difficult to concentrate at the moment, with so many things going on.

So, let's round off with some quickfire comments;

SRT Marine Systems (LON:SRT)

This is a small technology company, specialising in marine location products.

Figures for y/e 31 Mar 2017 look quite good;

- Revenue up 3% to £11.0m

- A big improvement in gross margin - gross profit is up 40.1% to £7.2m - so even though sales have not increased much, the company has made much bigger profits on each item sold. It would be interesting to find out if that's sustainable, or due to some one-off lucrative sales?

- Operating profit up from £320k last year, to £1.3m this year - pretty good.

- Note that the company benefits from a negative tax charge, which would obviously flatter EPS.

Balance sheet - trade debtors looks extremely high - this needs explaining. Ah, I've just found an emphasis of matter note from the auditors, as follows;

The auditors, in forming their opinion on the financial statements, which is not modified have included in their report an emphasis of matter on the recoverability of trade receivables of £2.166m, which have been outstanding for fourteen months and remain unpaid.

Due to the length of time that has passed, there is a potential risk to the recoverability. Based upon information provided by SRT's customer, the directors are confident that this balance will be paid in full, however the exact timing is uncertain due to the end customers internal project deliverable sign off processes. The financial statements do not reflect any additional provision that may be required, if the £2.166m is not recoverable.

Hmmm, that's not great. It's a material exposure, which makes me wonder why the company extended credit, rather than requiring payment up-front? All sales are a gift, until they're paid for, as the saying goes.

It also highlights the risks of dealing with overseas public sector bodies, where bureaucracy can be painfully slow, to get sign off on orders, and payments.

Outlook comments are always unrelentingly upbeat from this company, and today is no different;

" SRT Marine Systems now sits at the centre of the growing global market for maritime domain awareness technologies, products and systems. We end the year having increased our profits over three times and start the new year with a £77 million contract order book to deliver over the next three years and a validated pipeline of new sales opportunities worth up to £270 million."

These figures certainly excite investors, and imply a big increase in future profitability.

The trouble is, we've been hearing that sort of thing for years now, but the company never seems (yet) to make the big breakthrough in sales & profits that is promised.

This is shown by the Stockopedia historical history;

My opinion - I think the company has promise, and an apparently bursting order book & pipeline. However, given the history, personally I wouldn't be willing to pay a market cap of almost £70m, at the current share price of 54.2p. That strikes me as rather rich.

However, if the company does deliver a big increase in future sales & profits, then the market cap might make more sense.

For me though, based on what we currently know, I'd say risk:reward doesn't look particularly brilliant.

All done for today!

I'm out & about in the City tomorrow, including meetings with Revolution Bars (LON:RBG) and Best Of The Best (LON:BOTB) Directors. So I'll report back with my impressions.

Then of course it'll be an all-nighter for me with the election coverage. So I'm not sure whether I'll be up to doing a report on Friday.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.