I first blogged about Smiths News almost a year ago, and saw on Twitter that they'd released an interim statement today. Having read it, it seems they've really done rather well over the last year since I first looked at them, so they definitely warrant a second look. What interested me then is exactly what interests me now - they're the larger firm in a tight duopoly. Additionally, in a situation where this might not be a huge disadvantage, they're in that competitive position in a slowly declining market. If you want to deter competitors, being one of two dominant firms in an industry with an uncertain future seems a good way of doing it.

I first blogged about Smiths News almost a year ago, and saw on Twitter that they'd released an interim statement today. Having read it, it seems they've really done rather well over the last year since I first looked at them, so they definitely warrant a second look. What interested me then is exactly what interests me now - they're the larger firm in a tight duopoly. Additionally, in a situation where this might not be a huge disadvantage, they're in that competitive position in a slowly declining market. If you want to deter competitors, being one of two dominant firms in an industry with an uncertain future seems a good way of doing it.

That industry, of course, is distribution - newspapers and magazines mostly, though they're diversifying into books and more niche markets like education. News is still by far the largest segment, and contributes the most to operating profit. The obvious danger, of course, is that a cash cow is being milked in the wrong way. There is clearly a temptation on the part of directors to prefer to diversify and try to create a long-term business model in other distribution segments, rather than simply wind down the news division and pay out the copious cash flow to investors. Which one is the right thing to do? That's a little more difficult to decide. How easily transferable are these distribution skills that Smiths News has acquired? To note - both new divisions are earning better margins than News, on much smaller revenue. Is that question already being answered?

Putting the cart before the horse

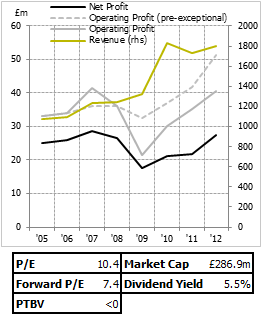

There is one more fundamental difference between investing in Smiths News in 2012 and investing in Smiths news today, though, and one that does do quite something to put me off. Look at the graph below:

The fact is that the company is considerably more expensive than it was when I first looked at it. It's gone from around 90p to 157p today - and given about 7p of dividends, if I'd bought then I would've made about 82% on my capital in that timeframe. That's not to say it's by any means a poor investment now - I think it's a terrible fallacy (though one I'm definitely not immune to) to look at a stock that's gone…

.png)