This post leads directly on from yesterday's, in which I pontificated on the structure of the industry in which Smiths News operate. Like a veteran soap writer, I left on a tantalising cliffhanger - where does what was discussed leave the business? This is an investing blog, after all, so I suppose I should consider the financials and have a poke at thinking about the valuation of the company.

The basics

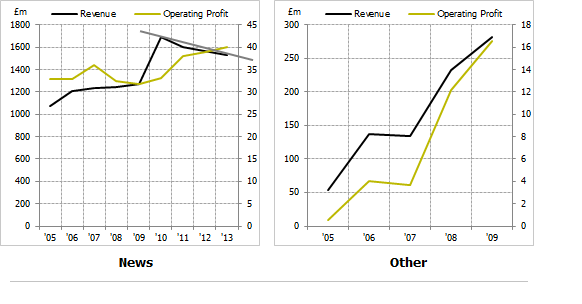

The way to value Smiths News, I think, is by viewing it as basically two different sides of the same coin - the mature and declining news segment, which still dominates overall business performance, and 'the rest' - faster growing with more growth opportunities. The group's rising revenue figures should be seen as a combination of these two disparate sides, and also as a consequence of consolidation in the industry (notably in 2010, where they effectively bailed out one of their failing competitor's contracts). This sort of consolidation is unsurprising and normal in a declining industry - the economies I talked about previously become critical.

Splitting the business into two segments is also instructive because I imagine it is how management will strategise in the next few years - they will look at the (still strong) cashflows from the declining news segment and funnel that money into the growing parts of the business. They've made a number of acquisitions in recent years, and if you want two big flags in that direction, look at management rhetoric recently. Firstly, they've set a target to earn over half of group operating profit from non-news sources by 2016. Clearly, the easiest way to do this would be to acquire. Secondly, they've refinanced with £26m more headroom than they previously had.

This presents an interesting sort of situation for investors, then, because the news bit of Smiths News is a great business from our point of view - it's extremely capital light and has decent visibility of revenues as well as effective barriers to entry. High return businesses are valuable because they can compound growth. The catch here is that if your business is in a declining market segment, you simply cannot reinvest profitably - the returns on capital in a sector are irrelevant if you cannot allocate any more capital to it, or (worse) have to start pulling it away. Circularly, we're back to…

.png)