Sound Oil plc are a highly dynamic and innovative company embarking on a very real and true push into production and high impact exploration across Italy.

The story so far as I see it is Sound Oil have fully restructured the company after a failed PSC in Indonesia. The company appointed a new and highly regarded CEO in James Parsons who was incidentally CFO for 12 months prior, James comes from good stock with a Royal dutch shell background from 1994-2006 working as part of a global team in London,Denmark,Brazil,Holland and Santa Domingo He then went to Inter Pipeline Europe 2006 - 2011 before being appointed at CFO at Sound Oil 2011 and CEO in 2012.

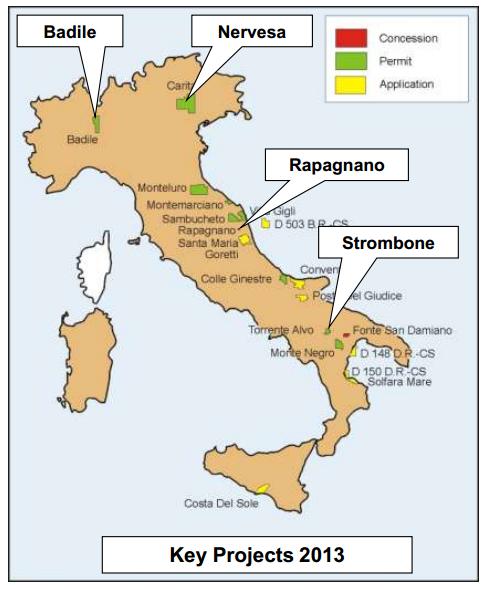

The company has a very different feel as they are heavily funded (to the tune of about £9m) and on the cusp of change with 1st Gas at rapagnano and the drilling commencement (Spud) of Carita (Nervesa) a high value and Ex-Agip concession in the North which was last operated 30yrs ago. (80's) and signed off when it was $15 a barrel With the barrel traveling between $90-$100 consistently for £37m NPV and 21 Billion cubic feet (Bscf) recoverable it is clear there is significant value attainable, taken from a very low risk position 1:3-4 COS.

The permits/concessions and drilling contracts are all in place and ready to spud Q1-2 2013

https://docs.google.com/file/d/0Bzfe1KSKjhfASmNHQTZHQ2FrVjA/edit?pli=1

Sound Oil's Response and strategy:

It should be made clear that the proposed testing programme for this well involves conventional completion technology and there are no plans for hydraulic fracturing of any potential gas bearing reservoirs. The outline plan is to set a 7" liner over any gas-bearing reservoirs and perforate the intervals of interest with wireline-conveyed perforating guns using a conventional explosive charge. This operation will be not significantly different to that used in the original Nervesa-1 discovery well when it was drilled in 1985; http://www.soundoil.co.uk/sites/default/files/attachments/Response%20to%20Nervesa%20Fracking%20Concerns.pdf

Sound Oil were Quick to identify Italys low risk project area and high fiscal value's for its production and exploration targets with some of the highest recovery value's for Oil and Gas in Europe. Nervesas a low risk high reward exploration target for Sound Oil who also looks to its milestone of first gas at Rapagnano.

In laymans…

.jpg)