Back in June, Small Cap Editor Paul Scott described Boohoo.com as “the share I’m most excited about as a core long term growth stock in my portfolio”.

Paul is a very successful investor and a retail expert to boot, so I hesitate to disagree with him. However, it does take two sides to make a market. In this article I’ll take a close look at Boohoo.Com from a more quantitative perspective, working within the Stockopedia framework.

Do the numbers support Paul’s view that this is a superior quality business? Is the valuation attractive? Most of all, is Boohoo.Com statistically likely to outperform?

Let’s get started

Founded in 2006, Boohoo.Com floated at 50p per share in 2014 on an over-optimistic P/E ratio that rose to over 100x earnings after the first day’s trading.

The stock touched a 52-week high of 55p back in September 2014 before reality intervened in the form of a profit warning. Boohoo shares then fell to about 22p, from which level they have gradually been recovering.

Boohoo.com sells affordable fashion targeting 16-24 year-old customers. To borrow from Paul again, “it’s basically Primark online”. In this market, a low price point is essential, and here Boohoo scores well. There are some question marks over product quality, but customers appear to like it regardless. The firm reported 3.3m active customers at the end of May, 32% more than at the same time last year.

The UK is Boohoo’s biggest market, but Ireland and Australia are also significant and overseas sales now account for 36% of total group sales.

The numbers

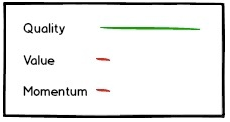

In spite of the hype, Boohoo.Com has a StockRank of just 35. The Momentum and Value ranks are pretty dire. The only ranking bright spot is a QualityRank of 87. This QVM profile suggests that Boohoo.Com could be categorised as a Falling Star in the Stockopedia Taxonomy - a former high flyer that’s coming back to earth.

This doesn’t seem to square up with the image of a profitable growth stock with rising sales. Can this be right? Surely Boohoo should be a High Flyer?

Quality credentials

Let’s start by understanding why Boohoo has such a high QualityRank.

Two things immediately jump out. Boohoo appears to generate market-leading gross profits, relative…