A poster child for the perils of private equity Somero demonstrates how a cyclic, construction-sector supplier can profit when run by experienced, cost-sensitive management.

Introduction

While Somero is far from a household name it's likely that we've all benefited from its products - machines that guarantee a totally flat concrete floor for non-residential customers. This might not sound like a big deal, unless you're employed in the concrete laying business, but apparently clients derive long-term benefits from such accuracy. Even better Somero is the undisputed global leader in this niche market, which it essentially created, and has been for the last 30 years.

A downside to this laser-like focus is that the fortunes of the company are closely tied to the health of the global economy; in 2009 demand for Somero's machines fell off a cliff and it took four hard years for earnings to recover. During this period the company came as close to insolvency as you can and still survive; only an emergency injection of capital along with bank covenant relaxation plus deep staff and wage cuts allowed the business to survive.

Now recent share price action has reflected this recovery, and perhaps more than that, by leaping from a nadir of 10p in late 2011 to around 142p today. The big question, in my mind, is whether Somero still offers decent value, even now, or whether the easy gains have been made and the company is at the top of its cycle and poised for another fall.

Analysis

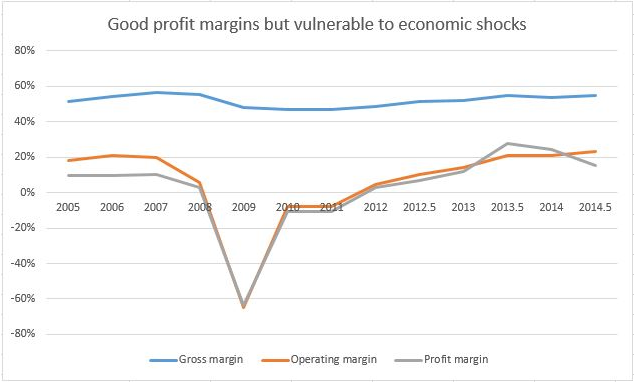

A key element of Somero's attraction is that it's a global leader in its niche of ultra-flat concrete flooring and as such is in a position to command high profit margins. At the gross profit level this theory is borne out with a margin of around 50% being achieved even during the downturn. In contrast profits after non-production costs have been considerably more volatile but with solid progress in recent years; in rebounding from 2009-11 the profit margin has accelerated past a pre-recession level of circa 10% to hit 15% as a result of both general business recovery and reduced drag from debt servicing costs.

A slight wrinkle in the data is that profit margins appear to be trending lower after a bumper 2014 - which ties in with an EPS of 25c being reported last year versus the current…